• What is consumer surplus? How is it related

advertisement

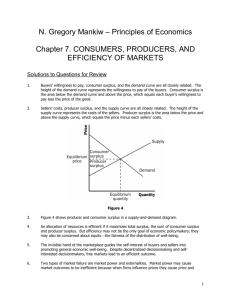

In this chapter, look for the answers to these questions: • What is consumer surplus? How is it related to the demand curve? • What is producer surplus? How is it related to the supply curve? • Do markets produce a desirable allocation of resources? Or could the market outcome be improved upon? © 2007 Thomson South-Western Consumers, Producers and the Efficiency of Markets • Revisiting the Market Equilibrium – Do the equilibrium price and quantity maximize the total welfare of buyers and sellers? – Market equilibrium reflects the way markets allocate scarce resources. – Whether the market allocation is desirable can be addressed by welfare economics. © 2007 Thomson South-Western © 2007 Thomson South-Western Consumers, Producers and the Efficiency of Markets • Welfare Economics – Welfare economics is the study of how the allocation of resources affects economic well-being. – Buyers and sellers receive benefits from taking part in the market. – The equilibrium in a market maximizes the total welfare of buyers and sellers. – Equilibrium in the market results in maximum benefits, and therefore maximum total welfare for both the consumers and the producers of the product. – Consumer surplus measures economic welfare from the buyer’s side. – Producer surplus measures economic welfare from the seller’s side. © 2007 Thomson South-Western Table 1: Four Possible Buyers’ Willingness to Pay CONSUMER SURPLUS • Willingness to pay is the maximum amount that a buyer will pay for a good. • It measures how much the buyer values the good or service. • Consumer surplus is the buyer’s willingness to pay for a good minus the amount the buyer actually pays for it. © 2007 Thomson South-Western © 2007 Thomson South-Western 1 Using the Demand Curve to Measure Consumer Surplus WTP and the Demand Curve Q: If price of iPod is $200, who will buy an iPod, and what is quantity demanded? name WTP A: Anthony & Flea will buy an iPod, Chad & John will not. Anthony $250 Chad 175 Flea 300 John 125 • The market demand curve depicts the various quantities that buyers would be willing and able to purchase at different prices. Hence, Qd = 2 when P = $200. © 2007 Thomson South-Western © 2007 Thomson South-Western Figure 1 The Demand Schedule and the Demand Curve The Demand Schedule and the Demand Curve Price of Album John’s willingness to pay $100 Paul’s willingness to pay 80 George’s willingness to pay 70 Ringo’s willingness to pay 50 Demand 0 1 2 3 4 Quantity of Albums © 2007 Thomson South-Western Figure 2 Measuring Consumer Surplus with the Demand Curve © 2007 Thomson South-Western Figure 2 Measuring Consumer Surplus with the Demand Curve (a) Price = $80 (b) Price = $70 Price of Album Price of Album $100 $100 John ’s consumer surplus ($30) John ’s consumer surplus ($20) 80 80 Paul’s consumer surplus ($10) 70 70 50 50 Total consumer surplus ($40) Demand Demand 0 1 2 3 4 Quantity of Albums 0 © 2007 Thomson South-Western 1 2 3 4 Quantity of Albums © 2007 Thomson South-Western 2 Using the Demand Curve to Measure Consumer Surplus • The area below the demand curve and above the price measures the consumer surplus in the market. • Consumer surplus is the amount the buyer is willing to pay minus the price the buyer actually pays. Figure 3 How the Price Affects Consumer Surplus (a) Consumer Surplus at Price P Price A Consumer surplus P1 B C Demand 0 Q1 Quantity © 2007 Thomson South-Western © 2007 Thomson South-Western What Does Consumer Surplus Measure? Figure 3 How the Price Affects Consumer Surplus (b) Consumer Surplus at Price P Price • Consumer surplus, the amount that buyers are willing to pay for a good minus the amount they actually pay for it, measures the benefit that buyers receive from a good as the buyers themselves perceive it. A Initial consumer surplus P1 P2 0 C B Consumer surplus to new consumers F D E Additional consumer surplus to initial consumers Q1 Demand Q2 Quantity © 2007 Thomson South-Western © 2007 Thomson South-Western Table 2: The Costs of Four Possible Sellers PRODUCER SURPLUS • Producer surplus is the amount a seller is paid for a good minus the seller’s cost. • It measures the benefit to sellers participating in a market. © 2007 Thomson South-Western © 2007 Thomson South-Western 3 Using the Supply Curve to Measure Producer Surplus The Supply Schedule and the Supply Curve • Just as consumer surplus is related to the demand curve, producer surplus is closely related to the supply curve. © 2007 Thomson South-Western © 2007 Thomson South-Western Figure 4 The Supply Schedule and the Supply Curve Using the Supply Curve to Measure Producer Surplus • The area below the price and above the supply curve measures the producer surplus in a market. • The producer surplus is the actual price received by the seller minus the minimum price the seller is willing to accept. © 2007 Thomson South-Western © 2007 Thomson South-Western Figure 5 Measuring Producer Surplus with the Supply Curve Figure 5 Measuring Producer Surplus with the Supply Curve (a) Price = $600 (b) Price = $800 Price of House Painting Price of House Painting Supply $900 $900 800 Supply Total producer surplus ($500) 800 600 600 500 500 Georgia’s producer surplus ($200) Grandma’s producer surplus ($100) Grandma’s producer surplus ($300) 0 1 2 3 4 Quantity of Houses Painted 0 © 2007 Thomson South-Western 1 2 3 4 Quantity of Houses Painted © 2007 Thomson South-Western 4 Figure 6 How the Price Affects Producer Surplus Figure 6 How the Price Affects Producer Surplus (a) Producer Surplus at Price P (b) Producer Surplus at Price P Price Price Supply P2 P1 B Producer surplus P1 C A 0 Supply Additional producer surplus to initial producers D E F B Initial producer surplus C Producer surplus to new producers A Q1 Quantity 0 Q1 Q2 Quantity © 2007 Thomson South-Western © 2007 Thomson South-Western The Benevolent Social Planner MARKET EFFICIENCY • Consumer surplus and producer surplus may be used to address the following question: – Is the allocation of resources determined by free markets in any way desirable? Consumer Surplus = Value to buyers – Amount paid by buyers Producer Surplus = Amount received by sellers – Cost to sellers Total surplus = Consumer surplus + Producer surplus = (value to buyers) – (amount paid by buyers) + (amount received by sellers) – (cost to sellers) Total surplus = Value to buyers – Cost to sellers © 2007 Thomson South-Western © 2007 Thomson South-Western Efficiency The Benevolent Social Planner Total surplus = (value to buyers) – (cost to sellers) • Efficiency is the property of a resource allocation of maximizing the total surplus received by all members of society. • In addition to market efficiency, a social planner might also care about equity – the fairness of the distribution of well-being among the various buyers and sellers. © 2007 Thomson South-Western • Efficiency means making the pie as big as possible. • In contrast, equity refers to whether the pie is divided fairly. • What’s “fair” is subjective, harder to evaluate. • Hence, we focus on efficiency as the goal, even though policymakers in the real world usually care about equity, too. © 2007 Thomson South-Western 5 Figure 7 Consumer and Producer Surplus in the Market Equilibrium Evaluating the Market Equilibrium Price A D • Three Insights Concerning Market Outcomes Supply • Free markets allocate the supply of goods to the buyers who value them most highly, as measured by their willingness to pay. • Free markets allocate the demand for goods to the sellers who can produce them at least cost. • Free markets produce the quantity of goods that maximizes the sum of consumer and producer surplus. Consumer surplus Equilibrium price E Producer surplus B Demand C 0 Quantity Equilibrium quantity © 2007 Thomson South-Western © 2007 Thomson South-Western Figure 8 The Efficiency of the Equilibrium Quantity Price Value to buyers • Because the equilibrium outcome is an efficient allocation of resources, the social planner can leave the market outcome as he/she finds it. • This policy of leaving well enough alone goes by the French expression laissez faire (French for “allow them to do”). Cost to sellers Cost to sellers 0 Evaluating the Market Equilibrium Supply Value to buyers Equilibrium quantity Value to buyers is greater than cost to sellers. Demand Quantity Value to buyers is less than cost to sellers. © 2007 Thomson South-Western © 2007 Thomson South-Western Why Non-Market Allocations Are Usually Bad • Suppose the allocation of resources were instead determined by a central planner (e.g., the Communist leaders of the former Soviet Union.) • To choose an efficient allocation, the planner would need to know every seller’s cost and every buyer’s WTP, for each of the thousands of goods produced in the economy. Evaluating the Market Equilibrium • Market Power • If a market system is not perfectly competitive, market power may result. • Market power is the ability to influence prices. • Market power can cause markets to be inefficient because it keeps price and quantity from the equilibrium of supply and demand. • This is practically impossible, so centrally planned economies are never very efficient. © 2007 Thomson South-Western © 2007 Thomson South-Western 6 Evaluating the Market Equilibrium • Externalities • created when a market outcome affects individuals other than buyers and sellers in that market. • cause welfare in a market to depend on more than just the value to the buyers and cost to the sellers. • When buyers and sellers do not take externalities into account when deciding how much to consume and produce, the equilibrium in the market can be inefficient. © 2007 Thomson South-Western 7