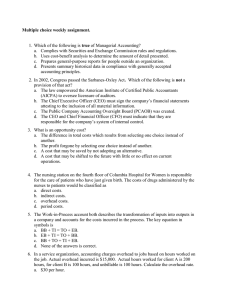

Chapter 5 Activity-Based Costing

advertisement

Chapter 5 Activity-Based Costing Overcosting and Undercosting (Example 1 at the end of these notes) Distortions from inaccurate costing Activities/Resources/Cost Drivers Steps in ABC Identify resources and activities Assign costs to activities Assign costs to cost objects Types of cost-pools and drivers: Unit based (volume) Batch-level Product-sustaining level Facility-sustaining level Comparison of volume-based (POHR) allocation and ABC Example 2 (at the end of these notes) Activity analysis and value-added activities ABC for a service firm ABC for customer profitability analysis Strategic cost management Example 1 Orange networks makes network hubs. They have two types: C (complex) and S (simple). They are the industry leader – and have been for years in making hubs like the S hub. But they find that they are not currently price competitive in making these anymore. Their strategy is to mark up their products 30% on full cost – which is about as much as the market for this type of product will allow. Here is a summary of their unit manufacturing costs: Direct materials Direct labor Overhead Total C $120.00 40.00 97.78 $257.78 S $90.00 $20.00 48.89 $158.89 Selling prices are, thus set at: $205 for S and $335 for C. The “market” price for C is $198 and for S is $375. Direct labor is $20 per hour and overhead is applied based upon the rate of $48.89 per DLH. After investigation, they noted that there were two cost pools. There was a volume-based cost pool that totaled $120,000 and a batch-based cost pool that totaled $100,000. There are 2 units of C or 10 units of S in a batch and DLH is still considered an appropriate driver for the volume based cost pool. Orange networks plans to produce 1,000 units of C and 2,500 units of S. What is the appropriate unit cost for each of these products and what is the appropriate selling price to obtain a 30% markup on full cost? Example 2 College Supply Company (CSC) makes three types of drinking glasses: short, medium, and tall. It presently applies overhead using a predetermined overhead rate based on direct labor-hours. A group of company employees recommended that CSC switch to activitybased costing and identified the following activities, cost drivers, estimated costs and estimated cost driver units for Year 5 for each activity center. Activity pool Setting up production Processing orders Handling materials Using machines Quality control Packing and shipping Recommended Cost Driver Number of production runs Number of orders Estimated Cost $24,000 Estimated Cost Driver Units 100 runs 40,000 200 orders Pounds of materials 16,000 8,000 pounds Machine-hours Number of inspections Units produced 48,000 40,000 10,000 40 hours inspections 32,000 20,000 units $200,000 In addition, management estimated 2,000 direct labor-hours for year 5. Assume the following cost driver volumes occurred in February of Year 5: Short Medium Tall Number of units produced 1,000 500 400 Direct materials costs $4,000 $2,500 $2,000 Direct labor-hours 100 120 110 Number of orders 8 8 4 Number of production runs 2 4 8 Pounds of material 400 800 200 Machine-hours 500 300 300 Number of inspections 2 2 2 Units shipped 1,000 500 300 Direct labor costs were $20.00 per hour. 1. Compute the production cost per unit of each product using Direct Labor-Hours to allocate overhead (indirect costs) 2. Compute the production cost per unit of each product using Activity-Based Costing to allocate overhead (indirect costs). 3. Compute Cost of Goods Sold using each method. Example 3 The controller for Wolfe Machining has established the following overhead cost pools and cost drivers: Budgeted Overhead Cost Overhead Cost Pool Machine setups $240,000 Cost Driver Budgeted Activity Number of setups 200 setups Material handling $90,000 Units of raw material Quality control inspections $48,000 Number of inspections Other overhead costs $160,000 Machine hours 60,000 units 1,200 inspections 20,000 machine hours Order no. 715 has the following production requirements: Machine setups: Raw material: Inspections: Machine hours: 7 11,200 16 850 Required: A. Compute the total overhead that should be assigned to order no. 715 by using activitybased costing. B. Suppose that Wolfe were to use a single, predetermined overhead rate based on machine hours. Compute the rate per hour and the total overhead assigned to order no. 715.