Aggregate Demand and Aggregate Supply © 2003 South-Western/Thomson Learning

advertisement

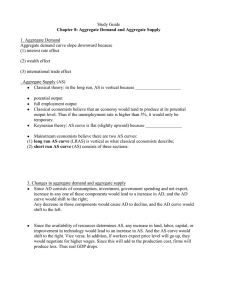

Aggregate Demand and Aggregate Supply © 2003 South-Western/Thomson Learning The Aggregate Demand Curve The Aggregate Demand Curve combines the elements of the simple Keynsian model with the monetary sector so as to display the relationship between the aggregate price level and spending balance real GDP Spending balance real GDP is what we had called ‘equilibrium GDP’ in the simple Keynesian model -- that level of real GDP where the AE curve intersects the 45° line. The Aggregate Demand Curve The derivation of the AD curve proceeds in two steps: (1) In the money market it is noted that higher prices shift out the demand for money, thereby increasing the equilibrium interest rate; (2) In the spending balance diagram, higher interest rates lead to a lowering of the AE curve resulting in lower spending balance. This exercise shows that higher price levels are associated with lower spending balance. The AD curve is simply a locus of all such price level -spending balance combinations, and must have a declining slope. P AD curve is a relationship between the aggregate price level and Real GDP AD Real GDP Deriving The Aggregate Demand Curve A rise in price level causes the • money demand curve to shift rightward • interest rate to rise • aggregate expenditure line to shift downward • equilibrium GDP to decrease The Aggregate Demand Curve (a) Interest Rate 9% 6% M (b) Aggregate Expenditure ($ Trillions) s AEr = 6% AEr = 9% E H E H d M2 d M1 500 6 Money ($ Billions) 10 (c) Real GDP ($ Trillions) Price Level H 140 E 100 AD 6 10 Real GDP ($ Trillions) The Aggregate Demand Curve (a ) Interest Rate 9% 6% M (b) s Aggregate Expend iture ($ Trillions) AE r = E H 6% AEr = 9% E d H M2 d M1 500 Money ($ Billions) A rise in price level causes the •money demand curve to shift rightward •interest rate to rise •aggregate expenditure line to shift downward •equilibrium GDP to decrease 6 10 (c ) Rea l GD P ($ Trillions) Price Level H 140 E 100 AD 6 10 Rea l GD P ($ Trillions) The Aggregate Demand Curve A rise in the price level causes a decrease in equilibrium GDP. Deriving the Aggregate Demand Curve Aggregate Demand (AD) Curve A curve indicating equilibrium GDP at each price level. Understanding the Aggregate Demand Curve Each point on the AD curve represents a short-run equilibrium in the economy. Understanding the Aggregate Demand Curve P768 fig 1 Price goes up Increase in money demand r goes up a and I P go down Equilibrium GDP goes down Understanding the Aggregate Demand Curve P768 fig 1 Price goes down Decrease in money demand r goes down a and I P go up Equilibrium GDP goes up Shifts of the Aggregate Demand Curve • When a change in the price level causes equilibrium GDP to change, we move along the AD curve. • Whenever anything other than the price level causes equilibrium GDP to change, the AD curve itself shifts. Shifts of the Aggregate Demand Curve (a) Real Aggregate Expenditure ($ Trillions) AE 2 AE 1 H E 10 13.5 Real GDP ($ Trillions) (b) Price Level 100 H E AD1 AD2 10 13.5 Real GDP ($ Trillions) Shifts of the Aggregate Demand Curve (a) Real Aggregate Expenditure ($ Trillions) AE 2 AE 1 H E Here we show the impact of a positive spending shock. AE shifts up resulting in a higher equilibrium GDP for the prevailing price level. 10 13.5 Real GDP ($ Trillions) (b) Price Level 100 H E AD1 AD2 10 13.5 Real GDP ($ Trillions) Spending Shocks The AD curve shifts rightward when • government purchases • investment spending • autonomous consumption spending • or net exports increase • or when taxes decrease. Spending Shocks The AD curve shifts leftward when • government purchases • investment spending • autonomous consumption spending • or net exports decrease • or when taxes increase. Changes in the Money Supply • An increase in the money supply shifts the AD curve rightward. • A decrease in the money supply shifts the AD curve leftward. How the Fed Changes the Interest Rate At point E, the money market is in equilibrium at an interest rate of 6 percent. Interest Rate 6% s M1 s M2 To lower the interest rate, the Fed could increase the money supply to $800 billion. The excess supply of money (and excess demand for bonds) would cause bond prices to rise, and the interest rate to fall, until a new equilibrium is established at point F with an interest rate of 3 percent. E F 3% M 500 800 d Money ($ Billions) Monetary Policy and the Economy P=100 (b) (a ) Interest M 1s M 2s Rea l Rate AE r = 4.5% Ag gregate Expenditures H ($ Trillions) AE r = 6% E 6% E H 4.5% d M Y = $10 trillion 3% F d MY = $8 trillion 500 800 Money ($ Billions) 45º 8 10 Rea l GD P ($ Trillions) P P=125 P=100 AD’ AD 8 10 Real GDP (a) Price Level Effects of Key Changes on the AD Curve Price level moves us leftward along the AD curve P3 Price level moves us rightward along the AD curve P1 P2 AD Q3 (b) Price Level Entire AD curve shifts rightward if: • A , Ip , G , or NX increases • Taxes decrease • The money supply increases AD 2 Q1 Price Level Q2 Real GDP (c) Entire AD curve shifts leftward if: • A , I p, G , or NX decreases • Taxes increase • The money supply decreases AD 1 AD 2 AD 1 Real GDP Real GDP The Aggregate Supply Curve Costs and Prices A firm sets the price of its products as a markup over cost per unit. Costs and Prices The average percentage markup in the economy is determined by competitive conditions in the economy. Markup= price/unit cost - 1 In the short-run we assume this mark-up to be fixed Costs and Prices In the short run • the price level rises when there is an economy-wide increase in unit costs, and • the price level falls when there is an economy-wide decrease in unit costs. Outputs, Costs, and the Price Level As total output increases • Greater amounts of inputs may be needed to produce a unit of output. • The prices of non-labor inputs rise. • The nominal wage rate rises. Output, Costs, and the Price Level For a year or so after a change in output, changes in the average nominal wage are less important than other forces that change unit costs. Output, Costs, and the Price Level Assume that changes in output have no effect on the nominal wage rate in the short run. In the short run • a rise in real GDP will also cause a rise in the price level. • a fall in real GDP will also cause a decrease in the price level. Deriving the Aggregate Supply Curve Aggregate Supply (AS) Curve A curve indicating the price level consistent with firms’ unit costs and markups for any level of output over the short run. Deriving the Aggregate Supply Curve Price Level AS 130 B 100 80 A C 6 10 13.5 Real GDP ($ Trillions) Movements Upward Along the Aggregate Supply Curve Prices of non-labor inputs go up Real GDP goes up Unit costs go up Input requirements per unit of output go up Price level goes up Movements Downward Along the Aggregate Supply Curve P768 fig 1Input requirements per unit of output go down Real GDP goes down Unit costs go down Prices of non-labor inputs go down Price level goes down Shifts of the Aggregate Supply Curve • When a change in real GDP causes the price level to change, we move along the AS curve. • When anything other than a change in real GDP causes the price level to change, the AS curve itself shifts. Shifts of the Aggregate Supply Curve Examples of changes that shift AS • Changes in world oil prices • Changes in the weather • Technological change • Adjustment to the long run Shifts of the Aggregate Supply Curve Price Level AS2 AS1 140 L 100 A 10 Real GDP ($ Trillions) Shifts of the Aggregate Supply Curve Price Level AS2 AS1 140 L 100 A 10 Real GDP ($ Trillions) (a) Price Level Effects of Key Changes on the Aggregate Supply Curve AS Real GDP moves us rightward along the AS curve P2 Real GDP moves us leftward along the AS curve P1 P3 Q3 Q1 (b) Price Level Real GDP (c) AS2 Entire AS curve shifts upward if unit costs for any reason besides an increase in real GDP Q2 AS1 Real GDP Price Level AS1 Entire AS curve shifts downward if unit costs for any reason besides a decrease in real GDP AS2 Real GDP AD and AS Together: Short-Run Equilibrium Short-Run Macroeconomic Equilibrium A combination of price level and GDP consistent with both the AD and AS curves The Aggregate Demand Curve Aggregate Demand Curve Price Level Real GDP Aggregate Supply Curve AD and AS Together: Short-Run Equilibrium Price Level AS B 140 E 100 F AD 6 10 14 Real GDP ($ Trillions)