SOUTHERN UNIVERSITY BANGLADESH

advertisement

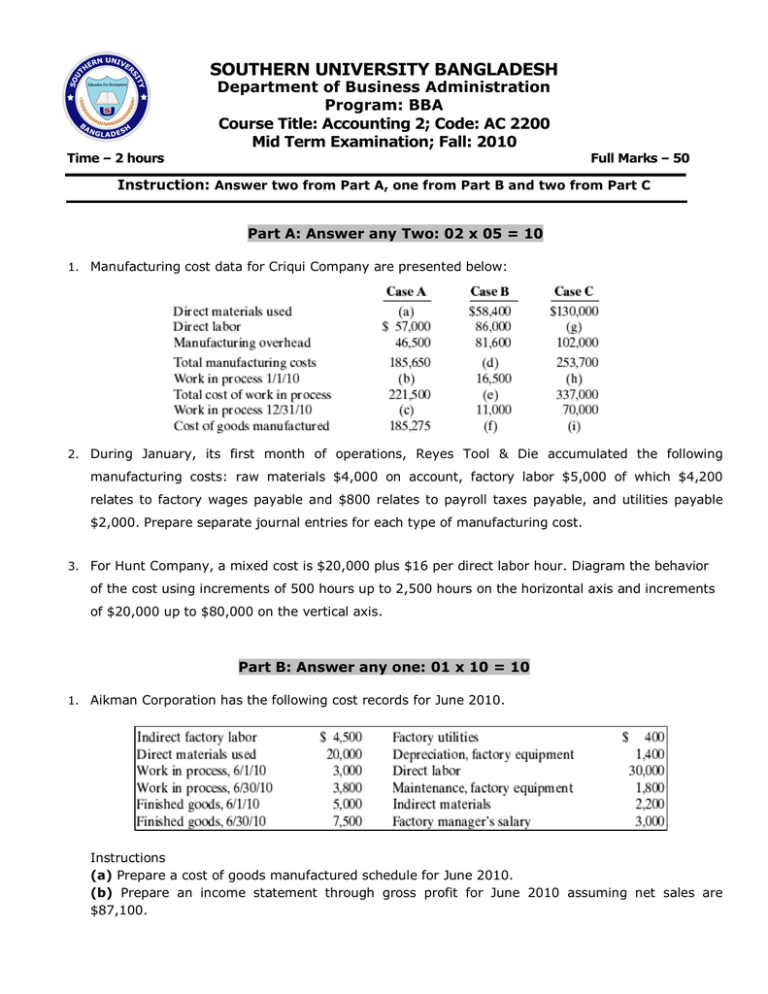

SOUTHERN UNIVERSITY BANGLADESH Department of Business Administration Program: BBA Course Title: Accounting 2; Code: AC 2200 Mid Term Examination; Fall: 2010 Time – 2 hours Full Marks – 50 Instruction: Answer two from Part A, one from Part B and two from Part C Part A: Answer any Two: 02 x 05 = 10 1. Manufacturing cost data for Criqui Company are presented below: 2. During January, its first month of operations, Reyes Tool & Die accumulated the following manufacturing costs: raw materials $4,000 on account, factory labor $5,000 of which $4,200 relates to factory wages payable and $800 relates to payroll taxes payable, and utilities payable $2,000. Prepare separate journal entries for each type of manufacturing cost. 3. For Hunt Company, a mixed cost is $20,000 plus $16 per direct labor hour. Diagram the behavior of the cost using increments of 500 hours up to 2,500 hours on the horizontal axis and increments of $20,000 up to $80,000 on the vertical axis. Part B: Answer any one: 01 x 10 = 10 1. Aikman Corporation has the following cost records for June 2010. Instructions (a) Prepare a cost of goods manufactured schedule for June 2010. (b) Prepare an income statement through gross profit for June 2010 assuming net sales are $87,100. 2. A job order cost sheet for Rolen Company is shown below. Instructions (a) On the basis of the foregoing data answer the following questions. (1) What was the balance in Work in Process Inventory on January 1 if this was the only unfinished job? (2) If manufacturing overhead is applied on the basis of direct labor cost, what overhead rate was used in each year? (b) Prepare summary entries at January 31 to record the current year’s transactions pertaining to Job No. 92. 3. NIU Company has the following information available for September 2010. Unit selling price of video game consoles $ 400 Unit variable costs $ 270 Total fixed costs $52,000 Units sold 620 Instructions (a) Prepare a CVP income statement that shows both total and per unit amounts. (b) Compute NIU’s breakeven point in units. (c) Prepare a CVP income statement for the breakeven point that shows both total and per Part C: Answer any two: 02 x 15 = 30 1. The following data were taken from the records of Dosey Manufacturing Company for the year ended December 31, 2010. Instructions (a) Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials.) (b) Prepare an income statement through gross profit. (c) Prepare the current assets section of the balance sheet at December 31. 2. For the year ended December 31, 2010, the job cost sheets of Moxie Company contained the following data. Other data: 1. Raw materials inventory totaled $20,000 on January 1. During the year, $100,000 of raw materials was purchased on account. 2. Finished goods on January 1 consisted of Job No. 7648 for $93,000 and Job No. 7649 for $62,000. 3. Job No. 7650 and Job No. 7651 were completed during the year. 4. Job Nos. 7648, 7649, and 7650 were sold on account for $490,000. 5. Manufacturing overhead incurred on account totaled $135,000. 6. Other manufacturing overhead consisted of indirect materials $12,000, indirect labor $18,000 and depreciation on factory machinery $19,500. Instructions (a) Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T account for Work in Process Inventory.) Calculate each of the following, then post each to the T account: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. (b) Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to cost of goods sold. (c) Determine the gross profit to be reported for 2010. 3. The McCune Barber Shop employs four barbers. One barber, who also serves as the manager, is paid a salary of $3,900 per month. The other barbers are paid $1,900 per month. In addition, each barber is paid a commission of $2 per haircut. Other monthly costs are: store rent $700 plus 60 cents per haircut, depreciation on equipment $500, barber supplies 40 cents per haircut, utilities $300, and advertising $100.The price of a haircut is $10. Instructions (a) Determine the variable cost per haircut and the total monthly fixed costs. (b) Compute the break-even point in units and dollars. (c) Prepare a CVP graph, assuming a maximum of 1,800 haircuts in a month. Use increments of 300 haircuts on the horizontal axis and $3,000 increments on the vertical axis. (d) Determine the net income, assuming 1,700 haircuts are given in a month. Bonus Question (Any One) “Bonus question is optional. Answering it will add additional 5 Marks” Or