ACCT2102 – Introduction to Management Accounting Exam #2, Fall 2008

advertisement

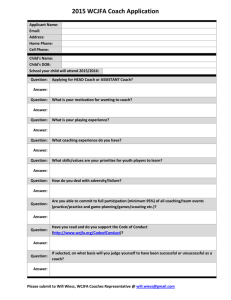

ACCT2102 – Introduction to Management Accounting Exam #2, Fall 2008 Problem (12 points) Be sure to show and organize your work On the following pages you will find financial information related to Coach Inc.’s most recent fiscal year that ended June 28, 2008. Coach has grown from a family‐run workshop in a Manhattan loft to a leading American marketer of fine accessories and gifts for women and men. Coach is one of the most recognized fine accessories brands in the U.S. and in targeted international markets. We offer premium lifestyle accessories to a loyal and growing customer base and provide consumers with fresh, relevant and innovative products that are extremely well made, at an attractive price. Coach’s modern, fashionable handbags and accessories use a broad range of high quality leathers, fabrics and materials. In response to our customer’s demands for both fashion and function, Coach offers updated styles and multiple product categories which address an increasing share of our customer’s accessory wardrobe. Coach has created a sophisticated, modern and inviting environment to showcase our product assortment and reinforce a consistent brand position wherever the consumer may shop. We utilize a flexible, cost‐effective global sourcing model, in which independent manufacturers supply our products, allowing us to bring our broad range of products to market rapidly and efficiently. Using the available data answer the following questions. All computations relate to the fiscal year ending 06/28/2008. Assume a 35% income tax rate. 1. Determine the company’s ROIC. NOPAT = 783 + (1‐.35)0 = 783, Invested Capital = 2273.8 – 450.9 = 1822.9 * Note that the interest expense is 0 because Coach only had interest income, not interest expense ROIC = 783 / 1822.9 = 42.95% 2. Determine the company’s CCCT (and its individual components: DIA, DSO, DPO). Average Daily Sales = 3180.8/365 = $8.71 million DIA = (345.5 + 291.2)/2 / 8.71 = 37 days DSO = (106.7 + 107.8)/2 / 8.71 = 12 days DPO = (134.7 + 109.3)/2 / 8.71 = 14 days CCCT = 37 + 12 – 14 = 35 days 3. Briefly discuss how Coach’s CCCT has changed since 2005 and how it compares to the industry overall. Coach’s DIA of 37 days is significantly better than the industry average of a little more than 50 days. Their DIA has decrease only slightly this year over the previous 3 year average of about 41 days. The company’s DSO of 12 days is again much better than the industry average of about 47 days. Also, the company has improved slightly in 2008 compared to previous years DSO of around 15 days. Finally, DPO of 14 days is better than industry averag of 23 days and has remained steady over the past several years. Overall, Coach’s CCCT of 35 days compares favorably to the industry average of about 77 days. This contributes to Coach’s seemingly high ROIC. Short CCCT indicates efficient operations contributing to high overal financial performance. 4. Determine the company’s CFROIC CFROIC = 923.4 / 10,600 = 8.7% While CFROIC is not has high as traditional ROIC that may be because the firm’s stock is trading at a very high market value relative to the book value of invested capital. In fact, operating cash flow as a percent of book value invested capital is 51% (923.4 / 1822.9) indicating that the firm is generating significant cash flow from operations. Page 3