Revision

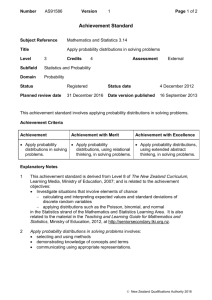

advertisement

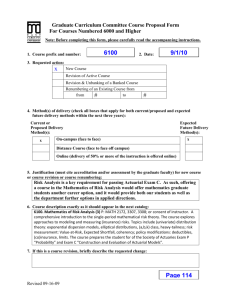

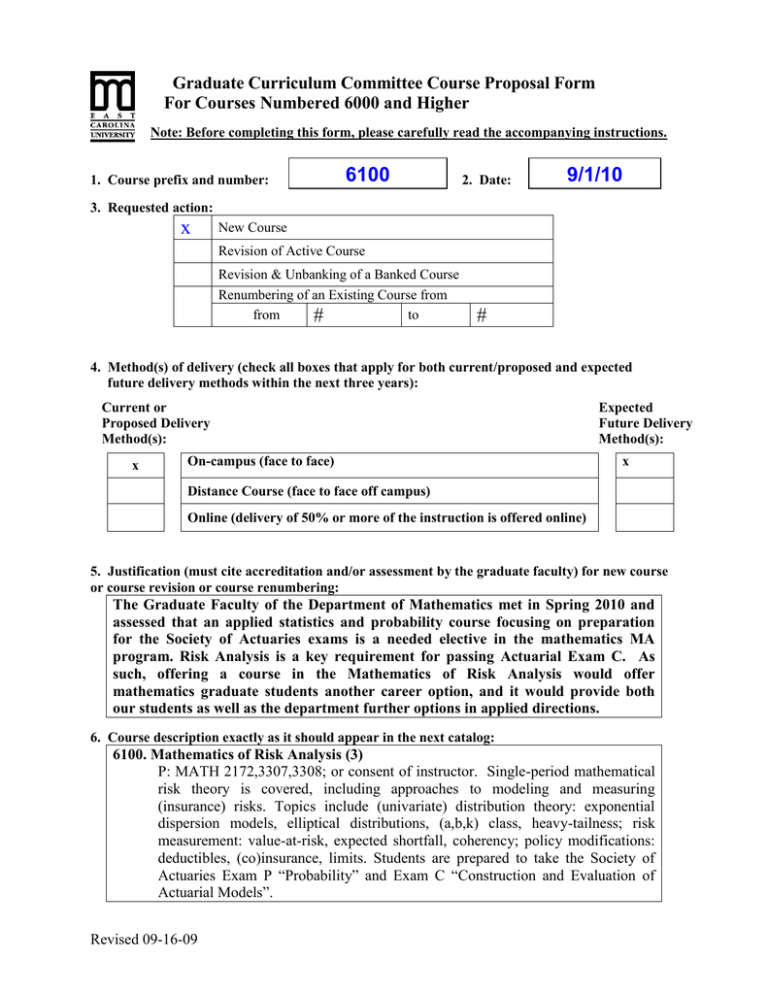

Graduate Curriculum Committee Course Proposal Form For Courses Numbered 6000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. 1. Course prefix and number: 6100 2. Date: 9/1/10 3. Requested action: x New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # # 4. Method(s) of delivery (check all boxes that apply for both current/proposed and expected future delivery methods within the next three years): Current or Proposed Delivery Method(s): x On-campus (face to face) Expected Future Delivery Method(s): x Distance Course (face to face off campus) Online (delivery of 50% or more of the instruction is offered online) 5. Justification (must cite accreditation and/or assessment by the graduate faculty) for new course or course revision or course renumbering: The Graduate Faculty of the Department of Mathematics met in Spring 2010 and assessed that an applied statistics and probability course focusing on preparation for the Society of Actuaries exams is a needed elective in the mathematics MA program. Risk Analysis is a key requirement for passing Actuarial Exam C. As such, offering a course in the Mathematics of Risk Analysis would offer mathematics graduate students another career option, and it would provide both our students as well as the department further options in applied directions. 6. Course description exactly as it should appear in the next catalog: 6100. Mathematics of Risk Analysis (3) P: MATH 2172,3307,3308; or consent of instructor. Single-period mathematical risk theory is covered, including approaches to modeling and measuring (insurance) risks. Topics include (univariate) distribution theory: exponential dispersion models, elliptical distributions, (a,b,k) class, heavy-tailness; risk measurement: value-at-risk, expected shortfall, coherency; policy modifications: deductibles, (co)insurance, limits. Students are prepared to take the Society of Actuaries Exam P “Probability” and Exam C “Construction and Evaluation of Actuarial Models”. Revised 09-16-09 7. If this is a course revision, briefly describe the requested change: 8. Graduate catalog page number from current (.pdf) graduate catalog:Page Page114 114 9. Course credit: Lecture Hours 3 3 Weekly OR Per Term Credit Hours s.h. Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Other (e.g., independent study) Please explain. 3 Total Credit Hours 10. Anticipated annual student enrollment: 10 11. Affected degrees or academic programs: Degree(s)/Program(s) Current Catalog Page M.A. in Mathematics M.B.A. in Business M.S. in Economics s.h. p. 111 (pdf) p. 164 (pdf) p. 82 (pdf) Changes in Degree Hours None None None 12. Overlapping or duplication with affected units or programs: Not applicable x Notification & response from affected units is attached 13. Council for Teacher Education (CTE) approval (for courses affecting teacher education): Not applicable x Applicable and CTE has given their approval. 14. Service-Learning Advisory Committee (SLAC) approval x Not applicable Applicable and SLAC has given their approval. 15. Statements of support: a. Staff x Current staff is adequate Additional staff is needed (describe needs in the box below): b. Facilities x Current facilities are adequate Revised 09-16-09 Additional facilities are needed (describe needs in the box below): c. Library x Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Unit computer resources x Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): e. ITCS resources x ITCS resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software Approval from the Director of ITCS attached 16. Course information (see: Graduate Curriculum and Program Development Manual for instructions): a. Textbook(s) and/or readings: author(s), name, publication date, publisher, and city/state/country Klugman, S.A., Panjer, H.H., Wilmot, G.E., (2008), Loss Models: From Data to Decisions (Third Edition), Wiley Hassett, M.J., Stewart, D., (2009), Probability for Risk Management (Second Edition), ACTEX Publications b. Course objectives for the course (student – centered, behavioral focus) Upon completion of the course the student will be able to: 1) model, and measure (insurance) risk; 2) apply exponential dispersion models, elliptical distributions, (a,b,k) class, heavy-tailness; 3) apply risk analysis in insurance settings, including: Value-at-Risk, Expected Shortfall, coherency; 4) determine and modify policy, including: deductibles, (co)insurance, limits; 5) pass the Society of Actuaries Exams P “Probability” and C “Construction Revised 09-16-09 and Evaluation of Actuarial Models”. c. Course topic outline A. Severity Models 1. Calculate the basic distributional quantities: a) Moments b) Percentiles c) Generating functions 2. Describe how changes in parameters affect the distribution. 3. Recognize classes of distributions and their relationships. 4. Apply the following techniques for creating new families of distributions: a) Multiplication by a constant b) Raising to a power c) Exponentiation, d) Mixing 5. Identify the applications in which each distribution is used and reasons why 6. Apply the distribution to an application, given the parameters. 7. Calculate various measures of tail weight and interpret the results to compare the tail weights. B. Frequency Models For the Poisson, Mixed Poisson, Binomial, Negative Binomial, Geometric distribution and mixtures thereof: 1. Describe how changes in parameters affect the distribution, 2. Calculate moments, 3. Identify the applications for which each distribution is used and reasons why, 4. Apply the distribution to an application given the parameters. 5. Apply the zero-truncated or zero-modified distribution to an application given the parameters C. Aggregate Models 1. Compute relevant parameters and statistics for collective risk models. 2. Evaluate compound models for aggregate claims. 3. Compute aggregate claims distributions. D. For severity, frequency and aggregate models, 1. Evaluate the impacts of coverage modifications: a) Deductibles b) Limits c) Coinsurance 2. Calculate Loss Elimination Ratios. 3. Evaluate effects of inflation on losses. E. Risk Measures 1. Calculate VaR, and TVaR and explain their use and limitations. F. Construction of Empirical Models 1. Estimate failure time and loss distributions using: a) Kaplan-Meier estimator, including approximations for large data sets b) Nelson-Åalen estimator c) Kernel density estimators 2. Estimate the variance of estimators and confidence intervals for failure time and loss distributions. 3. Apply the following concepts in estimating failure time and loss distribution: a) Unbiasedness Revised 09-16-09 b) Consistency c) Mean squared error G. Construction and Selection of Parametric Models 1. Estimate the parameters of failure time and loss distributions using: a) Maximum likelihood b) Method of moments c) Percentile matching d) Bayesian procedures 2. Estimate the parameters of failure time and loss distributions with censored and/or truncated data using maximum likelihood. 3. Estimate the variance of estimators and the confidence intervals for the parameters and functions of parameters of failure time and loss distributions. 4. Apply the following concepts in estimating failure time and loss distributions: a) Unbiasedness b) Asymptotic unbiasedness c) Consistency d) Mean squared error e) Uniform minimum variance estimator 5. Determine the acceptability of a fitted model and/or compare models using: a) Graphical procedures b) Kolmogorov-Smirnov test c) Anderson-Darling test d) Chi-square goodness-of-fit test e) Likelihood ratio test f) Schwarz Bayesian Criterion H. Credibility 1. Apply limited fluctuation (classical) credibility including criteria for both full and partial credibility. 2. Perform Bayesian analysis using both discrete and continuous models. 3. Apply Bühlmann and Bühlmann-Straub models and understand the relationship of these to the Bayesian model. 4. Apply conjugate priors in Bayesian analysis and in particular the Poisson-gamma model. 5. Apply empirical Bayesian methods in the nonparametric and semiparametric cases. I. Simulation 1. Simulate both discrete and continuous random variables using the inversion method. 2. Estimate the number of simulations needed to obtain an estimate with a given error and a given degree of confidence. 3. Use simulation to determine the p-value for a hypothesis test. 4. Use the bootstrap method to estimate the mean squared error of an estimator. 5. Apply simulation methods within the context of actuarial models. d. List of course assignments, weighting of each assignment, and grading/evaluation system for determining a grade Tests (3 tests) = 50% Final Exam = 25% Quizzes = 25% Grade in course: 100% - 90% = A; 80% - 89% = B ; 70% - 79% = C; < 70% = F Revised 09-16-09