Chapter 5: open economy

advertisement

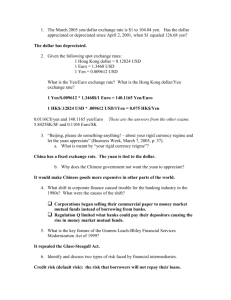

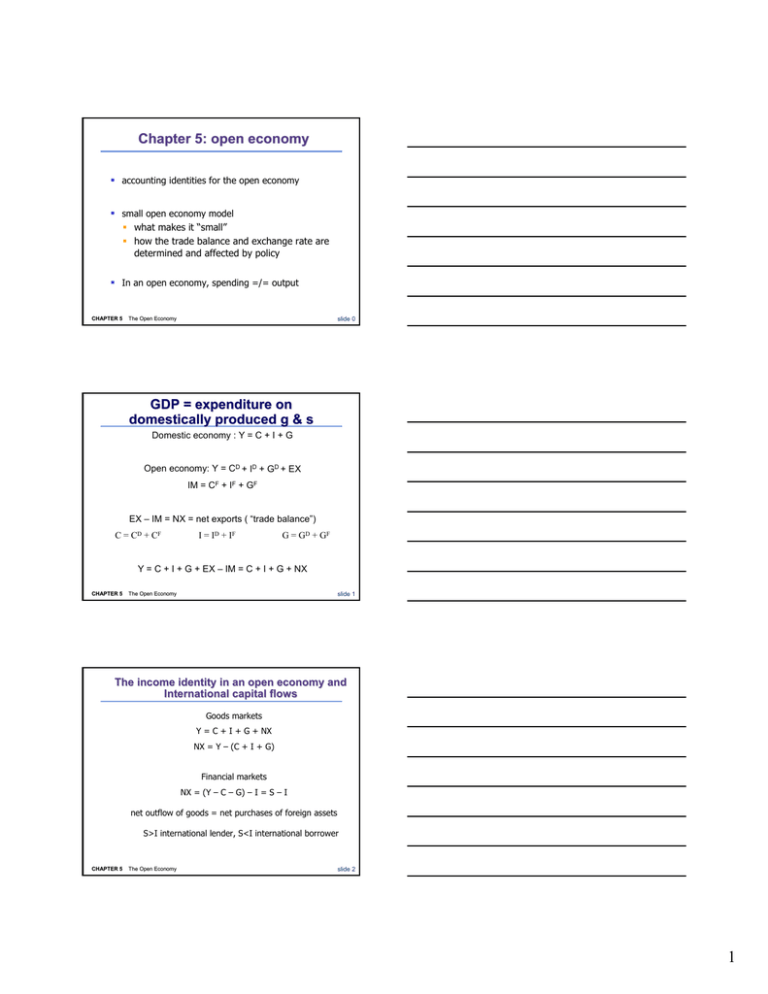

Chapter 5: open economy accounting identities for the open economy small open economy model what makes it “small” how the trade balance and exchange rate are determined and affected by policy In an open economy, spending =/= output CHAPTER 5 slide 0 The Open Economy GDP = expenditure on domestically produced g & s Domestic economy : Y = C + I + G Open economy: Y = CD + ID + GD + EX IM = CF + IF + GF EX – IM = NX = net exports ( “trade balance”) C = CD + CF I = I D + IF G = GD + G F Y = C + I + G + EX – IM = C + I + G + NX CHAPTER 5 slide 1 The Open Economy The income identity in an open economy and International capital flows Goods markets Y = C + I + G + NX NX = Y – (C + I + G) Financial markets NX = (Y – C – G) – I = S – I net outflow of goods = net purchases of foreign assets S>I international lender, S<I international borrower CHAPTER 5 The Open Economy slide 2 1 Saving and Investment in a Small Open Economy Open-economy version loanable funds model. Key elements: production function: consumption function: Y Y F (K , L ) C C (Y T ) I I (r ) investment function: exogenous policy variables: G G , T T CHAPTER 5 slide 3 The Open Economy Assumptions about capital flows a. domestic & foreign bonds are perfect substitutes (same risk, maturity, etc.) b. perfect capital mobility: no restrictions on international trade in assets c. economy is small: cannot affect the world interest rate, denoted r* A and B r = r* C r* exogenous CHAPTER 5 slide 4 The Open Economy Investment and saving r S Y C (Y T ) G NX r* rc I (r ) I1 CHAPTER 5 The Open Economy S, I slide 5 2 Experiment 1: Fiscal policy at home r S 2 S1 An increase in G reduces saving. NX2 r1* NX1 Results: I 0 I (r ) NX S 0 S, I I1 CHAPTER 5 slide 6 The Open Economy 2. Fiscal policy abroad r Expansionary fiscal policy abroad raises the world interest rate. NX2 r2* S1 NX1 r1* Results: I 0 I (r ) NX I 0 I (r1* ) I (r2* ) CHAPTER 5 S, I slide 7 The Open Economy The nominal exchange rate e = nominal exchange rate, the relative price of one currency in terms of the other country exchange rates Euro 1.46 $/Euro (0.68 Euro/$) Japan 90 Yen/$ Beware of the conventions! Euro: we normally quote dollar vs euro Yen: we normally quote yen vs dollar CHAPTER 5 The Open Economy slide 8 3 The real exchange rate = real exchange rate, relative price of domestic goods in terms of foreign goods e P (Yen per $) ($ per unit U.S. goods) P* Yen per unit Japanese goods ε CHAPTER 5 Yen per unit U.S. goods Yen per unit Japanese goods Units of Japanese goods per unit of U.S. goods slide 9 The Open Economy ~ example 1 ~ one good: Big Mac price in Japan: P* = 280 Yen price in USA: P = $3.50 nominal exchange This example: ε>1 Goods in US are ``more expensive” than in Japan Dollar is overvalued wrt yen rate e = 90 Yen/$ ε =90 x 3.50 / 280 = 1.125 CHAPTER 5 Would need 80 Yen/$ to restore PPP. slide 10 The Open Economy ~ example 2 ~ one good: Kindle (from Amazon.com, .de) price in Euro Area: P* = 270 euros price in USA: P = 300 dollars nominal exchange rate This example: ε<1 Goods in US are ``less expensive” than in the Euro area (25% cheaper) e = 0.68 Euro/$ ε =0.68 x 300 / 270 = 0.75 CHAPTER 5 The Open Economy slide 11 4 How NX depends on ε ε U.S. goods become more expensive relative to foreign goods EX, IM NX The net exports function : NX = NX (ε ) CHAPTER 5 slide 12 The Open Economy How ε is determined NX = S I • S depends on domestic factors (output, fiscal policy variables, etc) • I is determined by the world interest rate r * ε must adjust to ensure NX (ε ) S I (r *) CHAPTER 5 slide 13 The Open Economy How ε is determined ε S 1 I (r *) ε1 NX(ε ) NX 1 CHAPTER 5 The Open Economy NX slide 14 5 Exp 1. Fiscal policy at home S 2 I (r *) ε S 1 I (r *) ε2 ε1 NX(ε ) CHAPTER 5 NX NX 1 NX 2 slide 15 The Open Economy Exp. 2. Fiscal policy abroad S 1 I (r1 *) ε S 1 I (r 2 * ) ε1 ε2 NX(ε ) NX 1 CHAPTER 5 NX 2 NX slide 16 The Open Economy From real to nominal variables: Nominal Exchange Rate determination Real exchange rate: e P / P* Solve for nominal exchange rate: e ε P* P M L (r * ,Y ) P N X (ε ) S I (r *) e e CHAPTER 5 ε ε P * P* The Open Economy P P M* L * (r * *,Y * ) P* ε ε * slide 17 6 Inflation and nominal exchange rates Percentage 10 change 9 in nominal exchange 8 rate 7 6 5 4 3 2 1 South Africa New Zealand Australia Spain Sweden Ireland Canada UK France Belgium 0 -1 Germany Netherlands -2 Switzerland -3 Japan -4 -3 -2 -1 0 CHAPTER 5 Depreciation relative to U.S. dollar Italy Appreciation relative to U.S. dollar 1 2 3 4 5 6 7 8 Inflation differential slide 18 The Open Economy Purchasing Power Parity (PPP) goods must sell at the same (currency adjusted) price in all countries. e P = P* PPP: ε e CHAPTER 5 P P* P 1 * P P P* slide 19 The Open Economy Purchasing Power Parity (PPP) If e = P*/P, then and the NX curve is horizontal: ε ε =1 S I NX Under PPP, changes in (S I ) have no impact on ε or e. NX CHAPTER 5 The Open Economy slide 20 7 Does PPP hold in the real world? No, for two reasons: 1. International arbitrage not possible. nontraded goods transportation costs 2. Goods in different locations are not perfect substitutes. CHAPTER 5 slide 21 The Open Economy US: large open economy A FISCAL EXPANSION causes national saving to fall. The effects of this depend on the degree of openness: closed economy large open economy small open economy r rises rises, but not as much as in closed economy no change I falls falls, but not as much as in closed economy no change NX no change falls, but not as much as in small open economy falls CHAPTER 5 The Open Economy slide 22 8