1. A Placidian manufacturing company bought a truck for $35,000

advertisement

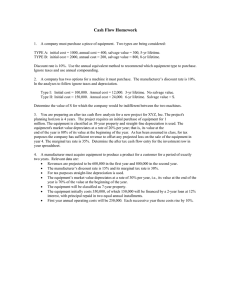

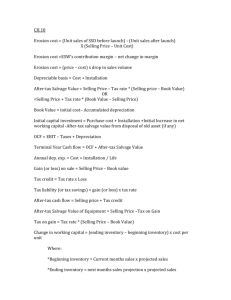

1. A Placidian manufacturing company bought a truck for $35,000. After 10 years the truck’s salvage value will be $5,000. The truck is expected to produce revenue of $10,000/year, while maintenance costs are expected to be $1,000/year. If the annual interest rate is 10%, the corporate tax rate is 35%, and straight-line depreciation is applied, with no first-year rule, and considering only the cashflows mentioned in the question, how much will the company pay in tax in the first year? Answer: Tax is imposed on net income, which is the difference between annual revenue and total annual expenditure. Annual revenue is $10,000 and the total annual costs are depreciation plus maintenance. [Presumably the truck also has a driver, otherwise what’s the point of having it, but the driver’s salary isn’t mentioned, so we’ll ignore it.] Since the Placidian tax authorities [unlike Canada] use straight-line depreciation, the annual depreciation amount is D = (P-S)/N = (35,000-5,000)/10 = $3000 (5 points; they can have 3 points for answering $3,500) So total annual costs are $3,000+$1,000 = $4,000, and the before-tax income is Income = Revenue – Costs = $10,000 - $4,000 = $6,000 (5 points; if they said 3,500 for part (i), they can have $5,500 here and still get 5 points) So the tax due is 6,000 * 0.35 = $2,100 (5 points; if they said 5,500 for part (ii), they would get $1,925 here) 2. An engineering project involves the purchase of a capital asset with a first cost of $100,000, operating costs of $5,000/year, and a service life of 10 years. The expected revenue is $20,000 per year. If the CCA rate for this asset is 25%, the MARR is 10%, and the corporate tax rate, t, is 33%, what is the after-tax present value of the project? Answer: The present worth of the project is: PW(Revenue) * (1-t) – PW(capital costs) – PW (operating costs) * (1-t) (5 points if they are clearly using this equation) The PW of the capital costs is: PW = CTF * 100,000 = (1 – (0.33*0.25*(1+0.1/2))/((0.1+0.25)*(1+0.1))) * 100,000 =(1 – 0.33*0.25*1.05/ 0.385) * 100,000 =(1 – (0.0866)/ 0.385) * 100,000 =0.775* 100,000 = 0.775 * 100,000 = 77,500 (5 points; they can also get this result by adding up the present value of tax savings over the ten years) Therefore, PW(Project) = 20,000(P/A,0.1,10)*(1-0.33) – 77,500 - 5,000(P/A,0.1,10)*(1-0.33) = 20,000 * 6.1445 * 0.67 – 77,500 – 5,000 * 6.1445 *0.67 = 82,337 – 77,500 – 20,584 = -$15,747 (10 points for getting this result; if they make numerical errors along the way, but are using the right method, 1 point off for each error.) (So it’s not a good project.) 3. An engineering company just bought a bending machine for $50,000. Its service life is 10 years, at the end of which time it will be worth $2,000. It depreciates by declining balance depreciation, both in the company books and in Revenue Canada’s asset class for machinery of this type. The services that the machine provides bring in $10,000 in annual revenue, and its operating costs are $2,000 per year. If the company’s after-tax MARR is 5% and it is taxed at t = 30%, find the present worth of the investment. Answer: The depreciation rate is D = 1 – (2,000/50,000)1/10 = 0.275 (5 points) The present worth of the investment is PW = (10,000-2,000)(P/A,0.05,10)(1-t) – CTF*50,000 + CSF*2,000*(P/F,0.05,10) (5 points; they may use “CCTF” and “CCTF*” in place of CSF and CTF; that’s OK.) Using the formulas at the back of the book, CTF = 1 – (0.3*0.275*(1+0.05/2))/((0.05+0.275)(1+0.05)) = 0.7522 (3 points) CSF = 1 – 0.3 * 0.275 / (0.05 + 0.275) = 0.746 (2 points) And the present worth of the investment is therefore: PW = 8000 * 7.7217 * (1-0.3) – 0.7522 * 50,000 + 0.746 * 2,000 * 0.6139 = 43,241 – 37,610 + 916 = $6,547 (5 points) 4. A company just bought a new piece of equipment for a million dollars. It’s a Class 8 asset, which means that Revenue Canada considers it to depreciate at 20% per annum. However, in reality the machine is wearing out, and losing value, at 25% per annum, and the salvage price the company will be able to get for it reflects this depreciation rate. The company’s after-tax MARR is 8% and the corporate tax rate is 36%. What is the after-tax present worth of the salvage price we expect to get for the machine when we sell it in 10 years time? Answer: First, we calculate the salvage price we expect to get. This is: S = 1,000,000 * (1-0.25)10 = $56,313 (5 points) The present worth of this is PW(S) = 56,313 * CSF * (P/F,0.08,10) CSF = 1 – 0.36*0.2/(0.08+0.02) = 0.7429 (5 points) Therefore PW(S) = 56,313*0.7429 * 0.463 = $19,376 (5 points) So the maximum possible score for the assignment is 70 points.