Optimal Cash Purchase St t i

advertisement

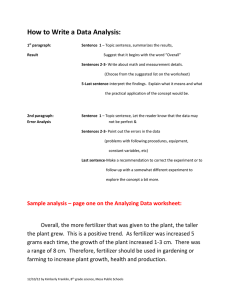

Optimal Cash Purchase St t i tto R Strategies Reduce d F Fertilizer tili Price Risk Phil Kenkel Oklahoma State University Background • Fertilizer represents 30-35% 30 35% of variable cost of production of grain crops and up to 85% for some forage crops • The cost of nitrogen and phosphate products has increased almost 400% since 1992 • Prices Pi ffor b both th products d t ffellll over 50% iin late summer of 2008 Fertilizer Price Volatility • Impacts all levels of the supply chain • Fertilizer dealers have historically absorbed price swings in their margins and stockpiled for peak periods • Within year price swings of $100 have occurred for the past 3 years with price g of $500/ton in 2008 changes • Dealers are shifting to advance purchases • Increased interest in timing purchases Fertilizer Price Risk Tools • Futures contracts on CME were discontinued due to lack of liquidity • Direct Hedge Exchange Exchange, based in Switzerland, has a 5,000 ton contract size • OTC products d t require i relationship l ti hi with ith broker and involves counterparty risk • Cross hedging with natural gas contracts is ineffective Cash Purchase Strategies • Attempt to diversity risk by spreading purchases across year • Take advantage of seasonal patterns • Require working capital and storage f ilit facility • Could systematically purchasing fertilizer on the same date(s) each year reduce risk? Data and Methods • 17 year time series of weekly fertilizer prices for Enid Oklahoma (inland) and Tulsa Port of Catoosa (barge) • Urea, UAN and DAP • Spring S i and d ffallll application li ti seasons • 25%, 50%, 75% and 100% warehouse capacity j for interest • Prices adjusted Scenarios • Baseline-even Baseline even purchase each month • Examined the effect of purchasing 25%, 50% 75% 50%, 75%, 100% of annual needs at the same date each year • Determined D t i db bestt d dates t Table 1: Impact of Mechanical Purchase Strategies on Average Fertilizer Price for Various Warehouse Capacity Capacity, Locations and Product Forms Urea-Tulsa Urea-Enid UAN-Tulsa UAN-Enid DAP-Tulsa 25% .98 .98 .96 .97 .97 50% .97 .97 .95 .96 .97 75% .96 .96 .94 .94 .96 100% .96 96 .95 95 .93 93 .93 93 .96 96 Even Monthly y 1.00 1.00 1.00 1.00 1.00 Prices shown relative to a base strategy of purchasing an even amount each week 3-7% advantage in systematically purchasing on the best date Table 2: Impact of Mechanical Purchase Strategies on Price Variance for Various Warehouse Capacity Capacity, Locations and Product Forms Urea-Tulsa Urea-Enid UAN-Tulsa UAN-Enid DAP-Tulsa 25% 1.07 1.03 .82 .85 .70 50% 1.05 .99 .72 .73 .55 75% .85 .83 .68 .69 .47 100% .74 .83 .66 .67 .43 Even Weekly 1.00 1.00 1.00 1.00 1.00 Prices shown relative to a base strategy of purchasing an even amount weekly Mechanical strategies can reduce risk by up to 57% Table 3: Difference Between the Minimum and Maximum Average Fertilizer Price for Various Warehouse Capacity, Capacity Locations and Product Forms Urea Tulsa Urea-Tulsa Urea Enid Urea-Enid UAN Tulsa UAN-Tulsa UAN Enid UAN-Enid DAP Tulsa DAP-Tulsa 25% .08 .08 .10 .07 .07 50% .10 .10 .12 .10 .08 75% .12 .12 .14 .12 .09 100% .13 13 .14 14 .16 16 .15 15 .09 09 Prices shown relative to a base strategy of purchasing an even amount weekly 7-16% Difference between systematically purchasing on best And worst dates Table 5: Optimal Time Periods to Purchase Fertilizer U Urea-Tulsa T l U Urea-Enid E id UAN T l UAN-Tulsa UAN E id UAN-Enid DAP T l DAP-Tulsa Minimum Average Price 2nd week of July 1st week in July 2nd week of November 2nd week of November 1st week in November Maximum Average Price 4th week in March 1st week in April 4th week in April 4th week in April 4th week of March Minimum Variance Varying amounts over 50 weeks of the year Varying 4th week of amounts November over 49 weeks of the year 2nd week in January plus 4th week in November 2nd week in January plus 2nd week of November Maximum Variance 4th week of October 1st week in April 4th week in April 4th week of March 4th week of April Prices shown relative to a base strategy of purchasing an even amount each week Conclusions • Mechanical cash purchase strategies would have reduced price by 3-7% or variance by up to 50% • 7-16% difference between best and worst dates for managing price Conclusion ( (continued) i d) • Optimal dates for reduced price were in mid-summer for Urea and November for UAN and DAP • Variance was minimized by purchasing throughout the year or Jan and November • Spring and October were the worst dates t purchase to h Limitations • Historical price patterns may not reflect structural change in the industry • Fertilizer markets in the Southern Plains reflect local basis producers might g have more difficulty y in • Corn belt p taking advantage of seasonal price patterns • Results provide a starting point for dealers and producers who are making decisions in timing purchases