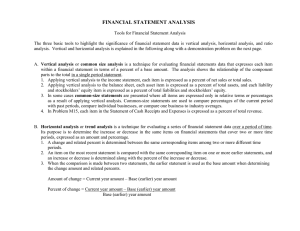

Chapter 14 Chapter 14-1 Limitations of Financial Statement Analysis

advertisement

Chapter 14-1 Chapter 14 “How Well Am I Doing?” Financial Statement Analysis © The McGraw-Hill Companies, Inc., 2007 McGraw-Hill /Irwin Limitations of Financial Statement Analysis Differences in accounting methods between companies sometimes make comparisons difficult. We use the LIFO method to value inventory. We use the FIFO method to value inventory. 14-2 Limitations of Financial Statement Analysis Industry trends Technological changes Changes within the company Consumer tastes Economic factors Analysts should look beyond the ratios. 14-3 Chapter 14-2 Statements in Comparative and Common-Size Form n Dollar and percentage changes on statements Analytical techniques used to examine relationships among financial statement items o Common-size statements p Ratios 14-4 Learning Objective LO1 To prepare and interpret financial statements in comparative and common-size form 14-5 Horizontal Analysis Horizontal analysis shows the changes between years in the financial data in both dollar and percentage form. 14-6 Chapter 14-3 Horizontal Analysis Example The following slides illustrate a horizontal analysis of Clover Corporation’s December 31, 2005 and 2004 comparative balance sheets and comparative income statements. 14-7 Horizontal Analysis CLOVER CORPORATION Comparative Balance Sheets December 31 2005 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets $ 12,000 60,000 80,000 3,000 155,000 40,000 120,000 160,000 $ 315,000 Increase (Decrease) Amount % 2004 $ 23,500 40,000 100,000 1,200 164,700 40,000 85,000 125,000 $ 289,700 14-8 Horizontal Analysis Calculating Change in Dollar Amounts Dollar Change = Current Year Figure – Base Year Figure The dollar amounts for 2004 become the “base” year figures. 14-9 Chapter 14-4 Horizontal Analysis Calculating Change as a Percentage Percentage Change = Dollar Change Base Year Figure × 100% 14-10 Horizontal Analysis CLOVER CORPORATION Comparative Balance Sheets December 31 Increase (Decrease) 2005 2004 Amount % Assets Current assets: Cash $ 12,000 $ 23,500 $ (11,500) (48.9) Accounts receivable, net 60,000 40,000 Inventory 80,000 100,000 Prepaid expenses 3,000 1,200 $12,000 –155,000 $23,500164,700 = $(11,500) Total current assets Property and equipment: Land 40,000 40,000 ($11,500 ÷ $23,500) × 100% = 48.9% Buildings and equipment, net 120,000 85,000 Total property and equipment 160,000 125,000 Total assets $ 315,000 $ 289,700 14-11 Horizontal Analysis CLOVER CORPORATION Comparative Balance Sheets December 31 2005 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets $ 12,000 60,000 80,000 3,000 155,000 40,000 120,000 160,000 $ 315,000 $ 2004 Increase (Decrease) Amount % 23,500 40,000 100,000 1,200 164,700 $ (11,500) 20,000 (20,000) 1,800 (9,700) (48.9) 50.0 (20.0) 150.0 (5.9) 35,000 35,000 $ 25,300 0.0 41.2 28.0 8.7 40,000 85,000 125,000 $ 289,700 14-12 Chapter 14-5 Horizontal Analysis We could do this for the liabilities & stockholders’ equity, but now, let’s look at the income statement accounts. 14-13 Horizontal Analysis CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 2005 2004 Net sales $ 520,000 $ 480,000 Cost of goods sold 360,000 315,000 Gross margin 160,000 165,000 Operating expenses 128,600 126,000 Net operating income 31,400 39,000 Interest expense 6,400 7,000 Net income before taxes 25,000 32,000 Less income taxes (30%) 7,500 9,600 Net income $ 17,500 $ 22,400 Increase (Decrease) Amount % 14-14 Horizontal Analysis CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 2005 2004 Net sales $ 520,000 $ 480,000 Cost of goods sold 360,000 315,000 Gross margin 160,000 165,000 Operating expenses 128,600 126,000 Net operating income 31,400 39,000 Interest expense 6,400 7,000 Net income before taxes 25,000 32,000 Less income taxes (30%) 7,500 9,600 Net income $ 17,500 $ 22,400 Increase (Decrease) Amount % $ 40,000 8.3 45,000 14.3 (5,000) (3.0) 2,600 2.1 (7,600) (19.5) (600) (8.6) (7,000) (21.9) (2,100) (21.9) $ (4,900) (21.9) 14-15 Chapter 14-6 Horizontal Analysis CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 2005 2004 Net sales $ 520,000 $ 480,000 Cost of goods sold 360,000 315,000 Gross margin 165,000 Sales increased160,000 by 8.3%, yet Operating 128,600by 126,000 net expenses income decreased 21.9%. Net operating income 31,400 39,000 Interest expense 6,400 7,000 Net income before taxes 25,000 32,000 Less income taxes (30%) 7,500 9,600 Net income $ 17,500 $ 22,400 Increase (Decrease) Amount % $ 40,000 8.3 45,000 14.3 (5,000) (3.0) 2,600 2.1 (7,600) (19.5) (600) (8.6) (7,000) (21.9) (2,100) (21.9) $ (4,900) (21.9) 14-16 Horizontal Analysis CLOVER CORPORATION There were increases in both cost of goods Comparative Statements sold (14.3%) and operatingIncome expenses (2.1%). For the Years Ended December 31 These increased costs more than offset the Increase increase in sales, yielding an overall (Decrease) decrease in net2005 income.2004 Amount % Net sales $ 520,000 $ 480,000 $ 40,000 Cost of goods sold 360,000 315,000 45,000 Gross margin 160,000 165,000 (5,000) Operating expenses 128,600 126,000 2,600 Net operating income 31,400 39,000 (7,600) Interest expense 6,400 7,000 (600) Net income before taxes 25,000 32,000 (7,000) Less income taxes (30%) 7,500 9,600 (2,100) Net income $ 17,500 $ 22,400 $ (4,900) 8.3 14.3 (3.0) 2.1 (19.5) (8.6) (21.9) (21.9) (21.9) 14-17 Trend Percentages Trend percentages state several years’ financial data in terms of a base year, which equals 100 percent. 14-18 Chapter 14-7 Trend Percentages Trend = Percentage Current Year Amount 100% × Base Year Amount 14-19 Trend Percentages Example Look at the income information for Berry Products for the years 2001 through 2005. We will do a trend analysis on these amounts to see what we can learn about the company. 14-20 Trend Percentages Berry Products Income Information For the Years Ended December 31 Item Sales Cost of goods sold Gross margin 2005 $ 400,000 285,000 115,000 2004 $ 355,000 250,000 105,000 Year 2003 $ 320,000 225,000 95,000 2002 $ 290,000 198,000 92,000 2001 $ 275,000 190,000 85,000 The base year is 2001, and its amounts will equal 100%. 14-21 Chapter 14-8 Trend Percentages Berry Products Income Information For the Years Ended December 31 Item 2005 2004 Year 2003 2002 105% 104% 108% Sales Cost of goods sold Gross margin 2001 100% 100% 100% 2002 Amount ÷ 2001 Amount × 100% ( $290,000 ÷ $275,000 ) × 100% = 105% ( $198,000 ÷ $190,000 ) × 100% = 104% ( $ 92,000 ÷ $ 85,000 ) × 100% = 108% 14-22 Trend Percentages Berry Products Income Information For the Years Ended December 31 Item 2005 145% 150% 135% Sales Cost of goods sold Gross margin 2004 129% 132% 124% Year 2003 116% 118% 112% 2002 105% 104% 108% 2001 100% 100% 100% By analyzing the trends for Berry Products, we can see that cost of goods sold is increasing faster than sales, which is slowing the increase in gross margin. 14-23 Trend Percentages 160 Percentage 150 We can use the trend percentages to construct a graph so we can see the trend over time. 140 130 Sales COGS GM 120 110 100 2001 2002 2003 2004 2005 Year 14-24 Chapter 14-9 Common-Size Statements Common-size statements use percentages to express the relationship of individual components to a total within a single period. This is also known as vertical analysis. 14-25 Common-Size Statements In income statements, all items are expressed as a percentage of net sales. 14-26 Gross Margin Percentage Gross Margin Percentage = Gross Margin Sales This measure indicates how much of each sales dollar is left after deducting the cost of goods sold to cover expenses and provide a profit. 14-27 Chapter 14-10 Common-Size Statements In balance sheets, all items are expressed as a percentage of total assets. 14-28 Common-Size Statements Wendy's McDonald's Dollars Percentage Dollars Percentage 2002 Net income $ 219 8.00% $ 893 5.80% (dollars in millions) Common-size financial statements are particularly useful when comparing data from different companies. 14-29 Common-Size Statements Example Let’s take another look at the information from the comparative income statements of Clover Corporation for 2005 and 2004. This time let’s prepare common-size statements. 14-30 Chapter 14-11 Common-Size Statements CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 Common-Size Percentages 2005 2004 2005 2004 Net sales $ 520,000 $ 480,000 100.0 100.0 Cost of goods sold 360,000 315,000 Net sales is Gross margin 160,000 165,000 the base Operating expenses 128,600 126,000 Net operating income 31,400 39,000 and is Interest expense 6,400 7,000 expressed Net income before taxes 25,000 32,000 as 100%. Less income taxes (30%) 7,500 9,600 Net income $ 17,500 $ 22,400 14-31 Common-Size Statements CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 Common-Size Percentages 2005 2004 2005 2004 Net sales $ 520,000 $ 480,000 100.0 100.0 Cost of goods sold 360,000 315,000 69.2 65.6 Gross margin 160,000 165,000 Operating expenses 128,600 126,000 2005 Cost ÷ 2005 Sales Net operating income 31,400× 100% 39,000 ( $360,000 ) × 100% = 69.2% Interest expense ÷ $520,000 6,400 7,000 Net income before taxes 25,000 32,000 Cost ÷ 2004 × 100% Less income 2004 taxes (30%) 7,500 Sales 9,600 $480,000 ) × 100% = 65.6% Net income ( $315,000 $÷17,500 $ 22,400 14-32 Common-Size Statements CLOVER CORPORATION Comparative Income Statements For the Years Ended December 31 Common-Size What conclusions can we draw? Percentages 2005 2004 2005 2004 Net sales $ 520,000 $ 480,000 100.0 100.0 Cost of goods sold 360,000 315,000 69.2 65.6 Gross margin 160,000 165,000 30.8 34.4 Operating expenses 128,600 126,000 24.8 26.2 Net operating income 31,400 39,000 6.0 8.2 Interest expense 6,400 7,000 1.2 1.5 Net income before taxes 25,000 32,000 4.8 6.7 Less income taxes (30%) 7,500 9,600 1.4 2.0 Net income $ 17,500 $ 22,400 3.4 4.7 14-33 Chapter 14-12 Quick Check 9 Which of the following statements describes horizontal analysis? a. A statement that shows items appearing on it in percentage and dollar form. b. A side-by-side comparison of two or more years’ financial statements. c. A comparison of the account balances on the current year’s financial statements. d. None of the above. 14-34 Quick Check 9 Which of the following statements describes horizontal analysis? a. A statement that shows items appearing on it in percentage and dollar form. b. A side-by-side comparison of two or more years’ financial statements. c.Horizontal A comparison of the account analysis shows the balances changes on the current year’s financial statements. between years in the financial data, in d. None ofdollar the above. both and percentage form. 14-35 Ratios Common Stockholders Short-term Creditors Long-term Creditors 14-36 Chapter 14-13 Now, let’s look at Norton Corporation’s recent financial statements. 14-37 NORTON CORPORATION Balance Sheets December 31 2005 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets $ 30,000 20,000 12,000 3,000 65,000 165,000 116,390 281,390 $ 346,390 2004 $ 20,000 17,000 10,000 2,000 49,000 123,000 128,000 251,000 $ 300,000 14-38 NORTON CORPORATION Balance Sheets December 31 2005 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 39,000 $ Notes payable, short-term 3,000 Total current liabilities 42,000 Long-term liabilities: Notes payable, long-term 70,000 Total liabilities 112,000 Stockholders' equity: Common stock, $1 par value 27,400 Additional paid-in capital 158,100 Total paid-in capital 185,500 Retained earnings 48,890 Total stockholders' equity 234,390 Total liabilities and stockholders' equity $ 346,390 $ 2004 40,000 2,000 42,000 78,000 120,000 17,000 113,000 130,000 50,000 180,000 300,000 14-39 Chapter 14-14 NORTON CORPORATION Income Statements For the Years Ended December 31 Net sales Cost of goods sold Gross margin Operating expenses Net operating income Interest expense Net income before taxes Less income taxes (30%) Net income 2005 $ 494,000 140,000 354,000 270,000 84,000 7,300 76,700 23,010 $ 53,690 2004 $ 450,000 127,000 323,000 249,000 74,000 8,000 66,000 19,800 $ 46,200 14-40 Learning Objective LO2 To compute and interpret financial ratios that would be useful to a common stockholder 14-41 Ratio Analysis – The Common Stockholder NORTON CORPORATION 2005 Use this information to calculate ratios to measure the well-being of the common stockholders of Norton Corporation. Number of common shares outstanding Beginning of year End of year Net income 17,000 27,400 $ 53,690 Stockholders' equity Beginning of year 180,000 End of year 234,390 Dividends per share Dec. 31 market price per share Interest expense 2 20 7,300 Total assets Beginning of year 300,000 End of year 346,390 14-42 Chapter 14-15 Earnings Per Share Earnings per Share = Net Income – Preferred Dividends Average Number of Common Shares Outstanding Whenever a ratio divides an income statement balance by a balance sheet balance, the average for the year is used in the denominator. 14-43 Earnings Per Share Earnings per Share = Net Income – Preferred Dividends Average Number of Common Shares Outstanding $53,690 – 0 (17,000 + 27,400)/2 Earnings per Share = = $2.42 This measure indicates how much income was earned for each share of common stock outstanding. 14-44 Price-Earnings Ratio Price-Earnings Ratio = Market Price Per Share Earnings Per Share Price-Earnings Ratio = $20.00 = 8.26 times $2.42 This measure is often used by investors as a general guideline in gauging stock values. Generally, the higher the priceearnings ratio, the more opportunity a company has for growth. 14-45 Chapter 14-16 Dividend Payout Ratio Dividend Payout Ratio = Dividend Payout Ratio = Dividends Per Share Earnings Per Share $2.00 = 82.6% $2.42 This ratio gauges the portion of current earnings being paid out in dividends. Investors seeking current income would like this ratio to be large. 14-46 Dividend Yield Ratio Dividend Yield Ratio = Dividends Per Share Market Price Per Share Dividend Yield Ratio = $2.00 = 10.00% $20.00 This ratio identifies the return, in terms of cash dividends, on the current market price of the stock. 14-47 Return on Total Assets Return on = Total Assets Return on = Total Assets Net Income + [Interest Expense × (1 – Tax Rate)] Average Total Assets $53,690 +[7,300 × (1 – .30)] = 18.19% ($300,000 + $346,390) ÷ 2 This ratio measures how well assets have been employed. 14-48 Chapter 14-17 Return on Common Stockholders’ Equity Return on Common = Net Income – Preferred Dividends Stockholders’ Equity Average Stockholders’ Equity Return on Common $53,690 – 0 = = 25.91% Stockholders’ Equity ($180,000 + $234,390) ÷ 2 This measure indicates how well the company employed the owners’ investments to earn income. 14-49 Financial Leverage Financial leverage involves acquiring assets with funds at a fixed rate of interest. Return on investment in > assets Fixed rate of return on borrowed funds Positive = financial leverage Return on investment in < assets Fixed rate of return on borrowed funds Negative = financial leverage 14-50 Quick Check 9 Which of the following statements is true? a. Negative financial leverage is when the fixed return to a company’s creditors and preferred stockholders is greater than the return on total assets. b. Positive financial leverage is when the fixed return to a company’s creditors and preferred stockholders is greater than the return on total assets. c. Financial leverage is the expression of several years’ financial data in percentage form in terms of a base year. 14-51 Chapter 14-18 Quick Check 9 Which of the following statements is true? a. Negative financial leverage is when the fixed return to a company’s creditors and preferred stockholders is greater than the return on total assets. b. Positive financial leverage is when the fixed return to a company’s creditors and preferred stockholders is greater than the return on total assets. c. Financial leverage is the expression of several years’ financial data in percentage form in terms of a base year. 14-52 Book Value Per Share Book Value per Share = Book Value per Share Common Stockholders’ Equity Number of Common Shares Outstanding = $234,390 27,400 = $ 8.55 This ratio measures the amount that would be distributed to holders of each share of common stock if all assets were sold at their balance sheet carrying amounts and if all creditors were paid off. 14-53 Book Value Per Share Book Value per Share = Book Value per Share Common Stockholders’ Equity Number of Common Shares Outstanding = $234,390 27,400 = $ 8.55 Notice that the book value per share of $8.55 does not equal the market value per share of $20. This is because the market price reflects expectations about future earnings and dividends, whereas the book value per share is based on historical cost. 14-54 Chapter 14-19 Learning Objective LO3 To compute and interpret financial ratios that would be useful to a short-term creditor 14-55 Ratio Analysis – The Short–Term Creditor NORTON CORPORATION Use this information to calculate ratios to measure the well-being of the short-term creditors for Norton Corporation. 2005 Cash $ 30,000 Accounts receivable, net Beginning of year 17,000 End of year 20,000 Inventory Beginning of year 10,000 End of year 12,000 Total current assets Total current liabilities 65,000 42,000 Sales on account 500,000 Cost of goods sold 140,000 14-56 Working Capital The excess of current assets over current liabilities is known as working capital. Working capital is not free. It must be financed with long-term debt and equity. 14-57 Chapter 14-20 Working Capital December 31, 2005 Current assets $ 65,000 Current liabilities Working capital (42,000) $ 23,000 14-58 Current Ratio Current Ratio = Current Assets Current Liabilities The current ratio measures a company’s short-term debt paying ability. A declining ratio may be a sign of deteriorating financial condition, or it might result from eliminating obsolete inventories. 14-59 Current Ratio Current Ratio = Current Assets Current Liabilities Current Ratio = $65,000 $42,000 = 1.55 : 1 The current ratio measures a company’s short-term debt paying ability. 14-60 Chapter 14-21 Acid-Test (Quick) Ratio Acid-Test = Ratio Quick Assets Current Liabilities Acid-Test = Ratio $50,000 $42,000 = 1.19 : 1 Norton Corporation’s quick assets consist of cash of $30,000 and accounts receivable of $20,000. 14-61 Quick assets include Cash, Marketable Securities, Accounts Receivable and current Notes Receivable. This ratio measures a company’s ability to meet obligations without having to liquidate inventory. Accounts Receivable Turnover Accounts Receivable Turnover = Sales on Account Average Accounts Receivable Accounts $500,000 Receivable = = 27.03 times ($17,000 + $20,000) ÷ 2 Turnover This ratio measures how many times a company converts its receivables into cash each year. 14-62 Average Collection Period Average 365 Days Collection = Accounts Receivable Turnover Period Average Collection = Period 365 Days 27.03 Times = 13.50 days This ratio measures, on average, how many days it takes to collect an account receivable. 14-63 Chapter 14-22 Inventory Turnover Inventory Turnover Cost of Goods Sold Average Inventory = This ratio measures how many times a company’s inventory has been sold and replaced during the year. If a company’s inventory turnover Is less than its industry average, it either has excessive inventory or the wrong types of inventory. 14-64 Inventory Turnover Inventory Turnover Inventory Turnover = Cost of Goods Sold Average Inventory = $140,000 = 12.73 times ($10,000 + $12,000) ÷ 2 This ratio measures how many times a company’s inventory has been sold and replaced during the year. 14-65 Average Sale Period Average Sale Period Average = Sale Period = 365 Days Inventory Turnover 365 Days 12.73 Times = 28.67 days This ratio measures how many days, on average, it takes to sell the inventory. 14-66 Chapter 14-23 Learning Objective LO4 To compute and interpret financial ratios that would be useful to a long-term creditor 14-67 Ratio Analysis – The Long–Term Creditor Use this information to calculate ratios to measure the well-being of the longterm creditors for Norton Corporation. NORTON CORPORATION 2005 Earnings before interest expense and income taxes This is also referred to as net operating income. $ Interest expense 84,000 7,300 Total stockholders' equity 234,390 Total liabilities 112,000 14-68 Times Interest Earned Ratio Times Interest = Earned Times Interest = Earned Earnings before Interest Expense plus Income Taxes Interest Expense $84,000 = 11.5 times 7,300 This is the most common measure of the ability of a firm’s operations to provide protection to the long-term creditor. 14-69 Chapter 14-24 Debt-to-Equity Ratio Debt–to– Total Liabilities Equity = Stockholders’ Equity Ratio This ratio indicates the relative proportions of debt to equity on a company’s balance sheet. Stockholders like a lot of debt if the company can take advantage of positive financial leverage. Creditors prefer less debt and more equity because equity represents a buffer of protection. 14-70 Debt-to-Equity Ratio Debt–to– Total Liabilities Equity = Stockholders’ Equity Ratio Debt–to– Equity = Ratio $112,000 $234,390 = 0.48 This ratio indicates the relative proportions of debt to equity on a company’s balance sheet. 14-71 Published Sources That Provide Comparative Ratio Data 14-72 Chapter 14-25 End of Chapter 14 14-73