EL Camino College Department of Behavioral & Social Sciences

advertisement

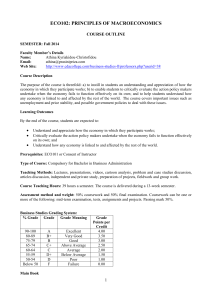

EL Camino College Department of Behavioral & Social Sciences Economics 1 Principles of Macroeconomics Section 2248, Wednesday 6:00-9:10 PM, Social science, Room 117 Spring 2012 02/15/2012– 06/06/2012 Instructor: F. Tahernia Office: ARTB 320 Phone: (310) 660-3593 ext. 4610 E-mail: tahfar@Hotmail.com Office Hours: Wednesday 5:00 – 6:00 PM and by appointment. REQUIRED TEXTBOOK: Roger Le Roy Miller, Economics Today The Macro View. Addison Wesley Fifteenth Edition, Topical handouts will also being provided. In addition, students are urged to read Wall Street Journal or Business Week to keep current on economic issues. COURSE DISCRIPTION: This course is an introduction to fundamental concepts in macroeconomics. As a sub-discipline within economics, macroeconomics examines the economy as a whole. Our focus in this course is on topics such as: GDP, unemployment, inflation, business cycle, national debt, fiscal policy, monetary policy, economic growth, international trade and foreign exchange rate. We also examine the extent of poverty and income distribution in the U. S. economy today and the macroeconomics consequences of the current financial crisis. Many of you may have come across some of these terms in the news media or even in your high school economics courses. Our goal here is to understand not only what these terms mean but also how these topics relate to our daily lives. In addition, we will examine closely how these economic statistics are officially calculated and some of the limitation in interpreting these numbers. COURSE OBJECTIVES 1. Define and describe the principle tools utilized in economic analysis. 2. Describe the central economic problem of scarcity and the economic resources available to produce goods and services. 3. Describe the determinants of supply and demand and their effects on equilibrium price and quantity. 4. Analyze the economic roles played by households, business firms, governments, and international trade in the U.S. economy. 5. Calculate the rate of unemployment and the rate of inflation utilizing numerical data. 6. Define GDP, identify the component of GDP, and calculate GDP utilizing numerical data. 7. Describe economic growth. 8. Analyze how various economic changes impact national output, unemployment and inflation using an aggregate demand & aggregate supply model. 9. Describe the principle tools of fiscal policy and how the federal government uses these tools to correct unemployment problems and inflation. 10. Explain the operations of private banks and the role the private banking system plays in the conduct of Federal Reserve Bank Monetary policy. 11. Identify the principal tools of monetary policy and explain how they are utilized to correct problems of unemployment and inflation. 12. Understand and evaluate economic globalization. 13. Understand how foreign exchange rates are determined and their macroeconomic consequences. EXAMINATIONS: There will be three non-cumulative midterms and a cumulative final exam. To allow for problems, which may arise, I will count two higher scores achieved on the three midterms in your grade calculation. This does not apply to the final exam. Exams could be in the form of true & false questions, multiple choice questions, essay questions, diagrams, and numerical problems. The tentative dates of these exams are given below, however the exact date of the exam may change depending on our progress. If we do so, indeed, change the date, you will have a week’s notice in advance. Date of exams: First: March 7, 2012 and due date for first homework. Second: April 4, 2012 and due date for second homework. Third: May 16, 2012 and due date for third homework. Final: June 6, 2012 . HOMEWORK: There will be three written homework assignment most of them are problem set that comes along with the textbook. These assignments are due in class on the day indicated. GRADING: Your final grade will be computed as follows: Midterms 50% (25% each) Homework 15% (5% each) Final 30% Class participation and attendance 5% Total 100% Also there are opportunities to earn a maximum of 5% extra credit points during the course of the semester. MAKE-UP POLICY: I do not give make up tests, so a missed midterm exam will be dropped as your worst score on the three-midterm exams. I also do not give Incomplete, so a missed final exam will be counted as a zero in your final grade determination. ATTENDANCE& CLASS PARTICIPATION: A portion of your grade is based on attendance and participation. I will take attendance at every class and this may be taken at anytime during the class period. If you are not physically present at that time you will be marked absent. If you are late, you will be counted as tardy. If you are tardy twice it will be count as absent. You are allowed one unexcused absence. Any more than that will impact your course grade. In addition to attendance, you are also required to participate effectively in class. To do this you need to read appropriate assignment ahead of time, ask questions, and provide relevant input into class discussion. ADA STATEMENT: EL Camino College is committed to providing educational accommodations for students with disabilities upon the timely request by student to the instructor. A student with a disability, who would like to request an academic accommodation, is responsible for identifying herself/himself to the instructor and to the Special Resources Center. To make arrangement for academic accommodations, contact Special Resources Center. COMMUNICATION: Please feel at ease at any point in talking to me before, after, our during my office hours. If you are unclear about any part of my lecture or textbook, please do not hesitate to ask me. I am here to help you. READING LIST- STUDENT OBJECTIVES: Part I INTRODUCTION TO ECONOMICS 1- Defining Economies. 2- Microeconomic versus Macroeconomists. 3- Positive versus Normative analysis. 4- Define the scarcity-choice problem. 5- Verbally and graphically analyze direct and inverse relationship. CHAPTER 1 TOOLS OF ECONOMIC ANALYSIS 1- Choice and opportunity cost. 2- Production possibilities curve and the concept of trade offs. 3- Marginal benefit and marginal cost. 4- Economic growth and Production Possibilities Curve. 5- Comparative advantage and gains associated with specialization. CHAPTER 2 DEMAND AND SUPPLY ANALYSIS CHAPTER 3 & 4 1- The Law of Demand. 2- Demand curve, schedule and demand function. 3- Shift of the Demand curve. 4- The Law of Supply. 5- Supply curve, schedule and supply function 6- Shift of the Supply curve. 7- Market equilibrium, change in market equilibrium, and market disequilibrium. 8- Change in demand and supply. 9- The policy of Government-Imposed Price Control. (Rent control & Minimum wage). THE AMERICAN ECONOMY IN THE GLOBAL SETTING 1234- CHAPTER 5 & 6 Economic decision makers. Economic functions of Government and public spending. Paying for public sector. Systems of taxation from the point of view of producers and consumers. Part II MEASURING A COUNTRY’S PRODUCTION 12345- UNEMPLOYMENT, INFLATION, & DEFLATION 12345- CHAPTER 8 The Simple Circular Flow. National Income Accounting. Two Main Methods of Measuring GDP. Real versus Nominal GDP. Business Cycles. CHAPTER 7 Unemployment and Full employment. The Major types of Unemployment. Inflation and Deflation. Anticipated versus Unanticipated Inflation Changing Inflation and Unemployment. Business Fluctuation. Part III AGGREGATE DEMAND & AGGREGATE SUPPLY 1234- Output Growth and the Long-Run Aggregate Supply. Total Expenditure and Aggregate Demand. Shifts in the Aggregate Demand Curve. Long-Run Equilibrium and the Price Level. CHAPTER 10 CLASSICAL AND KEYNESIAN MODEL CHAPTER 11, 12, APPENDIX-12 The Classical Model. Keynesian Economics and Short-Run Aggregate Supply Curve. Output Determination Using Aggregate Demand & Aggregate Supply (Fixed & Flexible Price Level). Shift in the Short-Run Aggregate Supply Curve. Consequences of Shift in Aggregate Demand and Aggregate Supply Curves. Consumption Function, Investment Function, Government Expenditure Functions, and Net Exports Function. 7- Macroeconomic Equilibrium without Government and with Government. 123456- FISCAL POLICY AND THE FEDERAL BUDGET 1234567- CHAPTER 13, 14, APPENDIX-13 Tools of Fiscal Policy. Spending Multiplier. Tax Multiplier. Balanced Budget Multiplied. Crowding Out Effect. Discretionary Fiscal Policy & Automatic Stabilizers. Problems with Fiscal Policy. Part IV MONEY AND BANKING SYSTEM 12345- Functions of Money. Defining Money. Financial Institution in the U.S. The Federal Reserve System. Federal Deposit Insurance. MONETARY POLICY 1234567- CHAPTER 16 &17 Money Creation. The Money Multiplier. Demand and Supply of Money. Money and Aggregate Demand. How the Fed Influences Interest Rates. Targets for Monetary Policy. Monetary Policy and Inflation. ECONOMIC GROWTH 12345- CHAPTER 15 CHAPTER 9 & 19 Define Economic Growth. Saving: A Fundamental Determinant of Economic growth. Labor Resources and Economic Growth. Capital Goods and Economic Growth. International Comparisons. INTERNATIONAL FINANCE 1- Balance Payments and International Capital Movements. 2- Determining Foreign Exchange Rates. 3- Fix versus Floating Exchange Rates. CHAPTER 34