ACCOUNTING 220 Earl J. Weiss Professor of Accounting INTRODUCTION TO FINANCIAL ACCOUNTING

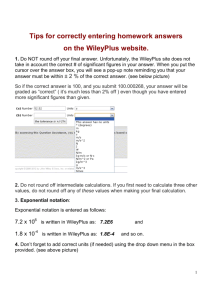

advertisement

ACCOUNTING 220 INTRODUCTION TO FINANCIAL ACCOUNTING FALL 2010 Earl J. Weiss Professor of Accounting OFFICE JH4211 E-MAIL earl.weiss@csun.edu PHONE (818) 677-2426 DEPT. WEBSITE http://www.csun.edu/acct CLASS WEBSITE http://www.csun.edu/acct350 OFFICE HOURS MW 5:00-6:30 REQUIRED Kimmel, Weygandt, and Kieso, Financial Accounting:Tools for Business Decision Making, Fifth Edition, Wiley, 2009. COURSE OBJECTIVES This course is an introduction to the role of accounting in business and society, a summary of the accounting process, accounting measurement issues, analyzing and recording financial transactions, accounting valuation and allocation issues, conceptual foundation for understanding financial reporting, the usefulness of financial statements for decisionmaking, and financial statement analysis and interpretation. The BEST way to perform satisfactorily in this class is to: 1. Read the required chapter BEFORE the related class meeting. 2. Ask questions. 3. Do ALL the assigned work. There is a lot of it. If you find that you don’t have the time, you probably shouldn’t be taking this class. 4. Periodically review past chapters and homework assignments. 5. Spend a minimum of THREE HOURS of independent study for each hour spent in class. That’s NINE hours a week. GRADING The final letter grade will be based on following allocation and curve using plus/minus grading: Midterm Exams (3) Final Exam Assignments Total points A 88% A- 85% B+ 81% B 78% B- 75% C+ 71% C 68% C- 65% 300 140 60 500 D+ 61% D 58% D- 55% F Below 55% A permanent seating chart will be created at the third class meeting. WILEYPLUS WileyPLUS is an online learning aid. Selected assignments listed in bold on pages 3 and 4 of this syllabus must be completed using WileyPLUS. The registration code to access WileyPLUS comes with your textbook if it was purchased new at the CSUN bookstore. As an alternative, you may purchase the online version of the textbook and WileyPLUS at www.wileyplus.com/buy. To register your WileyPLUS, go to http://edugen.wiley.com/edugen/class/cls187113. RULES OF CLASS DECORUM You should come to class prepared. Missing class, arriving late to class (after the class lecture begins), and talking to your neighbor during the class lecture will result in the loss of points. Cell phones must be turned off while in class. Failure to do so will result in the loss of points. TUTORING Tutoring is available from Beta Alpha Psi as follows: Monday & Tuesday: 1 p.m.-3 p.m. @ Tax Library (JH2214) Wednesday: 3:30 p.m.-5:30 p.m. @ Tax Library (JH2214) Thursday: 3:30 p.m.-5:30 p.m. (Location to be announced in the second week) Tutoring is available from the Business Honors Association (BHA) as follows: Make an appointment with a tutor one week in advance using the following link: http://www.csun.edu/~bha/tutoring.html. The BHA tutoring hours are 8 a.m.-6 p.m., Monday-Thursday @ Room JH1214. POLICY ON MISSED EXAMS No make-up exams are given. If you miss a midterm exam due to unavoidable circumstances, your other exams will be weighted, provided: The reasons for missing the exam are acceptable to me. I was notified prior to the date of the exam. If I was not notified prior to the exam date, written documentation must be submitted to clearly establish that the circumstances were unavoidable and could not have been anticipated. If you miss the final exam due to unavoidable circumstances that could not have been anticipated (see the requirements above), you may request the assignment of an incomplete within 24 hours after the exam by completing a Request for a Grade of Incomplete form available at www.csun.edu/anr/forms/request_incomplete.pdf. If you miss more than one exam, a grade of zero will be assigned to all missed exams regardless of the reasons. WITHDRAWAL FROM CLASS The last day to withdraw from this course without any approval is Friday, September 10 (end of the third week). To withdraw during the fourth week of instruction, students must have a serious and compelling reason that is approved by the instructor and department chair of the course. Requests for withdrawal after the fourth week are rarely approved and only in cases where the student can provide written proof of extraordinary circumstances that have arisen from events beyond his or her control. Furthermore, there must be no viable alternative to the requested withdrawal, such as repeating the course in the following term. The following situations ARE NOT considered extraordinary circumstances and WILL NOT be approved to justify a withdrawal after the end of the fourth week of instruction: 1. 2. 3. 4. 5. 6. failing the class or receiving less-than-desired grade; waiting for the instructor to give a permission number; failing to take action to add or drop a class, assuming incorrectly that the instructor will do it for the student; failing to make payment of registration and/or waiting for financial aid; the need to work because of financial considerations or opportunities; encountering a situation that should have been anticipated, such as the need to have transportation, the need to pay for ordinary living expenses, the need for child care; 7. aspirations of either the student or his/her family in regard to GPA, the dean's list, graduate school, scholarships, etc.; 8. dissatisfaction with course material, instructor, instructional method, or class intensity; 9. lack of motivation, change in academic interests, or change of major; 10. participation in extracurricular activities; or 11. academic overload and inability to keep up in all classes. The following situations are typically the only ones that would meet the standard of extraordinary circumstances for which there is no viable alternative and would justify a withdrawal after the fourth week of instruction: 1. 2. 3. medical documentation that the academic schedule is detrimental to the student's physical or mental health activation for compulsory military duty relocation out of the immediate area POLICY ON ACADEMIC DISHONESTY Academic dishonesty, which includes cheating, fabrication, facilitation of academic dishonesty, and plagiarism, is a serious academic offense. Please carefully review the current schedule of classes regarding definitions and penalties. A grade of "F" shall be assigned to any student who engages in academic dishonesty in this class, and formal disciplinary action shall be taken. 2 Schedule Legend Q = question BE = brief exercise E = exercise P = problem BOLD = complete with WileyPLUS Chapter Topic Assignments 8/23 1 8/25 1 Course Overview. Introduction to Financial Statements Introduction to Financial Statements 8/30 2 A Further Look at Financial Statements 9/1 2 A Further Look at Financial Statements 9/6 3 The Accounting Information Systems – Chapter 1: Q2,6,8,12,13,14,15,18,19,20 BE 1-6,1-8 E1-1,1-9,1-10,1-14 P1-3A,1-5A Chapter 2: Q1,2,4,5,12,13,18,20 BE2-1,2-2,2-5,2-7,2-9 E2-8,2-12,2-13 P2-3A,2-7A Labor Day – No Class 9/8 3 The Accounting Information Systems Chapter 3: Q1,6,7,9,11,15,16,17,19 E3-1,3-2,3-11,3-12 9/13 3 The Accounting Information Systems P3-4A,3-8A 9/15 4 Accrual Accounting Concepts Chapter 4: Q6,9,10,18,20,26,29 9/20 4 Accrual Accounting Concepts 9/22 5 9/27 5 Merchandising Operations and the Multiple-Step Income Statement Merchandising Operations and the Multiple-Step Income Statement E4-2,4-3,4-5,4-10,4-12 P4-2A,4-6A,4-8A Chapter 5: Q1,11,12,16,18,22,26 9/29 E5-6,5-7,5-10,5-11 Exam I: Chapters 1-4 10/4 5 10/6 6 Merchandising Operations and the Multiple-Step Income Statement Reporting and Analyzing Inventory P5-3A,5-4A,5-9A Chapter 6: Q2,4,13,20,21,24,25 (skip pp. 292-294) 10/11 6 Reporting and Analyzing Inventory E6-5,6-9 (skip pp. 292-294) 10/13 6 Reporting and Analyzing Inventory P6-1A,6-3A,6-8A 10/18 7 Fraud, Internal Control, and Cash Chapter 7: Q3,6,23,24,25,28 10/20 7 Fraud, Internal Control, and Cash E7-4,7-8,7-15 P7-3A,7-4A 10/25 8 Reporting and Analyzing Receivables Chapter 8: Q1,3,5,7,11,14,16 3 10/27 8 11/1 Reporting and Analyzing Receivables E8-4,8-5,8-7,8-16 P8-1A,8-3A,8-4A Exam II: Chapters 5-7 11/3 9 Reporting and Analyzing Long-Lived Assets and appendix Chapter 9: Q2,3,6,9,10,11,12,20,21 11/8 9 Reporting and Analyzing Long-Lived Assets and appendix E9-1,9-3,9-5,9-7,9-14 11/10 9 Reporting and Analyzing Long-Lived Assets and appendix P9-1A,9-3A,9-5A 11/15 10 Reporting and Analyzing Liabilities & Appendix 10A Chapter 10: Q3,4,5,6,25 BE10-3,10-4 10 Reporting and Analyzing Liabilities & Appendix 10A E10-3,10-4,10-15,10-19 P10-1A Time Value of Money Skip bottom C-2 to C-6 and mid C-11 to C-13 Appendix C: BE C-7,C-8,C-9,C-11,C-19 11/17 11/22 Appendix C 11/24 Exam III: Chapters 8-10 11/29 11 Reporting and Analyzing Stockholders’ Equity Chapter 11: Q1,4,8,9,10,11,12,16 12/1 11 Reporting and Analyzing Stockholders’ Equity E11-2,11-4,11-5,11-6,11-7 P11-1A,11-6A 12/6 12 Statement of Cash Flows (skip appendix) Chapter 12: Q2,3,6,12,15,16 12/8 12 Statement of Cash Flows (skip appendix) E12-2,12-4,12-8 P12-7A,12-9A,12-11A 12/13 Final Exam: Chapters 3-12 and Appendix C Time: 3:00 p.m. 4