Unilateral Trade Policy Professor Ralph Ossa 33501 International Commercial Policy

advertisement

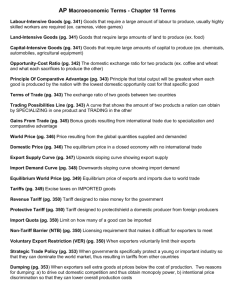

Unilateral Trade Policy Professor Ralph Ossa 33501 International Commercial Policy International Commercial Policy Unilateral Trade Policy Introduction So far, we compared two extreme scenarios, autarky and free trade, and concluded that countries are usually better off under free trade. But is free trade also a country’s optimal trade policy? And why do governments engage in trade policy in practice? In this lecture we look at unilateral trade policy only. In the next lecture we will then consider multilateral trade negotiations. 2 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments Governments use a wide range of trade policy instruments in practice. The most important ones are: (i) import tariffs, (ii) export subsidies, (iii) import quotas, (iv) voluntary export restraints, and (v) local content requirements 3 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – import tariffs Import tariffs are simply taxes on imported goods. Governments usually impose one of two types of import tariffs: A specific tariff, i.e. a tariff charged per unit of imports, say $1,000 per imported automobile. An ad valorem tariff, i.e. a tariff charged per value of imports, say $.1 per $1 worth of imported automobiles (or simply 10 percent). 4 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – import tariffs (cont.) In the U.S., tariffs are relatively modest by international standards. Currently, the U.S. average (ad valorem equivalent) tariff is less than 2 percent. However, this does not imply that U.S. tariffs are low in all sectors. Indeed, the U.S. imposes much higher tariffs in sectors such as clothing and apparel, leather and footwear, and agriculture. Remember also our discussion on antidumping duties. 5 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – export subsidies Export subsidies are simply subsidies on exported goods. Governments again usually impose one of two types of export subsidies: A specific export subsidy, i.e. a subsidy paid per unit of exports, say $1,000 per exported automobile. An ad valorem export subsidy, i.e. a subsidy paid per value of exports, say $.1 per $1 worth of exported automobiles (or simply 10 percent). 6 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – export subsidies (cont.) In the U.S., export subsidies are mainly applied in agriculture. An example is the Department of Agriculture’s Dairy Export Incentive Program (DEIP). The DEIP is designed to help “exporters of dairy products meet prevailing world prices for targeted dairy products and destinations”. The E.U.’s Common Agricultural Policy is another wellknown agricultural export subsidy program (more on that later). 7 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – import quotas An import quota is a restriction on the quantity of a good that may be imported. This restriction is usually enforced through import licenses. While these are usually issued to importers in the importing country, they are also sometimes issued to governments of exporting countries. In the U.S., the quota on sugar imports is an example of the latter kind. It restricts yearly sugar imports to approximately 1.4 million tons. 8 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – voluntary export restraint A voluntary export restraint (VER) is essentially an export quota. Despite its name it is typically not fully voluntary but instead requested by an importing country. The Japanese VER on auto exports to the U.S. between 1981 and 1985 is perhaps the best known example. It restricted Japanese auto exports to the U.S. to 1.68 million units initially and 1.85 million units eventually. 9 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – local content requirement A local content requirement is a regulation that requires a specific fraction of the final good to be produced domestically. In may be specified in terms of value or of physical units. In the U.S., the Buy American Act is a good example. It was originally passed in 1933 and requires government agencies to give preference to U.S. firms in their procurement. In particular, a bid by a foreign company can only be accepted if it is a specified percentage below the lowest bid by a U.S. firm. 10 International Commercial Policy Unilateral Trade Policy Overview of trade policy instruments – local content requirement (cont.) Also, American firms are not allowed to simply act as sales agents for foreign firms. While “American” products may contain some foreign parts, 51 percent of the materials must be domestic. This requirement can lead to some curious situations. For example, the “made in the USA” buses bought in 1995 by the cities of Miami and Baltimore were really 49 percent “made in Hungary”. 11 International Commercial Policy Unilateral Trade Policy Overview of the lecture Unfortunately, we cannot discuss all effects of all these trade policy instruments in detail. We only analyze import tariffs and export subsidies in a simple perfectly competitive environment: (i) What is a country’s optimal import tariff? Why do governments impose import tariffs in practice? (ii) What is a country’s optimal export subsidy? Why do governments impose export subsidies in practice? 12 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework Consider an industry in which Home is an importer and Foreign is an exporter. It is useful to illustrate the (partial) equilibrium using import demand and export supply curves. Home’s import demand curve measures the quantity Home’s consumers demand minus the quantity Home’s producers supply for any given Home price. 13 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Price No-trade equilibrium Price S PA A' Each point on the import demand curve is a point that corresponds to Home imports at a given Home price A B PW D S1 Q0 D1 Quantity 14 Imports, M1 Import demand curve, M M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Foreign’s export supply curve measures the quantity Foreign’s producers supply minus the quantity Foreign’s consumers demand for any given Foreign price. Home is typically referred to as small, if changes in Home’s import demand have only a negligible effect on Foreign’s price so that Foreign’s export supply curve facing Home is flat. Home is typically referred to as large, if changes in Home’s import demand have a non-negligible effect on Foreign’s price so that Foreign’s export supply curve facing Home is upward sloping. 15 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Price No-trade equilibrium Case 1: Home is small Price S PA A' A B PW D S1 Q0 D1 Quantity 16 Imports, M1 Foreign export supply, X* Import demand curve, M M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Price No-trade equilibrium Case 2: Home is large Price S PA A' Foreign export supply, X* A B PW D S1 Q0 D1 Quantity 17 Imports, M1 Import demand curve, M M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Consumer welfare can be measured by consumer surplus, in this supply and demand framework. Consumer surplus is given by the difference between what consumers would be maximally willing to pay and what they actually pay. Graphically, it can be represented by the area below the demand curve and above the price. 18 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) 19 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Producer welfare can be measured by producer surplus in this supply and demand framework. Producer surplus is given by the difference between what producers would be minimally willing to charge and what they actually charge. We can loosely refer to this difference as profits. Graphically, it can be represented by the area above the supply curve and below the price. 20 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) 21 International Commercial Policy Unilateral Trade Policy Optimal import tariff – basic framework (cont.) Suppose now that Home’s government imposes a specific import tariff. Notice that the tariff drives a wedge between the price in Home and the price in Foreign. For example, if the tariff is $1,000 per unit, PT = PT* + 1,000. In general, PT = PT* + t. 22 International Commercial Policy Unilateral Trade Policy Optimal import tariff – overview The effects of Home’s tariff differ in important ways between the small country and the large country case and we discuss both cases in turn. First, we demonstrate that the optimal tariff of a small country is zero. Second, we show that the optimal tariff of a large country is positive. 23 International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case Home price rises by the amount of the tariff No-trade equilibrium Price Price S Home supply increases and Home demand decreases imports fall to M2 Foreign producers still receive the net-of-tariff price PW A C PT=PW+t B PT*=PW PW X*+t D D D S1 S 2 2 1 M2 24 Quantity Foreign export supply, X* M M2 M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case (cont.) No-trade equilibrium The loss in consumer surplus due to the higher price with the tariff is equal to the shaded area (a+b+c +d) Price S A b d PW+t a c PW D S1 S2 D2 D1 Quantity 25 M2 International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case (cont.) No-trade equilibrium The gain in producer surplus due to the higher price with the tariff is equal to the shaded area (a) Price S A b d PW+t a c PW D S1 S2 D2 D1 Quantity 26 M2 International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case (cont.) No-trade equilibrium The gain in government revenue due to the tariff is equal to the shaded area (c) Price S This equals the tariff, t, times the quantity of imports, M2 A b d PW+t a c PW D S1 S2 D2 D1 Quantity 27 M2 International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case (cont.) The optimal tariff of a small country is therefore zero: Fall in consumer surplus Rise in producer surplus Rise in government revenue Net effect on Home welfare -(a+b+c+d) +(a) +(c) -(b+d) The area (b+d) is referred to as deadweight loss or efficiency loss. It arises because the tariff distorts consumption and production decisions. 28 International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case (cont.) No-trade equilibrium (a) is a transfer from consumers to producers Price (c) is a transfer from consumers to the government (b+d) is deadweight loss S A b d PW+t a c PW D S1 S2 D2 D1 Quantity 29 M2 International Commercial Policy Unilateral Trade Policy Optimal import tariff – small country case (cont.) The deadweight loss can also be illustrated in the import demand and export supply diagram Price Dead weight loss due to tariff, b+d X*+ t C X* M M2 30 M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case Home price now rises by less than the amount of the tariff Price Price No-trade equilibrium Foreign producers are absorbing part of the tariff X*+t S A PT*+t t t PW PT* D X* t C B* C* M S1 S2 D2 D1 Quantity M2 M1 31 M2 M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case (cont.) No-trade equilibrium Price Price X*+t S b+d A PT*+t PW PT* a e t X* C c b -(a+b+c+d) +(a) +(c+e) - (b+d) + (e) Fall in consumer surplus Rise in producer surplus Rise in government revenue Net effect on Home welfare d B* D e C* M S1 S2 D2 D1 Quantity 32 M2 M1 Imports International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case (cont.) The net effect on Home welfare is therefore ambiguous. It is positive if e > b + d and negative if e < b + d. On the one hand, there is again a deadweight loss (b + d) just as in the small country case. It again arises because the tariff distorts Home’s consumption and production decisions. But on the other hand, there is now also a terms-oftrade gain (e). It arises because the tariff lowers Foreign’s export prices. 33 International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case (cont.) It can be shown that the terms-of-trade gain dominates the deadweight loss for a sufficiently small tariff so that the optimal tariff of a large country is positive. The derivation of this result is actually not too difficult. If you are interested, you can take a look at the appendix to chapter 9 in K-O. 34 International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case (cont.) The optimal tariff maximizes the importer’s welfare, point C Too high of a tariff will decrease importer’s welfare and can increase to the point where there is no trade Terms of trade gain exceeds deadweight loss Importer’s Welfare C Free Trade B' B A No Trade 35 Terms of trade gain is less than deadweight loss Optimal Tariff Prohibitive Tariff Tariff International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case (cont.) It turns out that the optimal tariff is just the inverse of the elasticity of Foreign export supply: Optimal tariff = 1/EX* EX* is the percentage increase in the quantity exported in response to a percentage increase in the world price of the export. Intuitively, the optimal tariff is decreasing in EX* since Home’s monopsony power in world markets is decreasing in EX*. 36 International Commercial Policy Unilateral Trade Policy Optimal import tariff – large country case (cont.) As is easy to verify, Home’s gain from a tariff comes directly at Foreign’s expense. This is because Home’s terms-of-trade gain is Foreign’s terms-of-trade loss. The optimal tariff is therefore a beggar-thy-neighbor policy. This observation will play a crucial role in our discussion of trade negotiations next week. 37 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff This model can be used to estimate how costly tariffs are in practice. We illustrate this using the case of U.S. steel tariffs, which were in place from March 2002 until December 2003. For simplicity, we consider only the small country case. Of course, this estimate is very rough since it relies on many special assumptions (small country, no variety effects, no productivity effects, etc.). However, it is a useful starting point for more sophisticated calculations. 38 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) During the 2000 presidential campaign, George W. Bush promised to protect the U.S. steel industry. To deliver on this promise, he requested that the International Trade Commission (ITC) initiate a Section 201 investigation into the steel industry. As we will discuss in more detail next week, Section 201 of the U.S. Trade Act of 1974 mirrors Article XIX of the General Agreement on Tariffs and Trade (GATT), known as the “safeguard” or “escape clause”. It allows a temporary tariff to be used under certain circumstances. 39 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) After investigating, the ITC determined that the conditions of section 201 and Article XIX were met and recommended that tariffs be put in place to protect the U.S. steel industry. The tariffs recommended by the ITC varied across products, ranging from 10 percent to 20 percent for the first year and then falling over time so as to be eliminated after three years. President Bush accepted the ITC’s recommendation but applied even higher tariffs. 40 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) 41 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) Knowing that U.S. trading partners would be upset by this action, President Bush exempted some countries from the tariffs on steel. The countries exempted included Canada, Mexico, Jordan, and Israel, all of which have free-trade agreements with the U.S., and 100 small developing countries that were exporting only a very small amount of steel to the U.S.. 42 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) Recall that the DWL is given by the area of the triangle (b+d) Price Deadweight loss due to the tariff, b+d PW(1+τ) ΔP=PWτ c DWL = ½ PWτ ΔM PW M M2 M1 Imports 43 In our calculation, we have to take into account that the steel tariff is quoted as an ad valorem tariff ΔM International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) It is convenient to first compute the DWL relative to the import value in the year prior to March 2002: DWL ⎛ 1 ⎞ ⎛ PW τ ⎞ ⎛ ΔM ⎞ ⎛ 1 ⎞ = ⎜ ⎟⎜ ⎟ = ⎝ ⎠ (τ )(%ΔM ) ⎝ ⎠ PW M1 2 ⎝ PW ⎠ ⎝ M1 ⎠ 2 Since the most commonly used steel products had a tariff of 30 percent in the year following March 2002, we set τ = .3. Since the quantity of steel imports in the year following March 2002 was about 25 percent less than in the year prior to March 2002, we set %ΔM = -.25. 44 International Commercial Policy Unilateral Trade Policy Application – U.S. steel tariff (cont.) Hence, DWL = ⎛ 1 ⎞ (τ )(%ΔM ) = ⎛ 1 ⎞ (.3)(−.25) = −.0375 PW M ⎝ 2⎠ ⎝ 2⎠ The welfare loss in the year after March 2002 was therefore equal to around 3.75 percent of the import value in the year prior to March 2002. Since the import value in the year prior to March 2002 was equal to around $4.7 billion, the net welfare loss to the U.S. economy in the year after March 2002 was equal to around $176 million. 45 International Commercial Policy Unilateral Trade Policy Import tariffs in practice The above analysis suggests three motives for governments to impose import tariffs: (i) raising government revenue, (ii) increasing producer welfare, (iii) increasing overall welfare. All these motives appear to be relevant in practice. 46 International Commercial Policy Unilateral Trade Policy Import tariffs in practice – raising government revenue Recall that one effect of an import tariff is to generate government revenue. While tariffs are more distortionary than income or value-added taxes, they are also much easier to collect. This makes them an attractive source of government revenue especially for poor countries. Even in the U.S., tariff revenue was the main source of federal government revenue from the 1790s until the 1910s. 47 International Commercial Policy Unilateral Trade Policy Import tariffs in practice – raising government revenue (cont.) 48 International Commercial Policy Unilateral Trade Policy Import tariffs in practice – increasing producer welfare Recall that another effect of an import tariff is to increase producer welfare. Producers are usually better organized politically than consumers and therefore lobby the government more effectively so that the government puts more weight on producer surplus in its trade policy decisions. One reason for this asymmetry is that the political collective action problem is easier to overcome the smaller is the number of benefitting individuals. 49 International Commercial Policy Unilateral Trade Policy Import tariffs in practice – increasing producer welfare (cont.) Most economists believe such special interest politics to be at the heart of most trade policy decisions. In a famous study, Princeton professor Penny Goldberg and Yale professor Giovanni Maggi (1999) find that the degree of import protection is systematically related to campaign contributions in the U.S.. In particular, industries donating more generously tend to receive more import protection in return. 50 International Commercial Policy Unilateral Trade Policy Import tariffs in practice – increasing overall welfare Recall that a small import tariff can also increase overall welfare in the large country case. While the optimal tariff argument is analytically impeccable, most economists believed it to be of little relevance in practice. Very recent evidence provided by Chicago Booth professor Christian Broda together with coauthors, however, suggests that this is not the case. 51 International Commercial Policy Unilateral Trade Policy Import tariffs in practice – increasing overall welfare (cont.) For a sample of non-World Trade Organization (WTO) member countries, Broda et al. (2009) find that import tariffs are systematically related to export supply elasticties. In particular, import tariffs tend to be higher in industries, which face a lower export supply elasticity, just as predicted by the optimal tariff formula. The reason they focus on non-WTO countries will become apparent in the next lecture. 52 International Commercial Policy Unilateral Trade Policy Optimal export subsidy – basic framework Consider now an industry in which Home is an exporter and Foreign is an importer. We can again illustrate the equilibrium in this industry using import demand and export supply curves. Analogous to our above discussion, Foreign’s import demand curve facing Home is flat if Home is a small country and downward sloping if Home is a large country. 53 International Commercial Policy Unilateral Trade Policy Optimal export subsidy – basic framework (cont.) Case 1: Home is small Home Price World Price S D Home export supply X B PW Foreign import demand PA A D 1 54 X1 S1 Quantity X1 Exports International Commercial Policy Unilateral Trade Policy Optimal export subsidy – basic framework (cont.) Case 2: Home is large Home Price World Price S D Home export supply X B PW Foreign import demand PA A D 1 55 X1 S1 Quantity X1 Exports International Commercial Policy Unilateral Trade Policy Optimal export subsidy – basic framework (cont.) Suppose now that Home’s government imposes a specific export subsidy. Notice that the subsidy again drives a wedge between the price in Home and the price in Foreign. For example, if the subsidy is $1,000 per unit, P*S = PS 1,000. In general, PS = PS* + s. 56 International Commercial Policy Unilateral Trade Policy Optimal export subsidy – overview The effects of an export subsidy again differ between the small country and the large country case. However, the differences matter less for the overall result. In particular, the optimal export subsidy is zero in both cases. 57 International Commercial Policy Unilateral Trade Policy Optimal export subsidy – small country case Home price rises by the amount of the subsidy Home Price World Price Foreign consumers still pay PW S D Home supply increases and Home demand decreases exports increase to X2 C PS=PW+s s X X–s B PS*=PW PW C' s A D 2 D 1 58 X1 X2 S1 S2 Quantity X1 X2 Exports International Commercial Policy Unilateral Trade Policy Optimal export subsidy – small country case (cont.) Home Price PW+s s S D b a World Price Total deadweight loss, b+d d X–s C B c PW X C' s A D 2 D 1 59 X2 S1 S2 Quantity X1 X2 Exports International Commercial Policy Unilateral Trade Policy Optimal export subsidy – small country case (cont.) The optimal export subsidy of a small country is therefore zero: Fall in consumer surplus Rise in producer surplus Fall in government revenue Net effect on Home welfare - (a+b) +(a+b+c) - (b+c+d) - (b+d) The area (b+d) is again a deadweight loss arising because of consumption and production distortions. 60 International Commercial Policy Unilateral Trade Policy Optimal export subsidy – large country case Home price now rises by less than the amount of the subsidy Home Price World Price D X2 PS*+s s Foreign consumers are absorbing part of the subsidy Home exports supply, X S s X1 X–s PW PS* Foreign import demand, M* D 2 D 1 61 S1 S2 Quantity X1 X2 Exports International Commercial Policy Unilateral Trade Policy Optimal export subsidy – large country case (cont.) Fall in consumer surplus Rise in producer surplus Fall in government revenue Net effect on Home welfare Home Price D PS*+s s b d S c a PW e PS* D 2 D 1 62 S1 S2 Quantity - (a+b) +(a+b+c) - (b+c+d+e) - (b+d+e) International Commercial Policy Unilateral Trade Policy Optimal export subsidy – large country case (cont.) The optimal export subsidy of a large country is therefore also zero. The welfare costs are even larger than for a small country because of an additional termsof-trade loss. As is easy to verify, Foreign gains from Home’s export subsidy in this case. This is because Home’s terms-oftrade loss is Foreign’s terms-of-trade gain. 63 International Commercial Policy Unilateral Trade Policy Application – Europe’s CAP The E.U.’s Common Agricultural Policy (CAP) provides financial support to European farmers at a massive scale through a variety of policy instruments. CAP expenditures were 49.8€ billion in 2006, accounting for 48 percent (!) of the E.U.’s entire budget. The CAP began as an effort to guarantee high prices to European farmers by having the E.U. buy agricultural products whenever the prices fell below specified support levels. 64 International Commercial Policy Unilateral Trade Policy Application – Europe’s CAP (cont.) To prevent this policy from drawing in large quantities of imports, it was initially backed by tariffs that offset the difference between European and world agricultural prices. The result was that the E.U. found itself obliged to store huge quantities of food. At the end of 1985, European nations had stored 780,000 tons of beef, 1.2 million tons of butter, and 12 million tons of wheat. 65 International Commercial Policy Unilateral Trade Policy Application – Europe’s CAP (cont.) To avoid unlimited growth in these stockpiles, the E.U. turned to a policy of subsidizing exports to dispose of surplus production. In view of our analysis of export subsidies above, who gained and lost from these export subsidies, assuming (realistically) that the E.U. is a large country? 66 International Commercial Policy Unilateral Trade Policy Application – Europe’s CAP (cont.) European farmers gained, European consumers lost, and European governments had to incur the subsidy costs. On balance, Europe lost from these export subsidies. Farmers in the rest of the world lost and consumers in the rest of the world gained. On balance, the rest of the world gained from these export subsidies. The negative effect on farmers in developing countries was often criticized. 67 International Commercial Policy Unilateral Trade Policy Application – Europe’s CAP (cont.) Starting in 1992, the CAP has been reformed substantially. It is now much less based on price support and much more on direct payments to farmers, which are often independent of the amount of production. Nevertheless, agricultural protectionism is still a highly controversial issue in multilateral trade negotiations. In fact, the Doha Round of trade negotiations is currently suspended mainly because of disagreement over such protectionism, as we will discuss in more detail next week. 68 International Commercial Policy Unilateral Trade Policy Export subsidies in practice The above analysis suggests only one motive for governments to impose export subsidies: raising producer surplus as discussed in the case of import tariffs. While this is likely to be a critical driving force of government’s trade policy decisions, other motives for export subsidies can arise in imperfectly competitive environments. This is also the case for import tariffs. Some of these other motives are discussed in the two Krugman articles on the reading list. 69