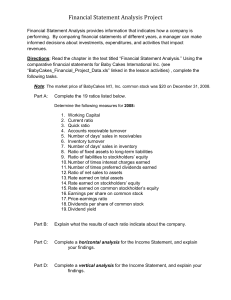

Chapter 12 000)

advertisement

Chapter 12 Cash debt coverage ratio A cash-basis ratio used to evaluate solvency, calculated as cash provided by operating activities divided by average total liabilities. (p. 000) Current cash debt coverage ratio A cash-basis ratio used to evaluate liquidity, calculated as cash provided by operations divided by average current liabilities. (p. 000) Direct method A method of determining net cash provided by operating activities by adjusting each item in the income statement from the accrual basis to the cash basis. (p. 000) Financing activities Cash flow activities that include (a) obtaining cash from issuing debt and repaying the amounts borrowed and (b) obtaining cash from stockholders and providing them with a return on their investment. (p. 000) Free cash flow Cash provided by operating activities adjusted for capital expenditures and dividends paid. (p. 000) Indirect method A method of preparing a statement of cash flows in which net income is adjusted for items that do not affect cash, to determine net cash provided by operating activities. (p. 000) Investing activities Cash flow activities that include (a) purchasing and disposing of investments and productive long-lived assets using cash and (b) lending money and collecting on those loans. (p. 000) Operating activities Cash flow activities that include the cash effects of transactions that create revenues and expenses and thus enter into the determination of net income. (p. 000) Product life cycle A series of phases in a product’s sales and cash flows over time; these phases, in order of occurrence, are introductory, growth, maturity, and decline. (p. 000) Statement of cash flows A basic financial statement that provides information about the cash receipts and cash payments of an entity during a period, classified as operating, investing, and financing activities, in a format that reconciles the beginning and ending cash balances. (p. 000) Asset turnover ratio A measure of how efficiently a company uses its assets to generate sales, computed as net sales divided by average total assets. (p. 000) Available-for-sale securities Securities that may be sold in the future. (p. 000) Average collection period The average number of days that receivables are outstanding, calculated as receivables turnover divided into 365 days. (p. 000) Cash debt coverage ratio A cash-basis measure used to evaluate solvency, computed as cash from operations divided by average total liabilities. (p. 000) Change in accounting principle Use of an accounting principle in the current year different from the one used in the preceding year. (p. 000) Chapter 12 Comprehensive income Includes all changes in stockholders’ equity during a period except those resulting from investments by stockholders and distributions to stockholders. (p. 000) Current cash debt coverage ratio A cash-basis measure of short-term debt-paying ability, computed as cash provided by operations divided by average current liabilities. (p. 000) Current ratio A measure that expresses the relationship of current assets to current liabilities, calculated as current assets divided by current liabilities. (p. 000) Days in inventory A measure of the average number of days it takes to sell the inventory, computed as inventory turnover divided into 365 days. (p. 000) Debt to total assets ratio A measure of the percentage of total assets provided by creditors, computed as total debt divided by total assets. (p. 000) Discontinued operations The disposal of a significant segment of a business. (p. 000) Earnings per share The net income earned by each share of common stock, computed as net income divided by the average common shares outstanding. (p. 000) Extraordinary items Events and transactions that meet two conditions: (1) unusual in nature and (2) infrequent in occurrence. (p. 000) Free cash flow The amount of cash from operations after adjusting for capital expenditures and cash dividends paid. (p. 000) Gross profit rate An indicator of a company’s ability to maintain an adequate selling price of goods above their cost, computed as gross profit divided by net sales. (p. 000) Horizontal analysis A technique for evaluating a series of financial statement data over a period of time to determine the increase (decrease) that has taken place, expressed as either an amount or a percentage. (p. 000) Inventory turnover ratio A measure of the liquidity of inventory, computed as cost of goods sold divided by average inventory. (p. 000) Leveraging Borrowing money at a lower rate of interest than can be earned by using the borrowed money; also referred to as trading on the equity. (p. 000) Liquidity ratios Measures of the short-term ability of the enterprise to pay its maturing obligations and to meet unexpected needs for cash. (p. 000) Payout ratio A measure of the percentage of earnings distributed in the form of cash dividends, calculated as cash dividends divided by net income. (p. 000) Chapter 12 Price-earnings ratio A comparison of the market price of each share of common stock to the earnings per share, computed as the market price of the stock divided by earnings per share. (p. 000) Pro forma income A measure of income that usually excludes items that a company thinks are unusual or nonrecurring. (p. 000) Profit margin ratio A measure of the net income generated by each dollar of sales, computed as net income divided by net sales. (p. 000) Profitability ratios Measures of the income or operating success of an enterprise for a given period of time. (p. 000) Quality of earnings Indicates the level of full and transparent information that is provided to users of the financial statements. (p. 000) Receivables turnover ratio A measure of the liquidity of receivables, computed as net credit sales divided by average net receivables. (p. 000) Return on assets ratio An overall measure of profitability, calculated as net income divided by average total assets. (p. 000) Return on common stockholders’ equity ratio A measure of the dollars of net income earned for each dollar invested by the owners, computed as income available to common stockholders divided by average common stockholders’ equity. (p. 000) Solvency ratios Measures of the ability of the enterprise to survive over a long period of time. (p. 000) Times interest earned ratio A measure of a company’s ability to meet interest payments as they come due, calculated as income before interest expense and income taxes divided by interest expense. (p. 000) Trading on the equity Same as leveraging. (p. 000) Trading securities Securities bought and held primarily for sale in the near term to generate income on short-term price differences. (p. 000) Vertical analysis A technique for evaluating financial statement data that expresses each item in a financial statement as a percent of a base amount. (p. 000) Accounting The process of identifying, recording, and communicating the economic events of a business to interested users of the information. (p. 6) Annual report A report prepared by corporate management that presents financial information including financial statements, notes, and the management discussion and analysis. (p. 22) Assets Resources owned by a business. (p. 10) Chapter 12 Auditor’s report A report prepared by an independent outside auditor stating the auditor’s opinion as to the fairness of the presentation of the financial position and results of operations and their conformance with accepted accounting standards. (p. 23) Balance sheet A financial statement that reports the assets, liabilities, and stockholders’ equity at a specific date. (p. 13) Basic accounting equation Assets = Liabilities + Stockholders’ Equity. (pp. 13–14) Certified Public Accountant (CPA) An individual who has met certain criteria and is thus allowed to perform audits of corporations. (p. 23) Common stock Stock representing the primary ownership interest in a corporation. In the balance sheet it represents the amount paid in by stockholders. (p. 9) Comparative statements A presentation of the financial statements of a company for multiple years. (p. 19) Corporation A business organized as a separate legal entity having ownership divided into transferable shares of stock. (p. 4) Cost principle An accounting principle that states that assets should be recorded at their cost. (p. 25) Dividends Distributions of cash or other assets from a corporation to its stockholders. (p. 9) Economic entity assumption An assumption that economic events can be identified with a particular unit of accountability. (p. 25) Expenses The cost of assets consumed or services used in ongoing operations to generate revenues. (p. 10) Full disclosure principle Accounting principle that dictates that circumstances and events that make a difference to financial statement users should be disclosed. (p. 26) Going concern assumption The assumption that the enterprise will continue in operation long enough to carry out its existing objectives and commitments. (p. 25) Income statement A financial statement that presents the revenues and expenses and resulting net income or net loss of a company for a specific period of time. (p. 12) Liabilities The debts and obligations of a business. Liabilities represent claims of creditors on the assets of a business. (p. 8) Management discussion and analysis (MD&A) A section of the annual report that presents management’s views on the company’s short-term debt paying ability, expansion, financing, and results. (p. 22) Monetary unit assumption An assumption stating that only transaction data that can be expressed in terms of money be included in the accounting records of the economic entity. (p. 24) Net income The amount by which revenues exceed expenses. (p. 10) Net loss The amount by which expenses exceed revenues. (p. 10) Notes to the financial statements Notes that clarify information presented in the financial statements, as well as expand upon it where additional detail is needed. (p. 23) Partnership A business owned by more than one person. (p. 4) Retained earnings The amount of net income kept in the corporation for future use, not distributed to stockholders as dividends. (p. 13) Retained earnings statement A financial statement that summarizes the changes in retained earnings for a specific period of time. (p. 13) Chapter 12 Revenues The assets that result from the sale of a product or service. (p. 10) Sole proprietorship A business owned by one person. (p. 4) Statement of cash flows A financial statement that provides information about the cash inflows (receipts) and cash outflows (payments) for a specific period of time. (p. 15) Stockholders’ equity The stockholders’ claim on total assets. (p. 13) Time period assumption An accounting assumption that the economic life of a business can be divided into artificial time periods. (p. 25) Key Term Matching Activity Cash debt coverage ratio A measure of solvency that is calculated as cash provided by operating activities divided by average total liabilities. (p. 74) Classified balance sheet A balance sheet that contains a number of standard classifications or sections. (p. 58) Comparability Ability to compare the accounting information of different companies because they use the same accounting principles. (p. 56) Conservatism The approach of choosing an accounting method, when in doubt, that will least likely overstate assets and net income. (p. 57) Consistency Use of the same accounting principles and methods from year to year within a company. (p. 56) Current assets Cash and other resources that are reasonably expected to be converted to cash or used up by the business within one year or the operating cycle, whichever is longer. (p. 60) Current cash debt coverage ratio A measure of liquidity that is calculated as cash provided by operating activities divided by average current liabilities. (p. 74) Current liabilities Obligations reasonably expected to be paid within the next year or operating cycle, whichever is longer. (p. 62) Current ratio A measure used to evaluate a company’s liquidity and short-term debt-paying ability, computed by dividing current assets by current liabilities. (p. 70) Debt to total assets ratio Measures the percentage of total financing provided by creditors; computed by dividing total debt by total assets. (p. 71) Earnings per share (EPS) A measure of the net income earned on each share of common stock; computed by dividing net income minus preferred stock dividends by the average number of common shares outstanding during the year. (p. 66) Financial Accounting Standards Board (FASB) A private organization that establishes generally accepted accounting principles. (p. 55) Generally accepted accounting principles (GAAP) A set of rules and practices, having substantial authoritative support, that are recognized as a general guide for financial reporting purposes. (p. 55) Intangible assets Assets that do not have physical substance. (p. 61) Liquidity The ability of a company to pay obligations that are expected to become due within the next year or operating cycle. (p. 70) Chapter 12 Liquidity ratios Measures of the short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash. (p. 70) Long-term investments Generally, investments in stocks and bonds of other companies that are normally held for many years. Also includes long-term assets, such as land and buildings, not currently being used in the company’s operations. (p. 60) Long-term liabilities (Long-term debt) Obligations not expected to be paid within one year or the operating cycle. (p. 62) Materiality The constraint of determining whether an item is large enough to likely influence the decision of an investor or creditor. (p. 57) Operating cycle The average time required to go from cash to cash in producing revenues. (p. 60) Price-earnings (P-E) ratio A measure of the ratio of the market price of each share of common stock to the earnings per share; it reflects the stock market’s belief about a company’s future earnings potential. (p. 66) Profitability ratios Measures of the income or operating success of a company for a given period of time. (p. 65) Property, plant, and equipment Assets of a relatively permanent nature that are being used in the business and are not intended for resale. (p. 61) Ratio An expression of the mathematical relationship between one quantity and another; may be expressed as a percentage, a rate, or a proportion. (p. 64) Ratio analysis A technique for evaluating financial statements that expresses the relationship among selected financial statement data. (p. 64) Relevance The quality of information that indicates the information makes a difference in a decision. (p. 55) Reliability The quality of information that gives assurance that it is free of error and bias. (p. 55) Securities and Exchange Commission (SEC) The agency of the U.S. government that oversees U.S. financial markets and accounting standards-setting bodies. (p. 55) Solvency The ability of a company to pay interest as it comes due and to repay the face value of debt at maturity. (p. 71) Solvency ratios Measures of the ability of the company to survive over a long period of time. (p. 71) Statement of stockholders’ equity A financial statement that presents the factors that caused stockholders’ equity to change during the period, including those that caused retained earnings to change. (p. 68) Working capital The difference between the amounts of current assets and current liabilities. (p. 70) Account An individual accounting record of increases and decreases in specific asset, liability, and stockholders’ equity items. (p. 00) Accounting information system The system of collecting and processing transaction data and communicating financial information to interested parties. (p. 00) Accounting transactions Events that require recording in the financial statements because they affect Chapter 12 assets, liabilities, or stockholders’ equity. (p. 00) Chart of accounts A list of a company’s accounts. (p. 00) Credit The right side of an account. (p. 00) Debit The left side of an account. (p. 00) Double-entry system A system that records the dual effect of each transaction in appropriate accounts. (p. 00) General journal The most basic form of journal. (p. 00) General ledger A ledger that contains all asset, liability, and stockholders’ equity accounts. (p. 00) Journal An accounting record in which transactions are initially recorded in chronological order. (p. 00) Journalizing The procedure of entering transaction data in the journal. (p. 00) Ledger The group of accounts maintained by a company. (p. 00) Posting The procedure of transferring journal entries to the ledger accounts. (p. 00) T account The basic form of an account. (p. 00) Trial balance A list of accounts and their balances at a given time. (p. 00) Accrual basis accounting Accounting basis in which transactions that change a company’s financial statements are recorded in the periods in which the events soccur, rather than in the periods in which the company receives or pays cash. (p. 000) Accrued expenses Expenses incurred but not yet paid in cash or recorded. (p. 000) Accrued revenues Revenues earned but not yet received in cash or recorded. (p. 000) Adjusted trial balance A list of accounts and their balances after all adjustments have been made. (p. 000) Adjusting entries Entries made at the end of an accounting period to ensure that the revenue recognition and matching principles are followed. (p. 000) Book value The difference between the cost of a depreciable asset and its related accumulated depreciation. (p. 000) Cash basis accounting An accounting basis in which revenue is recorded only when cash is received, and an expense is recorded only when cash is paid. (p. 000) Closing entries Entries at the end of an accounting period to transfer the balances of temporary accounts to a permanent stockholders’ equity account, Retained Earnings. (p. 000) Contra asset account An account that is offset against an asset account on the balance sheet. (p. 000) Depreciation The process of allocating the cost of an asset to expense over its useful life. (p. 000) Fiscal year An accounting period that is one year long. (p. 000) Income Summary A temporary account used in closing revenue and expense accounts. (p. 000) Matching principle The principle that dictates that efforts (expenses) be matched with accomplishments (revenues). (p. 000) Permanent accounts Balance sheet accounts whose balances are carried forward to the next accounting period. (p. 000) Post-closing trial balance A list of permanent accounts and their balances after closing entries Chapter 12 have been journalized and posted. (p. 000) Prepaid expenses (Prepayments) Expenses paid in cash and recorded as assets before they are used or consumed. (p. 000) Revenue recognition principle The principle that revenue be recognized in the accounting period in which it is earned. (p. 000) Reversing entry An entry made at the beginning of the next accounting period; the exact opposite of the adjusting entry made in the previous period. (p. 000) Temporary accounts Revenue, expense, and dividend accounts whose balances are transferred to Retained Earnings at the end of an accounting period. (p. 000) Time period assumption An assumption that the economic life of a business can be divided into artificial time periods. (p. 000) Unearned revenues Cash received before revenues were earned and recorded as liabilities until they are earned. (p. 000) Useful life The length of service of a productive facility. (p. 000) Work sheet A multiple-column form that may be used in the adjustment process and in preparing financial statements. (p. 000) Contra revenue account An account that is offset against a revenue account on the income statement. (p. 00) Cost of goods sold The total cost of merchandise sold during the period. (p. 00) Gross profit The excess of net sales over the cost of goods sold. (p. 00) Gross profit rate Gross profit expressed as a percentage by dividing the amount of gross profit by net sales. (p. 00) Net sales Sales less sales returns and allowances and sales discounts. (p. 00) Periodic inventory system An inventory system in which detailed records are not maintained and the cost of goods sold is determined only at the end of an accounting period. (p. 00) Perpetual inventory system A detailed inventory system in which the cost of each inventory item is maintained and the records continuously show the inventory that should be on hand. (p. 00) Profit margin ratio Measures the percentage of each dollar of sales that results in net income, computed by dividing net income by net sales. (p. 00) Purchase allowance A deduction made to the selling price of merchandise, granted by the seller so that the buyer will keep the merchandise. (p. 00) Purchase discount A cash discount claimed by a buyer for prompt payment of a balance due. (p. 00) Purchase invoice A document that supports each credit purchase. (p. 00) Purchase return A return of goods from the buyer to the seller for cash or credit. (p. 00) Sales discount A reduction given by a seller for prompt payment of a credit sale. (p. 00) Sales invoice A document that provides support for credit sales. (p. 00) Sales returns and allowances Purchase returns and allowances from the seller’s perspective. See entry for Purchase returns and allowances. Sales revenue Primary source of revenue in a merchandising company. (p. 00) Chapter 12 Average cost method An inventory costing method that uses the weighted average unit cost to allocate the cost of goods available for sale to ending inventory and cost of goods sold. (p. 000) Consigned goods Goods held for sale by one party (the consignee) although ownership of the goods is retained by another party (the consignor). (p. 000) Current replacement cost The current cost to replace an inventory item. (p. 000) Days in inventory Measure of the average number of days inventory is held; calculated as 365 divided by inventory turnover ratio. (p. 000) Finished goods inventory Manufactured items that are completed and ready for sale. (p. 000) First-in, first-out (FIFO) method An inventory costing method that assumes that the costs of the earliest goods purchased are the first to be recognized as cost of goods sold. (p. 000) FOB destination Freight terms indicating that the goods are placed free on board at the buyer’s place of business, and the seller pays the freight cost; goods belong to the seller while in transit. (p. 000) FOB shipping point Freight terms indicating that the goods are placed free on board the carrier by the seller, and the buyer pays the freight cost; goods belong to the buyer while in transit. (p. 000) Inventory turnover ratio A ratio that measures the number of times on average the inventory sold during the period; computed by dividing cost of goods sold by the average inventory during the period. (p. 000) Last-in, first-out (LIFO) method An inventory costing method that assumes that the costs of the latest units purchased are the first to be allocated to cost of goods sold. (p. 000) LIFO reserve For a company using LIFO, the difference between inventory reported using LIFO and inventory using FIFO. (p. 000) Lower of cost or market (LCM) basis (inventories) A basis whereby inventory is stated at the lower of cost or market (current replacement cost). (p. 000) Raw materials Basic goods that will be used in production but have not yet been placed in production. (p. 000) Specific identification method An actual physical flow costing method in which items still in inventory are specifically costed to arrive at the total cost of the ending inventory. (p. 000) Weighted average unit cost Average cost that is weighted by the number of units purchased at each unit cost. (p. 000) Work in process That portion of manufactured inventory that has begun the production process but is not yet complete. (p. 000) Bank statement A statement received monthly from the bank that shows the depositor’s bank transactions and balances. (p. 00) Cash Resources that consist of coins, currency, checks, money orders, and money on hand or on deposit in a bank or similar depository. (p. 00) Cash budget A projection of anticipated cash flows, usually over a one- to two-year period. (p. 00) Cash equivalents Highly liquid investments, with maturities of three months or less when purchased, that can be converted to a specific amount of cash. (p. 00) Deposits in transit Deposits recorded by the depositor that have not been recorded by the bank. (p. 00) Electronic funds transfer (EFT) A disbursement system that uses wire, telephone, telegraph, Chapter 12 or computer to transfer cash from one location to another. (p. 00) Internal auditors Company employees who evaluate on a continuous basis the effectiveness of the company’s system of internal control. (p. 00) Internal control The plan of organization and all the related methods and measures adopted within a business to safeguard its assets and enhance the accuracy and reliability of its accounting records. (p. 00) NSF check A check that is not paid by a bank because of insufficient funds in a customer’s bank account. (p. 00) Outstanding checks Checks issued and recorded by a company that have not been paid by the bank. (p. 00) Petty cash fund A cash fund used to pay relatively small amounts. (p. 00) Restricted cash Cash that is not available for general use, but instead is restricted for a particular purpose. (p. 00) Treasurer Employee responsible for the management of a company’s cash. (p. 00) Accounts receivable Amounts owed by customers on account. (p. 00) Aging the accounts receivable The analysis of customer balances by the length of time they have been unpaid. (p. 00) Allowance method A method of accounting for bad debts that involves estimating uncollectible accounts at the end of each period. (p. 00) Average collection period The average amount of time that a receivable is outstanding, calculated by dividing 365 days by the receivables turnover ratio. (p. 00) Bad debts expense An expense account to record uncollectible receivables. (p. 00) Cash (net) realizable value The net amount expected to be received in cash. (p. 00) Concentration of credit risk The threat of nonpayment from a single customer or class of customers that could adversely affect the financial health of the company. (p. 00) Direct write-off method A method of accounting for bad debts that involves expensing accounts at the time they are determined to be uncollectible. (p. 00) Dishonored note A note that is not paid in full at maturity. (p. 00) Factor A finance company or bank that buys receivables from businesses for a fee and then collects the payments directly from the customers. (p. 00) Maker The party in a promissory note who is making the promise to pay. (p. 00) Notes receivable Claims for which formal instruments of credit are issued as evidence of the debt. (p. 00) Payee The party to whom payment of a promissory note is to be made. (p. 00) Percentage of receivables basis Management establishes a percentage relationship between the amount of receivables and the expected losses from uncollectible accounts. (p. 00) Promissory note A written promise to pay a specified amount of money on demand or at a definite time. (p. 00) Receivables Amounts due from individuals and companies that are expected to be collected in cash. (p. 00) Receivables turnover ratio A measure of the liquidity of receivables, computed by dividing net credit sales by average gross receivables. (p. 00) Trade receivables Notes and accounts receivable that result from sales transactions. (p. 00) Chapter 12 Accelerated-depreciation method A depreciation method that produces higher depreciation expense in the early years than in the later years. (p. 000) Additions and improvements Costs incurred to increase the operating efficiency, productive capacity, or expected useful life of a plant asset. (p. 000) Amortization The process of allocating to expense the cost of an intangible asset. (p. 000) Asset turnover ratio Measure of sales volume, calculated as net sales divided by average total assets. (p. 000) Capital expenditures Expenditures that increase the company’s investment in productive facilities. (p. 000) Capital lease A long-term agreement allowing one party (the lessee) to use another party’s asset (the lessor). The arrangement is accounted for like a purchase. (p. 000) Cash equivalent price An amount equal to the fair market value of the asset given up or the fair market value of the asset received, whichever is more clearly determinable. (p. 000) Copyright An exclusive right granted by the federal government allowing the owner to reproduce and sell an artistic or published work. (p. 000) Declining-balance method A depreciation method that applies a constant rate to the declining book value of the asset and produces a decreasing annual depreciation expense over the useful life of the asset. (p. 000) Depreciable cost The cost of a plant asset less its salvage value. (p. 000) Depreciation The process of allocating to expense the cost of a plant asset over its useful life. (p. 000) Franchise A contractual arrangement under which the franchisor grants the franchisee the right to sell certain products, to render specific services, or to use certain trademarks or trade names, usually within a designated geographic area. (p. 000) Goodwill The value of all favorable attributes that relate to a business enterprise. (p. 000) Impairment A permanent decline in the market value of an asset. (p. 000) Intangible assets Rights, privileges, and competitive advantages that result from the ownership of longlived assets that do not possess physical substance. (p. 000) Lessee A party that has made contractual arrangements to use another party’s asset without purchasing it. (p. 000) Lessor A party that has agreed contractually to let another party use its asset. (p. 000) Licenses Operating rights to use public property, granted by a governmental agency to a business enterprise. (p. 000) Operating lease An arrangement allowing one party (the lessee) to use the asset of another party (the lessor). The arrangement is accounted for as a rental. (p. 000) Ordinary repairs Expenditures to maintain the operating efficiency and expected productive life of the asset. (p. 000) Patent An exclusive right issued by the U.S. Patent Office that enables the recipient to manufacture, sell, or otherwise control an invention for a period of 20 years from the date of the grant. (p. 000) Chapter 12 Plant assets Tangible resources that have physical substance, are used in the operations of the business, and are not intended for sale to customers. (p. 000) Research and development costs Expenditures that may lead to patents, copyrights, new processes, and new products. (p. 000) Return on assets ratio A profitability measure that indicates the amount of net income generated by each dollar invested in assets; computed as net income divided by average assets. (p. 000) Revenue expenditures Expenditures that are immediately charged against revenues as an expense. (p. 000) Straight-line method A method in which periodic depreciation is the same for each year of the asset’s useful life. (p. 000) Trademark (trade name) A word, phrase, jingle, or symbol that distinguishes or identifies a particular enterprise or product. (p. 000) Units-of-activity method A depreciation method in which useful life is expressed in terms of the total units of production or use expected from the asset. (p. 000) Bond certificate A legal document that indicates the name of the issuer, the face value of the bonds, and such other data as the contractual interest rate and the maturity date of the bonds. (p. 00) Bonds A form of interest-bearing notes payable issued by corporations, universities, and governmental entities. (p. 00) Callable bonds Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer. (p. 00) Capital lease A type of lease whose characteristics make it similar to a debt-financed purchase and that is consequently accounted for in that fashion. (p. 00) Contingencies Events with uncertain outcomes, such as a potential liability that may become an actual liability sometime in the future. (p. 00) Contractual interest rate Rate used to determine the amount of interest the borrower pays and the investor receives. (p. 00) Convertible bonds Bonds that permit bondholders to convert them into common stock at their option. (p. 00) Current liability A debt that can reasonably be expected to be paid (1) from existing current assets or through the creation of other current liabilities, and (2) within one year or the operating cycle, whichever is longer. (p. 00) Discount (on a bond) The difference between the face value of a bond and its selling price, when a bond is sold for less than its face value. (p. 00) Effective-interest method of amortization A method of amortizing bond discount or bond premium that results in periodic interest expense equal to a constant percentage of the carrying value of the bonds. (p. 00) Effective-interest rate Rate established when bonds are issued that remains constant in each interest period. (p. 00) Face value Amount of principal due at the maturity date of the bond. (p. 00) Long-term liabilities Obligations expected to be paid more than one year in the future. (p. 00) Chapter 12 Market interest rate The rate investors demand for loaning funds to the corporation. (p. 00) Maturity date The date on which the final payment on a bond is due from the bond issuer to the investor. (p. 00) Mortgage note payable A long-term note secured by a mortgage that pledges title to specific units of property as security for the loan. (p. 00) Notes payable An obligation in the form of a written promissory note. (p. 00) Off – balance-sheet financing The intentional effort by a company to structure its financing arrangements so as to avoid showing liabilities on its books. (p. 00) Operating lease A contractual arrangement giving the lessee temporary use of the property with continued ownership of the property by the lessor. Accounted for as a rental. (p. 00) Premium (on a bond) The difference between the selling price and the face value of a bond when a bond is sold for more than its face value. (p. 00) Present value The value today of an amount to be received at some date in the future after taking into account current interest rates. (p. 00) Secured bonds Bonds that have specific assets of the issuer pledged as collateral. (p. 00) Straight-line method of amortization A method of amortizing bond discount or bond premium that allocates the same amount to interest expense in each interest period. (p. 00) Times interest earned ratio A measure of a company’s solvency, calculated by dividing income before interest expense and taxes by interest expense. (p. 00) Unsecured bonds Bonds issued against the general credit of the borrower; also called debenture bonds. (p. 00) Authorized stock The amount of stock that a corporation is authorized to sell as indicated in its charter. (p. 000) Cash dividend A pro rata distribution of cash to stockholders. (p. 000) Corporation A company organized as a separate legal entity, with most of the rights and privileges of a person. Evidence of ownership is shares of stock. (p. 000) Cumulative dividend A feature of preferred stock entitling the stockholder to receive current and unpaid prior-year dividends before common stockholders receive any dividends. (p. 000) Declaration date The date the board of directors formally declares the dividend and announces it to stockholders. (p. 000) Deficit A debit balance in retained earnings. (p. 000) Dividend A distribution by a corporation to its stockholders on a pro rata (equal) basis. (p. 000) Dividends in arrears Preferred dividends that were scheduled to be declared but were not declared during a given period. (p. 000) Legal capital The amount per share of stock that must be retained in the business for the protection of corporate creditors. (p. 000) No-par value stock Capital stock that has not been assigned a value in the corporate charter. (p. 000) Outstanding stock Capital stock that has been issued and is being held by stockholders. (p. 000) Paid-in capital The amount paid in to the corporation by stockholders in exchange for shares of Chapter 12 ownership. (p. 000) Par value stock Capital stock that has been assigned a value per share in the corporate charter. (p. 000) Payment date The date dividend checks are mailed to stockholders. (p. 000) Payout ratio A measure of the percentage of earnings distributed in the form of cash dividends to common stockholders. (p. 000) Preferred stock Capital stock that has contractual preferences over common stock in certain areas. (p. 000) Privately held corporation A corporation that has only a few stockholders and whose stock is not available for sale to the general public. (p. 000) Publicly held corporation A corporation that may have thousands of stockholders and whose stock is regularly traded on a national securities market. (p. 000) Record date The date when ownership of outstanding shares is determined for dividend purposes. (p. 000) Retained earnings Net income that is retained in the business. (p. 000) Retained earnings restrictions Circumstances that make a portion of retained earnings currently unavailable for dividends. (p. 000) Return on common stockholders’ equity ratio A measure of profitability from the stockholders’ point of view; computed by dividing net income minus preferred stock dividends by average common stockholders’ equity. (p. 000) Stated value The amount per share assigned by the board of directors to no-par stock that becomes legal capital per share. (p. 000) Stock dividend A pro rata distribution of the corporation’s own stock to stockholders. (p. 000) Stock split The issuance of additional shares of stock to stockholders accompanied by a reduction in the par or stated value per share. (p. 000) Treasury stock A corporation’s own stock that has been issued, fully paid for, and reacquired by the corporation but not retired. (p. 000)