Accounting for Municipal Solid Waste Landfill Closure and Postclosure Care Costs ABSTRACT

advertisement

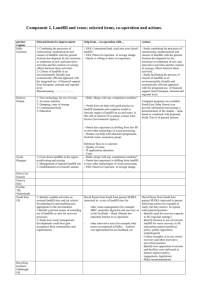

Accounting for Municipal Solid Waste Landfill Closure and Postclosure Care Costs ABSTRACT METHODOLOGY AND PROCEDURAL RESULTS In 1993, The Government Accounting Standards Board (GASB) enacted Statement No. 18,"Accounting for Municipal Solid Waste Landfill Closure and Postclosure Care Costs," which requires that municipal solid waste landfills (MSWLF) recognize closure and post closure costs as expenses and liabilities during the period that the landfill is in operation. All closure and postclosure costs should be recognized by the time the landfill is closed. However, evidence indicates that there is a disparity in the way the Statement is addressed in that disclosure of landfill costs varies from no disclosure, to footnote disclosure to liability recognition. The objective of this research is to assess why some municipalities (counties) adopt better disclosures than others. A key component of this study will be to assess the role that specific social, economic, demographic, and political attributes play in the disclosure decision. As such, the study will speak to both economic and social sustainability, two issues that are of key interest to local and community stakeholders. The first step in addressing the research question was to identify the relevant range of municipalities of interest to the study. The top 1000 municipalities by population was deemed to be the optimal sample for a widely applicable analysis of closure and postclosure accounting procedures. The primary source of data regarding these subjects is the municipality’s Comprehensive Annual Financial Reports (CAFR). The CAFR’s were collected via the respective county websites, if available. If unavailable online, steps were taken to alternatively contact these counties to collect the documents. In some cases it was not possible to collect all of the relevant information; these counties were eliminated from the scope of the study, as incomplete data would taint any meaningful analysis. These CAFR’s are then reviewed for completeness and mined for data. In order to use any data collected it was first necessary to design a comprehensive database that accounts for all information relevant to municipality accounting practices. This database is intended for use beyond the scope of the landfill research question and is intended to be applicable to future research into the expansive subject of municipality accounting practices and strategies. Data mined from the CAFR’s was input into the newly designed database and once again, in the context of all variables included in the database, vetted for completeness and accuracy; any materially incomplete study participants and participants that did not have a landfill were ultimately eliminated from the study. The remaining study participants were then assessed to determine whether they follow proper procedure according to GASB Statement No. 18 with relation to the closure and postclosure costs during the operation of the landfill. Analysis of the data to ascertain municipality motivation for their actual accounting procedures has not yet ensued. RESEARCH QUESTION We seek to find whether the top 1000 counties in the U.S. are adhering to Statement No.18, and if not, what are the factors motivating either the partial or total deviation from proper accounting procedures.