ARTICLE IN PRESS

ADIAC-00048; No of Pages 9

Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

Contents lists available at ScienceDirect

Advances in Accounting, incorporating Advances in

International Accounting

j o u r n a l h o m e p a g e : w w w. e l s e v i e r. c o m / l o c a t e / a d i a c

1

Monetary unit sampling: Improving estimation of the total audit error

2

Huong N. Higgins a,⁎, Balgobin Nandram b,1

a

b

Worcester Polytechnic Institute, Department of Management, 100 Institute Road, Worcester, MA 01609, United States

Worcester Polytechnic Institute, Department of Mathematical Sciences, 100 Institute Road, Worcester, MA 01609, United States

OO

F

3

4

5

a r t i c l e

i n f o

a b s t r a c t

In the practice of auditing, for cost concerns, auditors verify only a sample of accounts to estimate the error of

the total population of accounts. The most common statistical method to select an audit sample is by

monetary unit sampling (MUS). However, common MUS estimation practice does not explicitly recognize the

multiple distributions within the population of account errors. This often leads to excessive conservatism in

auditors' judgment of population error. In this paper, we review the common MUS estimation practice, and

introduce our own method which uses the Zero-Inflation Poisson (ZIP) distribution to consider zero versus

non-zero errors explicitly. We argue that our method is better suited to handle the real populations of

account errors, and show that our ZIP upper bound is both reliable and efficient for MUS estimation of

accounting data.

© 2009 Elsevier Ltd. All rights reserved.

Available online xxxx

PR

6

7

Q1 8

910

11

ED

25

24

1. Introduction

27

In auditing a company's accounts receivable, the goal of auditors is

to verify if the values of the accounts reported by the company are not

materially misstated. To determine the total error in the amount

reported by the company, auditors must audit all accounts in the

population of accounts. However, it is costly and it takes much time to

audit all accounts. In practice, auditors audit only a sample to estimate

the total error in the population of accounts.

A common statistical sampling method is monetary unit sampling

(MUS), where each monetary unit (e.g., dollar) is equally likely to be

included in the sample. In this method, an account with a book value

of $10,000 is ten times as likely to be sampled as an account with a

book value of $1000.

This paper addresses the estimation process for MUS sampling.

Common MUS estimation has a shortcoming because it does not

explicitly recognize that a total population of account errors typically

consists of distinct distributions, namely one large mass with zero

error, a second distribution of small errors, and a third distribution of

100% errors. These distribution characteristics of accounting error

populations have been discussed in prior research (e.g. Kaplan, 1973;

Neter & Loebbecke, 1975; Chan, 1988). Due to this shortcoming, in

practice sample accounts are incorrectly assumed to have similar

tainting (ratio of Error-Per-Dollar) to non-sample accounts. This

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

RE

32

33

CO

R

30

31

UN

28

29

assumption, combined with MUS sampling bias towards selecting

larger accounts, often leads to very large estimations of total error in

the population and overly conservative auditors' decisions.

We acknowledge that the major risk of accounts receivable in

financial reporting is overstatement, so generally auditors should

prefer methods that result in larger error estimations. However, we

argue that estimations in practice are too conservative, and excessive

conservatism has its own practical problems. For example, discussions

with auditors in three large accounting firms reveal that clients rarely

approve large adjustments for error estimations (Elder & Allen, 1998).

This, along with the cost of statistical expertise, may cause auditors

not to project sample errors to the population at all. Indeed, surveys of

auditors reveal that they often fail to project errors to populations,

notwithstanding audit standards and professional guidelines (Burgstahler & Jiambalvo, 1986; Akresh & Tatum, 1988; Hitzig, 1995; Elder &

Allen, 1998). Overall, excessive conservatism in the estimation method

may lead to projection problems, which impairs the auditor's overall

decision process.

We introduce our own approach which is better suited to handle

the real distributions of account errors. We use a regression with

selection probability as a covariate to address MUS sampling bias. Our

technical innovation lies in the development of the Zero-Inflation

Poisson (ZIP) model, using the Poisson distribution to treat errors as

rare count data, and increasing the probabilities of zero errors to

inflate the weights of these observations. By handling accounts with

zero versus non-zero errors explicitly, our technique does not rely on

the assumption of similar tainting in the population. We provide

mathematical expressions and, upon request, will furnish the software

codes for our ZIP estimation and confidence intervals. Through

simulations, we show that our ZIP bound is reliable and efficient for

CT

26

⁎ Corresponding author. Tel.: +1 508 831 5626; fax: +1 508 831 5720.

E-mail addresses: hhiggins@wpi.edu (H.N. Higgins), balnan@wpi.edu (B. Nandram).

1

Tel.: +1 508 831 5539; fax: +1 508 831 5824.

0882-6110/$ – see front matter © 2009 Elsevier Ltd. All rights reserved.

doi:10.1016/j.adiac.2009.06.001

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

13

14

12

15

16

17

18

19

20

21

22

23

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

ARTICLE IN PRESS

90

2. Monetary unit sampling

91

92

In performing substantive tests of accounts, an auditor often takes

a sample to estimate the true total balance of all accounts. Ultimately,

the auditor's goal is to estimate the total amount of error, which is the

difference between the true total balance of all accounts and the

reported balance amount. The standards for audit sampling are set by

the Audit Standards Board's Statement on Auditing Standards (SAS)

No 39, (AICPA, 1981) amended by SAS No. 111 (AICPA, 2006).

Both statistical and non-statistical sampling methods are allowed

for substantive tests in auditing (AICPA, 1981, 2008). Both are used by

a wide-range of public accounting firms (Nelson, 1995) and government agencies (Annulli, Mulrow & Anziano, 2000). Some surveys

show that non-statistical sampling is used more than half the time

(Annulli et al., 2000; Hall, Hunton & Pierce, 2000, 2002). Of course,

non-statistical sampling procedures do not afford the full control

provided by statistical theory, and so raise questions concerning

auditors' evaluation of sample results (Messier, Kachelmeier & Jensen,

2001).

Among statistical sampling techniques, monetary unit sampling

(MUS) is the most commonly used for substantive tests (Tsui,

Matsumura & Tsui, 1985; Smieliauskas, 1986b; Grimlund & Felix,

1987; Hansen, 1993; Annulli et al., 2000; AICPA, 2008). The

authoritative guide for the auditing profession, the AICPA's Audit

Guide — Audit Sampling (AICPA, 2008), has detailed MUS instructions.

MUS is a statistical sampling method where the probability of an

item's selection for the sample is proportional to its recorded amount

(probability proportional to size). MUS can be thought of as employing the ultimate in stratification by book amount. No further

stratification by book amount is possible with dollar units because

all sampling units are of exactly the same size in terms of book value.

Consequently, MUS incorporates efficiency advantages similar to

those of stratification by book value without requiring stratification.

Despite its widespread use, the relative performance of MUS

compared to traditional normal distribution variables is often not

clear (Smieliauskas, 1986b). Prior research has developed a number of

methods for evaluating MUS samples (Tsui et al., 1985; Smieliauskas,

1986b; Grimlund & Felix, 1987). Evaluating criteria include sample

size (Kaplan, 1975), sampling risks (Smieliauskas, 1986b), sample size

implications of controlling for the same level of sampling risks

(Smieliauskas, 1986b), and bounds (Tsui et al., 1985; Dworin &

Grimlund, 1986).

Obtaining reliable bounds on the total error in the population is

desirable for making decisions at different confidence levels and

probabilistic statements. There are many methods to compute bounds

for MUS sampling (Felix, Leslie & Neter, 1981; Swinamer, Lesperance &

Will, 2004). The Stringer bound, introduced by Stringer (1963), is used

extensively by auditors (Bickel, 1992; AICPA, 2008). A feature of thee

Stringer bound which is particularly attractive to auditors is that it

provides a non-zero upper bound even when no errors are observed in

the sample. Simulations show that the Stringer bound reliably exceeds

the true audit error (Swinamer et al., 2000). This reliability is

favorable to auditors who are concerned with strictly overstatements

(or strictly understatements) in financial statements. The Stringer

86

87

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

Q2 140

141

142

3. Data and common estimation

145

3.1. Data

146

To illustrate the common estimation method, we use data of a

company used by Lohr (1999) in her demonstration of MUS. The

company has a population of N = 87 accounts receivable, with a total

book balance of $612,824. We know the book values b1, b2, …, bN for

each account in the population. Let B denote the total book value of all

accounts receivable in the population,

147

148

B = b1 + b2 + … + bN = 612; 824:

149

150

151

152

ð1Þ

153

154

If each account in the population were audited, we would obtain 155

the set of audit values a1, a2, …, aN. Let A denote the unknown total 156

audit value in our data,

157

A = a1 + a2 + … + aN :

ð2Þ

We define the error on any account i (i = 1, 2, …, N) by di = bi − ai,

di ≥ 0. After performing audit on a sample size n, which we suppose is

predetermined, we observe a1, a2, …, a n (see Kaplan, 1975;

Menzefricke, 1984 for discussions of issues in determining the sample

size). We wish to fit an + 1, …, aN to predict the total error from all

accounts.

Let D denote the total error in the population of all accounts

receivable,

D = d1 + d2 + … + dN :

158

159

160

161

162

163

164

165

166

167

ð3Þ

168

169

The total error D is also the difference between the total book value 170

and the total audit value,

171

D = B−A:

ð4Þ

172

173

Our ultimate goal is to predict total error D. Because D is unknown,

it is standard practice to estimate its mean and upper bound.

The book values, audit values, selection probabilities and errors of

all accounts are tabulated in Table 1. Selection probability is the

probability of an account being selected from all the 87 accounts, equal

to the book value of an account divided by the total book balance

$612,824 (e.g. for account 3, the selection probability = 6842/612,824 =

0.011164706). Panel A describes the audit sample, and Panel B the nonsample.

The audit values and errors of accounts in the audit sample are

known, but these values are unknown for accounts in the non-sample.

In this company, only a small proportion of audited accounts (4 of 20,

or 80%) are subject to error.

174

175

3.2. Common estimation

187

SAS No. 39 on audit sampling (AICPA, 1981) promulgates that

auditors should estimate the total error in the population by

projecting sample errors to the population. A common estimation

method of the mean population error D is based on tainting, which

equals the average error amount per dollar in the audited accounts.

Taintings are multiplied by the total dollars in the sampling intervals,

or average tainting is multiplied by the total dollars in the population,

to yield an estimate of the total error dollars in the population. This

method is prescribed by the AICPA Audit Guide — Audit Sampling

(AICPA, 2008). Besides the AICPA guide, many professional publications also prescribe this MUS evaluation method (Gafford &

Carmichael, 1984; Guy & Carmichael, 1986; Schwartz, 1997; Yancey,

2002).

188

189

RR

EC

85

CO

83

84

UN

81

82

bound is also simple to compute and the required statistical tables are 143

readily available.

144

TE

88

89

MUS estimation of accounting data. Overall, our paper serves

professionals and academicians by pointing out an improvement

potential for MUS estimation.

The remainder of the paper is as follows. Section 2 reviews the

monetary unit sampling method in the accounting literature and

practice of auditing. Section 3 describes our data and demonstrates a

common method in current practice to estimate the total error in a

population of accounts from which a dollar unit sampling is taken.

Section 4 introduces our Zero-Inflated Poisson (ZIP) estimation

method. Section 5 reports simulations to validate our ZIP upper

bound. Section 6 concludes the paper with a brief summary.

RO

OF

79

80

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

DP

2

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

176

177

178

179

180

181

182

183

184

185

186

190

191

192

193

194

195

196

197

198

199

200

ARTICLE IN PRESS

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

t1:1

t1:2

t1:3

3

Table 1

Description of data.

Panel A: sample

Account number

Book value (b)

Audit value (a)

Selection probability (πi)

Error (d = b − a)

t1:5

t1:6

t1:7

t1:8

t1:9

t1:10

t1:11

t1:12

t1:13

t1:14

t1:15

t1:16

t1:17

t1:18

t1:19

t1:20

t1:21

t1:22

t1:23

t1:24

t1:25

t1:26

t1:27

3

9

13

24

29

34

36

43

44

45

46

49

55

56

61

70

74

75

79

81

Total error in the sample

6842

16,350

3935

7090

5533

2163

2399

8941

3716

8663

69,540

6881

70,100

6467

21,000

3847

2422

2291

4667

31,257

6842

16,350

3935

7050

5533

2163

2149

8941

3716

8663

69,000

6881

70,100

6467

21,000

3847

2422

2191

4667

31,257

0.011164706

0.026679765

0.006421093

0.01156939

0.009028693

0.003529562

0.003914664

0.014589833

0.006063731

0.014136196

0.113474668

0.011228346

0.11438847

0.010552785

0.034267587

0.006277496

0.003952195

0.003738431

0.007615563

0.051004856

0

0

0

40

0

0

250

0

0

0

540

0

0

0

0

0

0

100

0

0

940

t1:28

Account

number

Book

value (b)

Audit

value (a)

Selection

probability (πi)

Error

(d = b − a)

Account

number

Book

value (b)

Audit

value (a)

Selection

probability (πi)

Error

(d = b − a)

t1:29

t1:30

t1:31

t1:32

t1:33

t1:34

t1:35

t1:36

t1:37

t1:38

t1:39

t1:40

t1:41

t1:42

t1:43

t1:44

t1:45

t1:46

t1:47

t1:48

t1:49

t1:50

t1:51

t1:52

t1:53

t1:54

t1:55

t1:56

t1:57

t1:58

t1:59

t1:60

t1:61

t1:62

1

2

4

5

6

7

8

10

11

12

14

15

16

17

18

19

20

21

22

23

25

26

27

28

30

31

32

33

35

37

38

39

40

41

2459

2343

4179

750

2708

3073

4742

5424

9539

3108

900

7835

1091

2798

5432

2325

1298

5594

2351

7304

4711

4031

1907

3341

8251

4389

5697

7554

8413

4261

7862

3153

4690

6541

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0.004013

0.003823

0.006819

0.001224

0.004419

0.005014

0.007738

0.008851

0.015566

0.005072

0.001469

0.012785

0.00178

0.004566

0.008864

0.003794

0.002118

0.009128

0.003836

0.011919

0.007687

0.006578

0.003112

0.005452

0.013464

0.007162

0.009296

0.012327

0.013728

0.006953

0.012829

0.005145

0.007653

0.010674

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

42

47

48

50

51

52

53

54

57

58

59

60

62

63

64

65

66

67

68

69

71

72

73

76

77

78

80

82

83

84

85

86

87

9074

8746

7141

2278

3916

2192

5999

5856

7642

8846

2486

2074

3081

7123

5496

7461

6333

13,597

1317

5437

4030

2620

2416

5882

6596

2626

7571

1331

5924

4356

6618

5658

6943

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0.014807

0.014272

0.011653

0.003717

0.00639

0.003577

0.009789

0.009556

0.01247

0.014435

0.004057

0.003384

0.005028

0.011623

0.008968

0.012175

0.010334

0.022187

0.002149

0.008872

0.006576

0.004275

0.003942

0.009598

0.010763

0.004285

0.012354

0.002172

0.009667

0.007108

0.010799

0.009233

0.01133

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

t1:63

Book value is the amount reported by the audited company. Audit value is the value audited and verified by the auditors. Selection probability is the probability of which an account is

selected from all the accounts in the population, equal to the book value of an account divided by the total book balance $612,824 (e.g. for account 3, the selection

probability = 6842 / 612824 = 0.011164706). Error is the difference between book value and audit value. Panel A shows the accounts selected by the auditors to be audited (sample),

and Panel B the remainder of the population of accounts (non-sample). Accounts in the non-sample do not have audit value.

201

202

203

204

205

206

207

UN

CO

R

RE

CT

ED

PR

Panel B: non-sample

OO

F

t1:4

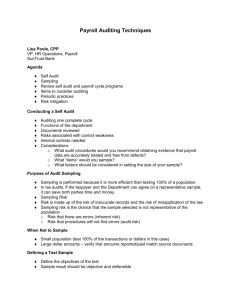

Table 2 illustrates this estimation process. Error-Per-Dollar (tainting) indicates the difference per dollar for each account, equal to the

difference in book and audit values divided by the corresponding book

value. Account 24, for example, has a book value of $7090 and an error

of $40. The error is prorated to every dollar in the book value, leading

to an error (tainting) percentage of $40/$7090 = 0.005642 for each of

the 7090 dollars. The average error for the individual dollars in the

sample is the sum of all Errors-Per-Dollar divided by 20, the number of

accounts in the sample, or 0.008063. Thus the total error for the

population D is estimated as 0.008063 ⁎ 612,824 = $4941.

Often, audit units greater than the sampling interval are excluded

from the population before sampling (AICPA, 2008). These units are

examined separately, and their projected misstatements equal their

full misstatements, not an extension of tainting. For example, the

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

208

209

210

211

212

213

214

ARTICLE IN PRESS

4

t2:1

t2:2

t2:3

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

Table 2

Common error estimation for dollar unit sampling.

Account

number

Book value

(b)

Audit value

(a)

Selection

probability (πi)

Error

(d = b − a)

Error-Per-Dollar

(tainting)

6842

16,350

3935

7050

5533

2163

2149

8941

3716

8663

69,000

6881

70,100

6467

21,000

3847

2422

2191

4667

31,257

0.011164706

0.026679765

0.006421093

0.01156939

0.009028693

0.003529562

0.003914664

0.014589833

0.006063731

0.014136196

0.113474668

0.011228346

0.11438847

0.010552785

0.034267587

0.006277496

0.003952195

0.003738431

0.007615563

0.051004856

0

0

0

40

0

0

250

0

0

0

540b

0

0

0

0

0

0

100

0

0

940

0

0

0

0.005642

0

0

0.10421

0

0

0

0.007765

0

0

0

0

0

0

0.043649

0

0

Projected mistatement

(taintinga sampling interval)

t2:4

t2:5

t2:6

t2:7

t2:8

t2:9

t2:10

t2:11

t2:12

t2:13

t2:14

t2:15

t2:16

t2:17

t2:18

t2:19

t2:20

t2:21

t2:22

t2:23

t2:24

t2:25

t2:26

3

6842

9

16,350

13

3935

24

7090

29

5533

34

2163

36

2399

43

8941

44

3716

45

8663

46

69,540b

49

6881

55

70,100

56

6467

61

21,000

70

3847

74

2422

75

2291

79

4667

81

31,257

Total error in the sample

Average Error-Per-Dollar

Total projected error in the population

t2:27

t2:29

t2:28

t2:30

Book value is the amount reported by the audited company. Audit value is the value audited and verified by the auditors. Selection probability is the probability of which an account is

selected from all the accounts in the population, equal to the book value of an account divided by the total book balance. Error is the difference between book value and audit value.

Error-Per-Dollar is the ratio between error and book value. The sampling interval is $612,824/20 = $30,641.20.

Total error D for the population is estimated as Average Error-Per-Dollar ⁎ total book value, or 0.008063 ⁎ 612,824 = $4941.

a

The Average Error-Per-Dollar is the sum of all error-per-dollars divided by the number of accounts in the sample (20).

b

This audit unit is greater than the sampling interval and may be considered separately from the sample evaluation.

218

219

220

221

222

223

n

k=j + 1

226

n k

n−k

p ð1−pÞ

= 1−α;

k

ð5Þ

if j b n and p(n; 1 − α) = 1.

The Stringer bound for the mean of tainting μ is

M

CO

ð6Þ

j=1

232

233

234

235

236

237

238

239

240

241

242

243

244

The upper bound of the total error in the population is μ–ST ⁎ B.

There is a similar bound for the case in which X has a Poisson (n ⁎ p)

distribution.

The AICPA (2008) publishes tables as aids in calculating the

Stringer upper bound (see Table C.3. “Monetary Unit Sampling —

Confidence Factors for Sample Evaluation” in Appendix C of the Audit

Guide). Our computation of the Stringer 95% upper bound based on

the binomial distribution for calculating p(n;1 − α) is $129,380. A

replication of the Stringer computation using the Poisson instead of

binomial distribution for p(n;1 − α) yields a similar value, $133,518.

The above results, which are based on the common estimation

approach, can be summarized as follows. The sample contains known

errors of $940. The total error projected in the population is $4941. The

Stringer 95% upper confidence bound of total error in the population is

$133,518. Thus, there is a 5% risk that the recorded amount of $612,824

is overstated by more than $133,518.

UN

230

231

RO

OF

DP

4941

μ ST ≡ pð0; 1−αÞ + ∑ ½pðj; 1−αÞ−pðj−1; 1−αÞzj :

227

228

229

1337.46

0.008063a

projection from account 46 would be its full misstatement of $540

instead of $237.94. In this case, the total projected error in the

population would be $5243 instead of $4941.

A common method to estimate the upper bound of D is the

Stringer bound. Let Ti be the tainting of the i-th selected item, Ti ≡ di/

bi. If M ≡ number of non-zero Ti let 0 b zM ≤ … ≤ z1 be the ordered non

zero Ti. Let p(j; 1 − α) be the 1 − α exact upper confidence bound for p

when X has a binomial (n, p) distribution and X = j. Thus p(j; 1 − α) is

the unique solution of

∑

225

224

237.94b

We argue that the approach described above is too conservative.

Compared to other bounds, for example the Multinomial-Dirichlet

bound computed at $11,125 for the same sample, the Stringer bound is

too large. References for Multinomial bounds can be found in

Swinamer et al. (2004) and Neter, Leitch and Fienberg (1978). As

Stringer (1963) stresses, if the population is free of errors it gives the

same answer (overestimate), no matter what sample is drawn from

the population. In fact, simulation studies (Reneau, 1978; Leitch, Neter,

Plante & Sinha, 1982) find that the Stringer bound is always too

conservative. The trade-off for high reliability is loss of efficiency: the

Stringer bound is always much larger than the population total error

(Bickel, 1992; Swinamer et al., 2004). It is probable that many auditors

do not project sample results to populations to avoid unrealistic

conservatism and client resistance. However, failing to project leads to

judgment error regarding the financial statements overall.

We seek to introduce an alternative method that is reliable but

more efficient, to help auditors make realistic projection and

probabilistic statements about the population error.

245

4. Zero-Inflated Poisson regression

263

To improve on the common estimation method described in

Section 3, our aim is to estimate total error D and its 95% upper

confidence bound. In the first step, we develop the Poisson regression

to view each dollar in an account either as error or not (as count data).

In the second step, we further develop the Poisson regression to count

data with a large number of zero values to suit populations of account

errors.

264

265

4.1. Ordinary Poisson regression

271

We use the generalized regression model to allow for count data so

that we can capture the distribution of our data more accurately (see

Nandram, Sedransk & Pickle, 2000 for a detailed discussion of the

generalized regression model and specifically the Poisson regression).

272

TE

216

217

3193.12

RR

EC

215

172.87

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

262

266

267

268

269

270

273

274

275

ARTICLE IN PRESS

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

280

281

282

283

284

285

286

287

288

289

290

291

di jλi ind

e Poissonðλi bi Þ

ð7Þ

ln λi = ðβ0 + r0i Þ + ðβ1 + r1i Þπi

292

293

294

295

296

297

298

where i = 1,2, …, N, r0i and r1i are random perturbations and are

independent and identically distributed with mean 0 and finite

variances, and λi is the error rate for a dollar, or equivalently, the

probability that a dollar is in error. Now we have two sets of random

coefficients β0 + r0i and β1 + r1i.

Note that the model with r0i = r1i = 0, i = 1,2, …, N, is

di jλi ind

e Poissonðλi bi Þ

ln λi = β0 + β1 πi :

299

300

305

306

di jλi ind

e Poissonðbi e

310

311

β0 + β1 πi

Þ:

ð9Þ

Centering allows us to use this simpler model to study the original,

more complex model. Because the dis are independent, the loglikelihood function is

n

CO

R

307

308

309

n

n

i=1

i=1

β0 + β1 πi

f ðβ0 ; β1 Þ = β0 ∑di + β1 ∑ πi di − ∑ bi e

i=1

312

313

316

317

318

319

320

321

:

n

i=1

ðhÞ

=M = E

h=1

ð13Þ

and the standard error is

329

330

sffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

M

S=

∑ ðE

ðhÞ

i=1

P 2

− E Þ = ðM−1Þ:

ð14Þ

To obtain a 95% confidence interval for the total overstatement

error, we order the E(h) from smallest to largest and pick the 250th and

9750th value from the lower and upper end of the confidence interval.

The 95% upper confidence bound is the 9500th value.

N

∑ d˜i

331

332

333

334

335

336

4.2. Zero-Inflation Poisson regression

337

We now develop the Poisson regression model to count data with

many zero values. This is our major innovation to address MUS

estimation errors. We assume that with probability θ the only

possible observation is 0 (i.e. pure zero), and with probability1 − θ, a

Poisson (λ) random variable is observed. In other words, we treat

errors as nearly impossible, but allow errors to occur according to a

Poisson (λ) distribution. This treatment is termed Zero-Inflation

Poisson (ZIP). For a pioneering description of ZIP regression, see

Lambert (1992). Both the probability θ of the perfect zero error state

and the mean number of errors λ in the imperfect state may depend

on covariates. Pertinent covariates, such as trade relationships, credit

terms, product prices, etc… can lead to improved precision in

statistical inference. For a discussion of how to introduce covariates,

see Nandram et al. (2000), for example. Sometimes θ and λ are

unrelated; other times θ is a simple function of λ. In either case, ZIP

regression models are easy to fit, and the maximum likelihood

estimates are approximately normal in large samples of at least 25

(Lambert, 1992).

As in the ordinary Poisson model in Section 4.1, our model is

Eq. (7). To increase the probabilities of zero errors, we use the

following distribution for di,

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

357

358

β 0 + β 1 πi

ð10Þ

We use maximum likelihood estimate in the centered model to

obtain MLEs. Preliminary estimations are possible at this step,

however they do not benefit from the zero inflation process, so they

are less adjusted for populations with a large number of zero errors.

We show in Appendix A how to obtain 10,000 copies of the

overstatement error. We use two estimators: the predicted estimator

and the projected estimator.

The two estimators are defined as:

Predicted: ∑ di +

M

∑E

pðdi = 0Þ = θ + ð1−θÞe−bi e

UN

314

315

from Appendix A, and M = 10,000, h = 1,2, …, M. An estimate of the 327

overstatement error is

328

CT

303

304

This is another important feature of our method because

observations are treated according to their selection probabilities π,

and so sample and non-sample observations are not assumed to be

the same.

The first model is centered on the second model. Centering is

achieved by taking r0i = r1i = 0, so that

RE

301

302

be the h-th copy of the 10,000 copies obtained 326

i=1

ED

ð8Þ

ðhÞ

Let EðhÞ = ∑ di

OO

F

278

279

We use random coefficients, instead of fixed coefficients as in a

standard linear regression, to treat each account as having its own set

of regression coefficients. By allowing random coefficients, we can

model the data more flexibly and therefore can achieve more accuracy.

This is an important feature of our method to incorporate random

effects. Using random coefficients also allows us to build confidence

intervals and upper confidence bounds. We approximate the

distribution of the random coefficients by using a standard mode–

Hessian normal approximation (Gelman, Carlin, Stern & Rubin, 2004),

which allows us to draw samples of the regression coefficients. This

permits us to make copies of the total errors, thus we get the

distribution of the total error. In a sample of 10,000 we obtain the

250th and 9750th values to form the lower and upper ends of the 95%

confidence interval.

To consider each dollar in an account is either in error or not, our

model is,

5

PR

276

277

N

ð11Þ

i=n + 1

ð15Þ

pðdi ≠0Þ = ð1−θÞ

β0 + β1 πi di −bi eβ0

ðbi e

Þ e

di !

+ β 1 πi

where di = 1,2,3, ….

The random effect corresponding to θ is θ + r21.We do not treat the

dis equally. Because most of the errors in the sample are zero, different

treatments of zero-valued dis and non-zero dis are desired to give

more appropriate weights to the zero values.

We center the ZIP model by taking r0i = r1i = r2i = 0, i = 1, 2, …, N,

similar to Eqs. (8) and (9).

Since the dis are independent, we consider their joint probability

density function:

359

360

361

362

363

364

365

366

367

368

322

323

N

Projected: ∑d˜i

i=1

ð12Þ

Lðθ; β0 ; β1 Þ = ∏

di = 0

324

325

where dĩ is the predicted value of di.

n

β

−b e 0

θ + ð1−θÞe i

+ β1 πi

o

(

∏

dt N 0

ð1−θÞ

ðbi e

β0 + β1 πi

β0 + β1 πi di −bie

Þ e

di !

)

:

ð16Þ 369

370

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

ARTICLE IN PRESS

Thus the log-likelihood function is

n

−bieβ0

Δðθ; β0 ; β1 Þ = ∑ ln½θ + ð1−θÞe

+ β1 πi

π=1

M

+

∑

l=π + 1

372

373

374

375

376

+ ðN−nÞ lnð1−θÞ ð17Þ

M

di ðβ0 + β1 πi Þ− ∑

bie

β0 + β1 πi

l=π + 1

:

We use the Expectation Maximization (EM) algorithm to maximize the function over θ and ß (see Appendix B).

The values we obtain from the above procedures are:

θ̃ = 0:80 β̃0 = −3:25 β̃1 = −14:36:

378

377

379

380

396

5. Simulations

397

We perform three simulations to assess the reliability and

efficiency of our ZIP upper bound, using the following definitions by

Swinamer et al. (2004): a 95% upper confidence bound is reliable if,

when used repeatedly, the bound exceeds the true error 95% of the

time. Efficiency measures the size of the bound: the smaller the bound

is, the more efficient it is said to be. We compare the reliability and

efficiency of our ZIP method with the Stringer bound, because this

bound is used the most extensively by accounting auditors as

discussed in previous sections. We also compare our ZIP method

with the Multinomial-Dirichlet bound, because this bound demonstrates the best reliability for a variety of populations (Tsui et al.,

1985). More MUS bounds exist but they have relatively more

reliability problems and they all have pros and cons (Grimlund &

Felix, 1987; Swinamer et al., 2004).

385

386

387

388

389

390

391

392

393

394

398

399

400

401

402

403

404

405

406

407

408

409

410

t3:1

RR

EC

383

384

Table 3

Simulation results.

t3:2

t3:3

Reliability

1

UN

t3:4

t3:5

t3:6

t3:7

t3:8

t3:9

t3:10

t3:11

t3:12

t3:13

t3:14

t3:15

CO

381

382

TE

395

Our estimations are based on two estimators, the predicted

estimator and the projected estimator as defined in Eqs. (11) and

(12). We estimate the mean, standard error, confidence interval, and

upper bound using in a manner as described in Eqs. (13) and (14). We

show in Appendix B how to obtain 10,000 copies of the overstatement

error.

The predicted estimator has a mean of $3272, a standard error of

$1037, a 95% confidence interval of [$1487; $5336], and a 95% upper

confidence bound of $4848. The projected estimator has a mean of

$3435, a standard error of $1463, a 95% confidence interval of [$931;

$6107], and a 95% upper confidence bound of $5444.

As per design, we argue our ZIP method has advantage because it

addresses the selection bias in MUS towards selecting larger accounts,

it handles populations with a large number of zero values, and it

handles zero versus non-zero values explicitly separately. As a result of

this design, ZIP should be better suited than common estimation

practice for accounting populations.

Simulation 1 consists of three steps. First, we fill in the missing

audit value for the 87 − 20 = 67 accounts in our data set. We use the

bivariate Parzen–Rosenblut kernel density estimator, an independent

non-parametric model (Silverman et al., 1986) to fill in the audit

values. To model errors, we formulate the missing audit values in the

range 0.90 book value b audit value b book value. We create the

scenario where 80% of the book values and the audit values are in

perfect agreement. This population is kept fixed throughout. Because

we generate all the necessary audit values, we have the entire

population and the true total population error.

Second, we draw 1000 PPS samples (probabilities of selection are

proportional to the book values) without replacement of size 20 from

the single populations we construct in the first step. Third, we fit the

ZIP regression model in exactly the same manner we discussed in

Section 3 for the observed data. We compute 90% confidence interval

for each fixed population, whose upper end provides a 95% upper

confidence bound. For comparison, we compute the same for the

Stringer bound and the Multinomial-Dirichlet bound. The results are

shown in Table 3.

Table 3, Columns 2–6 show the reliability results, specifically the

frequency in which the bounds exceed the true population error. In

Simulation 1, the ZIP bound exceeds the true population error 89.5% of

the times, whereas it is supposed to exceed 95% of the times. In

contrast, the Stringer bound exceeds the true error 100% of the times,

while this frequency is 96% for the Multinomial-Dirichlet bound.

These results demonstrate ZIP's lower reliability than the theoretical

level and the extra conservatism of the Stringer bound.

To report on the efficiency, Columns 5 and 6 show the frequency in

which the ZIP bound is larger (more inefficient) than the Stringer

bound and the Multinomial-Dirichlet bound. In Simulation 1, these

frequency numbers are very close to zero (0.7% and 9.6%, respectively), indicating the ZIP bound is almost always smaller, or more

efficient. To further shed light on the size of the other bounds relative

to the ZIP bound, Columns 7 and 8 show the ratio of the differential

size over the ZIP bound. On average, this ratio is about 13 times for the

Stringer bound, and 25.8% for the Multinomial-Dirichlet bound. These

results demonstrate the far greater efficiency of the ZIP bound

compared to the other two.

Simulation 2 is similar to the first, except that the audit values are

generated by the ZIP model. The generated data have similar

characteristics to accounting data in the sense that they come from a

distribution that presumes a very large number of zero errors. From

Column 2, the ZIP bound is reliable as its 95% upper bound exceeds the

true error value 96.8% of the times. From Columns 5 and 6, the frequency

in which the ZIP bound is larger than the other two bounds is very small

(0.8% and 3%, respectively), denoting ZIP's greater efficiency.

Simulation 3 is similar to the first two, except that the audit values

are generated to have error distributions identical to Population 4 in

RO

OF

371

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

DP

6

Simulation 1

Data from Parzen–Rosenblut model

Simulation 2

Data from ZIP model

Simulation 3

Data from Neter Loebbecke population 4

|{z}

Efficiency

2

3

4

5

6

7

8

ZNT

SNT

MNT

ZNS

ZNM

(S − Z) / Z

(M − Z) / Z

0.895

1.000

0.960

0.007

0.096

12.989

0.258

0.968

1.000

1.000

0.008

0.030

0.342

0.188

0.984

1.000

1.000

0.009

0.044

0.343

0.182

|{z}

Proportion of 1000 simulations

|{z}

Average over 1000 simulations

Z: ZIP bound, S: Stringer bound, M: Multinomial-Dirichlet bound, T: True value.

The rows show the results from three separate simulations. Columns 2–6 show the frequency in which one bound is larger than the true value or another bound. Columns 7 and 8

show the relative size of the other bounds compared to the ZIP bound.

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

411

412

413

414 Q3

415

416

417

418

419

420

421

422

423

424

425

426

427

428

429

430

431

432

433

434

435

436

437

438

439

440

441

442

443

444

445

446

447

448

449

450

451

452

453

454

455

456

457

458

ARTICLE IN PRESS

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

463

464

465

466

467

468

469

470

471

472

473

474

475

476

477

478

479

480

481

482

483

An estimate of the covariance matrix of β0̂ and β1̂ is the negative 514

inverse Hessian matrix. The Hessian matrix is

515

0

n

β + β1 πi

bi e 0

B i∑

B =1

B n

@

β

∑ bi πi e 0

β0 + β1 πi

i=1

+ β1 πi

i=1

n

2 β0 + β1 πi

∑ bi πi e

H

−1

=

c

a2

a1

c

where

519

520

n

2 β0 + β1 πi

∑ bi πi e

i=1

a1 =

n

β0 + β1 πi

∑ bi e

i=1

n

2 β0 + β1 πi

∑ bi πi e

i=1

n

494

495

496

497

498

499

500

501

Q4 502

7. Uncited reference

Silverman, 1986

504

Acknowledgement

505

506

507

The authors acknowledge the helpful comments from two

anonymous reviewers and the Journal's associate editor. Any errors

are the authors' responsibility.

508

Appendix A

509

UN

503

For the centered model, the log-likelihood function is

n

n

n

i=1

i=1

i=1

f ðβ0 ; β1 Þ = β0 ∑ di + β1 ∑ πi di − ∑ bi e

510

511

512

513

β0 + β1 πi

:

We use a two-dimensional Newton's method to maximize it over

β0 and β1. Details are omitted.

Þ

521

522

β0 + β1 πi

n

β0 + β1 πi 2

ð ∑ bi πi e

β0 + β1 πi

Þ − ∑ bi e

i=1

∑ bi e

n

2 β0 + β1 πi

∑ bi πi e

i=1

523

524

β0 + β1 πi

i=1

a2 =

n

β0 + β1 πi

∑ bi e

ED

492

493

β0 + β1 πi 2

i=1

∑ bi πi e

n

i=1

n

2 β0 + β1 πi

∑ bi πi e

i=1

n

β0 + β1 πi 2

−ð ∑ bi πi e

:

Þ

i=1

525

526

527

First, we take

β0 + r0i

β1 + r0i

CT

490

491

RE

488

489

We propose a method that improves upon the common MUS

estimation approach. MUS estimation as commonly practiced by

accounting auditors does not explicitly recognize that a total

population of account errors typically consists of multiple distinct

distributions. As a result, this common approach often leads to very

large error estimations and very conservative auditor's decisions on

the fairness of client financial statement. For conservatism auditors

should want large estimations of errors and upper bounds, however

estimations under common practice are too conservative, and

excessive conservatism has its own problems. Our method, based on

Zero-Inflation Poisson distribution, addresses the above shortcoming.

We discuss our method and show that for data similar to accounting

populations, our bound is reliable and more efficient than common

MUS practice, so we would recommend our bound to accounting

auditors. For other populations, our method may be slightly less

reliable than theoretically desired, and future research should seek to

improve the method for these populations.

n

−ð ∑ bi πi e

i=1

c=

6. Conclusion

CO

R

486

487

C

C

C

A

whose elements are all positive values. And the negative inverse 516

517

Hessian matrix is

518

n

485

1

i=1

i=1

484

n

∑ bi πi e

OO

F

461

462

Neter and Loebbecke (1975). This population consists of 4033

accounts receivables of a large manufacturer. Neter and Loebbecke

(1975) have made major contributions in analyzing the error

characteristics of accounting populations, and their populations are

often used to represent accounting populations (Chan, 1988;

Smieliauskas, 1986a; Frost & Tamura, 1982). From Column 2, the ZIP

bound is reliable as its 95% upper bound exceeds the true error value

98.4% of the times. From Columns 5 and 6, the frequency in which the

ZIP bound is larger than the other two bounds is very small (0.9% and

4.4%, respectively), denoting ZIP's greater efficiency. Columns 7–8

show the magnitude of the Stringer bound is about 34% larger and the

Multinomial-Dirichlet bound about 18% larger than the ZIP bound,

also denoting ZIP's greater efficiency.

Summing the simulation studies, results based on a general

population without distinct distributions reveal our ZIP method to

be very efficient, although with slightly lower reliability than the

theoretical level. However, based on populations similar to or taken

from accounting error populations, the ZIP bound is reliable and more

efficient than the Stringer and Multinomial-Dirichlet bounds. The ZIP

overall performance seems very good, in light of Swinamer et al.

(2004), who use extensive simulations on both real and simulated

data to compare 14 bounds, and find no single method to be superior

in terms of both reliability and efficiency. Given the trade-off between

reliability and efficiency in the state-of-the-art, our ZIP method is very

promising as an MUS estimation technique.

PR

459

460

7

β̃0

e Normalf β̃

1

ind

! a1

;

c

c

g

a2

where a1, a2, and c are the elements in the previous matrix H− 1. This

is a standard approximation and is typically used in generalized

regression model.

Next, we show how to construct the confidence interval.

We can see that ln λi = (β0 + r0i) + (β1 + r1i) πi also follows the

normal distribution and we can obtain its mean and variance easily,

528

529

530

531

532

533

534

2

ln λi iid

e Normalðβ̃0 + πi β̃1 ; 1 = a1 + πi = a2 + 2πi = cÞ:

As we discussed earlier, we know that di follows the Poisson

β0 + β1 πi

distribution di j λi ind

Þ. This is equivalent to di jλi ind

e Poissonðbi e

e

lnλi

Poissonðe bi Þ.

We can then draw Z1, Z2, …, ZN, N independent standard normal

random variables, and compute

lnðλi Þ = ðβ̃0 + πi β̃1 Þ + Zi

535

536

537

538

539

540

541

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

1 = a1 + π2i = a2 + 2πi = c

where i = 1, 2, …, N.

Thus, we can now draw di as a Poisson random variable with

parameter λ̃i, i = 1, 2, …, N. So these random draws of λ̃1, λ̃2, …, λ̃N are

given by

λ̃i = expfðβ̃0 + πi β̃1 Þ + Zi

542

543

544

545

546

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

1 = a1 + π2i = a2 + 2πi = cg

where i = 1, 2, …, N. We repeat this process 10,000 times and obtain 547

548

N

10,000 values of the overstatement error ∑ di.

i=1

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

549

ARTICLE IN PRESS

8

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

550

Appendix B

551

A Zero-Inflated Poisson (ZIP) regression model

Now the joint probability density function becomes

n

β

−b e 0

Lðθ; β0 ; β1 Þ = ∏ θ + ð1−θÞe i

+ β1 πi

D

556

557

559

558

561

560

562

563

564

565

566

567

+ β1 πi di −bi e

D

Þ e

di !

β0 + β1 πi

)

–

where D is the set of accounts with where di = 0; D is the set of

accounts with where di ≠ 0.

To apply the Expectation Maximization (EM) algorithm, we

introduce a new variable Zi, which is defined as

pðdi = 0jZi = 1Þ = 1

N

pðdi ≠0 jZi = 1Þ = 0:

∑di .

i=1

We can obtain the Hessian matrix of θ ̂, β̂0,1 to maximize the

likelihood function; it is more convenient to use the EM algorithm. By

EM algorithm, optimizing the joint probability density function above

is equivalent to optimizing the following quantity:

˜

where

β0 + β1 πi

+ β1 πi Þ−bi e

and the MLE of β0 and β1 can be obtained by Newton's method in

Appendix A.

Since θ only exists in the first two terms, we separate this product

into two parts, the first two factors and the last two factors. We

differentiate the log-likelihood function of g(θ, Z ), set it equal to zero

˜

and solve for θ. Thus we have

∑ Zi

n−∑ Zi

gðθ; Z Þ = θ D ð1−θÞ D

˜

D

∂

lnðgðθ; Z ÞÞ =

∂θ

˜

D

∑ Zi

D

θ

−

ðn−∑ Zi Þ

D

=0

1−θ

UN

Therefore,

CO

lnðgðθ; Z ÞÞ = ∑ Zi lnθ + ðn−∑ Zi Þ lnð1−θÞ

˜

θ = ∑ Zi = n

D

!

θ

β0 + β1 πi

θ + ð1−θÞe−bi e

Zi jðθ; β0 ; β1 Þ ind

e Bernoulli

582

581

i= 1; 2; …; n

ðB:1Þ

And the conditional expectation of Zi,

EfZi jθ; β0 ; β1 g =

θ

β 0 + β 1 πi

θ + ð1−θÞe−bi e

:

ðB:2Þ

584

583

585

586

587

n

i=1

N

∑

i=n + 1

di to 600

First iteration, we use θ = 0.5 as a random starting value. For β0, β1,

we use the MLE estimates of the regression coefficients as the starting

values, i.e., β̃0 = −5.71, β1̃ = − 0.22.

603

References

604

Akresh, A. D., & Tatum, K. W. (1988). Audit sampling — Dealing with the problems. The

saga of SAS No. 39 and how firms are handling its requirements. Journal of

Accountancy, 166(6), 58−64.

American Institute of Certified Public Accountants (AICPA). (1981). Statement on

Auditing Standards No. 39, Audit Sampling. New York: AICPA.

American Institute of Certified Public Accountants (AICPA). (2006). Statement on

Auditing Standarrds No. 111, Amendment to Statement on Auditing Standards No. 39,

Audit Sampling. New York: AICPA.

American Institute of Certified Public Accountants (AICPA). (2008). Audit Guide: Audit

Sampling. New York: AICPA.

Annulli, T. J., Mulrow, J., & Anziano, C. R. (2000). The Wisconsin audit sampling study.

Corporate Business Taxation Monthly (pp. 19−30).

Bickel, P. J. (1992). Inference and auditing: The Stringer bound. International Statistical

Review, 60(2), 197−209.

Burgstahler, D., & Jiambalvo, J. (1986). Sample error characteristics and projection of

error to audit populations. Accounting Review, 61(2), 233−248.

Chan, K. H. (1988). Estimating accounting errors in audit sampling: Extensions and

empirical tests of a decomposition approach. Journal of Accounting, Auditing &

Finance, 11(2), 153−161.

Dworin, L., & Grimlund, R. A. (1986). Dollar-unit sampling: A comparison of the quasiBayesian and moment bounds. Accounting Review, 61(1), 36−58.

Elder, R. J., & Allen, R. D. (1998). An empirical investigation of the auditor's decision to

project errors. Auditing: A Journal of Practice & Theory, 17(2), 71−87.

Felix, W. L., Jr., Leslie, D. A., & Neter, J. (1981). University of Georgia Center for Audit

Research Monetary-Unit Sampling Conference, March 24, 1981. Auditing: A Journal

of Practice & Theory, 1(2), 92−103.

Frost, P., & Tamura, H. (1982). Jacknifed ratio estimation in statistical auditing. Journal of

Accounting Research, 20(1), 103−120.

Gafford, W. W., & Carmichael, D. R. (1984). Materiality, audit risk and sampling: A nutsand-bolts approach (part two). Journal of Accountancy, 158(4–5), 109−118.

Gelman, A., Carlin, J. B., Stern, H. S., & Rubin, D. B. (2004). Bayesian data analysis, 2nd

edition, New York: Chapman & Hall.

Grimlund, R. A., & Felix, D. W., Jr. (1987). Simulation evidence and analysis of alternative

methods of evaluating dollar-unit samples. Accounting Review, 62(3), 455−480.

Guy, D. M., & Carmichael, D. R. (1986). Audit sampling: An introduction to statistical

sampling in auditing, 2nd edition, New York: John Wiley & Sons Inc.

Hall, T. W., Hunton, J. E., & Pierce, B. J. (2000). The use of and selection biases associated with

nonstatistical sampling in auditing. Behavioral Research in Accounting, 12, 231−255.

Hall, T. W., Hunton, J. E., & Pierce, B. J. (2002). Sampling practices of auditors in public

accounting, industry, and government. Accounting Horizons, 16(2), 125−136.

Hansen, S. C. (1993). Strategic sampling, physical units sampling, and dollar units

sampling. Accounting Review, 68(2), 323−345.

Hitzig, N. (1995). Audit sampling: A survey of current practice. CPA Journal, 65(7), 54−58.

Kaplan, R. S. (1973). Statistical sampling in auditing with auxiliary information

estimators. Journal of Accounting Research, 11(2), 238−258.

Kaplan, R. S. (1975). Sample size computations for dollar-unit sampling. Journal of

Accounting Research, 13(3), 126−133.

Lambert, D. (1992). Zero-inflated Poisson regression, with an application to defects in

manufacturing. Technometrics, 34(1), 1−14.

Leitch, R. A., Neter, J., Plante, R., & Sinha, P. (1982). Modified multinomial bounds for

larger number of errors in audits. Accounting Review, 57(2), 384−400.

Lohr, S. L. (1999). Sampling: Design and analysis. New York: Duxbury Press.

Menzefricke, U. (1984). Using decision theory for planning audit sample size with dollar

unit sampling. Journal of Accounting Research, 22(2), 570−587.

605

606

607

608

609

610

611

612

613

614

615

616

617

618

619

620

621

622

623

624

625

626

627

628

629

630

631

632

633

634

635

636

637

638

639

640

641

642

643

644

645

646

647

648

649

650

651

652

653

654

655

656

657

658

RR

EC

˜

N

i=1

TE

β0 + β1 πi ∑½d ðβ

−∑ð1−Zi Þbi e

i

0

D

eD

hðβ0 ; β1 ; Z Þ = e

580

579

595

596

obtain D for the predicted or the projected estimator. We repeat this 601

process 10,000 times and obtain 10,000 values of the overstatement error 602

˜

578

80 1

9

1

>

>

θ + r2i

< β̃0

=

ind

−1

C

@ β0 + r0i A e Normal B

:

@ β̃1 A; −H

>

>

:

;

β1 + r1i

θ̃

di from Poisson(biλi). Then we calculate ∑ di and ∑ di +

571

570

576

577

594

Thus, we have

∑ Zi

n−∑ Zi

gðθ; Z Þ = θ D ð1−θÞ D

574

575

592

593

Zi = 1; if di is pure zero;

Zi = 0; else

˜

573

572

590

591

We draw a random sample of (β0 +r0i, β1 +r1i, θ+r2i) from the 597

normal density i=1,2,⋯, N. Then we construct λi as λi =eβ0 + r01 + (β1 +r1i)πi 598

and we have Zi ~Bernoulli (θ+r2i). Now, if Zi =1, di =0; if Zi =0, we draw 599

gðθ; Z Þhðβ0 ; β1 ; Z Þ

569

568

588

589

0

DP

553

554

555

(

o

ðb eβ0

∏ ð1−θÞ i

RO

OF

552

After we get all the E{Zi|θ,β0,β1} for the sample using Eq. (B.2), we

can optimize h(β0, β1, Zi) and calculate a new θ following Eq. (B.1).

Then we can start our second iteration. The MLE of β0, β1 and the new

θ obtained will be used to calculate new Zis. After that, we optimize

h(β0, β1, Zi) and calculate a new θ again. These values will be used

in the third iteration. We repeat this process until θ, β0, β1 all converge.

Letting H be the Hessian matrix, too cumbersome to present, we take

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

ARTICLE IN PRESS

H.N. Higgins, B. Nandram / Advances in Accounting, incorporating Advances in International Accounting xxx (2009) xxx–xxx

659

660

661

662

663

664

665

666

667

668

669

670

671

672

673

Messier, W. S., Jr., Kachelmeier, S. J., & Jensen, K. L. (2001). An experimental assessment

of recent professional development in nonstatistical audit sampling guidance.

Auditing: A Journal of Practice & Theory, 20(1), 81−96.

Nandram, B., Sedransk, J., & Pickle, L. (2000). Bayesian analysis and mapping of

mortality rates for chronic obstructive pulmonary disease. Journal of the American

Statistical Association, 95(452), 1110−1118.

Nelson, M. K. (1995). Strategies of auditors: Evaluation of sample results. Auditing:

A Journal of Practice & Theory, 14(1), 34−49.

Neter, J., & Loebbecke, J. K. (1975). Behavior of major statistical estimators in sampling

accounting populations — An empirical study. New York: AICPA.

Neter, J., Leitch, R. A., & Fienberg, S. E. (1978). Dollar unit sampling: Multinomial bounds for

total overstatement and understatement errors. Accounting Review, 53(1), 77−94.

Reneau, J. H. (1978). CAV bounds in dollar unit sampling: Some simulation results.

Accounting Review, 53(3), 669−680.

Schwartz, D. A. (1997). Audit sampling — A practical approach. CPA Journal, 67(2), 56−60.

9

Silverman, B. W. (1986). Density estimation for statistics and data analysis. New York:

Chapman and Hall.

Smieliauskas, W. (1986). A simulation analysis of the power characteristics of some

popular estimators under different risk and materiality levels. Journal of Accounting

Research, 24(1), 217−230.

Smieliauskas, W. (1986). Control of sampling risks in auditing. Contemporary Accounting

Research, 3(1), 102−124.

Stringer, K. W. (1963). Practical aspects of statistical sampling in auditing. Proceedings of the

Business and Economic Statistics Section, American Statistical Association (pp. 404−411).

Swinamer, K., Lesperance, M. L., & Will, H. (2004). Optimal bounds used in dollar unit

sampling: A comparison of reliability and efficiency. Communications in Statistics —

Simulation and Computation, 33(1), 109−143.

Tsui, K. W., Matsumura, E. M., & Tsui, K. L. (1985). Multinomial-Dirichlet bounds for

dollar-unit sampling in auditing. Accounting Review, 60(1), 76−97.

Yancey, W. (2002). Statistical sampling in sales and use tax audits. Chicago: CCH Incorporated.

UN

CO

R

RE

CT

ED

PR

OO

F

689

Please cite this article as: Higgins, H. N., & Nandram, B., Monetary unit sampling: Improving estimation of the total audit error, Advances in

Accounting, incorporating Advances in International Accounting (2009), doi:10.1016/j.adiac.2009.06.001

674

675

676

677

678

679

680

681

682

683

684

685

686

687

688