Japan International Cooperation Agency

advertisement

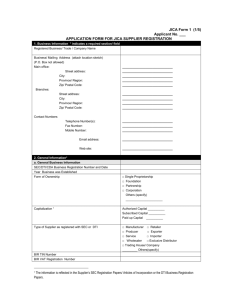

Disbursement Procedure for Japan International Cooperation Agency (JICA) Assistance Outline of the presentation Part A – Reimbursement Procedure – I Statement of Expenditure Procedure – II Part B – Commitment Procedure – I Transfer Procedure Part C – Debt Relief Project Financing (Budgeting) Step-I Annual Requirement of Rupee resources for meeting the expenditure of the Project Cost including External funding is required to be approved by the Planning Commission. Step-II Inclusion of the funds requirement approved under step-I, in the Annual Budget of the Government Pre-requisite for Disbursement Loan Agreement (L/A) • Signed and becomes effective Contract between the Executing Agency and the Supplier / Consultant • Signed • Concurred by JICA JICA Disbursement Procedures I. Reimbursement Procedure A. Reimbursement B. Statement of Expenditure II. Direct Payment A. Commitment Procedure B. Transfer Procedure Part – A Reimbursement Procedure I Reimbursement Procedure Used For: Payment already made to the suppliers In Short : 1. PIU makes payment to the Supplier / consultant / contractor 2. PIU requests JICA through AAAD to reimburse the amount paid 3. JICA makes disbursement Cont. Reimbursement Procedure Documents Required 1. Request for reimbursement 2. Summary Sheet 3. Evidence ( Document showing delivery of goods / services performed (e.g. Invoice, certificates )) 4. Contactor/consultant/Supplier’s receipt Documents for Reimbursement Request for disbursement JICA Summary sheet of Payment Invoices Supporting Documents Reports Fund flow Chart for Reimbursement Project Implementing Agency Claims AA&A Division Claims JICA New Delhi Advice JICA Tokyo Payment Nominated Bank in Tokyo Payment AAAD Account at RBI, New Delhi through RBI, Mumbai Advice to AAAD Part – A Statement of Expenditure Procedure (SOE) II Statement of Expenditure Procedure (SOE) This procedure is a variant of JICA Reimbursement Procedure. It is Used when large number of small payments and/or complicated paperwork is there in preparation of claim. It is useful in making timely disbursement with less administrative work involved. Documents for SOE Claim Request for disbursement JICA Summary sheet of Payment Invoices, Supporting Documents, & Reports Statement of Expenditure Procedure (SOE) 1. 2. 3. 4. JICA checks SOE Instead of Invoices and Receipts The PIA Employs the Auditor The Auditor checks invoices and receipts once a year JICA checks the Audit Report Auditor points out the non-eligible expenditure in SOE, Then borrower/PIA must adjust/ refund the amount to JICA. Disbursement will be suspended if the Audit Report is not submitted by due date or the adjustments required to be made are not adjusted/refunded. When SOE is to be adopted When the Borrower / Executing Agency wishes and JICA agrees to it, or When SOE Procedure is appropriate due to the nature of the project, and JICA considering its suitability makes it applicable for the project at the time of Appraisal. Main points considered by JICA for SOE An independent audit Adequate fund management structure Appointment of Auditor The PIA should Select an auditor. Submit an engagement letter to JICA. Requirement for appointment for Auditor Independent Expert Auditing Standards (GAAS) Responsibilities (e.g. Timing of report submission, providing detail information on unjustifiable SOE) Note:-However for Government Departments Comptroller & Auditor General of India shall be Auditor. Maintenance of Accounts Records The Executing Agency should maintain records and accounts that are adequate to reflect, in accordance with consistently maintained sound accounting practices, the expenditure financed from the proceeds of the loan. JICA may inspect the Executing Agency’s status of such custody from time to time. What should be audited Statement of Expenditure (SOE) Supporting documents Submission of Audit Report The Borrower/Executing Agency should Furnish a certified copy of the Audit Report to JICA As soon as it is available but not later than 9 months from the end of each fiscal year i.e. December Note: The copies of SOE that are audited to be attached with the Audit Report. Requirement of Auditor’s opinion 4 Types of Auditor’s Opinion Unqualified Opinion Qualified Opinion Adverse Opinion Disclaimer of the Opinion Adjustment In case when the use of a specified amount of the Loan is not justified JICA will deduct this amount from the next disbursement If the Borrower/ PIA fails to perform its obligation (e.g. submission of an audit report in time) The Borrower is required to refund the amount to the JICA or, Part or whole of its rights may be suspended. Important points for Auditor Late submission of Audit Report / Settlement Certificate. The Auditor should explain 1. Role and the responsibility of the Auditor. 2. Critical points of the projects and time schedule to be adhered to by the auditor. 3. Suspension of the disbursement in case of delay in submission of audit report. Availability for tracing of the disbursement claims in case of ineligible items 1. Clear indication of the claim No. in the Audit Report is to be given. Project should avoid Tendency of delay in submitting SOE Payment for not eligible goods and service Inaccurate deduction, taxes calculation Discrepancy of contents in SOE with the supporting documents Double-Disbursement of Claims Wrong / omitted words Loss of all or part of supporting documents Long periods required in setting objection with the Auditors Time consuming process to trace the details necessary for refund / adjustment of the objected amount. Part – B Commitment Procedure I Commitment Procedure Used for : Foreign currency payment for import of goods and services under Letter of Credit (L/C) In Short : JICA issues a Letter of Commitment (L/Com) that guarantees reimbursement made to the relevant L/C Documents Required Evidence ( Document showing delivery of goods / services performed (e.g. invoice/ certificate ) Commitment procedure issuing stage JICA Issue a L/Com Apply for L/COM Nominated bank in Tokyo (Japanese Bank & Issuing bank) L/C 3) Evidence AAAD Supplier’s Bank L/C Apply for L/C Sign a contract Supplier Apply for L/C Project Implementing Authority Commitment Procedure (Disbursement) Documents JICA (5). Disbursement Money (4) Disbursement Request Nominated bank in TOKYO (Japanese Bank) (6) Disbursement (3) Evidence Supplier’s Bank` (8)Disbursement (7) Intimation (9) Intimation AAAD (2) Evidence (1)Delivery Supplier Project Implementing Authority Commitment Procedure (Important Points) L/Com Amount is issued in Japanese Yen. JICA will not issue the L/Com until all the discrepancies between the L/C and the contract are resolved. At the time of issuing the L/Com, JICA will charge 0.1 % of its amount. This amount is treated as disbursed to the borrower. JICA does not make disbursement until all the discrepancies between the documents submitted and the documents required by the L/C are resolved. Part – B Transfer Procedure II Transfer Procedure Used For: Payment to be made directly to the suppliers/contractors in India In Short The Borrower issues Transfer Instruction to the Bank of India, Tokyo (JAPAN) JICA makes disbursement to Bank of India, Tokyo The bank makes payment to the Supplier/contractor in India in his bank account Transfer Procedure Documents Required Request for Disbursement Summary Sheet Claims for Payment Transfer Instruction Evidence (Document showing delivery of goods / services performed (e.g. Invoice, certificate) Pre-receipt Transfer Procedure (3). Disbursement Documents JICA Money Bank in TOKYO (Paying Bank) (4) Transfer Supplier Non-resident Yen Account of the Borrower (2) Transfer Instruction (1) Claims for Payment Evidence 2. Request for disbursement and other required documents Borrower Project Implementing Authority Check List Covering Letter Official Address of PIA, Tel. No. & fax No. Reference No. & Date. Subject along with IDP No. Claim Amount in figures and words. Beneficiary Name etc. if Transfer Procedure. Contd…. Check List I. Check list for Reimbursement Claims (Document-wise) A. Summary Sheet of Payment Whether correct Loan No. and amount indicated? Whether Contract No., Contract Concurrence No. Supplier’s Name indicated? Whether correct Category name and number indicated? Whether the amount of payment, amount applied for financing correct? Whether the document signed by the authorized signatory? Contd…. Check List B. Invoice Whether the Contract No. and the Supplier’s name indicated? Whether the total amount, amount of deduction, net amount for payment/Reimbursable amount) indicated? Whether the document signed by the authorized person? Contd…. Check List C. Receipt Whether the Contract No. and Supplier’s Name indicated? Whether the total amount (in the requested currency), deduction, paid amount indicated clearly? ‘Received’ Signature of Supplier with the company name and seal, date of receipt and “Received the amount’ on the Invoice is clearly indicated. Contd…. Check List Check list for Transfer procedure Documents required A. Request for Disbursement B. Summary Sheet of Payment C. Transfer Instruction D. Claim for Payment E. Invoice F. Delivery Certificate/Statement of Performance G. Pre-receipt Contd…. Check List A. Request for Disbursement Date, loan no and application S.No are given on the top of request form. Same has been correctly mentioned in the request. Amount has been given in figure and word and the same tallies with the amount mentioned in other documents attached with the application. Contd…. Check List B. Summary Sheet of Payment Contract Concurrence No., Contract No. should be correctly indicated. Amount to be paid and amount applied for JICA financing should be correctly indicated. Nature of Payment (e.g. Payment No., Period of Payment, Period, Invoice No.) should be correctly indicated. Reference No. of ‘Claim for Payment’ should be indicated in Summary Sheet of Payment. Contd…. Check List C. Transfer Instructions Date, loan agreement no and application sl. no are given on the top of Transfer Instructions. Same has been correctly mentioned in the Transfer Instructions. Amount has been given in figure and word and the same tallies with the amount mentioned in other documents attached with the application. Contd…. Check List D. Claim for Payment Whether the Reference No. indicated ? Whether the Contract Concurrence No. and Contract No. indicated? Whether the claimed amount correctly indicated? Whether the details such as Name & Address of the Supplier, his Bank’s name and Account etc. indicated correctly? Whether the Nature of Payment (e.g. Payment No., Payment Period, Invoice No. etc.) indicated ? Contd…. Check List E. Invoice Are the Contract No., Supplier’s Name and Amount indicated? Are the total amount, amount of deduction, net amount for payment, amount applied for JICA financing indicated? In case there are more than one Invoice, whether an abstract sheet for all the Invoices has been prepared? Contd…. Check List F. Delivery Certificate/Statement of performance Whether the Contract No., Supplier’s Name and Amount indicated? Whether it is signed by the authorized official? The certificate/statement is in English. In case it is in some other language an English translation of the same should be attached. In case there are more than one certificate/statement, whether an abstract sheet for all the Invoices has been prepared? Contd…. Check List G. Pre-receipt Whether the Contract No., Supplier’s Name and Amount indicated? Whether it is signed by authorized official? The Pre-receipt should be in English. In case it is in some other language an English translation of the same should be attached. In case there are more than one certificate/ statement, whether an abstract sheet for all the Invoices has been prepared? Contd…. Check List III. COMMITMENT PROCEDURE 1. Items of L/C should follow the Contract concurred by JICA. 2. Loan Agreement No. and Contract No. should be correctly indicated in the request. 3. Contract No. of L/C should be the number of original Contract (not amendment No.) which was concurred by JICA. Contd…. Check List III. COMMITMENT PROCEDURE Expiry date of L/C should be prior to Loan closing date i.e. expiry date of L/C should be at least one month before Loan Closing date. L/C amount cannot be more than the Contract concurred amount by JICA. Payment terms of L/C should be same as that of Contract. Contd…. JICA Disbursement Policy Proper Use of Loan Funds Clear Flow of Loan Proceeds Speedy Transfer of Loan Proceeds Accountability ( Internal / External Audit System ) Category of Expenditure In every loan agreement category wise allocation of loan amount is given Illustration shown in the next slide Illustration Category Amount of the Loan Allocated ( In Millions Japanese Yen) % of eligible expenditure to be financed (A) (B) (C) Total - Ineligible Expenditure In every loan agreement a list of Items not eligible for financing is given. For example: General Administration expenses Taxes and duties Purchase of land and other real property Compensation Other Indirect Charges – fine, penalty, interest etc. Revolving Fund This is also known as Special account. This is established to help the borrower reduce cash flow difficulties. This is kept with RBI Mumbai in JPY. This is maintained separately for each loan. This account is being operated by AAAD. AAAD is responsible for Annual audit of this account by C&AG and sending audit certificate to the JICA. This is only a Proforma Account. Part – C Debt Relief Grant Flow Chart - Debt Relief Grant INDIA Agreement JAPAN Payment Bank of India, Tokyo Debt Relief Grant Grants are given by Government of Japan through JICA (Japan International Cooperation Agency) Amount of grant is deposited in yen account in the Nominated bank in, Tokyo The amount can be used for making imports Imports can be from any country Imports can be in any currency Amount of grant cannot be used for procurement in India Debt Relief Grant – Control It is at the disposal of Japan Section, Ministry of Finance (DEA), New Delhi Implementing Agency who want to use this grant is required to approach Japan Section After its approval, importer will send request for issue of A.P. (Authorization to Pay) to Japan Section in prescribed format Japan Section will forward the same to AAAD Authorization to Pay (A.P) AAAD will scrutinize The request and issue A.P. A.P. means Authorization to Pay (A.P) It is used for authorizing Bank of India, Tokyo for making payment out of grant funds provided by Government of Japan for making Imports. Any change in A.P. can only be carried out with the approval of Japan Section in Ministry of Finance (DEA) For this purpose request, for any change like validity, enhancement of amount, change in description of import, change in quantity of items to be imported or any other change, is to be made the Japan Section and Japan Section will forward the same to AAAD. FLOW CHART FOR A.P (1) Supply Order PIA Supplier (6) Supply Min. of Fin. (DEA) (Japan Sec.) (6) Documents (3) Supplier’s Bank (7) Documents (8) Payment (2) Request for issue of A.P. Request for issue of A.P AAAD (5) A P (4) issue of A.P BOI, Tokyo (8) Advice