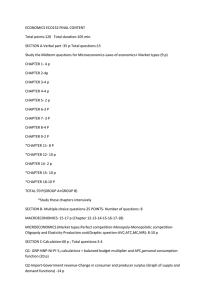

Another Look at Market Power in ... by Richard Schmalensee WP #1238-81

advertisement