Cash Flow Homework

advertisement

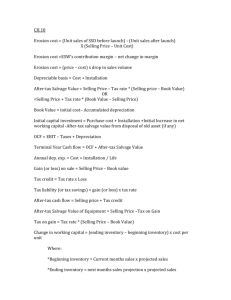

Cash Flow Homework 1. A company must purchase a piece of equipment. Two types are being considered: TYPE A: initial cost = 1000, annual cost = 400, salvage value = 300, 5-yr lifetime. TYPE B: initial cost = 2000, annual cost = 200, salvage value = 800, 8-yr lifetime. Discount rate is 10%. Use the annual equivalent method to recommend which equipment type to purchase. Ignore taxes and use annual compounding. 2. A company has two options for a machine it must purchase. The manufacturer’s discount rate is 10%. In the analyses to follow ignore taxes and depreciation. Type I: Initial cost = 100,000. Annual cost = 12,000. 3-yr lifetime. No salvage value. Type II: Initial cost = 150,000. Annual cost = 24,000. 6-yr lifetime. Salvage value = S. Determine the value of S for which the company would be indifferent between the two machines. 3. You are preparing an after tax cash flow analysis for a new project for XYZ, Inc. The project's planning horizon is 4 years. The project requires an initial purchase of equipment for 1 million. The equipment is classified as 10-year property and straight-line depreciation is used. The equipment's market value depreciates at a rate of 20% per year; that is, its value at the end of the year is 80% of its value at the beginning of the year. As has been assumed in class, for tax purposes the company has sufficient revenue to offset any projected loss on the sale of the equipment in year 4. The marginal tax rate is 35%. Determine the after tax cash flow entry for the investment row in your spreadsheet. 4. A manufacturer must acquire equipment to produce a product for a customer for a period of exactly two years. Relevant data are: • Revenues are projected to be 600,000 in the first year and 800,000 in the second year. • The manufacturer’s discount rate is 15% and its marginal tax rate is 30%. • For tax purposes straight-line depreciation is used. • The equipment’s market value depreciates at a rate of 30% per year, i.e., its value at the end of the year is 70% of the value at the beginning of the year. • The equipment will be classified as 7-year property. • The equipment initially costs 350,000, of which 150,000 will be financed by a 2-year loan at 12% interest, with principal repaid in two equal annual installments. • First year annual operating costs will be 250,000. Each successive year these costs rise by 10%. a. Obtain the after-tax cash flows by filling out the following table. Project cash flow analysis 0 1 2 Revenues Expenses Operating costs Interest expense Depreciation Total Net income before tax Income tax Net income after tax Adjustments Principal repayment Depreciation Investment After tax cash flow b. What is the after-tax (projected) cost of the equipment for this two-year project? c. What is the after-tax (projected) cost of the equipment over its seven-year life assuming no salvage value?