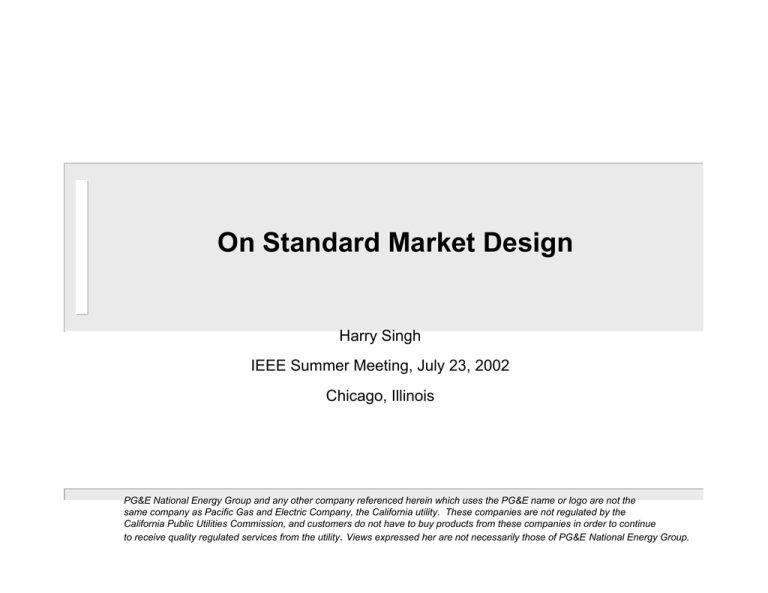

On Standard Market Design Harry Singh IEEE Summer Meeting, July 23, 2002

advertisement

On Standard Market Design Harry Singh IEEE Summer Meeting, July 23, 2002 Chicago, Illinois PG&E National Energy Group and any other company referenced herein which uses the PG&E name or logo are not the same company as Pacific Gas and Electric Company, the California utility. These companies are not regulated by the California Public Utilities Commission, and customers do not have to buy products from these companies in order to continue to receive quality regulated services from the utility. Views expressed her are not necessarily those of PG&E National Energy Group. Outline Structure and Scope of RTOs Evolution of RTOs Elements of Standard Market Design 2 Evolution of RTOs Order 888 Order 2000 – Outlined RTO characteristics and functions at a high level Standard Market Design (SMD) – – – – Eliminate Seams Adopt best practices Address RTO functions in greater detail To be released by FERC on Jul 31, 2002 3 Standard Market Design FERC’s proposal mirrors the PJM and NY ISO market designs Key elements of SMD – LMP based congestion management – Financial Transmission Rights – Financially binding day-ahead energy markets – Real time balancing markets – Capacity markets (initial reluctance, gradual acceptance) – Market power mitigation 4 Congestion Management Experiences with high uplift costs in California, ERCOT and New England Uplifts are difficult to hedge Zone redefinition creates uncertainties General acceptance of LMP and nodal pricing (albeit with appropriate hub definition) – (Bill Hogan was right after all!) NE Congestion Uplift 30 25 $(Millions) 20 15 10 5 0 Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun00 00 00 00 00 00 00 00 00 00 00 00 01 01 01 01 01 01 Source: ISO-NE 5 LMP components (NYISO LBMPs June 5, 2002) LBMP ($/MW Hr) Losses Congestion LBMP at Reference Bus LBMP decomposition depends on choice of reference bus 90 80 70 60 50 40 30 20 10 0 -10 LB M P ($/M W Hr) Los s es Conges tion ) (A T W ES PJ M H O N PX (D ) R TH N O N YC (J ) (H ) LW M IL M H K G VL IL D (E ) ) (K ) H U D LO N VL (G Q H (I) G EN ES E (B ) O D W TR NYC D U N C C EN AP IT L L (C (F ) ) Hr 14 LB M P at Referenc e B us 70 60 LMP components – – – Energy Congestion Losses 50 40 30 20 10 0 Source: NYISO 0 4 8 12 16 20 Hr 24 6 Financially Binding Day-ahead Markets Not required in Order 2000 but a key element of SMD Shifts risk of generator non-performance from loads to generators Encourages price signals for demand response Enhances reliability through day-ahead commitments Currently used in PJM and New York, New England implementation in Dec 02, missing in ERCOT Design choices – – – Centralized unit commitment with multi-part bids (PJM, NY) Decentralized self-commitment with single part portfolio bids (CalPX) General willingness to accept a NY (or PJM) style design despite complexity of centralized optimization 7 No Balanced Schedules The thinking then – Minimize RTO’s role by separating Power Exchange (PX) – RTO requires balanced schedule, PX allows participants to balance their schedules The thinking now – Little success with independent power exchanges – Too many coordination problems in congestion management – RTO required to operate day-ahead energy market – No balanced schedules necessary 8 Real-Time Markets Fundamental balancing function for an RTO General acceptance of ex-post pricing that reflects actual dispatch Prices that reflect reflect actual dispatch do not need to use penalties for uninstructed deviations However, FERC straw proposal allows penalties when necessary 9 Transmission Rights Emerging consensus on financial rights over physical rights (although FERC straw proposal on SMD does not use the term “financial rights”) “At the start of Network Access Service, the transmission provider must offer source-to-sink obligations” “Upon the request of market participants, the transmission provider must also offer source-to-sink options and flowgate rights as soon as it is technically feasible” Should historical customers get initial Transmission Rights? – – Option 1: Existing customers receive rights based on historical usage Option 2: All customers receive a share If existing customers receive rights, should they be auctioned or allocated? – – – – Option 1: Allocation Option 2: Auction Option 3: Partial allocation Option 4: Regional variation 10 RTO Congestion Costs Congestion Costs 2000 2001 600 $ (million) 500 400 300 200 100 0 New York PJM NE CAISO CAISO data excludes intra-zonal congestion New England data represents uplift costs Source: Market monitor reports 11 PJM FTRs and Revenue Adequacy P JM F T R P ayo u t M onthly A verage 120 100 80 % 60 40 20 0 Jan- Feb- M ar- A pr- M ay - Jun01 01 01 01 01 01 Jul- A ug- S ep- O c t- Nov- Dec 01 01 01 01 01 01 PJM Deficient/Excess Rents 15 $ (millions) 10 5 0 -5 Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec01 01 01 01 01 01 01 01 01 01 01 01 -10 -15 Source: PJM 12 CA FTR Auctions CAISO FTR Auctions Malin 90 80 Celilo (NOB) Humboldt $ (millions) Delta (Cascade)Captain Jack Summit North Bay NP15 Geysers (230kV) Silver Peak San Francisco Greater Bay Area Fresno 19 paths 9,976 MW 2001 Owens (Inyo) (LADWP) Mead McCullough (LADWP) 2002 40,000 Four Corners Moenkopi Eldorado Merchant Laughlin SP15 ZP26 70 60 50 40 30 20 10 0 35,000 30,000 No FTRs on Path 15 LADWP LA Orange County Zone Scheduling Point Retained Node Parker AVE42 Coachella (Mirage) ElCentro Imp Val IID San Diego Tijuanna La Rosito Blythe Palo Verde MW 25,000 Sylmar Victorville 20,000 15,000 10,000 N.Gila (PV) N.Gila (69kV) 5,000 0 FTRs Source: CAISO Total MW 13 ERCOT FTR Auctions ERCOT ERCOT TCR Auctions 80 Graham $ (millions) 70 60 North Parker Temple 50 40 West 30 Houston Dow 20 Sandow 10 0 Annual auction South Monthly auctions (Feb-Jun) Stp TCR Shift Factors p = H 'µ p= LMPs µ= Shadow prices H′= Shift factor matrix H = ' CM Zone W-N Graham to Parker G to P S-N Sandow to Temple S to T S-H Stp to Dow Stp to D Houston 0.027650492 0.204409959 -0.169735742 North 0.004613148 0.004989182 -0.003475207 South 0.04591408 0.396734818 0.190336475 West 0.580664652 0.032884411 0.016168457 Source: ERCOT 14 Capacity Markets Three distinct approaches – Energy only markets – Capacity payments – Difficult to guess “correct capacity price” Capacity obligations for Load Serving Entities (LSE) Price caps that disallow scarcity rents make this approach difficult in the current political climate RTO sets reserve margin and quantity obligation for each LSE based on peak demand Capacity price is determined by market Markets must be forward looking (2- years) and long-term (e.g, annual/seasonal) to make them meaningful Other recent proposals – Call options (combines generation adequacy and price insurance) 15 Market Power Mitigation Market power mitigation, not price management – – – – – – Encourage structural solutions, including divestiture Should minimize refunds and ex-post price revisions Damage control price caps a reality until a reasonable demand response is available Damage control price cap should be sufficiently high to allow recovery of scarcity rents and elicit a demand response Load pockets handled through RMR contracts Parameters in price screens need to be selected carefully Check for two conditions (1) impact test: prices jump suddenly by predefined tolerance (2) conduct test: bidding behavior changes suddenly (e.g., offer price exceeds 90 day-average by X% or Y$) If both conditions are true, mitigate offer price Does not apply to small portfolios, hydro resources and if prices fall below predefined threshold 16 RTO Consolidation RTO consolidation motivated by desire to eliminate seams between markets for increased efficiency and stable markets Ultimate goal to create around five RTOs that cover the United States Recent cost-benefit studies (PJM, Mirant, LECG, ICF) indicate clear benefits to customers from a common market in the Northeast and Midwest Some regions will see lower prices (e.g. New York) while others may see some increase in prices NERTO common market – – Common power market for ISO-NE and NYISO (Peak load 56,141 MW) Possible participation by Canadian provinces MISO-PJM-SPP common market (expected 2005) – – More than 5000 generators Will test the limits of large scale computation Largest unit commitment tests to date have used around 3000 generators 17 RTO Structures RTO ITC/Transco For-profit ITCs operating under a non-profit RTO can address independence concerns Is it possible to allow ITC to perform some RTO functions without compromising efficiency? What happens to ITC value proposition if RTO performs all functions? How should PBRs be established under an LMP regime? 18 Existing and Emerging RTOs IMO IMO RTO West MISO Cal ISO WestConnect PJM PJM-W PJM-S ISO-NE NY/NE NYISO GridSouth (?) SETrans SPP ERCOT HQ GridFlorida MISO PJM Standard Market Design (SMD) based largely on PJM, New York ISO PJM, NYISO, ISO-NE, CAISO & ERCOT, & MISO currently “operational” with varying elements of SMD 19 Power Market Liquidity Cinergy Into MW Daily volumes (non RTO hubs) Entergy Into PV Mid-C 30,000 25,000 MWh 20,000 15,000 10,000 5,000 NE MW Daily volumes (RTO markets) NY Zone G PJM W Jul-02 May-02 Mar-02 Jan-02 Nov-01 Sep-01 Jul-01 May-01 Mar-01 Jan-01 Nov-00 Sep-00 Jul-00 May-00 Mar-00 Jan-00 Nov-99 Sep-99 0 NP15 SP15 18,000 16,000 MWh 14,000 12,000 10,000 8,000 6,000 4,000 2,000 Source: MW Daily Jul-02 Jun-02 May-02 Apr-02 Mar-02 Feb-02 Jan-02 Dec-01 Nov-01 Oct-01 Sep-01 Aug-01 Jul-01 Jun-01 May-01 Apr-01 Mar-01 Feb-01 Jan-01 Dec-00 Nov-00 0 20