Money and Financial Markets Assets and Liabilities

advertisement

Money and Financial Markets

• Money in a World of Many Financial

Assets and Liabilities

– Three objectives

Money and Financial Markets

• The definition of the money supply

• The determinants of the money supply

• The determinants of money demand

– A stable, or reliable, demand for money is

required for changes in the money supply to

lead to predictable changes in the AD curve

September 14 & 16 and October 26, 1999

1

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• Financial Institutions, Markets, and

Instruments

• Financial Institutions, Markets, and

Instruments (continued)

– Financial markets and financial intermediaries

perform the function of channeling funds from

savers to borrowers

– Reasons for Saving and Borrowing

– Financial Institutions and Financial Markets

• Financial markets channel funds directly

– Size is an important consideration

• Financial intermediaries channel funds indirectly

– Spread risk and collect information efficiently

• Businesses -- net borrowers

• Households -- net savers

• Government -- mixed

• Foreign Sector -- mixed

September 14 & 16 and October 26, 1999

2

• Figure 13 - 1

3

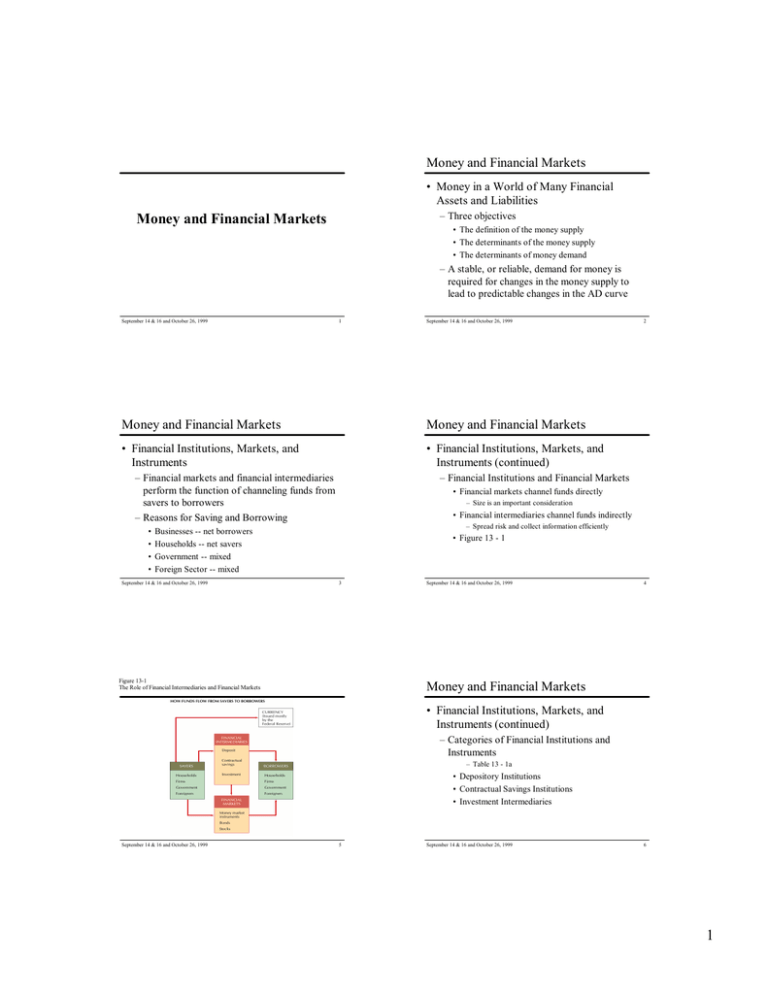

Figure 13-1

The Role of Financial Intermediaries and Financial Markets

September 14 & 16 and October 26, 1999

4

Money and Financial Markets

• Financial Institutions, Markets, and

Instruments (continued)

– Categories of Financial Institutions and

Instruments

– Table 13 - 1a

• Depository Institutions

• Contractual Savings Institutions

• Investment Intermediaries

September 14 & 16 and October 26, 1999

5

September 14 & 16 and October 26, 1999

6

1

Money and Financial Markets

Money and Financial Markets

• Financial Institutions, Markets, and

Instruments (continued)

• Definitions of Money

– Introduction

• There is a spectrum of financial assets running the

gamut of medium-of-exchange to store-of-value

• Financial deregulation has blurred the distinction

between different kinds of financial assets

– Financial Market Instruments

– Table 13 - 1b

• Money Market Instruments

– Original maturities of one year or less

• Capital Market Instruments

– Original maturities of more than one year

September 14 & 16 and October 26, 1999

7

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• Definitions of Money (continued)

• Definitions of Money (continued)

– The M1 Definition of Money

8

– The M2 Definition of Money

– Table 13 - 2

– Table 13 - 2

• Currency

• Transactions accounts

• Travelers checks

• M1

• Savings deposits

• Time deposits

• Money market mutual funds

– Excluded from M2 are mutual funds and all

money and capital market instruments

September 14 & 16 and October 26, 1999

9

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• Definitions of Money (continued)

• High-Powered Money and Determinants of

the Money Supply

– Money Supply Definitions and the Instability of

Money Demand

• The demand for M2 may shift unpredictably when

these omitted assets become more attractive relative

to the assets that are included in M2

September 14 & 16 and October 26, 1999

11

10

– Money Creation on a Desert Island

• An example

September 14 & 16 and October 26, 1999

12

2

Money and Financial Markets

Money and Financial Markets

• High-Powered Money and Determinants of

the Money Supply (continued)

• High-Powered Money and Determinants of

the Money Supply (continued)

– Required Conditions for Money Creation

– The Money-Creation Multiplier

• Equivalence of coins and deposits

• Redeposit of proceeds from loans

• Holding of cash reserves

• Willing borrowers

• Introduction

– High-powered money is the sum of currency held outside

of depository institutions and the reserves held in them

– The demand for high-powered money to be held as

reserves equals the supply of high-powered reserves

– If banks stop lending their excess reserves, the process of

money creation would stop

September 14 & 16 and October 26, 1999

13

e*D=H

D=H/e

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• High-Powered Money and Determinants of

the Money Supply (continued)

• High-Powered Money and Determinants of

the Money Supply (continued)

– The Money-Creation Multiplier (continued)

– The Money-Creation Multiplier (continued)

• Comparison with Income-Determination Multiplier

14

• Comparison with Real-World Conditions

– The intuition behind the money-creation multiplier is the

same as the income-determination multiplier

– e reflects the leakages from the money creation process

– Need to keep everything in the banking system

• Cash Holdings

– Multiplier changes as cash leaks out of the system

(e*D)+(c*D)=H

(e+c)*D=H

D=H/(e+c)

September 14 & 16 and October 26, 1999

15

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• High-Powered Money and Determinants of

the Money Supply (continued)

• High-Powered Money and Determinants of

the Money Supply (continued)

– The Money-Creation Multiplier (continued)

16

– Gold Discoveries and Bank Panics

• Cash Holdings (continued)

• Can change H, c, or e

M=D+c*D=(1+c)*D

M=(1+c)*D={(1+c)*H}/(e+c)

– The ratio of the money supply to high-powered money

( M / H ) is called the money multiplier

M/H=(1+c)/(e+c)

– There is a separate money multiplier for each definition of

the money supply

September 14 & 16 and October 26, 1999

17

September 14 & 16 and October 26, 1999

18

3

Money and Financial Markets

Money and Financial Markets

• The Fed’s Three Tools for Changing the

Money Supply

• The Fed’s Three Tools for Changing the

Money Supply (continued)

– In order to control the money supply the Fed

must predict the public’s desired cash-holding

ratio ( c ), over which the Fed has no control.

– Then the Fed can adjust H and e to make its

desired M consistent with the public’s chosen c

– First Tool: Open-Market Operations

• Purchases and sales of government securities made

by the Federal Reserve

• H is Created out of Thin Air

• Effect on Interest Rates

– Sometimes the Fed engages in open-market operations

even when it has no desire to raise or lower the money

supply

September 14 & 16 and October 26, 1999

19

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• The Fed’s Three Tools for Changing the

Money Supply (continued)

• The Fed’s Three Tools for Changing the

Money Supply (continued)

– Second Tool: Discount Rate

20

– Third Tool: Reserve Requirements

• The interest rate the Federal Reserve charges

depository institutions when they borrow reserves

• Most an emergency tool

• The minimum fraction of deposits that must be held

as reserves

– Required reserves

– Held in reserve accounts at the Fed or as vault cash

• The Fed can change the money supply by changing

bank reserve requirements, e

• Banks would hold some reserves even without

reserve requirements but they would be much less

September 14 & 16 and October 26, 1999

21

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• The Fed’s Three Tools for Changing the

Money Supply (continued)

• Theories of the Demand for Money

22

– Introduction

• Understand why the demand for money depends on

the interest rate available on assets that are

alternatives to money

• Understand why the demand for money might shift

in response to financial deregulation or other events

– Why the Fed Can’t Control the Money Supply

Precisely (Money-Multiplier Shocks)

• Multiple Definitions of Money

• The Public Chooses the Amount of Currency

– Foreigners

• Deposit Shifts between Reserve Categories

September 14 & 16 and October 26, 1999

23

September 14 & 16 and October 26, 1999

24

4

Figure 13-2 Alternative Allocations of an Individual’s Monthly Paycheck Between Cash and

Savings Deposits

Money and Financial Markets

• Theories of the Demand for Money (con’t)

– Interest-Responsiveness of the Transactions

Demand for Money (continued)

• Introduction

– Transaction demand for money depends on interest rate

– Funds can be held either in M1 or in savings accounts

» Figure 13 - 2

• Costs and Benefits of Holding Money

September 14 & 16 and October 26, 1999

25

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• Theories of the Demand for Money (con’t)

• Theories of the Demand for Money (con’t)

– Interest-Responsiveness of the Transactions

Demand for Money (continued)

26

– The Portfolio Approach

• Tobin’s Contribution

– Households diversify their holdings of financial assets

between risky and risk-free assets

– Does not explain why anyone holds currency or noninterest bearing checking accounts when alternatives are

available

• How Many Trips to the Bank?

Cost = b * T + ( r * C ) / 2

– The combined cost of broker’s fees and interest income

foregone should be minimized

Cost = b * ( Y / C ) + ( r * C ) / 2

• Friedman’s Version

– It can be shown that cash is minimized when

– Portfolio needs to include a broader array of assets

C = { ( 2 * b * Y ) / r } * 0.5

September 14 & 16 and October 26, 1999

27

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• CASE STUDY:

How Financial Deregulation and Innovation

Steepened the IS and LM Curves

• CASE STUDY (continued)

– Deregulation of financial markets can increase

the volatility of interest rates

September 14 & 16 and October 26, 1999

29

28

– Effects of Regulation Q

• Disintermediation, the effect on interest rates,

mortgage financing, and housing activity

September 14 & 16 and October 26, 1999

30

5

Figure 13-3

The Effect of Financial Deregulation in the Commodity and Money Markets

Money and Financial Markets

• CASE STUDY (continued)

– Financial Deregulation and the IS Curve

• Financial deregulation and innovations

–

–

–

–

Repeal of Req. Q

Introduction of interest-sensitive deposit accounts

Development of the mortgage-backed securities

Introduction of adjustable-rate mortgages

• Because disintermediation no longer stymies

spending, larger increases in interest rates are now

required to reduce spending by the same amount

» Figure 13 - 3a

September 14 & 16 and October 26, 1999

31

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• CASE STUDY (continued)

• CASE STUDY (continued)

– Why the LM Curve Became Steeper

– Effects on Interest Rates

• Financial deregulation and innovations

• The main effect of deregulation is likely to be

increased volatility of interest rates

– Introduction of interest bearing substitutes

– Development of mutual funds

» Figure 13 - 3b

September 14 & 16 and October 26, 1999

32

» Figure 13 - 4

• Deregulation can have adverse side effects that may

partially offset the benefits of greater efficiency and

fairness when prices play the main role in balancing

supply and demand in financial markets

33

Figure 13-4

The Effect of a Lower Money Supply on Interest Rates and Output

September 14 & 16 and October 26, 1999

34

Money and Financial Markets

• Why the Fed “Sets” Interest Rates

– Introduction

• Pervasive deregulation and innovation in financial

markets were apparently major contributors to the

frequent instability of the demand for money

• Sometimes the IS and LM curves will shift

unpredictably for reasons unrelated to financial

deregulation and innovation

• Large, frequent, and continuing instability of the

demand for money has led the Fed shift its focus

from the money supply to interest rates

September 14 & 16 and October 26, 1999

35

September 14 & 16 and October 26, 1999

36

6

Figure 13-5 Effects on Real Output of Policies That Either Stabilize the Interest Rate or Stabilize

the Real Money Supply When Either Commodity Demand or Money Demand is Unstable

Money and Financial Markets

• Why the Fed “Sets” Interest Rates (con’t)

– Introduction (continued)

• Show why the unpredictability, or instability, of the

demand for money led the Fed to shift its policies

toward setting interest rates

• Cannot set interest rates

– Only influence rates through open market operations

• Figure 13 - 5

– When commodity demand is unstable the IS curve shifts

back and forth

– When the demand for money is unstable the LM curve

shifts back and forth

September 14 & 16 and October 26, 1999

37

September 14 & 16 and October 26, 1999

Money and Financial Markets

Money and Financial Markets

• Why the Federal Reserve “Sets” Interest

Rates (continued)

• Why the Federal Reserve “Sets” Interest

Rates (continued)

– Introduction (continued)

– Introduction (continued)

• Implications of Unstable Commodity Demand

• The Analysis with Unstable Money Demand

» Figure 13 - 5a

– Targeting money supply

– Targeting interest rates

– Targeting real GDP

September 14 & 16 and October 26, 1999

38

» Figure 13 - 5b

– Targeting money supply

– Targeting interest rates

– Targeting real GDP

39

September 14 & 16 and October 26, 1999

40

Money and Financial Markets

• Why the Federal Reserve “Sets” Interest

Rates (continued)

– The Case for a GDP Target

• Real GDP targeting is best for either:

– Unstable commodity demand

– Unstable demand for money

• With supply shocks

– Targeting nominal GDP leads to lower real GDP

– Targeting real GDP leads to higher inflation

» Accommodating monetary policy

September 14 & 16 and October 26, 1999

41

7