MANAGEMENT SCIENCE inf orms

advertisement

MANAGEMENT SCIENCE

informs

Vol. 56, No. 3, March 2010, pp. 495–502

issn 0025-1909 eissn 1526-5501 10 5603 0495

®

doi 10.1287/mnsc.1090.1127

© 2010 INFORMS

Vertical Flexibility in Supply Chains

Wallace J. Hopp

Stephen M. Ross School of Business, University of Michigan, Ann Arbor, Michigan 48109, whopp@umich.edu

Seyed M. R. Iravani, Wendy Lu Xu

Department of Industrial Engineering and Management Sciences, Northwestern University,

Evanston, Illinois 60208 {s-iravani@northwestern.edu, wendy-xu@northwestern.edu}

J

ordan and Graves (Jordan, W. C., S. C. Graves. 1995. Principles on the benefits of manufacturing process

flexibility. Management Sci. 41(4) 577–594) initiated a stream of research on supply chain flexibility, which

was furthered by Graves and Tomlin (Graves, S. C., B. T. Tomlin. 2003. Process flexibility in supply chains.

Management Sci. 49(7) 907–919), that examined various structures for achieving horizontal flexibility within a single

level of a supply chain. In this paper, we extend the theory of supply chain flexibility by considering placement

of vertical flexibility across multiple stages in a supply chain. Specifically, we consider two types of flexibility—

logistics flexibility and process flexibility—and examine how demand, production, and supply variability at a single

stage impacts the best stage in the supply chain for each type of flexibility. Under the assumptions that margins

are the same regardless of flexibility location, capacity investment costs are the same within and across stages,

and flexibility is limited to a single stage of logistics (process) flexibility accompanied with necessary process

(logistics) flexibility, we show that both types of flexibility are most effective when positioned directly at the

source of variability. However, although expected profit increases as logistics flexibility is positioned closer to

the source of variability (i.e., downstream for demand variability and upstream for supply variability), locating

process flexibility anywhere except at the stage with variability leads to the same decrease in expected profit.

Key words: supply chain; flexibility; capacity investment

History: Received March 20, 2007; accepted April 25, 2009, by Paul H. Zipkin, operations and supply chain

management. Published online in Articles in Advance January 12, 2010.

1.

Introduction

Several authors have studied the problem of how

to use process flexibility. Jordan and Graves (1995)

showed that most of the benefits of full flexibility

(ability to produce and ship all products from all

plants) can be achieved by partial flexibility. Iravani

et al. (2005) introduced the concept of structural flexibility to capture the ability of a flexibility structure

to respond to demand or supply variability. Graves

and Tomlin (2003) presented a framework for analyzing the benefits of flexibility in a multistage supply

chain and developed a flexibility measure and guidelines for flexibility investment. Their paper addressed

the question of which flexibility structure is most efficient provided all stages of the supply chain make

use of the same flexibility structure. Other studies

include Fine and Freund (1990), Gupta et al. (1992),

and Van Mieghem (1998), among others. Taken as a

whole, this stream of research has provided a number

of useful insights that describe the impact of flexible

technology in a supply chain. However, all of these

studies have focused on process flexibility within a

single stage of the supply chain.

A multiechelon supply chain also presents the question of which stage to target for flexibility investment.

We term this the vertical flexibility problem because

of the analogy to vertical integration. Consequently,

The fundamental problem in any supply chain system

is efficiently matching supply with demand. Because

supply and demand are uncertain, we must make use

of various buffers, including safety stock, safety lead

time, and safety capacity, to facilitate this matching

problem. A well-known principle of factory physics

is that flexibility can reduce the amount of buffering needed to mitigate the effects of variability (Hopp

and Spearman 2008). Examples of flexible capacity

in a supply chain include (a) Dell sourcing multiple

mother boards from a single supplier, (b) HewlettPackard (HP) assembling voltage adaptors to printers

in its European distribution center before shipping

them to countries with different AC voltage standards, and (c) General Motors (GM) tooling stamping plants to produce body parts for more than one

model.

In each of these cases, by using capacity that can

be shifted from one product type to another, the firm

enhances its ability to adjust to fluctuations in either

the supply of materials or demand for products. However, as these examples highlight, the flexibility can

be positioned at different levels of the supply chain,

including suppliers (Dell), component plants (GM), or

distribution (HP).

495

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

496

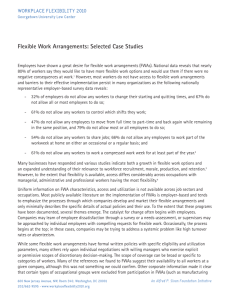

Figure 1

Management Science 56(3), pp. 495–502, © 2010 INFORMS

(a) and (b): Examples of Horizontal Flexibility (How to Use Flexibility in a Given Stage); (c) and (d): Examples of Vertical Flexibility

(What Stage to Make Flexible)

(a) Full flexibility

(c) Single-stage full logistics flexibility

Stage 5

Plant 1

ABC

Plant 2

ABC

Plant 3

ABC

Demand

A

Demand

B

Demand

C

Stage 4

Plant 1

Plant 1

Plant 1

ABC

ABC

ABC

Plant 2

Plant 2

Plant 2

ABC

ABC

ABC

Plant 3

Plant 3

Plant 3

ABC

ABC

ABC

(b) Chained flexibility

AB

Demand

A

Stage 2

Stage 1

Stage 0

Plant 1

Plant 1

Demand

A

A

Plant 2

Plant 2

Demand

B

B

B

Plant 3

Plant 3

Demand

C

C

C

Stage 1

Stage 0

A

(d) Single-stage full process flexibility

Stage 5

Plant 1

Stage 3

Stage 4

Plant 1

Plant 1

A

A

Stage 3

Plant 1

ABC

Stage 2

Demand

Plant 1

Plant 1

A

A

Plant 2

Plant 2

Demand

B

B

B

A

Plant 2

Demand

Plant 2

Plant 2

BC

B

B

B

Plant 3

Demand

Plant 3

Plant 3

Plant 3

Plant 3

Plant 3

Demand

CA

C

C

C

ABC

C

C

C

Plant 2

ABC

Notes. Unshaded boxes denote specialized plants. Shaded boxes denote flexible plants.

we refer to flexibility within a stage as horizontal flexibility. Figure 1 contrasts sample horizontal flexibility structures (Figure 1(a) and (b)) with sample vertical flexibility structures (Figure 1(c) and (d)). These

structures contain two types of flexibility: logistics flexibility (the ability to ship products to different locations) and process flexibility (the ability to produce different types of products). Aprile et al. (2005) used

numerical studies to compare lost sales resulting from

different process and logistics flexibility configurations in a fixed-capacity, five-product, two-stage supply chain. They observed that, given some degree

of logistics flexibility, process flexibility in the supply stage enables the system to cope with demand

variability. They also noted that process flexibility in

the assembler stage is more beneficial when there is

capacity variability in both supplier and assembler

stages.

Our paper goes beyond the results of Aprile et al.

(2005) toward a theory of vertical flexibility by providing analytical results of where to locate flexibility within a supply chain. We do this by proving a

principle that describes how the optimal location for

full logistics and process flexibility in a multiechelon

multiproduct supply chain is affected by variability in supply, demand, and intermediate processing.

Our main insight is that if (a) margins are the same

regardless of flexibility location, (b) capacity investment costs are the same within and across stages,

(c) only one stage in the supply chain has variability,

and (d) flexibility decisions are limited to locating a

single stage of full logistics (process) flexibility accompanied with necessary process (logistics) flexibility,

then logistics (process) flexibility is most effective

when positioned directly at the source of variability.

However, while the effectiveness of logistics flexibility increases with proximity to the source of variability, the effectiveness of process flexibility is equally

suboptimal when located at any stage other than the

stage with variability.

2.

Model Formulation

We consider a multiechelon, multiproduct supply

chain, which produces I different products, indexed

by n = 1 2 I, and has K + 1 stages, indexed by

k = 0 1 K, and I plants per stage. Note that the

number of plants at each stage is assumed to be the

same as the number of products so that, for a supply chain with no flexibility, each product has a dedicated plant at each stage of the supply chain. Stage 0

denotes demand, so that node n of stage 0 represents

the retail outlet for product n, whereas stage K represents the initial (supply) stage. We assume that there

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

497

Management Science 56(3), pp. 495–502, © 2010 INFORMS

are always sufficient raw materials at stage K and that

the cost of these materials is included in how much

the company earns for selling one unit of the product.

Shipping routes between plants in stage k and stage

k − 1, or between plants in stage 1 and demand

nodes at stage 0, are represented by an arc set Ak ,

k = 1 2 K, where plant i at stage k can supply

plant j at stage k − 1 (or demand node j if k = 1) iff

i j ∈ Ak . Plant i at stage k can produce product n

iff i n ∈ B k , k = 1 2 K. Set A = A1 AK and

set B = B 1 B K , respectively, represent the logistics and process flexibility configurations of the supply chain.

We assume both demands and production capacities can be random. However, to focus on the effect

of variability on the optimal location of flexibility,

we restrict our attention to cases where only a single

stage has variability. For a given flexibility configuration (i.e., fixed A and B), we formulate the problem of

maximizing expected profit as a two-step sequential

decision process:

1. Capacity Investment Decision: First, before

demand is observed, the firm chooses production

capacity levels for all plants, ki , by taking into

account demand distributions and unit capacity

investment costs cik , i = 1 2 I, k = 1 2 K.

For a plant with yield loss and machine failures

and other sources of variability, we consider the

production capacity to be a random variable, Qik ki ,

which follows distribution f Qik ki that depends on

the level of ki . We use qik to represent a realization

of capacity Qik ki and let = ki and c = cik be

corresponding matrices of capacity and capacity

investment cost, with ki and cik representing the

entries at the ith row and kth column.

2. Production Flow Decision: After all uncertain

demand or production capacities, or both, have been

observed, the firm chooses a matrix of production and

k

k

shipping flows, X = Xijn

, where Xijn

represents the

quantity of product n produced in plant i of stage k

for plant j of stage k − 1. Note that this flow matrix is

constrained by the flexibility configuration of the supk

ply chain. A flow Xijn

can be nonzero only if i j ∈ Ak ,

k

i n ∈ B , and j n ∈ B k−1 . In other words, a flow of

product n from plant i to plant j can only exist if there

is a shipping route from i to j and both plants are

able to process the product. Taking into account the

fact that distribution center i at stage 0 is for product type i, to make our model concise, we define a

set B 0 for the demand nodes, such that j n ∈ B 0 iff

j = n. To simplify the notation, we define set F k as

k

the set of all triples i j n for all feasible flows Xijn

k

k

k−1

that satisfy i j ∈ A , i n ∈ B , and j n ∈ B . Let

rn denote the unit selling price of product n minus

k

the cost of raw materials; pin

the unit production cost

k

the unit transof product n in plant i of stage k; tijn

portation cost of product n from plant i at stage k to

plant j of stage k − 1; and r, p, and t the corresponding vectors (matrices). To maximize profit, the firm

observes demand vector d = d1 d2 dI and production capacity matrix q = qik , and then chooses its

production flow matrix X as the optimal solution to

the following linear program, which we call problem

P2

A B d q, where · represents the maximum

profit:

ABdq

= max

X

ijn∈F 1

1

rn Xijn

−

K

k=1 ijn∈F k

k

k

k

pin

+tijn

Xijn

(1)

subject to

u u i n∈F k+1

k+1

Xuin

=

j i j n∈F k

k

Xijn

i n = 1 2 I k = 1 2 K − 1

jn i j n∈F k

i j i j n∈F 1

k

Xijn

≤ qik

i = 1 2 I

k = 1 2 K

1

Xijn

≤ dn

k

≥0

Xijn

(2)

n = 1 2 I

(3)

(4)

i j n = 1 2 I

k = 1 2 K

(5)

Constraint (2) is the balance equation that sets the

total production flow into a plant equal to the total

flow out of it for each product, with the implicit

assumptions that to meet one unit of demand for

product n, (a) one unit of capacity is needed at each

stage and (b) all products consume the same processing capacity at the plant. Constraint (3) guarantees

that the total quantity of production of a plant does

not exceed its capacity. Constraint (4) avoids producing more than needed. Constraint (5) ensures nonnegativity of production flow.

Solving P2

A B d q is premised on first making capacity investments. To do this, the firm considers a random demand vector D = D1 D2 DI and selects a production capacity matrix = ki that decides the distribution of corresponding random matrix Q

= Qik ki . Profit is therefore a

random variable, A B D Q

, that depends on

the demand and capacity distributions. For a given

demand d and capacity q, profit is A B d q,

which is found by solving P2

A B d q. Hence, we

can express the capacity investment decision faced by

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

498

Management Science 56(3), pp. 495–502, © 2010 INFORMS

the firm as solving the following problem, which we

label P1

A B D:

V ∗ A B D

I

K cik ki (6)

= max E DQ

!

A B D Q

" −

k=1 i=1

where E D Q

!

A B D Q

" is the expected

profit. The expectation is over random demand D and

random capacity Q

, and V ∗ · is the maximum

value of expected profit minus capacity investment

cost. The matrix ∗ that achieves V ∗ · is called the

optimal capacity investment strategy.

As shown in Jordan and Graves (1995) and Graves

and Tomlin (2003), there are many ways a single stage

of a supply chain can be made flexible. Because the

focus of this paper is on the position, rather than the

type, of flexibility, we will focus on full flexibility and

will assume a single stage of flexibility. Full logistics

flexibility is achieved at a stage kf if what is produced in each plant at stage kf can be shipped to all

plants at stage kf −1. We use A1full kf to represent full

logistics flexibility configuration, where A1full kf =

A1 Akf AK , with Ak = i i ∀ i = 1 2 I

for k = kf , and Akf = i j ∀ i = 1 2 I j =

1 2 I. It is worth emphasizing that to make use

of full logistics flexibility of stage kf , stage kf and all

stages upstream to kf must have process flexibility. As

illustrated in Figure 1(c), to make use of full logistics

flexibility of stage 3, plants 1, 2, and 3 at stage 3 and

all upstream stages must be able to process products

A, B, and C.

Full process flexibility is achieved at a single

stage kf if all product types can be processed in

each plant of stage kf . We use B1full kf to represent full logistics flexibility configuration, where

B1full kf = B 1 B kf B K , with B k = i i ∀ i =

1 2 I for k = kf , and B kf = i n ∀ i = 1 2 I

n = 1 2 I. To make use of process flexibility at

stage kf , stages kf and kf + 1 must have logistics flexibility so that plants at stage kf are supplied with

subassemblies of all products and are able to ship

all products to the subsequent stage. As illustrated in

Figure 1(d), to make use of full process flexibility of

stage 3, plants 1, 2, and 3 at stage 3 all need to ship

products to all plants at stage 2. Also all plants must

have supply from plants 1, 2, and 3 at stage 4. Therefore, full logistics flexibility is required at stages 3

and 4.

In the remainder of this paper, we focus on the

location of a single stage of full logistics (process)

flexibility. Also, when we say a stage is flexible, we

mean it has full logistics (process) flexibility and the

corresponding process (logistics) flexibility to make it

possible.

We assume that implementing full logistics flexibility at stage k incurs a fixed cost $k ≥ 0,

k = 1 2 K, to establish the shipping channels to

all plants of stage k − 1. Also, full process flexibility

at stage k incurs a fixed cost % k ≥ 0, (k = 1 2 K),

to equip the plant with the necessary tooling to process all types of products. We use $K+1 to denote

the fixed cost incurred for plants at stage K to establish inbound logistics flexibility (supply channels) to

obtain all types of raw material. Hence, to evaluate a

flexibility configuration A B, we need to compute

V ∗ A B D and subtract from it the fixed cost associated with the flexibility structure.

To develop our results on the optimal position of

full logistics flexibility in a supply chain, we first need

to characterize the solution to P2

A1full kf B d q.

We define

mL in kf = rn −

−

kf −1

k=1

kf −1

k=1

k

pnn

+

K

k=kf

k

pin

K

kf

k

k

+ tinn +

tnnn

tiin

k=kf +1

as the unit contribution margin for production flow

from plant i of stage K to demand node n, where

rn is how much the company earns for selling one

kf −1 k

k

unit of the product, k=1 pnn

+ Kk=kf pin

is the production cost associated with the production flow, and

kf −1 k

K

kf

k

k=kf +1 tiin is the transportation cost.

k=1 tnnn + tinn +

We can show (see Lemma 1 in Online Appendix I,

provided in the e-companion)1 that if a supply chain

has logistics flexibility only at a single stage, the production flow allocation problem in the entire supply

chain can be simplified to a single stage production

flow allocation problem, where production flow from

kf

plant i of stage K to demand node n is given by Yin

and is associated with a unit profit margin, mL in kf .

With respect to process flexibility, we define

mP in kf = rn −

−

K

k=1

k=kf

k

pnn

K

k=1

k=kf kf +1

kf

+ pin

k

tnnn

kf

+ tinn

kf +1

+ tnin

as the unit contribution margin for production flow of

product n that is produced in plant i of stage kf and in

plant n of all other stages. The company earns rn for

1

An electronic companion to this paper is available as part of the online version that can be found at http://mansci.journal.informs.org/.

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

499

Management Science 56(3), pp. 495–502, © 2010 INFORMS

selling the product. At the same time, this production

flow involves production cost

K

k=1

k=kf

kf

k

pnn

+ pin

Assumption 4. cik = cjk , i = 1 2 I, j = 1

2 I, i = j, k = 1 2 K

and transportation cost

K

k=1

k=kf kf +1

This assumption reflects the cost of flexibility, logistics or process flexibility, in the form of more sophisticated equipment, more highly trained staff, longer

routes, etc., which reduces the margins of products

produced in flexible plants or shipped along nonstandard distribution channels.

kf

kf +1

k

tnnn

+ tjnn + tnin We can show (see Lemma 2 in Online Appendix I)

that if a supply chain has process flexibility at only a

single stage, the production flow allocation problem

in the entire supply chain can be simplified to a single

stage production flow allocation problem, where flow

of product n that is produced in plant i of stage kf

kf

and in plant n of all other stages is given by Zin and

is associated with a unit profit margin, mP in kf .

Note that margin mL in kf or mP in kf depends on

the location (stage) of the logistics or process flexibility structure, respectively, and is therefore a function

of kf .

To generate our result, we will make use of the following assumptions throughout the paper.

Assumption 1. mL in k = mL in k

mP in k) for all i and n and all k = k.

(mP in k =

This assumption ensures that the unit contribution

margin is the same regardless of where logistics (process) flexibility is located, so that we can isolate the

role of variability from the role of cost.

k

Assumption 2. Unit variable production cost pin

and

k

unit transportation cost tijn are independent of whether the

capacity for product n at plant i of stage k is flexible or

dedicated.

The main components of the unit variable production cost are material and labor, which usually do

not depend on whether the capacity is flexible or

not. Consider, for instance, a flexible auto assembly

plant that produces models A and B, and a dedicated assembly plant that produces only model A. In

both plants, the material to produce model A is the

same, and the labor skill required (to install the doors,

for example) is the same. Furthermore, the cost of

shipping items from one plant to another is clearly

independent of whether those plants are flexible or

not. Thus, Assumption 2 represents many systems in

practice.

Assumption 3. mL ii kf > mL in kf , mL ii kf >

mL ni kf , and mP ii kf > mP in kf , mP ii kf >

mP ni kf ∀ n = i i n = 1 2 I 1 ≤ kf ≤ K

This assumption states that unit capacity investment costs are the same for all plants at the same

stage. This is a reasonable assumption in supply

chains where plants at one stage of the supply chain

perform similar processing functions and therefore

use similar equipment and facilities. For example, in

an electronics supply chain, semiconductor facilities

feed board assembly plants, which feed final assembly

plants. Because the complexity of the technologies at

each level is similar, the capacity costs of plants within

each level should also be similar. Of course, other supply chains may involve very different processes, with

very different capacity costs, at the same level. In such

cases, the differing capacity costs will obviously influence flexibility choices. However, because our focus is

on the influence of variability on the desired location

for flexibility, we consider only supply chains without

significant differences in capacity costs within stages.

The net effect of the aforementioned assumptions

is that variability will drive flexibility location decisions, not cost. Under these, we can show that for

the single-stage logistics (process) flexibility configuration, an optimal capacity configuration will have

the same capacity at all stages without variability or

(logistics or process) flexibility (see the proofs of Lemmas 3 and 4 in Online Appendix I).

3.

Optimal Location for Logistics

Flexibility

In systems where production facilities are already

flexible, increasing system flexibility can be achieved

by introducing logistics flexibility. This is often the

case in a pure distribution system consisting of warehouses, depots, and retail outlets, where all facilities

can process all products. But adding routes between

facilities may entail fixed and variable costs. Within

the Walmart distribution network, for example, personnel at any node (e.g., warehouse, depot, retail outlets) are able to process all types of products, and so

process flexibility can be realized without significant

costs, but logistics flexibility (e.g., supplying multiple

stores from depots) is not costless.

It can be shown that necessary conditions for

the optimal capacity investment strategies are that

if the single source of variability is downstream

(upstream) of the flexible stage, then plants downstream (upstream) of the flexible stage should have

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

500

larger total capacity than plants upstream (downstream) in order to hedge against the variability

(see Lemma 3 in Online Appendix I). This leads

directly to our main results for the case of a single

stage with logistics flexibility, which we present in

Theorem 1.

Theorem 1. For a multiechelon supply chain with full

logistics flexibility at only a single stage kf , process flexibility at all upstream stages of kf , and only a single source

of variability at stage kv , the following apply:

(1) If kv + 1 ≤ kf ≤ K − 1 (i.e., the source of variability is downstream from the stage with logistics flexibility),

then logistics flexibility at stage kf achieves higher expected

profit than does logistics flexibility at stage kf + 1.

(2) If 2 ≤ kf ≤ kv (i.e., the source of variability is

upstream from the stage with logistics flexibility), then

logistics flexibility at stage kf achieves higher expected

profit than does logistics flexibility at stage kf − 1.

Theorem 1 implies that if a supply chain has a single source of variability, and all stages have (full) process flexibility, it is most beneficial to place logistics

flexibility closest to the source of variability. The intuition behind this is as follows. Suppose we place the

logistics flexible stage adjacent to the source of variability on the downstream side (i.e., kv = kf ). This

allows us to use any available capacity of the plants at

the stage with variability kv (and its upstream plants,

because they feed the plants in the stage with variability kv ) to hedge against variability. Therefore, in

an optimal configuration, the capacity of plants at the

stage with variability kv (and upstream of stage kv )

will be higher than that of the dedicated plants downstream of the stage with variability kv . If we move

the flexible stage one level further from the source

of variability (i.e., kf = kv − 1), then we can still use

the plants at and upstream of the stage with variability kv to hedge against variability, but now we must

increase the capacity of the plants at an additional

stage (i.e., stage kf , because plants at stage kf should

have the capacity to process items that they receive

from plants at stage kv ). Hence, it costs more to get

the same amount of protection as the flexible stage is

moved away from the source of variability.

From a management perspective, these results suggest that demand variability (i.e., kv = 0) provides

motivation to make downstream stages of the supply chain flexible, whereas supply variability (i.e.,

kv = K) provides motivation to make the upstream

stages flexible. In systems where process flexibility is

inexpensive, this is a crisp insight. However, when

process flexibility is costly, downstream logistics flexibility becomes more expensive (because it requires

all upstream stages to have process flexibility). So,

when supply is variable, upstream logistics flexibility

is clearly preferable (because it is closer to source of

Management Science 56(3), pp. 495–502, © 2010 INFORMS

variability and requires fewer upstream stages to have

process flexibility). But when demand is variable, we

must balance the cost of the additional process flexibility with the benefits of positioning the logistics

flexibility further downstream. In Online Appendix II

(provided in the e-companion), we further investigate

this trade-off and show that the flexibility location

decision has a threshold structure.

4.

Optimal Location for Process

Flexibility

In addition to facilitating logistics flexibility, process

flexibility is effective in its own right. Indeed, in systems where full logistics flexibility is inexpensive (e.g.,

material is shipped between facilities via a third party

logistics firm and so additional routes can be added

without fixed cost), enhancing flexibility is solely a

matter of deciding where to add process flexibility. To

gain insight into this decision, we consider the problem of locating a single stage of full process flexibility.

It can be shown that the process flexible stage cannot have more (and may have less) capacity than the

other stages as a result of the ability to produce different products (see Lemma 4 in Online Appendix I

for details).

We can now state our main results for the optimal

location of process flexibility in Theorem 2. Note that

part (1) of the theorem holds when Assumptions 3

and 4 are relaxed, and with an additional assumption:

Assumption 5. cik = cik , i = 1 2 I k k = 1

2 K k = k This assumption states that unit capacity investment costs are the same for plants across stages. If

cik = cik , then the optimal location of flexibility could

be affected by both the location of variability and the

capacity investment cost structure. So we rule this out

to focus exclusively on variability location.

Theorem 2. For a multiechelon supply chain with

logistics flexibility at all stages, the following apply:

(1) If only stage kv = 0 (demand) has variability, then

the expected profit for a system with a single stage of process flexibility at stage k is equal for any k = 1 2 K.

(2) If only stage kv > 0 (plants) has variability, then

expected profit is maximized if the single stage with process flexibility is located at kv ; for all other positions of the

flexible stage, expected profit is equal.

Theorem 2 characterizes the optimal location for

process flexibility in a system where the fixed cost

of logistics flexibility is zero, and therefore it is costless to have logistics flexibility at all stages, including

stages adjacent to the stage with process flexibility.

The intuition behind the result of Theorem 2 is as

follows. If the only source of variability is demand,

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

501

Management Science 56(3), pp. 495–502, © 2010 INFORMS

then the amount of demand for a product, say product n, that can be satisfied is restricted by (1) the

capacity of plants that produce product n at all dedicated (i.e., nonflexible) stages and (2) the total capacity of plants at the flexible stage. No matter which

stage has process flexibility, these two restrictions are

the same. Therefore, investing in process flexibility at

any stage is equivalent. In contrast, if the only source

of variability is stage kv ≥ 1 (i.e., the capacity of stage

kv is random), then making the plants at stage kv flexible allows excess capacity of one plant at stage kv

to make up for a capacity shortage at another plant

at that stage. If, instead, any stage other than kv has

process flexibility, then such pooling is not possible

because production of each product is constrained by

the capacities at stage kv . Hence, investment in process flexibility at stage kv is optimal when it is the

only source of variability.

From a management perspective, the aforementioned results suggest that, when demand is the major

source of variability (i.e., kv = 0), the impact of variability is not the key consideration in decisions about

locating process flexibility. Because process flexibility is equally effective at almost all stages, it makes

sense to install such flexibility wherever it is least

expensive. In contrast, when supply is variable (i.e.,

kv = K), then there is incentive to make the suppliers

themselves flexible. In supply chain terms, this suggests that multisourcing from flexible suppliers may

be a helpful strategy for mitigating problems of yield

loss. However, it may not be a particularly attractive

option for dealing with uncertain demand, because it

may be cheaper to install (equally effective) flexibility

at a downstream stage.

5.

Conclusions

In this paper, we have focused specifically on the

impact of variability on the optimal placement of

logistics and process flexibility in a multiproduct,

multiechelon supply chain. Although we have only

discussed full flexibility, our insights about flexibility

position generally carry over to other configurations

(e.g., the “chaining” structure suggested by Jordan

and Graves 1995), provided that comparisons are

made between the same configuration at different

stages. To isolate the effect of variability, we have considered systems in which the capacity investment cost

is the same within and across levels of the supply

chain. For such systems, we have shown analytically that if there is only a single source of variability (in supply, demand, or any intermediate stage of

the supply chain), then positioning logistics flexibility as close as possible to the source of variability

or process flexibility at the source of variability is

optimal when the two types of flexibility are considered separately (i.e., either process or logistics flexibility is costless and the problem is only to locate

a single stage of the other type of flexibility). When

both types of flexibility are costly, the optimal configuration is more complicated, but still exhibits a

threshold structure that is informed by the behavior of the cases where process and logistics flexibility

are considered separately (see Online Appendix II for

details).

In practical terms, our results imply that systems

with a high degree of supply variability should make

use of upstream logistics flexibility provided process

flexibility is inexpensive. For example, supply chains

that rely on recycled materials may be subject to

uncontrollable fluctuations in their inputs and hence

would benefit from enhancing flexibility in this first

stage of the network (e.g., by using multiple recycling

plants to supply each downstream production plant).

In contrast, supply chains subject to volatile customer

demand may be better served by downstream logistics flexibility. For example, the automotive supply

chains that motivated the original Jordan and Graves

(1995) work must cope with fluctuations in individual

model sales that occur after plant capacity decisions

have been made. By making the final assembly plants

capable of supplying demands of different models,

their capacity can be used more efficiently to satisfy

demand.

Of course, variability is only one factor affecting optimal flexibility configurations. Another obvious factor is cost. For systems where flexibility is

very expensive at upstream stages (e.g., electronics supply chains in which the first stage is a very

costly and inflexible wafer fab), it may make sense to

use flexibility predominantly in downstream stages,

regardless of the source of variability. In contrast,

in systems where flexibility is very expensive at

downstream stages (e.g., some pharmaceutical supply

chains, in which cost, specialization, and regulations

may restrict the extent to which multiple products

can be produced in the same finishing plant), it may

make sense to use more flexibility in upstream stages

(e.g., commodity chemical plants). Further research is

needed to incorporate cost, variability, and the various process constraints of specific environments.

6.

Electronic Companion

An electronic companion to this paper is available as

part of the online version that can be found at http://

mansci.journal.informs.org/.

Acknowledgments

The authors thank two anonymous referees and an associate editor for thoughtful feedback, which greatly helped

to sharpen the ideas and presentation of this paper. The

502

authors are grateful to the department editor, Paul Zipkin,

for his encouragement and support. Finally, the authors

acknowledge the National Science Foundation for partial

support of this research under Grants DMI-0423048 and

DMI-0457412.

References

Aprile, D., A. C. Garavelli, I. Giannoccaro. 2005. Operations planning and flexibility in a supply chain. Production Planning Control 16(1) 21–31.

Fine, C. H., R. M. Freund. 1990. Optimal investment in

product-flexible manufacturing capacity. Management Sci. 36(4)

449–466.

Hopp, Iravani, and Xu: Vertical Flexibility in Supply Chains

Management Science 56(3), pp. 495–502, © 2010 INFORMS

Graves, S. C., B. T. Tomlin. 2003. Process flexibility in supply chains.

Management Sci. 49(7) 907–919.

Gupta, D., Y. Gerchak, J. A. Buzacott. 1992. The optimal mix

of flexible and dedicated manufacturing capacities: Hedging

against demand uncertainty. Internat. J. Production Econom.

28(3) 309–319.

Hopp, W. J., M. L. Spearman. 2008. Factory Physics: Foundations of

Manufacturing Management, 3rd ed. McGraw-Hill, New York.

Iravani, S. M., M. P. Van Oyen, K. T. Sims. 2005. Structural flexibility: A new perspective on the design of manufacturing and

service operations. Management Sci. 51(2) 151–166.

Jordan, W. C., S. C. Graves. 1995. Principles on the benefits of manufacturing process flexibility. Management Sci. 41(4) 577–594.

Van Mieghem, J. A. 1998. Investment strategies for flexible resources. Management Sci. 44(8) 1071–1078.