MULTINATIONAL CORPORATIONS & FOREIGN DIRECT INVESTMENT

advertisement

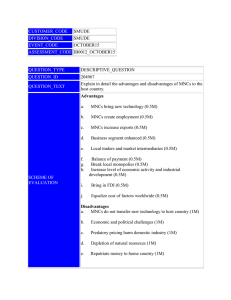

MULTINATIONAL CORPORATIONS & FOREIGN DIRECT INVESTMENT A firm is considered a multinational corporation (MNC) if it owns, in part or in whole, a subsidiary in a second country. High profile MNCs have many subsidiaries. There are different types of MNCs. Some are vertically integrated. The subsidiary provides inputs to the parent which produces a final good. Oil companies are good examples of vertically integrated MNCs. Oil exploration and production are accomplished abroad where the subsidiary exports crude petroleum to the parent corporation which then refines the crude into gasoline. Another example is the Maquiladora program. The US parent corporation exports components to an assembly Maquiladora subsidiary which in turn re-exports the assembled good back to the parent corporation. Other MNCs are horizontally integrated, meaning that the subsidiary produces a similar good to that of the parent. The soft drink industry is an example of horizontally integrated MNCs. The subsidiary is a bottling company which produces pretty much the same product as the parent. Foreign direct investment (FDI) or the means by which an MNC obtains or expands a subsidiary can take a variety of forms. FDI can be by merger or aquisition of an existing firm, by participating in the construction of a new firm, or by expanding existing subsidiaries. The following tables list amounts of FDI for the US by industry and countries. Hopefully they will be updated soon. Table 1 - Amounts of FDI -- US FDI abroad - measured as a stock at the end of 1989 (book value) Industry Manufacturing Finance excluding banking Petroleum Country/region Europe Canada L.America Asia & Pacific excluding Japan Japan billions $ 155.7 77.1 57.9 % of total 41.7 20.6 15.5 176.7 66.9 61.4 21 47.3 17.9 16.4 5.6 19.3 5.2 MNCs - page 1 Table 2 - Amounts of FDI -- Foreign FDI in US - measured as a stock at the end of 1989 (book value) Industry Manufacturing Wholesale Trade Real Estate Petroleum Country/World Europe Japan Canada billions $ 160.2 54.5 35.9 35.1 % of total 40 13.6 8.9 8.8 262 69.7 31.5 65.4 17.4 7.9 As of 1989 United Kingdom has the largest amount of FDI in US - 29.7%. Second is Japan with 17.4% of the total, and third is the Netherlands with 15.1%. Motives for Direct Foreign Investment As with any investment, FDI reflects the firm=s decision to spend resources today in the expectation that these resources will generate future profits sufficient to compensate the firm for these expenditures. In the jargon of economics, the present discounted value of the future stream of revenues will be greater than the present discounted value of costs. The underlying factors which may have dictated these flows of revenues and costs are demand and cost factors. The main decision for FDI is whether it is more profitable to set up production in one form or another with a foreign subsidiary or to increase production at home and expand exports of the good. The advantages to setting up a subsidiary fall into two categories, demand factors and cost factors. Demand Factors On the demand side, by having a foreign subsidiary, the firm will be capable of monitoring the foreign market more closely and, consequently, respond to changes in a more timely manner. This is especially true if the foreign market is large and growing rapidly. A second consideration on the MNCs - page 2 demand side is more direct. If foreign competition is eroding the firm=s market share, then simply by buying the competitor maintains the firm=s market power. Cost Factors The impetus for the creation of a foreign subsidiary may be lower costs of production. The most obvious is mineral extraction. The presence of large deposits of natural resources in foreign countries where the cost of extraction is considerably less than continued domestic exploration and extraction will lead to large amounts of FDI. There is a real danger in this type of FDI. Many examples abound of expropriation of these types of subsidiaries, for example, oil MNCs in Mexico and Libya, and bauxite MNCs in Jamaica. Firms may relocate production to take advantage of lower labor costs. But as already discussed, the attraction to lower labor costs must also take labor productivity into consideration. If foreign labor productivity is sufficiently low so as to offset the gains from lower wages, then FDI will not be profitable. Examples of FDI responding to labor costs include China, SE Asia, and the Mexican Maquiladora program. Probably the most significant motivation for FDI is the avoidance of trade restrictions. Recall the firm's choice is to either produce at home and export or to produce abroad. If the firm's exports face high barriers to trade, then FDI leading to production within the foreign country circumvents these barriers. Examples of this are close to home. Much of the Japanese automotive transplants were as a result of growing US protectionism against Japanese imports. Trade diversion occurring in Mexico also represents this type of FDI. Another factor which may encourage FDI is the idea of risk diversification. If the good produced is highly sensitive to income changes, i.e., highly income elastic, then it would make sense to have access to many different markets. The major national economies grow at different rates. While one part of the world is in recession, other areas may be expanding. For example the US is showing strong growth while Japan and Europe are coming out of recession. If a company only serviced the European market, it would be suffering from the slow pace of the European economy. However, if they also had production facilities in the US servicing the US market, then their losses in Europe are offset by the performance of their US subsidiary. The recent mega-megers in the automobile industry are examples of firms diversifying their markets. Potential Benefits to the Host Country of FDI MNCs - page 3 Much literature has been written about the effects of FDI on host countries. Generally the analysis has been done from a developing country point of view. However, the controversy is overstated. In my opinion, FDI generally benefits the host country. The pros and cons to the host country are listed in the following table. A. B. C. D. E. F. G. H. Pro Con Leads to greater output A. Displacement of domestic firms Increased wages B. Inappropriate technology and investment Increased employment C. Loss of sovereignty Increased exports D. Benefits only the "elites" while Increased tax revenues exploiting the poor Provision of new and better technology Better managerial and technical skills Increased domestic investment The attitudes towards FDI have changed. Now, most developing nations actively attract MNCs as a means of increasing investment and spurring economic growth. MNCs - page 4