Management Control Systems and Responsibility Accounting

advertisement

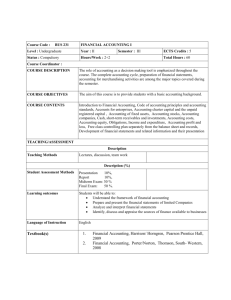

Chapter 17 Management Control Systems and Responsibility Accounting ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-1 Learning Objective 1 Describe the relationship of management control systems to organizational goals. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-2 Management Control System What is a management control system? It is a logical integration of techniques to gather and use information. Planning and Control Motivate Evaluate ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-3 Management Control System Set Goals, Measures, Targets Plan and Execute Feedback and Learning Evaluate, Reward Monitor, Report ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-4 Setting Goals, Objectives, and Performance Measures Top management develops organization-wide goals, measures, and targets. They also identify the critical processes needed to achieve the goals. Top management and critical process managers develop key success factors and performance measures. They also identify specific objectives. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-5 Setting Goals, Objectives, and Performance Measures Critical process managers and lower-level managers develop specific performance measures for each objective. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-6 Organizational Goals A well-designed management control system aids and coordinates the process of making decisions and motivates individuals throughout the organization to act in concert. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-7 Critical Process A critical process is a series of related activities that directly affect the achievement of organizational goals. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-8 Key Success Factors Key success factors are actions that must be done well in order to drive the organization towards its goals. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9-9 Learning Objective 2 Use responsibility accounting to define an organizational subunit as a cost center, a profit center, or an investment center. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 10 Responsibility Center A responsibility center is a set of activities assigned to a manager, a group of managers, or other employees. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 11 Responsibility Accounting Responsibility accounting is used to identify what parts of the organization have primary responsibility for each objective, develop performance measures and targets to achieve, and design reports of these measures by organization subunit or responsibility center. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 12 Types of Responsibility Centers A cost center’s manager is accountable for costs only. Profit centers have responsibility for controlling revenues as well as costs. Investment centers have responsibility for revenues, expenses, and the investment used by the center. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 13 Learning Objective 3 Compare financial and nonfinancial performance, and explain why planning and control systems should consider both. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 14 Measures of Performance Good performance measures will… relate to the goals of the organization. balance long-term and short-term concerns. reflect the management of key actions and activities. be readily understood by employees. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 15 Measures of Performance be affected by actions of managers and employees. be used in evaluating and rewarding managers and employees. be reasonably objective and easily measured. be used consistently and regularly. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 16 Nonfinancial Measures of Performance AT&T Universal Card Services uses 18 performance measures for its customer inquiries process. These measures include average speed of answer, abandon rate, and application processing time. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 17 Nonfinancial Measures of Performance Often the effects of poor nonfinancial performance do not show up in the financial measures until considerable ground has been lost. quality productivity satisfaction ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 18 Monitoring and Reporting Results Feedback and learning are at the center of the management control system. At all points in the planning and control process, it is vital that effective communication exists among all levels of management and employees. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 19 A Successful Organization and Measures of Achievement FINANCIAL STRENGTH Product Profitability, EBIT CUSTOMER SATISFACTION Market Share, Survey Scores, Complaints BUSINESS PROCESS IMPROVEMENT Cycle Time, Defects, Activity Costs ORGANIZATIONAL LEARNING Training Time, Turnover, Staff Satisfaction Score ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 20 The Balanced Scorecard A balanced scorecard is a performance measurement and reporting system that strikes a balance between financial and operating measures. It links performance to rewards. It gives explicit recognition to the diversity of organizational goals. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 21 The Balanced Scorecard The scorecard measures an organization’s performance from four key perspectives: Financial strength Business processes improvement Customer satisfaction Organizational learning ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 22 Key Performance Indicators What are key performance indicators? They are measures that drive the organization to achieve its goals. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 23 Learning Objective 4 Explain the importance of evaluating performance and how it impacts motivation, goal congruence, and employee effort. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 24 Goal Congruence Goal congruence exists when individuals and groups aim at the same organizational goals. It is achieved when employees, working in their own perceived best interests, make decisions that help meet the overall goals of the organization. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 25 Managerial Effort… is exertion toward a goal or objective. Planning Supervising Thinking ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 26 Motivation… is a drive for some selected goal. It creates effort. It creates action toward that goal. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 27 Learning Objective 5 Prepare segment income statements for evaluating profit and investment centers using the contribution margin and controllable-cost concepts. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 28 Controllability Management Control System Controllable events Uncontrollable events Controllable costs Uncontrollable costs ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 29 Controllability Controllable costs include any costs that are influenced by a manager’s decisions and actions. An uncontrollable cost is any cost that cannot be affected by the management of a responsibility center within a given time span. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 30 Contribution Margin The contribution margin is especially helpful for predicting the impact on income of short-run changes in activity volume. Managers may quickly calculate any expected changes in income by multiplying increases in dollar sales by the contribution margin ratio. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 31 Segments Segments are responsibility centers for which a separate measure of revenues and costs is obtained. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 32 Segments East Division Net sales $950,000 Variable costs 750,000 Contribution margin $200,000 Controllable costs 75,000 Segment margin $125,000 Allocated costs 70,000 Income $ 55,000 Unallocated costs Organization profit West Division Total $1,950,000 $2,900,000 950,000 1,700,000 $1,000,000 $1,200,000 60,000 135,000 $ 940,000 $1,065,000 80,000 150,000 $ 860,000 $ 915,000 300,000 $ 615,000 ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 33 Learning Objective 6 Measure performance against quality, cycle time, and productivity objectives. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 34 Quality Control Quality control is the effort to ensure that products and services perform to customer satisfaction. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 35 Cost of Quality Report In a cost of quality report, the financial impact of quality is displayed. Prevention Internal failure Appraisal External failure ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 36 Cost of Quality Report Prevention costs are the costs incurred to prevent the production of defective products or delivery of substandard services. Appraisal costs are the costs incurred to identify defective products or services. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 37 Cost of Quality Report Internal failure costs are the costs of defective components and final products or services that are scrapped or reworked. External failure costs are the costs caused by delivery of defective products or services to customers, such as field repairs, returns, and warranty expenses. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 38 Quality-Control Chart The quality-control chart is a statistical plot of measures of various product dimensions or attributes. This plot helps detect process deviations before the process generates defects. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 39 Quality-Control Chart Quality-Control Chart Actual Goal .6% Percentage of Defects 2 1.5 1 0.5 0 3/12 3/19 3/26 4/2 4/9 4/16 4/23 4/30 Week of 5/7 ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 5/14 9 - 40 Cycle Time Cycle time, or throughput time, is the time taken to complete a product or service, or any of the components of a product or service. One key to improving quality is to reduce cycle time. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 41 Control of Cycle Time Lowering cycle time requires smoothrunning processes and high quality, and also creates increased flexibility and quicker reactions to customer needs. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 42 Productivity Productivity is a measure of outputs divided by inputs. Productivity measures vary widely according to the type of resource with which management is concerned. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 43 Control of Productivity More than half the companies in the United States manage productivity as part of the effort to improve their competitiveness. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 44 Control of Productivity How should outputs and inputs be measured? Labor-intensive organizations are concerned with increasing the productivity of labor, so labor-based measures are appropriate. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 45 Control of Productivity Highly automated companies are concerned with machine use and productivity of capital investments, so capacity-based measures, such as the percentage of time machines are available, may be most important to them. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 46 Learning Objective 7 Describe the difficulties of management control in service and nonprofit organizations. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 47 Service, Government, and Nonprofit Organizations Most service, government, and nonprofit organizations have more difficulty implementing management control systems. Why? ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 48 Service, Government, and Nonprofit Organizations Outputs of service and nonprofit organizations are more difficult to measure than are the cars or computers that are produced by manufacturers. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 49 Learning Objective 8 Understand how a management control system uses accounting information. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 50 Future of Management Control Systems A changing environment often means that organizations must set different subgoals or critical success factors. Different subgoals create different targets and different benchmarks for evaluating performance. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 51 Accounting Information A management control system uses management accounting tools such as budgets and performance reports to focus resources and talents of the individuals in an organization on such goals as quality, cost, and service. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 52 End of Chapter 9 ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 9 - 53