Predictive Modeling Survey - Francis Analytics Actuarial Data Mining

Francis Analytics

Actuarial Data Mining Services

Predictive Modeling Workshop

Training for development and deployment

Francis Analytics and Actuarial Data Mining

The following presentation outlines a introductory training course for actuaries, and quantitative analysts to learn basic approaches and tools to create predictive model solutions in Property & Casualty Insurance www.data-mines.com

Introduction

Francis Analytics

Actuarial Data Mining Services

Predictive Modeling is an important new development for modifying traditional actuarial approaches to risk in P&C insurance

Actuaries and Quantitative Analysts can help advance their company’s competitive position with a greater understanding of analytical methods and tools

Learning opportunities in advanced actuarial modeling area not widely available.

Francis Analytics www.data-mines.com

2

Predictive Modeling Survey Course

Francis Analytics

Actuarial Data Mining Services

A two day hands-on workshop

Delivered by experienced practitioners

Includes case study learning approach

Includes instructions in using software and the latest statistical methods being deployed by industry leaders.

Custom course can be designed to fit specific needs

Participants will be able to conduct a Predictive Modeling project in their organizations and present the business case to non-technical management

Francis Analytics www.data-mines.com

3

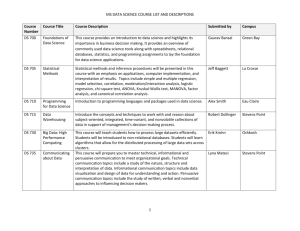

Course Agenda

Session

Introduction to P&C Actuarial Data

Introduction to Predictive Modeling Methods

Walk-through model development phases

Focus: Data Preparation Techniques

Focus: Mathematical Methods

Focus: Statistical Software

Hands-on Case Study workshop

Validation Methods

Industry Leading Innovation

Francis Analytics www.data-mines.com

Francis Analytics

Actuarial Data Mining Services

Description

Introduction and review of actuarial data for property & casualty insurance including basic operational view

Survey of Predictive Modeling approaches and current state of the art in P&C insurance

Walk-through of the project process for delivering successful predictive modeling capabilities

Focus teaching on data discovery and preparation steps used in the model development process

Focused teaching of the key statistical algorithms used in Predictive Modeling

Focused teaching and hands on tutoring of an statistical modeling package software

Live end-to-end walk through of a predictive modeling project

Teaching and illustration of model validation approaches to present to management

Discussion of industry leading innovation in development and deployment of Predictive Models

4

Case Study Approach

Actual P&C example

Sample Actuarial Dataset provided

Explore challenges throughout the exploration/model/deployment life-cycle

Francis Analytics

Actuarial Data Mining Services

Practitioners can design a custom case study with a specific modeling need or data-set provided by the company sponsor or organization.

Francis Analytics www.data-mines.com

5

Leading Statistical Methods Covered

Generalized Linear Modeling including Logistic

Regression

Neural Network

Classification and Regression Trees

Benchmarking with Naive Bayes

Tree ensemble method

Random Forest

Support Vector Machines

Francis Analytics

Actuarial Data Mining Services

Francis Analytics www.data-mines.com

6

Software

Excel

Access

Free Software

R

Web based software

S-Plus (similar to commercial version of R)

SPSS

CART/MARS

Data Mining suites

Francis Analytics

Actuarial Data Mining Services

Participants will download, install, tour and model in R, a freeware modeling tool

Francis Analytics www.data-mines.com

7

Learning Outcomes

Francis Analytics

Actuarial Data Mining Services

Working knowledge of the major statistical methods used for Predictive Modeling

Practical knowledge of advanced data mining techniques ready to be applied

General knowledge of Property & Casualty insurance data and related operations

General knowledge of Predictive Modeling project life-cycle management

Working knowledge of modeling software packages and review of leading software solutions and proprietary methods

The ability to manage the validation of models and present the validation results to laymen

Francis Analytics www.data-mines.com

8

Logistics

Item

Session Schedule

Course materials and Data Set

Software

Class Size

Customized Content

Francis Analytics www.data-mines.com

Francis Analytics

Actuarial Data Mining Services

2 days

Overnight Homework as assigned

Berry, M. and Linoff, G. Data Mining Techniques

2nd Edition , Wiley, supplied to all students

California Department of Insurance public

(CAARP) data on private passenger auto will be supplied to all participants as a download

‘R’ statistical programming language, including download and install instructions

Limit of 25 participants

Arranged by agreement

9

Pricing

Item

Course Fee

Course Materials

Follow-up Consultation

On-site/Group/Company Sponsored

TBD

Included

Included

Priced by custom proposal *

Francis Analytics

Actuarial Data Mining Services

* Pricing for customized workshop content and delivery by agreement

Francis Analytics www.data-mines.com

10

Workshop Presenters Francis Analytics

Actuarial Data Mining Services

Louise Francis, FCAS, MAAA

Louise Francis is the Consulting Principal and founder of Francis Analytics and Actuarial Data Mining, Inc. where she leads data mining and related actuarial projects and engagements. Ms. Francis has introduced insurance professionals to data mining methods both as a speaker at conferences and as an author of papers and articles on data mining topics. Three of her papers were awarded the Data Quality/Data Technology prize by the CAS

(Casualty Actuarial Society) and IDMA (Insurance Data Management Association).

As an insurance professional, Ms. Francis has expertise in a variety of techniques for pricing and reserving insurance products, both on a traditional and leading edge basis. She also has experience planning and evaluating programs for claims loss cost reduction. Ms. Francis pioneered the application of data mining technologies such as neural networks and decision trees to insurance data to identify patterns useful for mitigating claims costs and making underwriting decisions. Ms. Francis introduced procedures for benchmarking individual customer's data to industry targets to assess the performance of third party claims administrators and to assist clients with cost reduction efforts.

Ms. Francis has over 20 years of experience in the actuarial profession. Prior to starting her own firm, she was

Director and Associate Actuary for CIGNA Property and Casualty where she provided actuarial expertise to the

Claims Division and ESIS, CIGNA's third party claims administrator. She was responsible for evaluating the overall performance of the Claims Division and measuring the effectiveness of specific Claims Division initiatives to reduce claims costs. Ms. Francis has also worked as a consultant with Towers Perrin and Sedgwick James.

Ms Francis is chair of the Casualty Actuarial Society's (CAS) Committee on the Theory of Risk, a committee charged with the sponsorship and dissemination of research efforts on risk measurement and analysis. She participates on an American Academy of Actuaries committee which develops standards of actuarial practice for the actuarial profession.

Ms. Francis received her Bachelor of Arts degree from William Smith College and a Master of Science degree in

Health Sciences from the State University of New York at Stony Brook. She is a Fellow of the Casualty Actuarial

Society and a member of the American Academy of Actuaries.

Francis Analytics www.data-mines.com

11

Workshop Presenters

Francis Analytics

Actuarial Data Mining Services

RICHARD A. DERRIG, PH.D.

Dr. Derrig is President of OPAL Consulting LLC, established in February, 2004 to provide research and regulatory support to the property-casualty insurance industry.

Prior to forming OPAL, Dr. Derrig held various positions at the Automobile Insurers Bureau of Massachusetts and at the

Insurance Fraud Bureau of Massachusetts over a twenty seven year period, retiring in January, 2004 as Senior Vice

President at AIB and Vice President of Research at IFB. During the spring semesters of 1994 and 2002, he was a

Visiting Lecturer and Research Fellow in the Department of Risk Management and Insurance at the Wharton School,

University of Pennsylvania. Dr. Derrig has been appointed a visiting scholar at Wharton for 2004 and 2005.

Prior to joining the Bureaus, he taught graduate and undergraduate mathematics at Villanova University, Wheaton

College (MA) and Brown for a total of thirteen years. He earned a Bachelor of Science degree in mathematics from St.

Peter's College as well as Master's and Doctoral degrees from Brown University.

Dr. Derrig is the recipient of numerous awards and recognitions for his contribution to mathematics and actuarial sciences. He the author or co-author of numerous articles, review and contributions in the field.

He has lectured extensively on insurance topics to professional actuarial groups; the Casualty Actuarial Society, ASTIN, trade associations, and law enforcement personnel; and to seminars at the Universities of Barcelona, Hamburg,

Montreal, Tel Aviv, Pennsylvania, Illinois, Texas, Minnesota, Wisconsin and others in the U.S. He was a director of the

American Risk and Insurance Association (19921995) and a recipient of the President’s Award (1997). He is an academic correspondent of the CAS and a member of the Mathematical Association of America, American Statistical

Association, and the Association of Certified Fraud Examiners. He serves on the Insurance Fraud and Auto Injury Study

Committees of the Insurance Research Council and the CPCU Advisory Committee of the American Institutes. Since

1991, he has compiled an annotated bibliography of worldwide insurance fraud research that is made available at www.derrig.com/ifrr/ifrr.asp.

Francis Analytics www.data-mines.com

12

Contact

Ms. Louise Francis, FCAS, MAAA

Francis Analytics

215-923-1567 louise.francis@data-mines.com

www.data-mines.com

Francis Analytics

Actuarial Data Mining Services

Francis Analytics www.data-mines.com

13