Inventory

advertisement

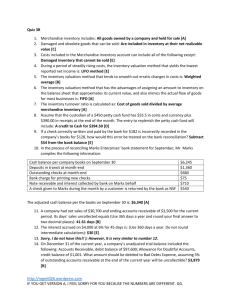

Inventory Problem no. 1 Alou Appliance Center accumulates the following cost and market data at December 31. Inventory Categories Cost Data Market Data Cameras $12,000 $12,100 Camcorders $9,500 $9,700 VCRs $14,000 $12,800 Compute the lower-of-cost-or-market valuation for the company's total inventory. Problem no. 2 Jensen's Department Stores uses a perpetual inventory system. Data for product E2-D2 include the following purchases. Date Number of units Unit price 07-May 50 $10 28-Jul 30 $13 On June 1 Jensen's sold 30 units and on August 27, 40 more units. Prepare the perpetual inventory schedule for the above transactions using 1) FIFO 2) LIFO 3) Average cost Problem no. 3 This information is available for Santo's Photo Corporation for 2007, 2008, and 2009. 2007 2008 2009 Beginning inventory $100,000 $300,000 $400,000 Ending inventory $300,000 $400,000 $480,000 Cost of goods sold $900,000 $1,120,000 $1,300,000 Sales $1,200,000 $1,600,000 $1,900,000 Instructions Calculate inventory turnover, days in inventory, and gross profit rate. Problem no. 4 Yount Company reports the following for the month of June Units Unit cost Total cost 01-Jun Inventory 200 $5 $1,000 12-Jun Purchase 300 $6 $1,800 23-Jun Purchase 500 $7 $3,500 30-Jun Inventory 120 Instructions a) Compute the cost of the ending and the cost of goods sold under (1) FIFO and (2) LIFO. b) Which costing method gives the higher ending inventory ? Why ? c) Which method results in the higher cost of goods sold ? Why ? Page 1 of 13 Problem no. 5 The management of Morales Co. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. They request your help in determining the results of operations for 2008 if either the FIFO method or the LIFO method had been used. For 2008, the accounting records show the following data. Inventories Beginning (15.000 units) $32,000 Ending (30.000 units) Purchases and Sales Total net sales (215.000 units) $865,000 Total cost of goods purchased (230.000 units) $595,000 Purchases were made quarterly as follows. Units Unit Cost Total cost Quarter 1 60.0000 $2.40 $144.000 2 50.0000 $2.50 $125.000 3 50.0000 $2.60 $130.000 $2.80 $196.000 4 70.0000 230.0000 $595.000 Operating expenses were $147.000, and the company's income tax rate is 34%. Instructions Prepare comparative condensed income statements for 2008 under FIFO and LIFO. (Show computations of ending inventory). Problem no. 6 Eddings Company had a beginning inventory of 400 units of product XNA at a cost of $8 per unit. During the year, purchases were : 20-Feb 600 units at $9 12-Aug 300 units at $11 05-Mar 500 units at $10 08-Dec 200 units at $12 Eddings Company uses a periodic inventory system. Sales totaled 1.500 units. Instructions a) Determine the cost of goods available for sale. b) Determine (1) the ending inventory, and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. c) Which cost flow method results in (1) the lowest inventory amount for the balance sheet, and (2) the lowest cost of goods sold for the income statement ? Problem no. 7 Presented is information related to Bolivia Co. for the month of January 2007. Freight-in $10.000 Rent expense $19.000 Freight-out $5.000 Salary expense $61.000 Page 2 of 13 Insurance expense $12.000 Sales discounts $8.000 Purchases $220.000 Sales returns $13.000 Purchase discounts $3.000 Sales $325.000 Purchase returns $6.000 Beginning merchandise inventory was $42.000. Ending inventory was $63.000. Instructions Prepare an income statement for the month of January 2007. Bank reconciliation Problem no. 1 Anna Pelo is unable to reconcile the bank balance at January 31,2007. Anna's reconciliation is as follows. Cash balance per bank $3560.20 Add : NSF check $690 Less : Bank service charge $25 Adjusted balance per bank $4225.20 Cash balance per books $3875.20 Less : Deposits in transit $530 Add : Outstanding checks $930 Adjusted balance per books $4275.20 Instructions a) Prepare a correct bank reconciliation. b) Journalize the entries required by the reconciliation. Problem no. 2 The information below relates to the Cash account in the ledger of Robertson Company. Balance September 1,2007 - $17,150; Cash deposited - $64,000 Balance September 30,2007 - $17,404; Checks written - $63,746 The September bank statement shows a balance of $16,422 on September 30,2007 and the following memoranda. Credits Collection of $1,500 note plus interest $30 $1,530 Interest earned on checking account $45 Debits Page 3 of 13 NSF check : J.E.Hoover $425 Safety deposit box rent $65 At September 30,2007 deposits in transit were $4,450, and outstanding checks totaled $2,383 Instructions a) Prepare the bank reconciliation at September 30,2007. b) Prepare the adjusting entries at September 30,2007, assuming (1) the NSF check was from a customer on account, and (2) no interest had been accrued on the note. Problem no. 3 The following information pertains to Family Video Company. 1- Cash balance per bank, July 31, $7,263. 2- July bank service charge not recorded by the depositor $28. 3- Cash balance per books, July 31, $7,284. 4- Deposits in transit, July 31, $1,500. 5- Bank collected $900 note for Family in July, plus interest $36, less fee $20. The collection has not been recorded by Family, and no interest has been accrued. 6- Outstanding checks, July 31, $591. Instructions a) Prepare a bank reconciliation at July 31, 2007. b) Journalize the adjusting entries at July 31 on the books of Family Video Company. Problem no. 4 On May 31, 2008 James Logan Company has a cash balance per books of $6,781.50. The bank statement from Farmers State Bank on that date showed a balance of $6,404.60. A comparison of the statement with the cash account revealed the following facts. 1- The statement included a debit memo of $40 for the printing of additional company checks. 2- Cash sales of $836.15 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $886.15. The bank credited Logan Company for the correct amount. 3- Outstanding checks at May 31 totaled $576.25. Deposits in transit were $1,916.15 4- On May 18, the company issued check No. 1181 for $685 to Barry Trest, on account. The check which cleared the bank in May, was incorrectly journalized and posted by Logan Company for $658. 5- A $2,500 note receivable was collected by the bank for Logan Company on May 31 plus $80 interest. The bank charged a collection fee of $20. No interest has been accrued on on the note. 6- Included with the cancelled checks was a check issued to Bridgetown Company to Tom Lujak for $800 that was incorrectly charged to Logan Company by the bank. 7- On May 31, the bank statement showed an NSF charge of $680 for a check issued by Sandy Grifton, a customer, to Logan Company on account. Instructions a) Prepare the bank reconciliation at May 31, 2008. Page 4 of 13 b) Prepare the necessary adjusting entries for Logan Company at May 31, 2008. Accounts Receivables Problem no. 1 Presented below are three receivables transactions. Indicate whether these receivables are reported as accounts receivable, notes receivables, or other receivables on a balance sheet. a) Sold merchandise on account for $64,000 to a customer. b) Received a promissory note of $57,000 for services performed. c) Advanced $10,000 to an employee. Problem no. 2 Record the following transactions in the books of Keyser Co. a) On July 1, Keyser Co. sold merchandise on account to Maxfield Inc. for $15,200, terms 2/10,n/30. b) On July 8, Maxfield Inc. returned merchandise worth $3,800 to Keyser Co. c) On July11, Maxfield Inc. paid for the merchandise. Problem no. 3 At the end of 2008, Delong Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $54,000. On January 24,2009, the company learns that its receivable from Ristau Inc. is not collectible, and management authorizes a write-off of $5,400. a) Prepare the journal entry to record the write-off. b) What is the cash realizable of the accounts receivable (1) before the write-off and (2) after the write-off. Problem no. 4 Assume the same information as problem no.3. On March 4,2009, Delong Co. receives payment of $5,400 in full from Ristau Inc. Prepare the journal entries to record this transaction. Problem no.5 Nieto Co. elects to use the percentage-of-sales in 2008 to record bad debts expense. It estimates that 2%of net credit sales will become uncollectible. Sales are $800,000 for 2008, sales returns and allowances are $45,000, and the allowance for doubtful account has a credit balance of $9,000. Prepare the adjusting entry to record bad debts expense in 2008. Problem no. 6 Linhart Co. uses the percentage-of-receivables basis to record bad debts expense. It estimates that 1% of accounts receivable will become uncollectible. Accounts receivable are $450,000 at the end of the year, and the allowance for doubtful accounts has a credit balance of $1,500. a) Prepare the adjusting journal entry to record bad debts expense for the year. b) If the allowance for doubtful accounts had a debit balance of $800 instead of a credit balance of $1,500, determine the amount to be reported for bad debts expense. Page 5 of 13 Problem no. 7 On January 10,2008 Edmunds Co. sold merchandise on account to Jeff Gallup for $13,000, n/30. On February 9, Jeff Gallup gave Edmunds Co. a 10% promissory note in settlement of this account. Prepare the journal entry to record the sale and the settlement of the account receivable. Problem no. 8 The ledger of Hixson Company at the end of the current year shows Accounts Receivable $120,000, Sales $840,000, and Sales Returns and Allowances $30,000. a) If Allowance fro Doubtful Accounts has a credit balance of $2,100 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 1% of net sales, and (2) 10% of accounts receivable. b) If Allowance for Doubtful Accounts has a debit balance of $200 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 0.75% of net sales and (2) 6% of accounts receivable. Problem no. 9 Ingles Company has accounts receivable of $93,100 at March 31,2007. An analysis of the accounts shows the following : Month of sale March February January Prior to January Balance, March 31 $60,000 $17,600 $8,500 $7,000 $93,100 Credit terms are 2/10, n/30. At March 31, Allowance for Doubtful Accounts has a credit balance of $1,200 prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimate of bad debts is as follows. Age of Accounts Estimated percentage Uncollectible 1-30 days 2% 30-60 days 5% 60-90 days 30% over 90 days 50% a) Determine the total estimated uncollectible. b) Prepare the adjusting entry at March 31, 2007 to record bad debts expense. Problem no. 10 At December 31,2007, Leis Co. reported the following information on its balance sheet. Accounts receivable $960,000 Less : Allowance for doubtful accounts $80,000 Page 6 of 13 During 2008, the company had the following transactions related to receivables. 1) Sales on account $3,200,000 2) Sales returns and allowances $50,000 3) Collections of accounts receivable $2,810,000 4) Write-offs of accounts receivable deemed uncollectible $90,000 5) Recovery of bad debts previously written off as uncollectible $24,000 Instructions a) Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of accounts receivable. b) Enter the January 1,2008, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use T accounts), and determine the balances. c) Prepare the journal entry to record bad debts expense for 2008, assuming that an aging of accounts receivable indicates that expected bad debts are $115,000. d) Compute the accounts receivable turnover ratio for 2008. Problem no. 11 On January 1,2008, Kloppenberg Company had Accounts Receivable $139,000, Notes Receivable $25,000, and Allowance for Doubtful Accounts $13,200. The note receivable is from Sara Rogers Company. It is a 4-month, 12% note dated December 31, 2007. Kloppenberg Company prepares financial statements annually. During the year the following selected transactions occurred. 05-Jan Sold $20,000 of merchandise to Dedonder Company, terms n/15. 20-Jan Accepted Dedonder Company's $20,000, 3-month,9% note for balance due. 18-Feb Sold $8,000 of merchandise to Ludwig Company and accepted Ludwig's $8,000, 6-month, 9% note for the amount due. 20-Apr Collected Dedonder Company note in full. 30-Apr Received payment in full from Sara Rogers Company on the amount due. 25-May Accepted Jenks Inc.'s $4,000, 3-month, 7% note in settlement of a past-due balance on account. 18-Aug Received payment in full from Ludwig Company on note due. 25-Aug The Jenks Inc. note was dishonored . Jenks Inc. is not bankrupt; future payment is anticipated. 01-Sep Sold $12,000 of merchandise to Lena Torme Company and accepted a $12,000, 6-month, 10% note for the amount due. Instructions Journalize the transactions. Problem no. 12 On May 2, Kleinsorge Company lends $7,600 to Everhart, Inc., issuing a 6-month, 9% note. At the maturity date, November 2, Everhart indicates that it cannot pay. Instructions a) Prepare the entry to record the dishonor of the note, assuming that Kleinsorge Company Page 7 of 13 expected collection will occur. b) Prepare the entry to record the dishonor of the note, assuming that Kleinsorge Company does not expect collection in the future. Depreciation Problem no. 1 Neely Company incurs the following expenditures in purchasing a truck : Cash price $30,000, accident insurance $2,000, sales tax $1,500, motor vehicle license $100, and painting and lettering $400. What is the cost of the truck ? Problem no. 2 Conlin Company acquires a delivery truck at a cost of $42,000. The truck is expected to have a salvage value of $6,000 at the end of its 4-year useful life. Compute annual depreciation for the first and second years using the straight-line method. Problem no. 3 Depreciation information for Conlin Company is given in BE10-3. Assuming the declining balance depreciation rate is double the straight-line rate, compute annual depreciation for the first and second years under the declining-balance method. Problem no. 4 Speedy Taxi Service uses the units-of-activity method in computing depreciation on its taxicabs. Each cab is expected to be driven 150.000 miles. Taxi no. 10 cost $33,500 and is expected to have a salvage value of $500. Taxi no. 10 is driven 30.000 miles in year 1 and 20.000 miles in year 2. Compute the depreciation for each year. Problem no. 5 On January 1,2008, the Ramirez Company ledger shows Equipment $29,000 and accumulated Depreciation $9,000. The depreciation resulted from using the straight-line method with a useful life of 10 years and salvage value of $2,000. On this date, the company concludes that the equipment has a remaining useful life of only 4 years with the same salvage value. Compute the revised annual depreciation. Problem no. 6 Prepare journal entries to record the following. a) Gomez Company retires its delivery equipment , which cost $41,000. Accumulated Page 8 of 13 depreciation is also $41,000 on this delivery equipment. No salvage value is received. b) Assume the same information as (a), except that accumulated depreciation for Gomez Company is $39,000, instead of $41,000. Problem no. 7 Chan Company sells office equipment on September 30, 2008, for $20,000 cash. The office equipment originally cost $72,000 and as of January 1, 2008, had accumulated depreciation of $42,000. Depreciation for the first 9 months of 2008 is $5,250. Prepare the journal entries to (a) update depreciation to September 30,2008, and (b) record the sale of the equipment. Problem no.8 Younger Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1,2008, at a cost of $168,000. Over its 4-year useful life, the bus is expected to be driven 100.000 miles. Salvage value is expected to be $8,000. Instructions a) Compute the depreciation cost per unit. b) Prepare a depreciation schedule assuming actual mileage was : 2008, 26.000; 2009, 32.000; 2010, 25.000; and 2011, 17.000. Problem no. 9 Kelm Company purchased a new machine on October 1, 2008, at a cost of $120,000. the company estimated that the machine will have a salvage value of $12,000. The machine is expected to be used for 10.000 working hours during its 5-year life. Instructions Compute the depreciation expense under the following methods for the year indicated. a) Straight-line for 2008. b) Units-of-activity for 2008, assuming machine usage was 1,700 hours. c) Declining-balance using double the straight-line rate for 2008 and 2009. Problem no. 10 Presented below are two independent transactions. Both transactions have commercial substance. 1) Sidney Co. exchanged old trucks (cost $64,000 less $22,000 accumulated depreciation) plus cash of $17,000 for new trucks. The old trucks had a fair market value of $36,000. 2) Lupa Inc. trades its used machine (cost $12,000 less $4,000 accumulated depreciation) for a new machine. In addition to exchanging the old machine (which had a fair market value of $9,000, Lupa also paid cash of $3,000. Instructions a) Prepare the entry to record the exchange of assets by Sidney Co. b) Prepare the entry to record the exchange of assets by Lupa Inc. Problem no. 11 Page 9 of 13 In recent years, Juresic Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is summarized below. Bus Acquired Salvage Useful Life Depreciation Cost value in Years Method 1 ####### $6,000 5 Straight-line $96,000 2 ####### $10,000 4 Declining-balance $120,000 3 ####### $8,000 5 Units-of-activity $80,000 For the declining-balance method, the company uses the double-declining rate. For the units of activity method, total miles are expected to be 120.000. Actual miles of use in the first 3 years were : 2007, 24.000; 2008, 34.000; and 2009, 30.000. Instructions a) Compute the amount of accumulated depreciation on each bus at December 31,2008. b) If a bus no. 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2006 and (2) 2007 ? Cash flow statement Problem no. 1 Martinez, Inc. reported net income of $2.5 million in 2008. Depreciation for the year was $160,000, accounts receivable decreased $350,000, and accounts payable decreased $280,000. Compute net cash provided by operating activities using the indirect method. Problem no. 2 The net income for Adcock Co. for 2008 was $280,000. For 2008 depreciation on plant assets was $70,000, and the company incurred a loss on sale of plant assets of $12,000. Compute net cash provided by operating activities under the indirect method. Problem no. 3 The comparative balance sheets for Goltra Company show these changes in noncash current asset accounts : accounts receivable decrease $80,000, prepaid expense increase $28,000, Page 10 of 13 and inventories increase $30,000. Compute net cash provided by operating activities using the indirect method assuming that net income is $200,000. Problem no. 4 The following T account is a summary of the cash account of Edmonds Company. Cash (Summary Form) Balance, Jan 1 $8,000 Payments for goods $200,000 Receipts from customers $364,000 Payments for operating expenses $140,000 Dividends on stock investments $6,000 Interest paid $10,000 Proceeds from sale of equipment $36,000 Taxes paid $8,000 Proceeds from issuance of bond payable $300,000 Dividends paid $50,000 Balance, Dec. 31 $306,000 What amount of net cash provided (used) by financing activities should be reported in the statement of cash flow. Problem no. 5 Villa Company reported net income of $195,000 for 2008. Villa also reported depreciation expense of $45,000 and a loss of $5,000 on the sale of equipment. The comparative balance sheet shows a decrease in accounts receivable of $15,000 for the year, a $17,000 increase in accounts payable, and a $4,000 decrease in prepaid expenses. Instructions Prepare the operating activities section of the statement of cash flow for 2008. Use the indirect method. Problem no. 6 The current sections of Bellinham Inc.'s balance sheets at December 31, 2007 and 2008 are presented below. Current assets 2008 2007 Cash $105,000 $99,000 Accounts receivable $110,000 $89,000 Inventory $158,000 $172,000 $22,000 Prepaid expenses $27,000 Total current assets $400,000 $382,000 Current liabilities Accrued expenses payable $15,000 $5,000 $92,000 Accounts payable $85,000 Total current liabilities $100,000 $97,000 Bellinham's net income for 2008 was $153,000. Depreciation expense was $24,000. Instructions Prepare the net cash provided by operating activities section of the company's statement of cash flows for the year ended December 31,2008, using the indirect method. Problem no. 7 Page 11 of 13 Comparative balance sheets for Eddie Murphy Company are presented below. Eddie Murphy Company Comparative balance sheets Dec-31 Assets 2008 2007 Cash $63,000 $22,000 Accounts receivable $85,000 $76,000 Inventories $180,000 $189,000 Land $75,000 $100,000 Equipment $260,000 $200,000 ($42,000) Accumulated depreciation ($66,000) Total $597,000 $545,000 Liabilities and Stockholders' Equity Accounts payable $34,000 $47,000 Bonds payable $150,000 $200,000 Common stock ($1 par) $214,000 $164,000 $134,000 Retained earnings $199,000 Total $597,000 $545,000 Additional information : 1) Net income for 2008 was $125,000. 2) Cash dividends of $60,000 were declared and paid. 3) Bonds payable amounting to $50,000 were redeemed for cash $50,000. 4) Common stock was issued for $50,000 cash. 5) Depreciation expense was $24,000. 6) Sales for the year were $978,000. Instructions Prepare a statement of cash flows for 2008 using the indirect method. Problem no. 8 The 2008 accounting records of Verlander Transport reveal these transactions and events. Payment of interest $10,000 Cash sales $48,000 Receipt of dividend revenue $18,000 Payment of income taxes $12,000 Net income $38,000 Payment of accounts payable for merchandise $115,000 Payment for land $74,000 Collection of accounts receivable $182,000 Payment of salaries and wages $53,000 Depreciation expense $16,000 Proceeds from sale of vehicles $12,000 Purchase of equipment for cash $22,000 Loss on sale of vehicles $3,000 Page 12 of 13 Payment of dividends $14,000 Payment of operating expenses $28,000 Instructions Prepare the cash flows from operating activities section using the direct method. (Not all of the items will be used.) Page 13 of 13