CONVERTING SIMULATION DATA TO COMPARATIVE INCOME STATEMENTS L. Leslie Gardner

advertisement

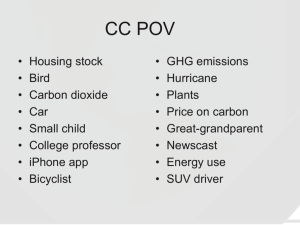

CONVERTING SIMULATION DATA TO COMPARATIVE INCOME STATEMENTS L. Leslie Gardner Mary E. Grant Laurie J. Rolston If a manufacturing system was a money amplifier, an accountant would see it like this: 2 If a manufacturing system was a money amplifier, an engineer would see it like this: 3 Models Built by Models Built by Accountants Engineers ---------------------------------- --------------------------------------------algebraic relationships time and spatial relationships cost, revenues throughput and queue lengths carrying costs shop floor congestion fiscal periods system state changes opportunity costs late orders spreadsheet simulation 4 HOW CAN WE BRIDGE THIS GAP? WHAT CAN SIMULATION CONTRIBUTE TO FINANCIAL ANALYSIS? (FOCUS ON CAPITAL INVESTMENT) 5 Outline Justifying a Capital Investment Measures of Investment Value Simulation-based Information Limitations Role of Activity-based Costing Example The Model Conversion of Data Conclusions 6 7 Justifying a capital investment ROI = return on investment EMV = expected monetary value IRR = internal rate of return NPV = net present value 8 Comparative Income Statements Revenue Cost of Goods Marginal Income Depreciation 10,000 Other Fixed Costs 300,000 Net Income Taxes(.50) Income after Tax Add Back Depreciation Cash Flow Before $1,000,000 600,000 400,000 20,000 310,000 300,000 90,000 45,000 45,000 10,000 55,000 After $1,000,000 585,000 415,000 320,000 95,000 47,500 47,500 20,000 67,500 9 Simulation-based Information for Capital Investment Analysis • • • • Throughput constrains revenue Processing time, setup time, number of setups, volume affect variable costs Thresholds of cost parameters affect fixed costs such as warehouse space Shop floor congestion affects carrying cost which is reflected as interest expense in cost of goods 10 Examples of Variable Manufacturing Costs Classification Prime costs Variable overhead Variable costs Measured attribute Direct materials Volume Direct labor Processing time Indirect materials Volume Lubricants Processing time Tooling Processing time Supplies Volume Utilities Processing time Setup Setup time, number of setups Indirect labor Volume 11 Limitations of Simulation-based Information • • Costs generated are relative costs Information limited by detail level and the scope of the model Benefits of Simulation-based Information • • Modeling flexibility can give wide range of detail levels Captures dynamic nature of manufacturing system 12 Activity-based Costing and Simulation Concepts: • Activities consume resources • Products consume specific activities Principles: • Trace costs directly when possible • Allocate costs based on occurrence of appropriate cost driver Application to simulation modeling: • Identification of cost drivers guides modeling efforts and forms a basis for cost allocation in 13 conversion of simulation data to income statements 14 Simulation Modeling with Costs Define problem Identify • performance measures • cost drivers Construct model Perform experiments Convert output to income statements 15 An Example: Facility and Equipment 4 part types 2 products bottleneck at finishing investigate profitability of purchase of fifth finishing machine 16 Performance Measures • • Revenue Variable costs - Raw materials - Direct labor - Indirect materials - Lubricants - Tooling - Supplies Utilities Setup cost Indirect labor Cost Drivers • • • Processing time for each machine Number of setups for each machine Product volume 17 Construct Model • • • • • Adequate level of detail Cost collection - Post process conversion - Accumulation Initial conditions Length of simulation window Validation and verification 18 Converting Simulation Data to Comparative Income Statements • • • Calculate unit variable costs from current financial data and performance measures or from specifications Infer costs from unit variable costs, performance measures and cost drivers Construct comparative income statements (conversion done in an electronic spreadsheet) 19 Comparative Income Statement Revenue Cost of Goods Marginal Income Depreciation 210,000 Other Fixed 595,475 Costs Net Income Taxes(.50) Income After Tax Add Back Depreciation Cash Flow Basecase $2,363,400 1,398,304 965,096 Fifth Machine $2,363,400 1,262,027 1,101,373 220,000 805,475 595,475 815,475 159,621 79,811 79,810 210,000 285,898 142,949 142,949 220,000 289,810 362,949 20 Conclusions • Translation of engineering data into financial terms • Common models for engineers and accountants • Use same models in business schools and engineering schools 21