9.{S}A. The cash outflow of $25.6 million represents the

advertisement

9.{S}A.

The cash outflow of $25.6 million represents the

decrease in the balance of sold but uncollected

receivables ($192.8 - $167.2). It represents net

collections (by Arkla as the firm continues to service

the

receivables)

of

receivables

sold;

amounts

collected from previously sold receivables were paid

to the purchasers of those receivables.

B.

Receivables sold but uncollected as of 12/31/93 can be

deduced to be:

Outstanding 3/31/94

Decrease during quarter

Outstanding 12/31/93

C.

$118.7 million

107.7

$226.4 million

The required adjustments to Arkla's CFO for quarters

ended:

March 31, 1994 March 31, 1995

Cash outflow

107.7

25.6

These amounts are the decrease in receivables sold

during the respective quarters. The adjustment is

required because the cash flow was recognized when the

receivables were sold rather than when customers paid.

This adjustment produces a measure of CFO based on

when the receivables were collected.

Additional Solutions Chapter 11 – P. 1

10{L}A.

Since December 1991, Morrison Knudsen has sold

receivables. Assuming that there was no gain or loss

on these sales and that proceeds were used to repay

debt, the sold receivables should be added back to the

receivables (see below), current assets, and shortterm debt (current liabilities).

1990

Reported Accounts Receivable $182,283

Sold Receivables

-0Adjusted Receivables

$ 182,283

Average Receivables: as reported

adjusted

1991

$135,253

66,976

$202,229

158,768

192,256

1992

$160,196

87,264

$247,460

147,725

224,845

1993

$231,021

75,937

$306,958

195,609

277,209

Reported

Adjusted

1990

$645,440

645,440

1991

$658,200

725,176

1992

$681,412

768,676

1993

$793,221

869,158

Current Liabilities

Reported

Adjusted

$404,795

404,795

$379,121

446,097

$608,730

695,994

$689,534

765,471

Current Assets

Current ratio

Reported

Adjusted

1992

1.12

1.10

1993

1.15

1.14

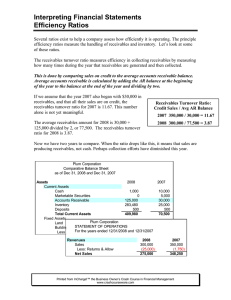

Receivables turnover

Reported

Adjusted

15.47

10.16

13.92

9.82

Days Receivables

Reported

Adjusted

24

36

26

37

1993 Computations:

Current ratio: Reported = $793,221/ $689,534 = 1.15

Adjusted = $869,158/ $765,471 = 1.14

Receivables

turnover:

Reported

=

$2,722,543/$195,609

=

13.92;

days

receivables = 365/13.92 = 26

Adjusted = $2,722,543/$277,209 = 9.82; days receivables = 365/9.82 = 37

The cash cycle equals days of receivables plus days of

inventories less days of payables. Neither the

inventories nor the payables are affected by sales of

receivables. Therefore, the receivables sales improved

the cash cycle. However, the adjusted data show that

the receivables are actually outstanding longer and

the firm’s cash cycle increased.

Additional Solutions Chapter 11 – P. 2

B.

Total debt

Reported

Adjustment

Adjusted

Equity

Debt-to-equity

Reported

Adjusted

Total capital

Reported

Adjustment

Adjusted

EBIT

Return on total capital

Reported

Adjusted

1992

$

1993

6,214

87,264

$ 93,478

$ 47,006

75,937

$122,943

375,771

406,967

0.02

0.25

0.12

0.30

$381,985

87,264

$469,249

$453,973

75,937

$529,910

36,690

66,075

9.6%

7.8%

14.6%

12.5%

Including the sold receivables increases the debt-toequity ratio significantly for both years. The higher

denominator reduces return-on-total-capital. Note that

EBIT should be adjusted for interest on sold

receivables; however, no information on interest

expense or interest rates has been provided.

Additional Solutions Chapter 11 – P. 3

C.

1990

Receivables sold

Closing

Opening

Change

1991

$66,976

$66,976

Cash flow from operations

Reported

$72,679

94,652

Adjustment

(66,976)

Adjusted

$72,679

$27,676

1992

$ 87,264

66,976

$ 20,288

1993

$ 75,937

87,264

$(11,327)

173,905

(64,302)

(20,288)

11,327

$153,617 $(52,975)

The sale of receivables increases the cash flow from

operations. In the absence of sales of receivables,

the firm would have reported lower CFO in 1991 and

1992. In 1993, the reduced amount of sold receivables

reduced CFO. Sales of receivables distort reported CFO

in each year as well as year-to-year comparisons.

Additional Solutions Chapter 11 – P. 4

11.{M} A. First, we compute data required to solve the problem.

($ in millions)

1993

1994

Accounts receivable Reported

$ 546.0

$ 742.0

Sold receivables

263.8

296.8

Adjusted

$ 809.8

$1,038.8

receivables

Average receivables Reported

644.0

Adjusted

924.3

Current assets

Reported

2,078.0

2,229.0

Adjusted

2,341.8

2,525.8

Current liabilities Reported

1,993.0

2,232.0

Adjusted

2,256.8

2,528.8

Total debt

Reported

1,707.0

1,530.0

Adjusted

1,970.8

1,826.8

The ratios can be computed as follows:

Current ratio Reported

Adjusted

Receivables

Reported

turnover

Adjusted

Days

Reported

receivables

Adjusted

1994

1.00

1.00

7.91

Computations

$ 2,229 / $ 2,232

$2,525.8/$2,528.8

$ 5,093 / $ 644

5.51

46

$ 5,093 / $ 924.3

365 / 7.91

66

365 / 5.51

The cash cycle equals days of receivables plus days of

inventories less days of payables. Neither the

inventories nor the payables are affected by sales of

receivables. Therefore, sales of receivables, by

increasing days of receivables from a reported 46 days

to an adjusted 66 days, increases the cash cycle by

the same number of days.

B.

1994

Debt

to

equity

ratio:

Reported

1.02

Adjusted

1.22

Return on total capital:

Reported

8.18%

Adjusted

7.47%

Computations

$1,530.0/$1,505.0

$1,826.8/$1,505.0

$ 249 / $ 3,045

$ 249/ $ 3.331.8

The adjusted leverage ratio is higher and the adjusted

return lower than the reported ratios.

Additional Solutions Chapter 11 – P. 5

C.

1994

CFO - as reported $ 454.0

Sold receivables

(33.0)

Adjusted CFO

$ 421.0

The firm reported an increase of 87% in CFO. However,

the increase in receivables sold inflated CFO by

recognizing the proceeds of sale sooner than if the

receivables had been collected in the normal course of

business. To compare with 1993 CFO, we would need to

know the change in receivables sold during that year

as well.

Additional Solutions Chapter 11 – P. 6