INVESTMENTS

advertisement

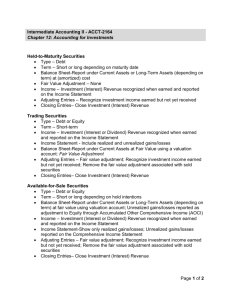

INVESTMENTS Chapter 12 covers the accounting for investments in another entity. Graphic 12-1 on page 522 outlines the types of investments and their accounting treatment. Type Characteristics Accounting Loan Intend to hold to Amortized Cost maturity Trading Held in an active Fair Value (holding gains security trading account and losses included in earnings) Availabl Fair Value (holding gains e and losses excluded from For Sale earnings) Equity Fair value is not Cost determinable Equity Investor can Cost adjusted for growth significantly alter investee's policies Equity Investor controls Consolidation investee In this course we will focus primarily on the first three types of securities and briefly introduce the accounting issues involved when the investor can exercise some control over the investee. Accounting For Marketable Securities The key problem is how to account for unrealized holding gains and losses on the securities. These are changes in value that are unrealized because the securities have not been sold. There are two issues involved: Should the changes in value be reflected in the balance sheet? Should the changes in value be included in current period's earnings? Debt Securities Held to Maturity Examples: Loans, Long-Term Note Receivables, LeaseReceivables Characteristics: Fixed Maturity, Fixed Interest Rate (if the interest rate floats then the fair value stays constant) The firm's intent is to hold the security until maturity, i.e., to receive interest and principal payments. The value of the security fluctuates with changes in interest rates. For example, if I have a loan receivable at 8%, and interest rates increase to 10%, the value of receiving 8% interest declines. However, because the firm does not intend to sell the security, the change in value may not be relevant. As a result, changes in value are not recorded. The fair value is reported in the footnotes. Dow Chemical Fair Value of Financial Instruments at December 31, 1999 Cost Marketable securities: Debt securities $ 1,771 Equity securities 1,043 Other 138 Total $ 2,952 Gain $ 20 580 2 $602 Loss Fair Value $ (31) $1,760 (47) 1,576 -140 $ (78) $3,476 Securities Available for Sale Most marketable securities (short-term investments) held by firms (except for financial institutions) are included in this category. • Securities are recorded at fair value on the balance sheet • Unrealized holding gains and losses appear in a separate section of stockholders equity. Temporary changes in value do not appear in the income statement. • Impairment (non-temporary) losses are recorded in the income statement. These are permanent declines in value due to bankruptcy, etc. Example: E 12-5 2000 March 2 Purchased 1 million PG common shares for $31 million April 12 Purchased $20 million of 10% bonds at face value. July 18 Received cash dividends of $2 million from PG Oct 15 Received $1 million in interest Oct 16 Sold the bonds for $21 million Nov 1 Purchased 500,000 LTD preferred shares for $40 million Dec 31 Market prices are $32 per share for PG and $74 per share for LTD. 2001 Jan 23 Mar 1 Sold half of PG shares for $32 Sold LTD shares for $76 Date Account Dr Cr Trading Securities The entity intends to actively buy and sell these securities with the intention of making a profit on short-term fluctuations in price. Primarily used by financial institutions. • Securities are reported on the balance sheet at fair value. • Unrealized holding gains and losses are included in net income. Example: E 12-5, assuming that the investments in PG and LTD are considered to be trading securities. Record the appropriate entries for 12/31/00, 1/23/01, 3/1/01. Date Account Dr Cr Example: Microsoft Balance Sheet June 30 1999 2000 $ 4,975 12,261 2,245 1,469 752 21,702 1,611 14,372 940 $38,625 $ 4,846 18,952 3,250 1,708 1,552 30,308 1,903 17,726 2,213 $52,150 Retained earnings, including other comprehensive income of $1,787 and $1,527 13,614 18,173 Current assets: Cash and equivalents Short-term investments Accounts receivable Deferred income taxes Other Total current assets Property and equipment, net Equity and other investments Other assets Total assets Income Statement Operating income Investment income Gain on sales 1998 6,414 703 -- 1999 9,928 1,803 160 2000 10,937 3,182 156 Income before income taxes 7,117 11,891 14,275 Statement of Cash Flows Investing Additions to property and equipment (656) Cash portion of WebTV purchase price (190) Cash proceeds from sale of Softimage, Inc. -Purchases of investments (19,114) Maturities of investments 1,890 Sales of investments 10,798 (36,441) (43,158) 4,674 4,025 21,080 28,085 Net cash used for investing (11,191) (11,927) (7,272) (583) --- (879) -79 Footnotes Financial Instruments The Company considers all liquid interest-earning investments with a maturity of three months or less at the date of purchase to be cash equivalents. Short-term investments generally mature between three months and six years from the purchase date. All cash and short-term investments are classified as available for sale and are recorded at market using the specific identification method; unrealized gains and losses are reflected in other comprehensive income. Cost approximates market for all classifications of cash and short-term investments; realized and unrealized gains and losses were not material. Equity and other investments include debt and equity instruments. Debt securities and publicly traded equity securities are classified as available for sale and are recorded at market using the specific identification method. Unrealized gains and losses are reflected in other comprehensive income. All other investments, excluding joint venture arrangements, are recorded at cost. June 30, 2000 Cost Basis Debt securities recorded at market 6,406 Common stock and Warrants Preferred stock Other investments Equity and other investments Unrealized Recorded Gains/(Losses) Basis (977) 5,429 5,815 2,319 205 3,958 --- 9,773 2,319 205 $14,745 $2,981 $17,726 Other Comprehensive Income The changes in the components of other comprehensive income are as follows: Year Ended June 30 Net unrealized investment gains/(losses) Translation adjustments and other Other comprehensive income/(loss) 1998 627 (124) $ 503 1999 1,052 69 $1,121 2000 (283) 23 $(260) Equity Method Includes investments in which the investor can exert significant influence, but cannot control the investee. Generally investor holds 20-50% of the investee. • Investment is recorded at historical cost • Investment is increased by share of the investee's net income (investor record's its share of investee's income in the investor's earnings) • Dividends received reduce the value of the investment. Example: Illustration 12-4, On 1/2/00, ACC purchases 25% of EM common stock for $200 million. EM has $100 net income and pays $24 in dividends. ACC Entries: Dr. Investment $200 Cr. Cash $200 Dr. Investment $25 Cr. Investment revenue $25 Dr. Cash $6 Cr. Investment $6 Required for Thursday, November 2 Financial Statements: • Determine the value of the marketable securities • Determine the amount of the unrealized holding gain and loss as of the end of the year. • Compute marketable securities as a proportion of current assets. • Compute the unrealized holding gain and loss as a proportion of net income. Chapter problems: E12-6, E12-7, E12-8, E12-12, P12-3