Chapter 16 June 04 Key Concepts and Skills

advertisement

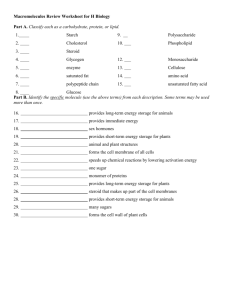

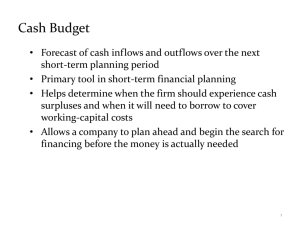

Chapter 16 June 04 1 2 Key Concepts and Skills Be able to compute the operating and cash cycles and understand why they are important Understand the essentials of short-term financial planning Understand the different types of short-term financial policy and the costs of each Short-Term Financial Planning Chapter Outline Tracing Cash and Net Working Capital The Operating Cycle and the Cash Cycle Some Aspects of Short-Term Financial Policy The Cash Budget A Short-Term Financial Plan Short-Term Borrowing 3 4 Sources and Uses of Cash Sources of Cash Obtaining financing: Increase in long-term debt Increase in equity Increase in current liabilities Selling assets Decrease in current assets Decrease in fixed assets Uses of Cash Paying creditors or stockholders Decrease in long-term debt Decrease in equity Decrease in current liabilities Buying assets Increase in current assets Increase in fixed assets 1 Chapter 16 June 04 5 The Operating Cycle 6 The Cash Cycle The time it takes to receive inventory, sell it and collect on the receivables generated from the sale The time between payment for inventory and receipt from the sale of inventory The cash cycle measures how long we need to finance inventory and receivables Operating cycle = inventory period + accounts receivable period Cash Cycle = Operating cycle – Accounts Payable Period time it takes to collect on receivables time inventory sits on the shelf = 365 Inventory Turnover Ratio 365 Receivables Turnover = 7 Example - Cash Cycle Inventory Purchased Cash Received Inventory Sold Inventory Period Accounts receivable period AP Period time between receipt of inventory and payment for it Previously Defined Cash Cycle Cash Paid for Inventory = 365 Payables Turnover 8 Example Item Beginning Ending Average Inventory 200,000 300,000 250,000 Accounts Receivable 160,000 200,000 180,000 75,000 100,000 87,500 Accounts Payable Net Sales = $1,150,000 Cost of Goods Sold = $820,000 Operating Cycle 2 Chapter 16 June 04 9 Example - Operating Cycle Operating cycle = inventory period + accounts receivable period 168 days = 111 days 57 days 365 where Cash Received Inventory Sold InventoryPeriod AR period 57 111 where Inventory Turnover = Ratio = Inventory Purchased 365 Receivables Turnover = Inventory Turnover Ratio 10 Example - Cash Cycle Receivables Turnover = COGS Average Inventory 365 $820,000 / $250,000 = Credit Sales Average AP 365 $1,150,000 / $180,000 11 Example - Cash Cycle Cash Cycle = Operating cycle – Accounts Payable Period 129 days 168 days 39 days = Operating Cycle 168 12 Example - Cash Cycle Inventory Purchased Cash Paid for Inventory Cash Received 365 Payables Turnover where Payables Turnover = = COGS Average AP 365 $820,000 / $87,500 AP Period 39 Cash Cycle 129 Operating Cycle 168 3 Chapter 16 June 04 Financing Current Assets 13 Compare the 2 following companies Determining the “Correct” level of Current Assets Balance Risk & Return Benefits of Current Assets Balance Sheet Marketable Securities Other Current Assets Fixed Assets Total Assets Higher Liquidity (Lowers Risk) Costs of Current Assets Lower Returns - $$ invested in lower returning securities rather than production. Firm 1 0 200 800 1000 ST Debt LT Debt Common Stock Total Liabilities&Equity Income Statement Operating Earnings Interest Earned EBT Taxes (40%) Net Income Example of Risk-Return Trade-off Compare the 2 following companies 15 Marketable Securities Other Current Assets Fixed Assets Total Assets Income Statement Operating Earnings Interest Earned EBT Taxes (40%) Net Income Current Ratio ROA Firm 1 Firm 2 150 150 8 0 150 158 63 60 90 95 2 9% Firm 1 Firm 2 ST Debt 100 100 LT Debt 400 400 700 Common Stock 500 Total Liabilities&Equity 1000 1200 Firm 2: $200 Marketable Securities Financed with Common Stock 200 x 4% = $8 interest earned on marketable securities Firm 1 150 0 150 60 90 Current Ratio = = Firm 1 100 400 500 1000 Current Assets Current Liabilities 200 = 2 100 Return on Assets = Net Income Assets = 90 = 9% 1000 16 Example of Risk-Return Trade-off Compare the 2 following companies Balance Sheet Firm 1 Firm 2 0 200 200 200 800 800 1000 1200 14 Example of Risk-Return Trade-off Balance Sheet Marketable Securities Other Current Assets Fixed Assets Total Assets Firm 1 Firm 2 0 200 200 200 800 800 1000 1200 Income Statement Operating Earnings Interest Earned EBT Taxes (40%) Net Income Current Ratio ROA Firm 1 Firm 2 150 150 8 0 150 158 63 60 90 95 2 9% ST Debt LT Debt Common Stock Total Liabilities&Equity Firm 1 Firm 2 100 100 400 400 700 500 1000 1200 Current Assets Current Liabilities = 400 = 4 100 Current Ratio = Net Income Assets = 95 = 7.9% 1200 Return on Assets = 4 Chapter 16 June 04 17 Example of Risk-Return Trade-off Compare the 2 following companies Flexible (Conservative) Policy Marketable Securities Other Current Assets Fixed Assets Total Assets Firm 1 Firm 2 ST Debt 100 100 LT Debt 400 400 700 Common Stock 500 Total Liabilities&Equity 1000 1200 Income Statement Operating Earnings Interest Earned EBT Taxes (40%) Net Income Current Ratio ROA 2 9% High liquidity Conclusion Firm 1 Firm 2 150 150 8 0 150 158 63 60 90 95 4 7.9% Firm 1 Firm 2 Higher ROA Less Liquid Riskier Lower ROA More Liquid Less Risky 18 Restrictive (Aggressive) Policy Large amounts of cash and marketable securities Large amounts of inventory Liberal credit policies (large accounts receivable) Relatively low levels of short-term liabilities Balance Sheet Firm 1 Firm 2 0 200 200 200 800 800 1000 1200 Short-Term Financial Policy Low cash and marketable security balances Low inventory levels Little or no credit sales (low accounts receivable) Relatively high levels of short-term liabilities Low liquidity What is the correct balance?? 19 Financing Current Assets Financing Current Assets Flexible (Conservative) Approach Dollars Dollars Total seasonal variation in Current Assets Current Assets 20 Total Liabilities and Owners Equity Marketable Securities Permanent Assets Time Policy always implies a short-term cash surplus and a large investment in cash and marketable securities. Time 5 Chapter 16 June 04 Financing Current Assets 21 Restrictive (Aggressive) Approach Dollars Total Liabilities and Owners Equity Short Term Loans Choosing the Best Policy 22 Best policy will be a combination of flexible and restrictive policies Things to consider Cash reserves Relative interest rates Compromise policy – borrow short-term to meet peak needs, maintain a cash reserve for emergencies Policy uses long-term financing for permanent asset requirements only and short-term borrowing for seasonal variations. Financing Current Assets Time 23 Compromise Approach Dollars Marketable Securities Total Liabilities and Owners Equity Short Term Loans Cash Budget 24 Primary tool in short-run financial planning Identify short-term needs and potential opportunities Identify when short-term financing may be required How it works Identify sales and cash collections Identify various cash outflows Subtract outflows from inflows and determine investing and financing needs Time 6 Chapter 16 June 04 25 Example: Cash Budget Information • Expected Sales for 2000 by quarter (millions) Q1: $57; Q2: $66; Q3: $66; Q4: $90 • Beginning Accounts Receivable = $30 • Average collection period = 30 days • Purchases from suppliers = 50% of next quarter’s estimated sales • Accounts payable period = 45 days • Wages, taxes and other expenses = 25% of sales • Interest and dividends = $5 million per quarter • Major expansion planned for quarter 2 costing $35 million • Beginning cash balance = $5 million with minimum cash balance of $2 million 27 Cash Collections Example: Cash Budget – Cash Collections Q1 Beginning Receivables 30 Sales 57 Cash Collections Q2 Q3 Q4 ? Ending Receivables 28 Cash Collections One Quarter = 90 days One Quarter = 90 days Average Collection Period = 30 days Average Collection Period = 30 days Beginning Receivables 26 Beginning Receivables 30 days Beginning AR Collected in 30 days 60 days 90 days 30 days 60 days 90 days Sales from first 30 days collected in 2nd 30 days 7 Chapter 16 June 04 29 Cash Collections 30 Cash Collections One Quarter = 90 days One Quarter = 90 days Average Collection Period = 30 days Average Collection Period = 30 days Beginning Receivables Beginning Receivables 30 days 60 days 90 days 30 days 60 days 90 days Sales from 3rd 30 days collected in next quarter (this amount is the beginning balance for the following quarter) Sales from 2nd 30 days collected in 3rd 30 days 31 Cash Collections 32 Cash Collections One Quarter = 90 days One Quarter = 90 days Average Collection Period = 30 days Average Collection Period = 30 days Beginning Receivables Beginning Receivables 30 days 60 days 90 days 30 days 60 days 90 days For Quarterly Budget: Total Cash Collections = Beginning Receivables + % of Sales Collected x Period Sales 2/3 1/3 % of Sales Collected = 90 – Avg Collection Period = 90 2 3 Total Cash Collections = Beginning Receivables + 2/3 x Sales 8 Chapter 16 June 04 Example: Cash Budget – Cash Collections Q1 Q2 Q3 33 Example: Cash Budget – Cash Collections Q4 Q1 Beginning Receivables 30 Beginning Receivables 30 Sales 57 Sales 57 Cash Collections 68 ? Cash Collections 68 Ending Receivables 19 ? Ending Receivables = Beginning Receivables + 2/3 x Sales = 30 + 2/3 x 57 Q2 Q3 34 Q4 = Beginning Receivables + Sales - Collections = 30 + 57 - 68 Example: Cash Budget – Cash Collections Q3 35 Q4 36 Example: Cash Budget – Cash Disbursement Q1 Q1 Q2 Beginning Receivables 30 19 22 22 Payment of A/P = 50% of sales Sales 57 66 66 90 Wages, taxes, other expenses Cash Collections 68 63 66 82 Ending Receivables 19 22 22 30 Q2 Q3 Q4 28.50 ? Capital Expenditures Long-term financing (interest and dividends) Total Disbursements 9 Chapter 16 June 04 37 Payment of A/P From Original Problem •Purchases from suppliers = 50% of next quarter’s est. sales •Accounts payable period = 45 days Sales: Q1: $57; Q2: $66; Q3: $66; Q4: $90 Payment for Purchases $28.50 2nd Q 1st Q 38 Example: Cash Budget – Cash Disbursement Sales: Q1: $57; Q2: $66; Q3: $66; Q4: $90 Q1 Payment of A/P = 50% of sales Q2 Q3 Q4 28.50 Wages, taxes, other expenses Capital Expenditures 3rd Q Long-term financing (interest and dividends) $57 $28.50 Total Disbursements Purchase 50% of $57 39 40 Example: Cash Budget – Cash Disbursement Example: Cash Budget – Cash Disbursement Sales: Q1: $57; Q2: $66; Q3: $66; Q4: $90 Sales: Q1: $57; Q2: $66; Q3: $66; Q4: $90 Q1 Q2 Q3 Q4 Q1 Payment of A/P = 50% of sales 28.50 Payment of A/P = 50% of sales 28.50 Wages, taxes, other expenses 14.25 Wages, taxes, other expenses 14.25 ? Capital Expenditures Capital Expenditures Long-term financing (interest and dividends) Long-term financing (interest and dividends) Total Disbursements Total Disbursements Q2 Q3 Q4 -5.00 47.75 ? = 25% of Sales = .25 x 57 10 Chapter 16 June 04 41 Example: Cash Budget – Cash Disbursement 42 Example: Cash Budget – Net Cash Flow Sales: Q1: $57; Q2: $66; Q3: $66; Q4: $90 Q1 Payment of A/P = 50% of sales Wages, taxes, other expenses Q3 14.25 16.50 16.50 Capital Expenditures Q4 45.00 22.50 -- 35.00 -- 5.00 5.00 5.00 5.00 47.75 89.50 54.50 72.50 Long-term financing (interest and dividends) Total Disbursements Q2 28.50 33.00 33.00 -- 43 Example: Cash Budget – Cash Balance Q1 Beginning Cash Balance 5.00 Q2 25.25 Q3 Summary Q1 Q2 Q3 Total Cash Collections 68.00 63.00 66.00 82.00 Total Cash Disbursements 47.75 89.50 54.50 72.50 Net Cash Flow 20.25 (26.50) Q1 Beginning Cash 5.00 Net Cash Inflow 20.25 New Short-Term Debt Net Cash Inflow Ending Cash Balance 20.25 (26.50) 25.25 (1.25) 11.50 9.50 10.25 19.75 Minimum Cash Balance -2.00 -2.00 -2.00 Cumulative surplus (deficit) 23.25 (3.25) 8.25 17.75 9.50 44 Q2 Q3 Q4 Surplus, therefore no ST Debt Needed this Month 0.00 0.00 Interest on Short-Term Debt Example: Cash Budget – Cash Balance (Slide 43) Short-Term Debt Repayment 0.00 Q1 Q2 Q3 Q4 Ending Cash Balance -2.00 11.50 Short-Term Financial Plan Q4 (1.25) 10.25 Q4 Beginning Cash Balance 5.00 25.25 (1.25) Net Cash Inflow Cumulative Surplus after loans 20.25 (26.50) 11.50 9.50 Ending Cash Balance 25.25 (1.25) 10.25 19.75 Beginning Short-Term DebtMinimum Cash 0.00 -2.00 -2.00 -2.00 -2.00 23.25 (3.25) 8.25 17.75 Minimum Cash Balance Balance Change in Short-Term Debt Ending Short-Term Debt Cumulative surplus (deficit) 10.25 11 Chapter 16 June 04 45 Short-Term Financial Plan Q1 Beginning Cash 5.00 Net Cash Inflow 20.25 Q2 Q3 Q4 Q1 25.25 46 Short-Term Financial Plan Q2 Q3 Beginning Cash 5.00 25.25 Net Cash Inflow 20.25 (26.50) 0.00 3.25 Q4 Deficit, Need loan to cover this amount New Short-Term Debt 0.00 New Short-Term Debt Interest on Short-Term Debt 0.00 Interest on Short-Term Debt 0.00 0.00 Example: Cash Budget – Cash Balance (Slide 43) 0.00 Q1 Short-Term Debt Repayment Q2 Q3 Q4 Short-Term Debt Repayment 0.00 Ending Cash Balance 25.25 Ending Cash Balance Minimum Cash Balance -2.00 Minimum Cash Balance Beginning Cash Balance -2.00 25.25 5.00 25.25 (1.25) Cumulative Surplus after loans 23.25 Net Cash Inflow Cumulative Surplus after loans 23.25 20.25 (26.50) 11.50 9.50 25.25 (1.25) 10.25 19.75 -2.00 -2.00 -2.00 -2.00 23.25 (3.25) 8.25 17.75 Ending Cash Balance Beginning Short-Term Debt 0.00 Change in Short-Term Debt 0.00 0.00 Change in Short-Term Debt Ending Short-Term Debt 0.00 Ending Short-Term Debt Beginning Short-Term DebtMinimum Cash 0.00 Balance 47 Short-Term Financial Plan Q1 Q2 Beginning Cash 5.00 25.25 Net Cash Inflow Q3 2.00 0.00 Cumulative surplus (deficit) 0.00 10.25 48 Short-Term Financial Plan Q4 Q1 Q2 Q3 Q4 Beginning Cash 5.00 25.25 2.00 Net Cash Inflow 20.25 (26.50) 11.50 0.00 3.25 0.00 Surplus 20.25 (26.50) New Short-Term Debt 0.00 3.25 New Short-Term Debt Interest on Short-Term Debt 0.00 0.00 Interest on Short-Term Debt 0.00 0.00 Example: Cash Budget – Cash Balance (Slide 43) Short-Term Debt Repayment 0.00 Q1 0.00 Q2 Q3 Q4 0.00 0.00 Ending Cash Balance 25.25 2.00 Minimum Cash Balance -2.00 -2.00 Short-Term Debt Repayment Cumulative Surplus after loans 23.25 Ending Cash Balance Minimum Cash Balance 0.00 25.25 Beginning Cash Balance -2.00 25.25 (1.25) Net Cash Inflow 20.25 (26.50) 11.50 9.50 Ending Cash Balance 25.25 (1.25) 10.25 19.75 -2.00 0.00 -2.003.25-2.00 -2.00 Cumulative Surplus after loans 3.25 2.00 5.00 Beginning Short-Term Debt 0.00 0.00 Change in Short-Term Debt 0.00 3.25 Change in Short-Term Debt Ending Short-Term Debt 0.00 3.25 Ending Short-Term Debt 23.25 Beginning Short-Term DebtMinimum Cash 0.00 Balance 0.00 Cumulative surplus (deficit) 0.00 -2.00 0.00 3.25 23.25 3.25 (3.25) 8.25 10.25 17.75 12 Chapter 16 June 04 49 Short-Term Financial Plan Q1 Q2 Q3 Q4 Beginning Cash 5.00 25.25 2.00 Net Cash Inflow 50 Short-Term Financial Plan Q1 Q2 Q3 Beginning Cash 5.00 25.25 2.00 Net Cash Inflow 20.25 (26.50) 11.50 20.25 (26.50) 11.50 New Short-Term Debt 0.00 3.25 0.00 New Short-Term Debt 0.00 3.25 0.00 Interest on Short-Term Debt 0.00 0.00 0.10 Interest on Short-Term Debt 0.00 0.00 0.10 Short-Term Debt Repayment 0.00 0.00 Short-Term Debt Repayment 0.00 0.00 3.25 Ending Cash Balance 25.25 2.00 Ending Cash Balance 25.25 2.00 10.15 Minimum Cash Balance -2.00 -2.00 Minimum Cash Balance -2.00 -2.00 -2.00 Cumulative Surplus after loans 23.25 0.00 Cumulative Surplus after loans 23.25 0.00 8.15 Borrow $3.25 for 1 quarter at 12% APR Beginning Short-Term Debt 0.00 0.00 Beginning Short-Term Debt 0.00 0.00 3.25 Change in Short-Term Debt 0.00 3.25 Change in Short-Term Debt 0.00 3.25 -3.25 Ending Short-Term Debt 0.00 3.25 Ending Short-Term Debt 0.00 3.25 0.00 51 Short-Term Financial Plan Q1 Beginning Cash Q2 5.00 Q3 Q4 2.00 10.15 Net Cash Inflow 20.25 (26.50) 11.50 Example: Cash Budget – Cash Balance (Slide 43) New Short-Term Debt 0.00 3.25 0.00 9.50 Interest on Short-Term Debt 0.00 Q1 Beginning Cash 5.00 Net Cash Inflow Ending Cash Balance 20.25 Balance Short-Term Debt Repayment Minimum Ending Cash Cash Balance Balance 25.25 Minimum Cash Cumulative Surplus after loans-2.00 Balance Cumulative surplus 23.25 25.25 Q2 Q3 25.25 (1.25) 0.00 0.00 Q4 0.10 0.00 3.25 0.00 10.15 19.65 10.25 (26.50) 25.25 11.502.009.50 (1.25) 0.00 0.00 19.75 -2.00 -2.00 -2.00 -2.00 23.25 -2.000.00 8.15 17.65 -2.00 (3.25) 10.25 -2.00 8.25 17.75 3.25 0.00 Change in Short-Term Debt 0.00 3.25 -3.25 0.00 Ending Short-Term Debt 0.00 3.25 0.00 0.00 Beginning (deficit) Short-Term Debt 0.00 0.00 Why Do Firms Need Short-term Financing? Q4 52 Profits may not be sufficient to keep up with growthrelated financing needs. Firms may prefer to borrow now for their needs rather than wait until they have saved enough. Short-term financing instead of long-term sources of financing due to: easier availability usually lower cost 13 Chapter 16 June 04 Sources of Short Term Financing 53 Bank Loans Estimation of Cost of Short-Term Credit Cost of Bank Loans Simple Interest Loan Simple Compensating Balance Commercial Paper Discount Interest APR = Loans Based on Short-Term Assets Interest 365 Amount Received x Days Factoring Accounts Receivable Inventory or Warehouse Loans Amount you pay vs. Amount you can use Estimation of Cost of Short-Term Credit Cost of Bank Loans Simple Interest Loan APR = 55 APR = Interest Amount Received Adjustment for less than annual term Estimation of Cost of Short-Term Credit 56 Cost of Bank Loans Simple Interest Loan Interest 365 Amount Received x Days **If Loan is for ONE Year, reduced to: 54 APR = Interest 365 Amount Received x Days Example: AU Corp needs to borrow $1000 to purchase a supply of Tee Shirts for graduation. They will repay the loan plus $25 interest in 30 days. What is the cost of the loan (APR)? APR $25 = $1000 x 365 30 = 0.3042 = 30.42% 14 Chapter 16 June 04 57 Estimation of Cost of Short-Term Credit Annual Percentage Rate (APR) aka Nominal Rate Use to determine the cost of the credit to be able to compare differing terms--standardizes the term to one year. Effective Annual Rate (EAR) or (APY) Takes into account the compounding that occurs on loans of less than one year. The real cost of the loan if it were renewed each time it matured. ( EAR = 1 + i M -- 1 M ) Previous Example: .3042 EAR = 1 + 12.2 ( where: i = APR M = # of compounding = periods in year 12.2 )–1= Estimation of Cost of Short-Term Credit Cost of Bank Loans Compensating Balance The bank requires a certain percentage of the loan to be on deposit in the bank; the borrower receives the loan amount minus the compensating balance requirement. The Compensating Balance requirement can be satisfied from the amount borrowed, or if the firm already has an cash account with the lender, this account can be used for the compensating balance Example: Tiger, Inc. borrows $1,800 for 6 months. The bank requires a compensating balance equal to 10% of the amount borrowed and charges 12% on the loan per year. What is the nominal cost of the loan? =30.42% 365 = 12.2 30 APR = 0.3505 = 35.05% Estimation of Cost of Short-Term Credit 58 59 Cost of Bank Loans Compensating Balance Interest 365 Amount Received x Days Estimation of Cost of Short-Term Credit 60 Cost of Bank Loans Compensating Balance The bank requires a certain percentage of the loan to be on deposit in the bank; the borrower receives the loan amount minus the compensating balance requirement. The Compensating Balance requirement can be satisfied from the amount borrowed, or if the firm already has an cash account with the lender, this account can be used for the compensating balance The bank requires a certain percentage of the loan to be on deposit in the bank; the borrower receives the loan amount minus the compensating balance requirement. The Compensating Balance requirement can be satisfied from the amount borrowed, or if the firm already has an cash account with the lender, this account can be used for the compensating balance Example: Example: Tiger, Inc. borrows $1,800 for 6 months. The bank requires a compensating balance equal to 10% of the amount borrowed and charges 12% on the loan per year. What is the nominal cost of the loan? Tiger, Inc. borrows $1,800 for 6 months. The bank requires a compensating balance equal to 10% of the amount borrowed and charges 12% on the loan per year. What is the nominal cost of the loan? APR = Interest Charge on Loan: .12 $1,800 x x 6 = $108 Interest 12 Monthly Interest Rate # of Months APR = Interest Amount Received Face Value – Compensating Balance 15 Chapter 16 June 04 Estimation of Cost of Short-Term Credit 61 Example: Tiger, Inc. borrows $1,800 for 6 months. The bank requires a compensating balance equal to 10% of the amount borrowed and charges 12% on the loan per year. What is the nominal cost of the loan? APR APR = Interest Face Value – Compensating Balance $108 = x $1800 – $180 10% of $1800 12 6 x Estimation of Cost of Short-Term Credit Cost of Bank Loans Compensating Balance The bank requires a certain percentage of the loan to be on deposit in the bank; the borrower receives the loan amount minus the compensating balance requirement. The Compensating Balance requirement can be satisfied from the amount borrowed, or if the firm already has an cash account with the lender, this account can be used for the compensating balance Example: 365 Days Tiger, Inc. borrows $1,800 for 6 months. The bank requires a compensating balance equal to 10% of the amount borrowed and charges 12% on the loan per year. What is the nominal cost of the loan? = 0.133 = 13.3% Alternative Formula for Compensating Balance 6 month loan APR Nominal Rate 1 – Compensating = Balance Rate Estimation of Cost of Short-Term Credit Commercial Paper and Discount Interest • Short-term unsecured promissory notes issued by major corporations • Maturities range from one or more days to a maximum of 270 days (9 months) • Generally sold on a discount basis • Generally cheaper than bank loans • Prestige of being able to offer commercial paper 62 63 = .12 1 – .10 = 0.133 = 13.3% Estimation of Cost of Short-Term Credit 64 Cost of Commercial Paper Discount Interest Interest is paid when the money is borrowed; the borrower receives the loan amount minus interest paid. Upon maturity, the borrow pays back the face value of the loan. APR APR = = Interest 365 Amount Received x Days Interest Face Value - Interest Paid x 365 Days 16 Chapter 16 June 04 Estimation of Cost of Short-Term Credit 65 Cost of Commercial Paper Discount Interest Estimation of Cost of Short-Term Credit 66 Cost of Commercial Paper Discount Interest Example: Example: Snowy issues $10 million of Commercial Paper with a 90 day term. Interest rate is 9% per year, interest is discounted. What is the APR and APY of this Commercial Paper ? Snowy issues $10 million of Commercial Paper with a 90 day term. Interest rate is 9% per year, interest is discounted. What is the APR of this Commercial Paper ? = APR Interest Face Value - Interest Paid x 365 Days APR Interest Paid: $10,000,000 x .09 x 90 = $221,918 365 Daily Interest Rate APR Interest Face Value - Interest Paid $221,918 = $10,000,000 – $221,918 x 365 Days x 365 90 = 0.0920 = 9.20% # of Days Estimation of Cost of Short-Term Credit = 67 68 Factoring Accounts Receivable Borrower’s Accounts Receivable are SOLD outright (at a discount) to a factor, the factor then collects the A/R from the borrower’s customers. Example: You have an average of $1 million in receivables and you borrow money by factoring receivables with a discount of 2.5%. The receivables turnover is 12 times per year. Discount % x 1 – Discount % Receivables Turnover APR = APR .025 = 1 – .025 EAR = x 12 = 0.3077 = 30.77% 12 (1 + .3077 12 ) – 1 = 0.3550 = 35.50% 17