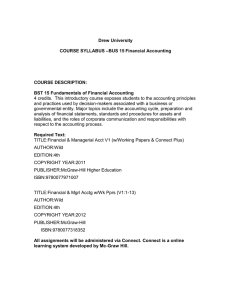

Drew University COURSE SYLLABUS –BUS 15 Financial Accounting COURSE DESCRIPTION:

Drew University

COURSE SYLLABUS –BUS 15 Financial Accounting

COURSE DESCRIPTION:

BUS 15 Fundamentals of Financial Accounting

4 credits. This introductory course exposes students to the accounting principles and practices used by decision-makers associated with a business or governmental entity. Major topics include the accounting cycle, preparation and analysis of financial statements, standards and procedures for assets and liabilities, and the roles of corporate communication and responsibilities with respect to the accounting process.

Required Text:

Financial and Managerial Accounting Vol. 1 (Ch. 1-13) softcover with Working

Papers + Best Buy Annual Report with Homework Manager Plus, by Wild,

Copyright 2009, Third Edition

COURSE OBJECTIVES:

By the end of the course the student will be able to:

•

Classify accounts as assets, liabilities, owner’s equities, revenues or expenses

•

Explain the Accounting Equation and the interaction of its elements

•

Apply GAAP to the analysis, recording and reporting of business transactions

•

Apply double-entry accounting to record business transactions

•

Define Accrual Accounting

•

Journalize and Post routine business transactions

•

Complete and balance a worksheet

•

Journalize and Post adjusting and closing entries

•

Prepare a complete set of basic financial statements

•

Prepare a post-closing trial balance, and any required reversing entries

•

Explain the advantages and disadvantages of periodic and perpetual inventory systems

•

Record transactions related to sales and purchases under the periodic and perpetual inventory systems

•

Calculate the pricing of inventory, using the cost basis under the periodic inventory system, using the (1) specific identification method; (2) average-

cost method; (3) first-in, first-out method; (4) and the last-in, first-out method

•

Define depreciation and compute using the (1) straight-line method; (2) the production method; and (3) declining-balance method

•

Record the issuance of Bonds

•

Record the amortization of bond discount or premium

•

Identify the forms of business ownership

•

State the principal purposes and uses of the statement of cash flows

•

Analyze Financial Statements

TOPICAL OUTLINE:

•

Chapter 1: Introduction to Accounting and Business

•

Chapter 2: Analyzing and Recording Transactions

•

Chapter 3: Adjusting Accounts and Preparing Financial Statements

•

Chapter 4: Accounting for Merchandising Operations

•

Chapter 5: Inventories and Cost of Sales

•

Chapter 6: Cash and Internal Control

•

Chapter 7: Accounts and Notes Receivables

•

Chapter 8: Long-Term Assets

•

Chapter 9: Current Liabilities

•

Chapter 10: Long-Term Liabilities

•

Chapter 11: Corporate Reporting and Analysis

•

Chapter 12: Reporting and Analyzing Cash Flows

•

Chapter 13: Analyzing Financial Statements

STATEMENT AND POLICY ON CHEATING, PLAGIARISM AND ACADEMIC

DISHONESTY:

Students are required to perform all the work specified by the faculty, and they are responsible for the content and integrity of all academic work submitted. A violation of academic integrity will occur if a student: (1) knowingly represents work of others as one’s own, (2) uses or obtains unauthorized assistance in any academic work, (3) gives fraudulent assistance to another student, or (4) furnishes false information or other misuse of college documents.

In cases of suspected violation of academic integrity, the incident is to be reported to the Office of the Dean of Students, and an investigation will be conducted as appropriate

Grading:

Online assignments 20%

Midterm Exams 20%

Final Exam 30%

Assignments :

Assignments will be online. The instructor will provide the URL on the first day of class.

LATE WORK POLICY:

Late assignments will not be accepted and will result in a grade of zero.

There will be no make-up exams. Missed exams will be graded as a zero.

This syllabus may be amended at the discretion of the instructor.