Financing the Venture: Debt v. Equity Debt

advertisement

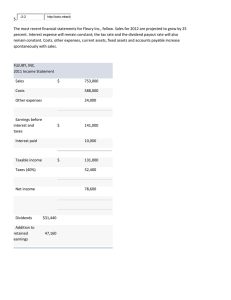

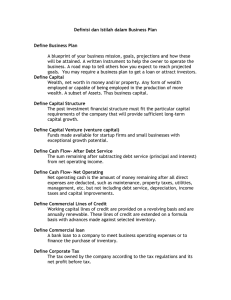

Financing the Venture: Debt v. Equity Debt Debt is borrowed money. It represents an agreement for repayment under a schedule and interest rate. Advantage: • Debt is usually less expensive than equity • Maintain ownership of the business Disadvantage: • Debt often requires collateral and the regular payments require discipline • Often requires personal guarantee of principals Equity Equity represents an ownership stake in the business. Advantage: • No regular schedule of repayment; the investors have no legal claim to the dividends so it is less risky • Investors will finance more risky ventures • Can raise larger amounts of money Disadvantage: • Equity is usually more expensive • Part of the control and ownership is surrendered If the business is successful in the long run, you have reduced the returns you would have received Sources of financing: • Founders the founders of the business - o Personal funds/Investments 1 • o Credit cards o Home equity o Unsecured loan Individuals - family, friends etc. o Loans o Equity investments • Banks - personal loan with guarantees and collateral • Government Programs o • Micro-loan Programs o • • Targeted towards groups and make riskier loans than banks Commercial Finance Companies o Give loans for equipment, inventory, and accounts receivables o • Help overcome objections a banker may have with request Usually rates are 2% - 6% higher than banks Angels - wealthy individuals that are interested in the high risk/return opportunities o Unsecured loans o Equity investment Venture Capital - outside equity from professionally managed pools of investor money usually over $750,000 in investment and very hard to secure • Preferred stock • Convertible debenture • Stock with warrants 2 - Financing Strategy: • Get the big picture before you start • Identify and evaluate the possible sources • Have enough ownership to keep you motivated • Tie the financing plan to the business development plan • Limit cold calls use a network and introductions - • Have a strategic use for each financing Non-Financing sources: • Lease/Purchase • Extend terms for supplies • Supplier financing • Swap or trade services 3