Fi8000 Valuation of Financial Assets Midterm

advertisement

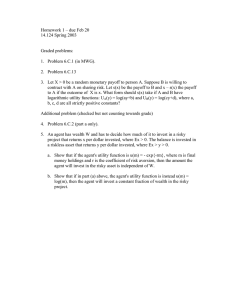

Fi8000 Valuation of Financial Assets Fall Semester 2008 Dr. Isabel Tkatch Assistant Professor of Finance Midterm ☺ Bring your own formulas – One page (letter) with formulas printed or written on one side ☺ Bring ☺ ☺ Make sure that it works Make sure that you know how to use it ☺ 4-5 ☺ ☺ ☺ your calculator open questions, 90 minutes. Write down the data and the details of your calculations Simple questions are not a trap Read each question carefully and make sure that you are providing the solution that the question is seeking 1 Midterm 1. Risk Aversion and Capital Allocation to Risky Assets 1.1 Mean Variance Efficient Portfolios – Mutually exclusive asset; One risk-free and n mutually exclusive risky assets; Two risky assets; n risky assets; n risky and one risk free asset. 1.2 The minimum variance portfolio and the market portfolio. 1.3 The CML and the separation theorem. 1.4 Diversifiable and non-diversifiable (systematic / market) risk. 2. Capital Asset Pricing Model 2.1 The definition of beta and CAPM equilibrium (SML equation). 2.2 Expected return, variance and beta calculations for portfolios and for efficient portfolios. 2.3 Pricing, overpriced and underpriced risky assets. Book Chapters: 6, 7 and 9. Midterm ☺Practice Problems: Practice Problems for Chapters 6, 7 and 9; Quiz #1 question 5 (parts 5a – 5c); Quiz #2 questions 2, 3, 4, 5, 6, 7; Final questions 3 (3a – 3d) and 5 (5a – 5d). 2