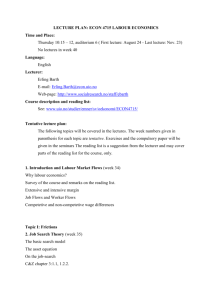

Wesleyan Economic Working Papers N : 2012-007

advertisement