The Economics of Insurance & Investments Self - Pro

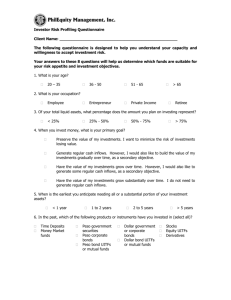

advertisement