SYLLABUS PRINCIPLES OF ACCOUNTING I EVANGEL UNIVERSITY Jerry Owens

advertisement

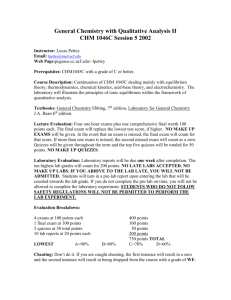

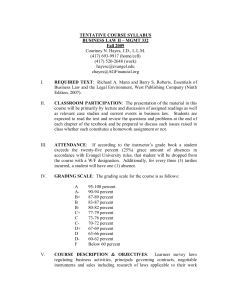

SYLLABUS PRINCIPLES OF ACCOUNTING I EVANGEL UNIVERSITY Jerry Owens 865-2815, (Leave message) owensj@evangel.edu I. COURSE DESCRIPTION: An introduction to the fundamentals of bookkeeping and accounting, including: transaction analysis and record keeping, general ledger accounts, books of original entry, trial balance, adjusting and closing process, receivables and payables, deferrals and accruals, inventories, plant assets, accounting and payroll systems, computer applications and concepts. II. TEXTBOOK AND RELATED MATERIALS: PRINCIPLES OF ACCOUNTING, Needles/Powers/Crosson, Houghton Mifflin, 2005 Calculator and pencils. Each student will need their own calculator. The borrowing of calculators will not be allowed. Students will not be allowed to use laptop computers, programmable calculators or calculators that write text. Use of cell phones during lecture, quizzes or exams is not allowed. Note that this means that you cannot use a cell phone as your calculator. Use of a cell phone during a quiz or exam will result in a grade of zero. III. OBJECTIVES: Upon completion of the course, each student should be able to: 1. Define accounting and identify the users of accounting information. 2. Identify the three basic forms of business organizations. 3. State and use the accounting equation. 4. Identify and use the four basic financial statements. 5. Define and know the principles of GAAP. Know what FASB is. 6. Define ethics and describe the ethical responsibilities of accounts. 7. Define and use the rules for the double-entry system. 8. Record transactions in the general journal and post from the general journal to the ledger. 9. Prepare a trial balance, adjusting entries, worksheet, required closing entries, and a post-closing trial balance. 10. Prepare journal entries using the periodical and perpetual inventory systems. 11. Calculate sales, COGS, gross margin, and net income for a merchandising firm. 12. Journalize and post using special journals. 13. Know the accounting conventions, classified balance sheets and how to calculate financial ratios. 14. Know how to journalize petty cash transactions and reconcile a bank statement. 15. Know how to account for uncollectible accounts, interest on a note and transactions involving a discounted note. 16. Know how to calculate the value of ending inventory and COGS under LIFO, FIFO, and weighted average. 17. Identify, compute, and record definitely determinable liabilities and estimated liabilities. 18. Know how to calculate and journalize depreciation under the various methods. 19. Define and journalize intangible assets. 20. Calculate and journalize the sale of an asset at a gain and at a loss. IV. COURSE OUTLINE: Part One: The Basic Accounting Model includes four chapters covering the study of the accounting environment, the double-entry system, and business income and adjusting entries. Part Two: Extensions of the Basic Account Model includes four chapters covering merchandising operations, special purpose journal, internal controls, and classified financial statements and concepts. Part Three: Measuring and Reporting Assets and Current Liabilities includes five chapters covering short-term liquid assets, inventories, current liabilities and payroll accounting, long-term assets: acquisition and depreciation, and long-term assets disposal and accounting for natural resources and intangibles. V. EVALUATION: Attendance: Attendance is required in accordance with university policy. You are responsible for all material covered and any assignments made during the normal class period. There are no excused absences. Upon the tenth absence (seventh for a class that meets twice a week) the student will be dropped from class. Tardiness – Excessive tardiness will not be tolerated and will result in a student being counted as absent. Leaving early – Although it may occasionally be necessary for a student to leave early from class, abuse of this may result in a student losing all points earned during the class period. Exams: There will be three unit examinations and one comprehensive final exam. Each exam, worth 100 points, may consist of problems, multiple choice, true/false, journal entries, and terminology. There will be no make up of unit exams. Howver, a student can replace a unit exam score with the final score. The final exam is not optional and must be taken. You can not drop the final exam. Quizzes: There will be several 10-point quizzes covering material from homework or chapter assignments. Each student may drop two quiz scores. Quizzes cannot be made up or taken early. Note: All quizzes and exams remain the property of the professor. Homework: The assigned exercise and problems at the end of each chapter, worth 10 points. No late work will be accepted. If you come to class after the homework has been collected it is too late to turn in the assignment. Grades: Approximate points are assigned as follows: Final grades will be determined on the basis of exam, quiz and homework scores. Attendance will be used for borderline cases. Letter grades will be given according to the following scale: 92+ A 72-76 C 90-91 A– 70-71 C– 87-89 B+ 67-69 D+ 82-86 B 62-66 D 80-81 B– 60-61 D– 77-79 C+ Below 60 F Points Possible (approximate) 3 Unit Exams 300 Final Exam 100 Homework 100 Quizzes 60-100 TOTAL 560–600 ACCOUNTING I In-Class Exercises and Homework Problems Evangel University In-class Exercises Chapter 1 SE 4, 8, E 11, SE 10; E 7, P 8 Homework Chapter 1 Assignment #1: SE 2, 3; E 4, 8, 14; P 5 Chapter 2 E 1, 3; SE 5, 6, 7 P3 EXAM 1 (Chapters 1 & 2) Chapter 2 Assignment #2: Assignment #3: SE 1, 3, 4; E 5, 6 Complete P 4 (parts 1, 2, 3) Chapter 3 SE 2, 3, 4, 5, 6 Chapter 3 Assignment #4: In-class Problem Chapter 4 SE 2, 3, 4, 5, 6 EXAM 2 (Chapters 1-4) Chapter 4 Assignment #5: In-class Problem Chapter 5 E 8; SE 5, 6, 7, 9; E 16 Chapter 5 Assignment #6: Handouts Chapter 6 Handout EXAM 3 (Chapters 5&6) Chapter 6 Assignment #7: SE 2, 3, 5, 6; Handout Chapter 9 SE 6, 7, 8; E 15 Chapter 9 Assignment #8: E 6, 7, 11, 12, 13 Chapter 10 SE 3, 4, 5, 6; E 11, 13 Chapter 10 Assignment #9: E 3, 9 Chapter 11 SE 2, 3, 4, 5, 6, 7, 9, 10 Chapter 11 Assignment #10: E 3, 4, 6, 8 (parts 1, 2, 3), 11, 14 Chapter 12 FINAL EXAM (Chapters 9-11, 1&2) Chapter 12 Replacement Homework: SE 1, 3; E 7, 8; E 6, 11