A Reversal of Rybczynski’s Comparative Statics via “Anything Goes” Hugo F. Sonnenschein

advertisement

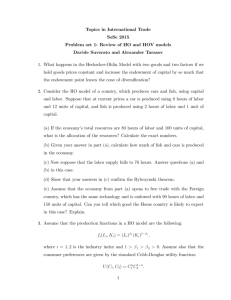

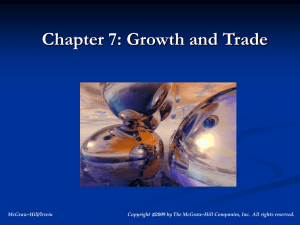

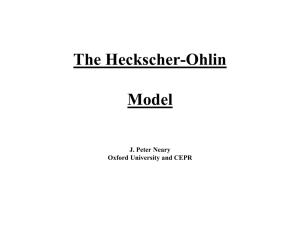

A Reversal of Rybczynski’s Comparative Statics via “Anything Goes” * Hugo F. Sonnenschein a and Marcus M. Opp b a Department of Economics, University of Chicago, 1126 E. 59th Street, Chicago, IL 60637 h-sonnenschein@uchicago.edu Phone: (773) 834-5960 Fax: (773) 702-8490 b Graduate School of Business, University of Chicago, 5807 South Woodlawn Avenue, Chicago, IL 60637 mopp@ChicagoGSB.edu Phone: (773) 752-4681 Fax: (773) 752-4681 Abstract We demonstrate that Rybczynski’s classic comparative statics can be reversed in the 2 × 2 × 2 Heckscher-Ohlin model of international trade when there is a home bias in consumption. An increase in the endowment of a factor of production can lead to an absolute curtailment in production of the commodity using relatively much of the factor and an absolute expansion of the commodity using relatively little of the same factor. This is accomplished with identical constant returns to scale production across countries, homothetic preferences for the representative consumer in each country, and factor price equalization. The assumption of home bias has empirical support. Keywords: Rybczynski Theorem, Heckscher-Ohlin Model, International Trade, Home Bias Consumption, Factor Endowments JEL classification: F11; D51; D33 * The investigation was inspired by the work of Cheng, Sachs, and Yang (2000), who conjectured that in the Heckscher-Ohlin model the relationship between factor endowments, outputs, and commodity prices can be quite arbitrary. Their conjecture was based on the S-M-D Theorem, see; for example Shafer and Sonnenschein (1982). It is not clear that the particular functional forms used in their analysis allow for the extreme comparative statics that are presented here; in fact, this is almost surely not the case. This paper is also related to a paper by Kemp and Shimomura who use the S-M-D Theorem to explore several of the classical theorems of international trade in a context in which the “conventional assumption” that consumers in each country behave collectively as if they are alike is dropped. The strength of the examples presented here is due to the fact that the “conventional assumption” is maintained; indeed, in each country demand is generated by a single consumer with homothetic preferences. This paper was presented in Melbourne as the first Xiaokai Yang Memorial Lecture. It is dedicated to the memory of Professor Yang. The paper was also presented in Delhi as a Sukhamoy Chakravarty Memorial Lecture and in seminars at the University of Chicago, the University of Rochester, Princeton University and the College of William and Mary. It is a pleasure to acknowledge helpful discussions and communications with Avinash K. Dixit, Gene M. Grossman, Matthew Jackson, Ronald W. Jones, Murray Kemp, Samuel S. Kortum, Andreu Mas-Colell, Philip Reny, and Christis Tombazos. 1 I. INTRODUCTION Fifty-two years ago T. M. Rybczynski (1955) published a frequently referenced note in which he inaugurated a systematic investigation of the comparative statics associated with a change in the endowment of a factor of production. The questions that he considered are fundamental: How do the prices and consumptions of final goods depend on factor endowments? How do factor prices and the wealth of consumers vary with changes in factor endowments? What are the welfare implications of changes in factor endowments? In this paper we reconsider Rybczynski’s theoretical analysis in the context of the 2 × 2 × 2 Heckscher-Ohlin model of international trade, and we use an elementary version of the Sonnenschein-Mantel-Debreu Theorem on the structure of excess demand functions (sometimes referred to as “anything goes”) to demonstrate the existence of economies in which Rybczynski's primary comparative statics conclusions are reversed in sign. Furthermore, in these economies production is constant returns to scale, preferences are homothetic, and equilibrium is unique. From a theoretical perspective nothing is unusual. Rybczynski considered a closed economy with two factors of production A and B and two consumption goods X and Y , each produced according to constant returns to scale and perfect competition. He argued that if X is A intensive and Y is B intensive, then an increase in A leads to an increase in the equilibrium output of X and a decrease in the equilibrium output of Y , provided that the marginal rate of transformation in production between X and Y , MRT ( X , Y )) does not change when one moves from the original to the new equilibrium. In other words, under Rybczynski's assumptions, the expanded production possibilities associated with a factor increase, which allows for an increased production of both outputs, leads in equilibrium to an increase in the output that is intensive in the factor that has increased, and a decrease in the other output. This unambiguous comparative statics result has been applied to the case of international trade in which an economy is small (more properly infinitesimal), so that the MRT at every interior equilibrium is determined by international prices and does not change. 2 Rybczynski understood that in a closed economy MRT ( X , Y )) at equilibrium varies with factor endowments (this is a general equilibrium effect), and he provided a rather complete analysis of how outputs (which are equal to consumptions in a closed economy) and prices will change following an increase in A . In particular, Rybczynski argued that in the absence of inferior goods, an increase in the amount of factor A leads to an increase in X , but that the effect on Y is ambiguous. Furthermore, it is apparent that he understood that with X inferior, an increase in A can lead to an absolute decrease in X and an increase in Y . We will call this outcome “Reverse Rybczynski”. Rybczynski did not consider the case of more than one consumer, which would have not been a standard form. It is not difficult to demonstrate that “Reverse Rybczynski“ is possible when demand is generated by two consumers who own different shares of the endowment commodities and have different homothetic preferences. Such a demonstration would be very much in the spirit of Kemp and Shimomura (2002), and aggregate demand in the closed economy could not be generated by a single consumer with homothetic preferences. The Heckscher-Ohlin example that we construct specifies production functions that are CRS and identical across countries. There are neither factor intensity reversals, nor specialization in production; thus, the conditions for factor price equalization are satisfied. Factor endowments are different in the two countries and demand in each country is generated by a single consumer with homothetic preferences; in particular, no goods are inferior in either country. (It is this final assumption that gives our result weight.) Despite this rather standard form, an increase in the amount of factor A in the first country leads to a decrease in the relative price of X that is so large that the equilibrium output of X in that country decreases while the output of Y increases. In other words, in general equilibrium, and without the small country assumption, the output implications of an increase in a factor endowment can be the reverse of what is established in the Rybczynski analysis; that is, “Reverse Rybczynski”, even with no inferior goods in either country. Furthermore, equilibrium is unique both before and after the increase in A and equilibria are interior (uniqueness is key here, since with multiple equilibria both before and after the increase in 3 A , there will generally be a selection from the equilibrium set that trivially yields “Reverse Rybczynski”). At the heart of the demonstration is the fact that in general equilibrium an increase in the amount of A in the home country can lead to an arbitrarily large rate of decrease in the relative price of X , and thus a decline in the amount of X produced. In our paper, these large price effects are driven by strong home biases in consumer demand, which is in line with Trefler’s empirical observations (Trefler, 1995). If preferences were identical across countries as well as homothetic, then “Reverse Rybczynski“ would not be possible (since the demand sector of the world economy is “as if” there was a single consumer with homothetic preferences: this is Eisenberg’s Theorem, see Shafer and Sonnenschein (1982)). In a precise sense, when one takes Rybczynski’s analysis to general equilibrium via Heckscher-Ohlin, home bias in consumption is both necessary and sufficient for the possibility of the reversal of Rybczynski’s comparative statics. The intuition for the possibility of “Reverse Rybczynski” is not difficult to understand. Start with an equilibrium in which the home country exports X (since it is relatively abundant in factor A , which is used intensively in the production of X ) and has preferences that favor X relative to Y when compared with preferences in the “other” country. This is the case of a home bias in consumption. Assume further that the technology is such that the home country can produce relatively little Y and the other country can produce relatively little X . If the home country experiences a small increase in A , then its supply function for X (setting the price of Y equal to unity) will move out, as will the world supply function for X . The demand for X depends on the price of X and the distribution of income among the countries. This demand will be small when the price of X is very large and large when the price of X is very small; however, for intermediate prices the demand for X can violate the gross substitute condition and have a positive slope. This is more likely to happen when the home bias in demand is significant, since then, decreases in the price of X , which is exported by the home country, make the “other country” wealthy relative to the home country and thus tend to decrease the demand for X . In this region the shift in supply of X , caused by the increase in A in the home country, will lower the price of X . Moreover, if the slope 4 of the demand function is close to the slope of the supply function (and yet cuts supply from above), then this increase in A will reduce the price of X a great deal. This effect can be so strong that the home country, which can now produce more of X and Y than before the increase in its holding of A , chooses to decrease its production of X and increase its production of Y . The Rybczynski effect, which has the home country decrease its production of Y and increase its production of X when prices remain constant, is overwhelmed by a very strong substitution effect. (The reader may wish to peek at Figure 3, with the obvious interpretation.) The achievement of this note is that it gives a precise argument that shows that all of this is possible, and in particular that it is possible with unique equilibrium. The delicate part is to show that with sufficient home bias demand and supply can have almost the same slope in the neighborhood of equilibrium and intersect only once. Although some details are left to the reader, we have made considerable effort to make the presentation brief, elementary, and accurate. Our guide has been to write in a style that we believe might have appealed to Rybczynski. II. CONSTRUCTION OF “REVERSE RYBCZYNSKI” The key idea in a “Reverse Rybczynski” example is that an increase the endowment of A in the first country (for example from 1 to 1 + Δ ) leads to a very large decrease in the relative price of commodity X . In order to get a handle on such large price effects, we first put production aside and consider an Edgeworth Box exchange economy in which consumer 1 holds one unit of X and no Y ( X 1 = 1, Y1 = 0 ) and consumer 2 holds no X and one unit of Y ( X 2 = 0, Y2 = 1 ). This asymmetric endowment (in the extreme form) causes opposite wealth effects for the consumers for every price change. The homothetic preferences of the first consumer are defined in terms of the marginal rate of substitution: MRS1 ( X , Y ) ≡ Y /X 1 − 2 (Y / X ) X ≥ 2Y > 0 5 (1) These preferences exhibit diminishing marginal rates of substitution and generate a linear offer curve with slope 1 : OC 1 ( p , X 1 ) = ( X 1D ( p ) , − 0.5 X 1 + X 1D ( p ) ) (2) where p is the price of X and the price of Y is normalized to one (The reader who has not seen this construction in connection with “anything goes” may wish to consult Shafer and Sonnenschein (1982), pp. 682-688). The graph of the excess demand curve of consumer 1 z 1 ( ⋅, X 1 ) , is then a translation of OC 1 ( ⋅, X 1 ) , and is linear with slope 1. An increase in the endowment X 1 by Δ shifts the excess demand function of consumer 1 left by Δ / 2 (see Figure 1). [INSERT FIGURE 1] The key idea for generating arbitrary large price effects in the Edgeworth Box economy is to define the preferences of the second consumer after determining the desired magnitude of the price effect. Suppose, that one wishes to generate a price decrease from p (1) = 2 to p (1 + Δ ) = 0.5 when X 1 increases from 1 to 1 + Δ . At p (1) = 2 the excess demand of consumer 1 with endowment X 1 = 1 is given by z 1 (2,1) and at p (1 + Δ ) = 0.5 the excess demand of consumer 1 with endowment X 1 = 1 + Δ is given by z 1 (0.5,1 + Δ ) . Note that the excess demand z 1 ( ⋅, X 1 ) at price p is determined by the intersection of the excess demand function z 1 ( ⋅, X 1 ) with a ray through the origin with slope − p . Next, one “reverse engineers” the preferences of the second consumer so that the graph of his excess supply function ( −z 2 ( ⋅) ) is a straight line through z 1 (2,1) and z 1 (0.5,1 + Δ ) . This construction causes the second consumer to absorb the excess demand of the first consumer precisely at the desired equilibrium prices and guarantees unique equilibria both before and after the price change. As the price effect we wish to create gets large (say from an arbitrary initial price p (1) to some p (1 + Δ ) ), the required slope of the second consumer’s excess supply function m 2 ( Δ, p (1) , p (1 + Δ ) ) approaches the slope of the excess demand function for the first consumer 6 (which is equal to one) from below. Finally, one can express consumer two’s preferences in terms of the MRS that generates the required excess supply function with slope m 2 ( ⋅) and intercept b2 ( ⋅) . MRS 2 ( X , Y ) = where m 2 = 1 − b2 b2 ( Y / X ) − m 2 Y≥ m2 X >0 b2 (3) 1− Δ 1 1 and b2 = + m 2 1 + 2Δ 3 6 An essential feature of this construction is that at every price ratio consumer 1 desires a higher ratio of X to Y than does consumer 2, that is both countries have a taste bias in favor of the good they supply (“home bias”). Before leaving the Edgeworth Box analysis, we note that the supply function −z 2 ( ⋅) could have been defined in the following equivalent manner: For each p we define: −z 2 ( p ) = γ ( p ) z 1 ( p ,1) + ⎡⎣1 − γ ( p ) ⎤⎦ z 1 ( p ,1 + Δ ) where: γ ( p ) = (4) (1 + Δ ) ( 2 p − 1) 1 − Δ + p (1 + 2Δ ) With the exchange economy analysis in place, we are now prepared to make the transition to the 2 × 2 × 2 Heckscher – Ohlin model in which the first country exhibits an increase in its holding of factor A from 1 to 1 + Δ . The idea of the proof is to consider an economy in which the deviations from the diagram of Figure 1 are relatively small (where increases in X 1 now correspond to increases in factor A holdings of the first country). As in Figure 1 equilibrium is unique both before and after the increase in A , and the equilibrium price changes from 2 to 0.5. The first step in doing this is to consider endowments in each country and technology so that the efficient production in the first county approximates the point (1, 0) in final goods space ( X , Y ) and efficient production in the second country approximates (0, 1). More precisely, for each α > 0 , we can consider CRS production functions f (α ) for good X and g (α ) for good Y such that: (i) there are no factor intensity reversals ( X is relatively A intensive and Y is relatively B intensive), 7 (ii) when factor endowments are A = 1 and B = α (where α is small relative to 1), the efficient production possibilities of X and Y satisfy 1 − α < X < 1 and 0 < Y < α , and when factor endowments are A = α , B = 1 , the efficient production possibilities satisfy 0 < X < α and 1 - α < Y < 1 , (iii) the efficient production possibilities are smooth and uniquely attain each slope between 0 and − ∞ . (This specification can almost be achieved with CES production and identical elasticities of substitution in both sectors that approach zero. Figure 2 illustrates a specification of technology that fulfills all requirements). [INSERT FIGURE 2] As before, p = 2 and p = 0.5 will play a key role. Let A1 = 1 and B1 = α , and A2 = α and B2 = 1 be the respective factor endowments of the representative consumer in each country. For each α there exists a Δ (α ) > 0 such that “Reverse Rybczynski” obtains if A1 is increased by Δ (α ) and prices change from 2 to 0.5. [INSERT FIGURE 3] The excess demand function z 1 ( ⋅,1) in the first country with factor endowment (1, α ) and technology f (α ) , g (α ) now depends on both preferences and α (which determines the set of production possibilities). For α small enough, one can find homothetic preferences for the representative consumer in the first country that generates the same excess demand function z 1 ( ⋅,1) as in the pure exchange case, that is, a linear graph (see again Shafer and Sonnenschein (1982), pp. 682-688). With preferences fixed, z 1 ( ⋅,1 + Δ (α ) ) is determined for each α . As in the pure exchange case, z 1 shifts to the left for Δ (α ) positive, and this shift is now amplified by the Rybczynski effect, since for each p and α the supply of Y in the first country is less at inputs (1 + Δ (α ) , α ) than it is at (1, α ) as in Figure 3 at price 2. 8 We next define the excess supply function in the second country to be the same (varying with p ) weighted average of z 1 ( ⋅,1) and z 1 ( ⋅,1 + Δ ) as it was in the pure exchange case. Observe that z 1 ( ⋅,1 + Δ ) no longer has a linear graph, since it now must include changes in production, and so the graph of −z 2 ( ⋅) is no longer linear; however, as before, the excess supply in the second country absorbs the excess demand in the first country, both at p = 2 and p = 0.5 . Again, −z 2 ( ⋅) can be generated by homothetic preferences for α small. Finally, we note that equilibrium is unique both before and after the factor increase, by the nature of the construction. For α small enough suitable homothetic preferences have been defined, and with the production side of the economy defined by α , the first country exhibits “Reverse Rybczynski” when its holding of input A is increased by Δ (α ) . III. CONCLUDING REMARKS The point of this paper has been to expose the theoretical limits of Rybczynski’s classic analysis in the standard 2 × 2 × 2 Heckscher – Ohlin model of a trading world in which all prices are determined endogenously. If preferences are identical and homothetic, then Rybczyski’s classic analysis of a closed economy properly points the way to the results in the H-O model; however, if preferences exhibit home biases, then Rybczynski’s results can be reversed in sign. 9 REFERENCES Cheng, W. L., Sachs, J., Yang, X., 2000. A General Equilibrium Re-appraisal of the Stolper-Samuelson Theorem. Journal of Economics 72, 1–18. Kemp, M. C., Shimomura, K., 2002. The Sonnenschein–Debreu–Mantel Proposition and the Theory of International Trade. Review of International Economics 10, 671–679. Mas-Colell, A., Whinston, M. D., Green, J. R., 1995. Microeconomic Theory Section 17E, Oxford University Press, New York. Rybczynski, T. M., 1955. Factor Endowments and Relative Commodity Prices. Economica 22, 336–41. Shafer, W., Sonnenschein, H., 1982. Market Demand and Excess Demand Functions, in: Arrow, K. J., Intriligator, M. D. (Eds.), Handbook of Mathematical Economics, Vol. 2, North-Holland, Amsterdam, pp. 671–693. Trefler, D., 1995. The Case of Missing Trade and Other Mysteries. American Economic Review 85, 1029– 1046. 10 FIGURES Excess Demand / Supply 0.8 z 1 (⋅,1) 0.7 z 1 (⋅,1+Δ) p=2 p = 0.5 0.6 -z *2(⋅) ← Good Y 0.5 0.4 z (2,1) 1 0.3 z (0.5,1+Δ) 0.2 1 0.1 0 -0.8 e -0.7 -0.6 -0.5 -0.4 Good X Figure 1: Construction of Preferences 11 -0.3 -0.2 -0.1 0 Factor B Production Function f(α ) (1,α/2) w = (0.5, α/4) x 0 1 Factor A Figure 2: The Production Function The black solid line denotes the 0.5 “ X output isoquant” of f (α ) and the remaining isoquants of f (α ) are determined by constant returns to scale. The segment between w and x has slope -1. Between w and x , the isoquant is a quarter circle. The MRS in the shaded region is infinite. The production function g (α ) for output Y is defined in a symmetric manner by reflecting f (α ) with respect to the line A = B . 12 Transformation Curve Country 1 Good Y F(0.5,1+Δ(α)) F(2,1) F(2,1+Δ(α)) 0 1 Good X Figure 3: Construction of “Reverse Rybczynski” Figure 3 plots the transformation curve for the first country both before and after the factor endowment increase (The production set after the factor increase is indicated by the dashed line). Note, that the diagram only satisfies (ii) in the definition of f (α ) and g (α ) for α relatively large, but this is irrelevant at this point in the argument. At price p (1) = 2 and factor endowment A1 = 1 the profit-maximizing production is F ( 2,1) . As the factor endowment increases to A1 = 1 + Δ (α ) the profit-maximizing production becomes F ( 2,1 + Δ (α ) ) if the price remains at 2 and F ( 0.5,1 + Δ (α ) ) if the price changes to p (1 + Δ (α ) ) = 0.5 . The change from F ( 2,1) to F ( 2,1 + Δ (α ) ) represents the Rybczynski effect (an increase in the production of X and a decrease in the production of Y ). The change from F ( 2,1 + Δ (α ) ) to F ( 0.5,1 + Δ (α ) ) is the “Reverse Rybczynski” effect (a decrease in the production of X and an increase in the production of Y ), when prices change by the required amount. 13