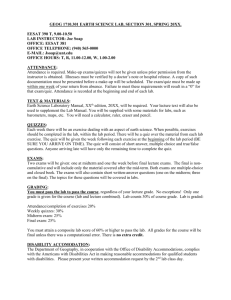

Introduction to Financial Accounting Accounting 201 3 Credit Hours

advertisement

Introduction to Financial Accounting Accounting 201 3 Credit Hours Fall 2006 Instructor: Phone: Fax: E-mail: Office: Office Hours: Class Meets: Melanie Nelson, MBA (760) 723-1806 (home) 750-4264 (support staff) (760) 723-2720 melaniemba@adelphia.net, mnelson@csusm.edu MARK 436 Tues/Thurs: 9:15 – 10:15 am AND 2:30 – 3:30 pm And by Appointment You are required to make one office hours visit before the first exam or else take a ten point deduction on the exam! Tues/Thurs 1:00 – 2:15 pm MARK 211 Required Materials: Kimmel, Weygandt & Kieso, Financial Accounting: Tools for Decision Making 4e Working papers will be provided for in-class problems. Students may download lecture notes, working papers and homework templates from WebCT: http://courses.csusm.edu Additional study materials are available at the textbook website: http://bcs.wiley.com/he-bcs/Books?action=index&itemId=0471730513&bcsId=2830 Course Objectives: This course is designed to introduce students to accounting as the “language of business” by giving an overview of the different types, sources and uses of accounting information. The course will take a user approach, recognizing that most students will be users of accounting information rather than preparers or reporters. After taking this course, students should be able to read, understand, and analyze financial statements. The following learning objectives are designed to help students achieve this goal: Understand and apply the basic Generally Accepted Accounting Principles (GAAP) by which financial statements are prepared Describe how various transactions affect the four basic financial statements Record basic transactions in general journal format Complete the accounting cycle beginning with entering transactions in the general journal through the preparation of financial statements and the closing entries. Understand and apply principles of internal control Analyze financial statements using ratio analysis, horizontal analysis, and vertical analysis Class Structure: Quiz: There will be a quiz on each chapter, given at the beginning of class on the dates indicated. Quizzes will be problem-oriented. All quizzes are open-book, open-notes. This is your opportunity to practice what you have learned in a medium-pressure situation. No makeup quizzes will be given, so please don’t ask. The two lowest quiz scores will be dropped. Credit will be awarded for correct responses only. In order to make the most effective use of class time, quizzes will be timed. Make the best use of your time by focusing first on the problem you understand best. Lecture: Students should read the assigned material before coming to class. This will give them the necessary background for the class lecture. Class lectures will focus on those areas deemed most important by the instructor. Discussion: A large block of time will be devoted to working through the homework problems and answering students’ questions. Homework: Problems and Exercises give the student the opportunity to develop and practice accounting skills. These will be collected and graded for completeness and effort. Late homework will receive a reduced grade. Homework may be submitted as a hard copy or electronically. Problems and Exercises will comprise approximately 75% of the homework grade. To encourage students to stay current and not leave homework until the last minute, there will be a weekly online homework assignment consisting of ten multiple choice questions due by noon each Monday. These assignments will be graded on a credit/no credit basis. In order to receive credit the assignment must be submitted by noon Monday, and at least five of the ten questions must be answered correctly. Late online assignments will not be accepted. The assignment will be available by 12:05 pm each Thursday and unavailable after noon each Monday. This assignment will also help prepare students for the multiple choice portion of the exams. Online assignments will comprise approximately 25% of the total homework grade. Exams: There will three equally weighted exams: two midterms and a final. The exams will be comprehensive to the extent that the material in the later portions of the course builds on the material at the beginning. Each exam, however, will focus on the material covered since the previous exam. Exams will consist of 16 multiple choice questions (40%) and 6 to 10 problems (60%). You may use a calculator and one 8½” x 11” sheet of notes (front and back) during the exam. Book bags, backpacks, purses, notebooks, etc. will be placed against the front wall of the classroom during the exam. Writing Requirement: The University writing requirement will be met through homework questions and through the on-line submission of ten one-page memos analyzing the Annual Financial Report of a corporation of your choosing. Publicly traded corporations are required by law to make an Annual Report available to stockholders, and most corporations post their annual reports on the internet. Choose a company that will interest you personally and/or have some value in your future or current career. Each memo is worth ten points. The memos should include a heading (To, From, Subject) and should be addressed to a prospective investor in the company you have chosen. The written assignments should integrate accounting theory and methodology, ethical issues and critical thinking. Students are expected to use proper grammar and a professional writing style. Be concise! Pretend you are writing to a busy executive who wants “just the facts”. Bulleted lists are useful for conveying a large amount of information in a few words. Late projects will be accepted at any time before the date of the final exam, but the highest grade possible for a late assignment is seven out of ten points. Grading: The course grade will be weighted as follows: Quizzes (10 @ 10 points each) Homework Memos (10 @ 10 points each) Exams 3 @ 100 pts. each 100 100 100 300 Total 600 Grades will be assigned based on the normal curve, as illustrated below. Homework quality and class participation will be the deciding factor in borderline cases. In the event that a student’s point value grade is higher than the curved grade, the student will be assigned the point value grade. Mean One Standard Deviation Below Mean C’s B’s One Standard Deviation Above Mean D’s and F’s -1 A’s 0 1 Points Grade 540 - 600 480 - 539 420 - 479 360 - 419 0 - 359 A B C D F Academic Integrity: In order to fairly evaluate each student’s performance in this class, it is imperative that all work submitted be your own. Therefore the following will be strictly enforced: 1) 2) 3) 4) There will be no talking allowed during individual quizzes or exams. If you finish your quiz early, please sit quietly (bring reading material if necessary.) Any suspicious quizzes or exams will be assigned a grade of zero. BEWARE: Either giving or receiving help during quizzes and exams is dishonest. In other words, if you allow someone to copy your work, you are just as guilty of cheating as the other party. If you have studied hard for an exam or quiz, don’t risk it! Cover your work. Plagiarism will not be tolerated. All direct quotes must be noted as such. Any ideas, claims or opinions that are not your own must also be cited. For example, to state that “AAA Inc. leads the way in the widget industry,” would require either citing the data that led you to form that opinion, or the source document that made the claim. Serious violations of the University’s policy on academic integrity will be referred to Academic Affairs for disciplinary action. Exceptions: Since homework is only graded for completeness, I do allow students to work together. However, each student must submit his or her own work to receive credit. Please let me know if you have a study partner or group. Assigned Reading Quiz Exercises and Problems Due -1 --- 2 1 --BE 1-3, 1-6, 1-8, 1-9; E1-14; P13A; BYP1-1, 1-2 BE2-4; E2-7, P2-6A; BYP2-1, 2-2 3 2 Date 24-Aug 29-Aug Day R T Lecture Topic Course Introduction Introduction to Financial Statements 31-Aug R A Further Look at Financial Statements 5-Sep T A Further Look at Financial Statements (cont'd) 7-Sep R The Accounting Information System 12-Sep T The Accounting Information System (cont"d) 14-Sep R Accrual Accounting Concepts *Online Memo #1 due* 19-Sep T Demonstration Problem 21-Sep R Merchandising Operations and the Multiple-Step Income Statement *Online Memo #2 due* 26-Sep T Review for Midterm I 28-Sep R Midterm I 3-Oct T Reporting and Analyzing Inventory 5-Oct R Reporting and Analyzing Inventory (cont'd) *Online Memo #3 due* 10-Oct T Internal Control and Cash 7 6 12-Oct R Financial Statement Analysis *Online Memo #4 due* 13 7 17-Oct T Financial Statement Analysis (cont'd) 19-Oct R Reporting and Analyzing Receivables *Online Memo #5 due* 8 13 24-Oct T Reporting and Analyzing Receivables (cont'd) 26-Oct R Review for Midterm II *Online Memo #6 due* 31-Oct T Midterm II 2-Nov R Reporting and Analyzing Long-Lived Assets 7-Nov T Reporting and Analyzing Long-Lived Assets (cont'd) 9-Nov R Reporting and Analyzing Liabilities *Online Memo #7 due* 14-Nov T Reporting and Analyzing Liabilities (cont'd) 16-Nov R Reporting and Analyzing Stockholders' Equity *Online Memo #8 due* 21-Nov T Reporting and Analyzing Stockholders' Equity (cont'd) 23-Nov R 28-Nov T The Statement of Cash Flows *Online Memo #9 due* 30-Nov R The Statement of Cash Flows (cont'd) *Online Memo #10 due* 5-Dec T Review for Final Exam BE3-2, 3-4; E3-10; P3-1A, 3-5A; BYP3-2 4 3 BE4-4, 4-6, 4-7; E4-3, P4-4A; BYP 4-1, 4-2; 5 4 Handout 5 BE5-1, 5-3, 5-4, 5-10; E5-2, 5-7, 5-8, 5-11; P5-3A; BYP5-2 -- 6 -BE6-1, 6-2, 6-3, 6-6; E6-2, 6-7; BYP6-2; Perpetual Inventory Handout -BE7-11; E7-3, 7-8, 7-15; BYP7-1 BE 13-2, 13-3, 13-4; E13-3, 134; P13-1A, 13-2A; BYP 13-2 -E8-4, 8-5 P8-1A, 8-6A; BYP8-2 8 -- --- 9 BE 9-2; E9-5, 9-15; P9-3A, 9-4A; BYP9-1, 9-2; 10 9 BE10-6, 10-12, 10-13; E10-3, 10-5; P10-10A; BYP10-2 11 10 -BE 11-2, 11-4, 11-5; E11-4, 11-7; P11-7A; BYP 11-1; Thanksgiving Holiday - No Class Meeting 12 11 -BE12-2, 12-3, 12-6, 12-13, 12-15; E12-7; P12-7A, 12-8A; BYP12-1 12 -- Final Exam - Tuesday, Dec. 12th - 11:30 -1:30