Workpapers: Documenting Internal Audit Activities

advertisement

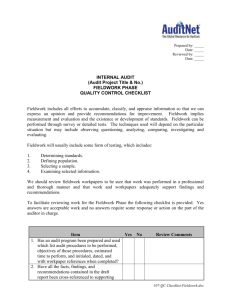

Workpapers: Documenting Internal Audit Activities ACT3642 1/2009 A.Phassawan S. Agenda Importance of Workpapers Functions of Workpapers Workpaper Content and Organization Workpaper Preparation Techniques Workpaper Review Process Importance of Workpapers Workpapers are the written records kept by internal auditors that contain the documentation, reports, correspondence, and other sample materials gathered or accumulated during the internal audit. The term workpaper is an auditor expression that describes a physical or computer file that includes the schedules, analyses, and copies of document prepared as a part of an audit. Importance of Workpapers The common nature of all workpapers is that they are the evidence used to describe the results of an internal audit. They should be formally retained for subsequent reference and substantiation of reported audit conclusions and recommendations. As a bridge between actual internal audit procedures and the reports issued, workpapers are a means to an end. Importance of Workpapers Workpapers are created to fit particular audit tasks and are subject to a great deal of flexibility. Workpapers must support and document the purposes and activities of internal auditor. Workpapers are the only record of that audit work performed, and they may provide future evidence of what did and did not happen in the audit at some point in time. Agenda Importance of Workpapers Functions of Workpapers Workpaper Content and Organization Workpaper Preparation Techniques Workpaper Review Process Functions of Workpapers The auditor forms an audit conclusion and opinion that are reported to the management, usually in the form of audit findings and recommendations published in an internal audit report. To support the auditor’s assertions and conclusions, the audit evidence, documented in the auditor’s workpapers, should be prepared. The objective of workpapers is to document an adequate audit that was conducted following professional standards. Functions of Workpapers The auditor can better understand the overall role of workpapers in the audit process by considering the major functions these papers serve: 1. 2. 3. 4. 5. 6. 7. 8. Basis for planning an audit Record of audit work performed Use during the audit Description of situations of special interest Support for specific audit conclusions Reference source Staff appraisal Audit coordination Functions of Workpapers 1. Basis for planning an audit Workpapers from prior audit provide the auditor with background information for conducting a current review in the same overall area. They may contain descriptions of the entity, evaluation of IA, time budgets, audit program used, and other results of past audit work. Functions of Workpapers 2. Record of audit work performed Workpapers describe the current audit work performed and reference it to an audit program. Even if the audit is of a special nature, such as a fraud investigation where there may not be a formal audit program, a record should be established as the auditing work is actually carried out. Functions of Workpapers 3. Use during the audit The workpapers prepared play a direct role in carrying out the specific audit effort. For example, a flowchart might be prepared and then used to provide guidance for a further review of the actual activities in some process. Functions of Workpapers 4. Description of situations of special interest As the audit work is carried out, situations may occur that have special significance in such areas as: Compliance with policies and procedures, Accuracy, Efficiency, Personnel performance, or Potential cost savings. Functions of Workpapers 5. Support for specific audit conclusions The final product of most internal audits is a formal audit report containing findings and recommendations. The workpapers should provide sufficient evidential matter to support the specific audit findings that would be included in an audit report. Functions of Workpapers 6. Reference source Workpapers can answer additional questions raised by management or by external auditors. They also provide basic background materials that may be applicable to future audits of the particular entity or activity. Functions of Workpapers 7. Staff appraisal The performance of staff members during an audit-including the ability to gather and organize data, evaluate it, and arrive at conclusions-is directly reflected in the workpapers. 8. Audit coordination An internal auditor may exchange workpapers with external auditors, each relying on the other’s work. Government auditors, in regulatory reviews of internal controls, may request to examine the IA’s workpapers. Functions of Workpapers (i) Workpaper standards According to IIA standards, internal auditors should record relevant information to support the conclusions and engagement results. Based on practice advisories, workpapers can provide supporting information. Functions of Workpapers (i) Workpaper standards An internal audit department should develop its own workpaper standards that are consistent with the IIA standards. Since workpapers will be used by other members of IA function, including management and QA, as well as external auditors and legal functions, the workpapers should follow a consistent set of standards. Functions of Workpapers (i) Workpaper standards As following the standards, workpapers should be able to stand alone, so that an authorized outside party can read through them and understand the objectives of the audit, the work performed, and any outstanding issues or findings. Workpapers should be concerned with the following areas: (i) Relevant to audit objectives, (ii) Condensation of detail, (iii) Clarity of presentation, (iv) Workpaper accuracy, (v) Action on open items, and (vi) Standards of form. Functions of Workpapers Concerned areas in workpapers Relevant to audit objectives The content must be relevant to both the total audit assignment and the specific objectives of the particular portion of the review. There is no need for materials that do not contribute to the objectives of the specific audit performed. Functions of Workpapers Concerned areas in workpapers Condensation of detail Condensation and careful summarization of detail reduces the bulk of workpapers and makes their later use more efficient. A total summary with test results, some sample details, and a copy of the computer program used may be sufficient. Functions of Workpapers Concerned areas in workpapers Clarity of presentation To present clear and understandable material, auditors and their supervisors should review workpaper presentations on an ongoing basis and make recommendations for improvements. Workpaper accuracy Accuracy is essential for all audit schedules and other quantitative data because workpapers may be used at any time in the future to answer questions. Functions of Workpapers Concerned areas in workpapers Action on open items Questions are frequently raised during an audit, as part of the workpaper notes, or information is disclosed that requires follow-up. There should be no open items in workpapers on completion of the audit All workpaper items should either be cleared or formally documented for future audit actions. Functions of Workpapers Concerned areas in workpapers Standards on form Workpapers must be prepared in a consistent format. The standards of form should include: Preparation of headings Organization Neatness and legibility Cross-indexing Functions of Workpapers (ii) Workpaper formats The workpaper can be manually prepared and developed through word-processing software. Workpaper pages should be titled, dated, initialed by the preparer, and prepared in a neat and orderly manner. Exhibit 15.1 shows substance and format standards. Agenda Importance of Workpapers Functions of Workpapers Workpaper Content and Organization Workpaper Preparation Techniques Workpaper Review Process Workpaper Content and Organization a) Workpaper document organization A typical audit will involve gathering a large number of materials to document the audit process. The form and content of those individual workpapers may vary greatly. Three types of documents are organized: (i) Permanent file, (ii) Administrative file, and (iii) Audit procedure file Workpaper Content and Organization (i) Permanent files A permanent workpaper file contains data of a historical or continuing nature pertinent to current audits. Overall organization charts of the audit unit Charts of accounts and copies of major policies and procedures Copies of last audit report, the audit program used, and any follow-up comments F/S about the entity and other useful analytical data Information about the audit unit such as major products, processes. Workpaper Content and Organization Permanent files A permanent file is not meant to be permanent in that it will never change; rather, it provides the auditor a source of background material to help plan the new audit. (i) The permanent file is a source of continuity to tie audits together over time. Exhibit 15.2 shows example. Workpaper Content and Organization (ii) Administrative files (iii) Audit Procedures files These files and folders record the actual audit work performed and vary with the type and nature of the audit assignment. Workpaper Content and Organization Most internal audit procedure files contain the following 9 elements: 1) Listing of completed audit procedures Workpapers document the audit procedures and include copies of the audit programs along with the initials of the auditors and the dates of the audit steps. Commentary notes may be on the programs or attached as cross-referenced supplementary notes. Exhibit 15.3 shows the example. Workpaper Content and Organization 2) Completed questionnaires Some internal audit functions use standard questionnaires covering particular types of internal control procedures. These questionnaires normally provide for yes and no answers and appropriate supplementary comments. Workpaper Content and Organization 3) Descriptions of operational procedures Workpapers frequently describe briefly the nature and scope of a specific type of operational activities. This description can provide a basis for later audit management probing and evaluation. It can be in flowchart. The auditor should always note the source of information to develop this description. Workpaper Content and Organization 4) Review activities Many operational audit workpapers cover specific investigations that appraise selected activities. These can include testing of data, observations of performance, and inquiries to designated individuals. Exhibit 15.4 shows an example. Workpaper Content and Organization 5) Analyses and schedules pertaining to financial statements In a financial audit, a special variety of workpapers relates to attesting to accuracy of FS or account balances. Fairness and accuracy statements may include: Analyses of individual accounts, such as accruals Details of backup data and supporting physical counts Results of specific kinds of verification Explanations of adjustments to accounts Summaries of statement balances and adjustments Workpaper Content and Organization 6) Organizational documents Organization charts, minutes of meetings, polices or procedures, and copies of contracts are basic organization documents. The internal auditor does not have to include all material in the workpapers. For example, it may be sufficient to include a table of contents and have relevant extracts rather than incorporating an entire procedures manual. Workpaper Content and Organization 7) Findings point sheets or drafts of reports Point sheets describing the nature of the audit finding as well as preference to the detailed audit work should be included in audit procedures files. 8) Supervisor’s notes (see exhibit 15.8) During an audit, the in-charge auditor or audit supervisor prepares review comments that may require explanation by the auditor. Further audit work may be needed. Workpaper Content and Organization 9) Audit bulk files Internal audits often produce large amounts of evidence materials, which should be retained but not included in the primary workpapers such as the returned questionnaires. These materials should be classified as workpapers but should be retrieved from the bulk file as necessary. Agenda Importance of Workpapers Functions of Workpapers Workpaper Content and Organization Workpaper Preparation Techniques Workpaper Review Process Workpaper Preparation Techniques There are several basic techniques needed for preparing adequate workpapers. Indexing and cross-referencing Tick marks References to external audit sources Workpaper rough notes Workpaper Preparation Techniques Workpaper indexing and cross-referencing Similar to reference notations in textbooks, sufficient cross-references and notations should allow an auditor to take a significant reference and trace it back to its original citation or source. 1) Index numbers on workpapers are the same as volume and page numbers in a published textbook. Exhibit 15.1 show a workpaper page with an index number. Workpaper Preparation Techniques Workpaper indexing and cross-referencing Cross-referencing refers to placing other reference workpaper index numbers within a given workpaper schedule. 1) Cross-reference numbers are important in financial audits where all numbers on various schedules should be tied together to ensure consistency. Workpaper Preparation Techniques Tick marks Tick marks are a form of auditor manual or pencil shorthand notation. 2) The auditors need only note somewhere in the workpapers the tick mark used for each specific propose. Workpaper Preparation Techniques Tick marks Standard tick marks improve communication because audit management can easily review and understand workpapers. 2) Exhibit 15.7 illustrates the set of traditional tick marks that were used in the pencil and paper days. Workpaper Preparation Techniques References to external audit sources Internal auditors often record information taken from outside sources. 3) For example, an auditor may gather an understanding of an operation area through an interview with management. IA would record that interview through workpaper notes and rely on what was told as the basis of further audit tests or conclusions. It is important to record the source of such commentary directly in the workpapers. Workpaper Preparation Techniques References to external audit sources Auditors may need to reference an external law or regulation to support their audit work. 3) In all, workpapers should clearly indicate the title and source of all external references. Exact page copies can be included to make a specific point when necessary, but a reference notation is normally sufficient. Workpaper Preparation Techniques Workpaper rough notes When conducting interviews, auditors often make a rough notes, often written in shorthand easily readable only by the auditors. 4) Auditors should rewrite these rough notes into commentary. The rough notes can also be included in the workpapers, placed in the back of workpaper manual binder or even in a separate file. Agenda Importance of Workpapers Functions of Workpapers Workpaper Content and Organization Workpaper Preparation Techniques Workpaper Review Process Workpaper Review Process All workpapers should go through an independent internal audit process to ensure that: All necessary work has been performed, Everything is properly described, and The audit findings are adequately supported. CAE has overall responsibility for this review but usually delegates that work to supervisory members of the IA department Workpaper Review Process Evidence of this supervisory review should consist of the reviewer’s initials and dates on each workpaper sheet reviewed. In addition to initialing completed workpapers, the supervisory reviewer should prepare a set of notes with any questions raised during the review process to give to the responsible auditor for resolution. Workpaper Review Process Some of these questions may be of a more significant nature and may require the auditor to do some additional follow-up work. Review questions should be cleared promptly, and the reviewer should take the responsibility to ensure that all open questions are resolved. Workpaper Review Process This workpaper review process should always take place prior to the issuance of the final audit report. This will ensure that all report findings have been properly supported by audit evidence as documented in the workpapers. QUESTIONS