F INANCE C

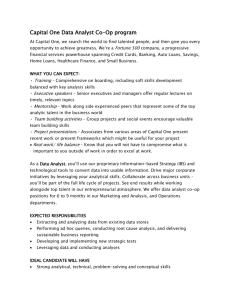

advertisement

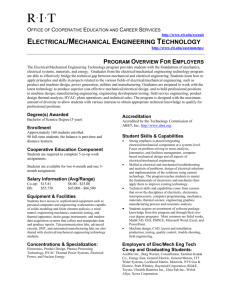

FINANCE CAREER OVERVIEW FOR STUDENTS DAY ONE – BUSINESS READY The finance program is offered through Saunders College of Business. The program prepares students for financial management positions in financial, commercial, industrial and government organizations. Alongside the applied nature of our program, our students are well equipped with advanced computer skills, an expertise in mathematics, and a strong understanding of global business. Students interested in financial analysis can find positions in asset and securities management with financial institutions such as banks, brokerage houses, insurance companies or real estate firms. Curriculum for Finance http://www.rit.edu/programs/finance-0 Degree(s) Awarded Bachelor of Science Master of Science in Finance MBA with a concentration in Finance Enrollment Approximately 100 undergraduate students currently enrolled. Cooperative Education Component Students are required to complete 1 semester or 2 summers of Cooperative Education. Salary Information – Avg/Range Co-op: $12.50 $8.00 - $18.90 BS: $39,000 $27,040 - $50,000 MS: $50,000 $45,000 - $55,000 Accreditation AACSB International - The Association to Advance Collegiate Schools of Business. Middle States Association of Colleges and Schools Rankings: BusinessWeek ranks Saunders one of the best Undergraduate Business Schools by Specialty in 2013. For 10 consecutive years, the Saunders College of Business undergraduate programs have ranked in the top 5% of all U.S. business schools, according to U.S. News & World Report's America's Best Colleges in 2004 – 2013 and #56 in the nation. Student Skills & Capabilities High quality technical knowledge and effective communication and presentation skills with in-depth understanding of the complex economic, legal and financial environment in which they operate. Strong functional skills in the area of concentration with broad knowledge of theory and application background of finance concepts from the following major courses: o Valuation of Real and Financial Assets In this course, students learn to obtain and organize financial data and conduct financial analysis such as discounted cash flow analysis, risk analysis and financial forecasting. Sources of data include webbased sources and proprietary databases. Excel will be the main software tool. o Managing Assets and Liabilities - Focuses on corporate financial management. Asset management topics include working capital management and advanced capital budgeting. Liability management topics include dividend policy, capital structure policy, security issuance and leasing. o Financial Modeling – A critical course in which students learn how to use spreadsheets in a systematic manner to model and solve financial problems. Included among the many problems studied are methods to diagnose financial performance, forecasting cash flows, and forecasting financing requirements. o Intermediate Investments - focuses on the financial investment problems faced by individuals and institutions. Theoretical topics include asset pricing, hedging and arbitrage. Application topics include risk management in bond and stock portfolio context. A discussion of options, futures and swaps is also included. Nature of Work Almost every firm, government agency, and other type of organization has one or more financial managers. Financial managers oversee the preparation of financial reports, direct investment activities, and implement cash management strategies. Managers also develop strategies and implement the long-term goals of their organization. (Source: U.S. Bureau of Labor Statistics Occupational Outlook Handbook) Training/Qualifications A bachelor’s degree in finance, accounting, economics, or business administration is the minimum academic preparation for financial managers. However, many employers now seek graduates with a master’s degree, preferably in business administration, economics, finance, or risk management. These academic programs develop analytical skills and teach the latest financial analysis methods and technology. (Source: U.S. Bureau of Labor Statistics O.O.H.) Job Outlook Employment growth for financial managers is expected is to be slower than average for all occupations. However, applicants will likely face keen competition for jobs. Those with a master's degree and certification will have the best opportunities. Employment change. Employment of financial managers over the 2010–20 decade is expected to grow by 8 percent, which is slower than average for all occupations. (Source: U.S. Bureau of Labor Statistics O.O.H.) Job Titles Corporate Finance, Stock Brokers, Financial Analyst, Financial Planner, Investment Bankers, Research Analyst, Budget Analyst, Insurance Underwriter, Loan Officer, Benefits Consultant, Risk Management Significant Points o Quantitative skills are extremely important. Take additional courses in math, statistics, and accounting. o An MBA is required to move beyond the entry-level analyst position in investment banking. Investment banking is highly competitive o Several professional designations and licenses, e.g. Chartered Financial Analyst or Certified Financial Planner, are available to finance professionals working in a particular area. Earning these designations may help one obtain advanced positions. Employment Financial managers held about 527,000 jobs in 2010. Although they can be found in every industry, approximately 3 out of 10 were employed by finance and insurance establishments, such as banks, savings institutions, finance companies, credit unions, insurance carriers, and securities dealers. About 8 percent worked for Federal, State, or local government. (Source: U.S. Bureau of Labor Statistics O.O.H.) Selected Employers of RIT Finance Co-op and Graduating Students Bank of New York Mellon, Bausch & Lomb, CitiGroup, First American Equipment Finance, Eastman Kodak, Harris Corporation, ITT Industries, JP MorganChase, M&T Bank, Manning & Napier Advisors Inc., Merrill Lynch, Midwest Inc., Morgan Stanley, Northwestern Mutual Financial Network, The Hershey Company, The Raymond Corporation, Xerox Corporation Contact Us We appreciate your interest in your career and we will make every effort to help you succeed. Feel free to contact Maria Richart, the program coordinator who works with the Finance program. You can access information about services through our web site at http://www.rit.edu/co-op/careers. Maria J. Richart, Associate Director, mjroce@rit.edu RIT Office of Cooperative Education and Career Services . Bausch & Lomb Center 57 Lomb Memorial Drive . Rochester NY 14623-5603, 585.475.2301, 585.475.6905 tty Unless otherwise noted, information is based upon data collected by RIT Office of Cooperative Education and Career Services. 4/14