The difference between pay settlements and earnings growth T

advertisement

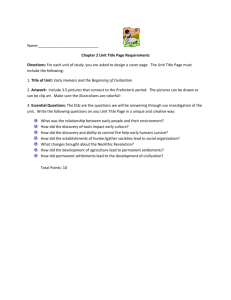

Feature 3 February 2005 1/2/05 3:46 pm Page 67 The difference between pay settlements and earnings growth Special feature 67 Special feature The difference between pay settlements and earnings growth By Sarah Miller, Incomes Data Services ■ ■ ■ ■ The Average Earnings Index (AEI), the official measure of earnings growth, shows a higher annual growth rate than aggregate data from pay settlements compiled by Incomes Data Services (IDS). Over the six years from 1998 to 2004, the median annual percentage rise from pay settlements has been around 1.0 to 1.5 percentage points lower that the annual growth in earnings measured by the AEI. The reason for the gap is that different things are being measured. The AEI captures the impact of bonuses, pay progression, interim adjustments and pay restructuring outside of the annual pay review, as well as changes in workforce composition. The gap between earnings growth and pay settlements is commonly termed ‘pay drift’. Some of this drift may not be particularly controlled, but some may be intentional and planned. Introduction he difference between earnings growth and pay settlements is a common source of confusion. Why is it that the measure of average earnings growth across the whole economy published by ONS is typically a percentage point or more higher than the median level of pay settlements published by Incomes Data Services (IDS)? This article looks at the reasons, explaining the differences between the two measures. The gap between earnings growth and pay settlements is commonly termed ‘pay drift’. T The IDS Pay Databank The median pay settlement level recorded in the IDS Pay Databank, published by IDS, has been fairly stable during 2004 at 3 per cent. However, growth in average earnings, as measured by the Average Earnings Index (AEI), has been more volatile, but has consistently been running at a significantly higher level. The whole economy figure, for the three months ended October 2004, was 4.1 per cent on the measure including bonuses, and 4.4 per cent excluding bonuses. Over a six-year period from 1998 to 2004, earnings growth has been running on average at around 1.25 percentage points higher than median pay settlements (see Figure 1). The reason for the gap is that different things are being measured. The measure of average earnings growth is more straightforward and precise in that it captures the totality of changes in all elements of pay. By contrast, the measurement of pay settlements is a far less exact science. When seeking to understand how pay is changing over time, to get a rounded picture it is important to look at the measures both of average earnings and of pay settlements, and to understand what each is measuring. What is a pay settlement? The IDS Pay Databank, published in the fortnightly IDS Pay Report, records around 1,000 settlements a year covering altogether some 8.5 million employees across the Office for National Statistics • Labour Market Trends • February 2005 ▼ Key points Feature 3 February 2005 3:46 pm Page 68 The difference between pay settlements and earnings growth Special feature ▼ 68 1/2/05 economy. The settlements recorded in the databank include both the pay rises that are collectively bargained between unions and employers and also non-negotiated pay awards. The data are gathered directly from employers and unions, and are based on asking about the percentage rise applied to wages or salaries in the annual pay review. Where the percentage rise varies (for example differing according to individual performance) the figure recorded is the average increase, or the increase received by most employees. The median settlement level is the point at which half of all settlements are above and half are below. Unlike the AEI measure, the pay settlement figure does not capture money paid out as non-consolidated bonuses or lump sums, nor the effects of any pay restructuring implemented outside of the annual pay review. The other main difference is that any changes in workforce composition that impact on the paybill are not reflected in the settlement figure, whereas they are in the AEI (see Box 1). In some cases the settlement figure is completely straightforward to Box Figure 1 Annual growth rates in the AEI, RPI and IDS Pay Databank; January 1998 to October 2004 Per cent 7 Average earnings growth (including bonuses)a Median pay settlementa 6 Retail Prices Index 5 4 3 2 1 0 1998 2000 1999 2002 2001 2004 Sources: Office for National Statistics; IDS Pay Databank a Three-monthly averages. ascertain – for example, where all employees in a company received a 3 per cent rise in salary. But with the growing emphasis in recent years on variable pay such as non-consolidated bonuses, and on differentiating pay rises by individual performance or market factors, the task of determining 1 What is being measured? Pay settlements in IDS Pay Databank Average Earnings Index (AEI) Included: Included: Consolidated increases in basic pay Performance-related pay rises Basic pay Overtime pay Bonuses Merit pay Progression increases Pay rises due to promotions Market adjustments Effects of pay restructuring Changes in workforce composition Excluded: Bonuses and lump sums Incremental progression ‘Off-cycle’ adjustments (outside the annual pay review) Pay restructuring outside of the annual review Changes in workforce composition Office for National Statistics 2003 • Labour Market Trends • February 2005 Feature 3 February 2005 1/2/05 3:46 pm Page 69 The difference between pay settlements and earnings growth Table Special feature 69 1 Numbers of pay settlements by month and range of increase; May 2003 to October 2004 2003 May June July August September October November December 1 1 3 0 0 0 0 0 0.1 to 1.9 1 0 0 0 0 2 0 1 2.0 to 2.9 13 8 16 4 8 14 9 3 3.0 to 3.9 12 18 48 25 11 43 15 4 4 0 to 4.9 4 3 8 5 4 7 1 0 5.0 to 5.9 1 6 4 3 1 4 0 0 6.0 to 6.9 0 2 2 1 0 2 1 0 Range of increase (per cent) Freeze 7.0 to 7.9 0 1 0 1 0 7 0 0 8.0 or more 1 1 2 0 2 1 0 0 33 40 83 39 26 80 26 8 January February March April May June July August September October Freeze 9 1 1 4 0 0 0 0 0 2 0.1 to 1.9 3 0 0 2 1 1 0 1 0 5 2.0 to 2.9 48 10 8 95 11 7 23 4 4 17 3.0 to 3.9 123 18 28 160 22 11 31 18 7 5 4 0 to 4.9 14 0 7 24 4 3 7 5 1 1 5.0 to 5.9 8 0 2 9 0 1 5 3 0 1 6.0 to 6.9 2 3 0 1 2 0 1 1 0 0 Total settlements 2004 Range of increase (per cent) 7.0 to 7.9 2 0 0 0 1 3 0 1 1 0 8.0 or more 4 3 2 6 0 1 1 0 0 0 213 35 48 301 41 27 68 33 13 31 Total settlements how much a pay settlement is worth in annual percentage terms has become far more complex. This has particularly been the case in the financial services sector, where the increase awarded on salaries in the annual pay review is only one element in the whole picture of changes to the remuneration package. The annual profit-sharing bonus and individual or job family market-related adjustments outside the annual pay review are just as important. A further complication is where pay deals span more than 12 months, or are paid in several stages. Arriving at a single percentage figure to record the settlement in the IDS Pay Databank often involves a certain amount of judgement. Table 1 gives a month-by-month breakdown by percentage intervals of the settlements in the IDS Pay Databank over the 18 months from May 2003 to October 2004. The month indicates the effective date of the increase, or the first-stage increase in the case of settlements that are implemented in more than one stage over the year. As this Office for National Statistics • Labour Market Trends • February 2005 ▼ Source: IDS Pay Databank 3:46 pm Page 70 The difference between pay settlements and earnings growth Special feature Figure 2 Median and interquartile range of pay increases; May 2003 to October 2004, three-monthly average Per cent 4.5 4.0 3.5 3.0 2.5 Upper quartile Median Lower quartile The AEI is published monthly by ONS and measures how fast earnings are growing (it is not designed to measure levels of earnings). The index measures how earnings in the latest month compare with those for a year ago, with the index currently based on year 2000. The AEI is based on information obtained from ONS’s Monthly Wages and Salary Survey of around 8,500 organisations. The AEI captures the total paybill for the month divided by the number of employees, and includes all forms of pay whether consolidated or not, including bonuses, lump sums, market supplements, progression increases, overtime pay and the effects of pay restructuring. Changes in the composition of the workforce, such as the proportion of the workforce employed full-time or part-time or in skilled or unskilled Office for National Statistics October 2004 September 2004 August 2004 July 2004 June 2004 May 2004 April 2004 March 2004 February 2004 January 2004 November 2003 October 2003 September 2003 The Average Earnings Index August 2003 July 2003 0 June 2003 shows, the effective dates of pay reviews are not evenly distributed through the year, but rather are heavily concentrated in certain months, principally January, April and July. January is the most important review month for private sector reviews, while April is the principal month for pay reviews for public sector employees. Figure 2 shows the same data, giving the trend in the median and interquartile range of increases over the 18 months to October 2004. These data are presented on a rolling three-month basis rather than by individual month, in order to give a clearer view of the trend. For example, the median settlement level of 3.1 per cent shown for October 2004 is based on a total of 77 settlements with effective dates in the three months up to 31 October 2004. May 2003 ▼ 70 1/2/05 December 2003 Feature 3 February 2005 Three-month period to end Source: IDS Pay Databank Note: the median is the level at which half of the settlements are above and half below; the lower quartile is the level at which a quarter of settlements are below; the upper quartile is the level at which a quarter of settlements are above. capacities, can and do affect the AEI. For example, a growth in the number of part-time employees who are earning less than full-timers will have the effect of depressing average earnings. In manufacturing there has been a long-term decline in the number of lower paid manual workers and a reliance on fewer more skilled workers and this leads to a growth in average earnings, aside from any impact from pay settlements. Seasonally adjusted series ONS publishes a seasonally adjusted AEI as well as an unadjusted series. The latter accurately reflects the • Labour Market Trends • February 2005 fluctuations in monthly pay due to the payment of bonuses at certain times of the year. For example, the unadjusted series for the financial services sector shows huge peaks each year at around February/March when large sums are paid out in annual bonuses. The seasonally adjusted series generally takes out these peaks and troughs, but can be affected by changes in the timing of bonus payments when compared with previous years. To give a better guide to the growth in regular pay, ONS now publishes a seasonally adjusted series excluding bonus payments (see pp575-80, Labour Market Trends, November 2003). Feature 3 February 2005 1/2/05 3:46 pm Page 71 The difference between pay settlements and earnings growth How big is the gap? Figure 1 shows the trend in both pay settlements and whole economy seasonally adjusted average earnings growth since 1998. The average earnings line plots the three-month average figure in annual earnings growth. For example, the figure for October 2004 (4.1 per cent) is the average year-on-year rise in August, September and October. Similarly the pay settlement trend line shows the median settlement level in each rolling three-month period. The trend in the annual rate of inflation (all-items measure) is also given, showing that both settlements and earnings have been running comfortably ahead of the rise in the cost of living. Over the past few years there has typically been a gap of around 1.0 to 1.5 percentage points between settlements and average earnings growth. Occasionally the measures have coincided, and at other times the gap has been wider: for example, in spring 2000 average earnings were growing at more than 5 per cent a year while settlements were some 3 percentage points lower. The high Special feature growth in average earnings at that time was due to the millennium effect – for example, extra bonuses in the IT sector and stronger economic activity in parts of both manufacturing and services. Pay drift and pay drive As we have seen, the key difference between the AEI and pay settlements is that the former reflects the impact on pay packets from bonuses, pay progression, interim adjustments and pay restructuring outside of the annual pay review. This is what is termed ‘pay drift’, which implies a process that is not particularly controlled. However, in some cases the factors leading to higher earnings growth are coming from planned pay restructuring moves, and so could more accurately be termed ‘pay drive’. The Government has been concerned about pay drift, particularly in the public sector. While the headline settlement levels in the public sector in recent years have been not dissimilar to the private sector, the growth in average earnings has at times been much higher. For example, for most of 2003 the public sector earnings growth rate was running at more than 5 per cent, compared with a rate of 2.5 to 3.0 per cent average earnings growth in the private sector. The explanation for the public sector earnings growth was not that basic pay awards were much higher than the private sector, but rather reflected the impact of the major pay restructuring moves for public sector groups. These included the new shorter pay spine for teachers and higher London and South East pay for nurses and police. There was also an impact from the timing of pay reviews. Further information The IDS Pay Databank monitors pay settlement levels across the economy and is published in the fortnightly IDS Pay Report. For further information, contact: Sarah Miller, E-mail: sarah.miller@incomesdata.co.uk, Tel: 020 7250 3434. www.incomesdata.co.uk Office for National Statistics • Labour Market Trends • February 2005 71