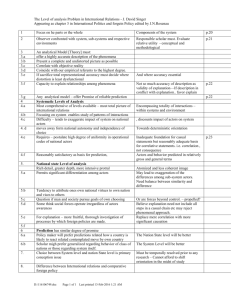

Economic Rationality

advertisement

Economic Rationality Economics • Allocation of scarce resources – “Economics exhibits in purest form the artificial component in human behavior …” • Occurs at all levels – individuals, business firms, markets, and economies – Outer environment: behavior of other actors – Inner environment: goals and capabilities for rational, adaptive behavior • Illustration of how outer and inner environments interact – Substantive rationality – adjustment to outer environment – Procedural rationality – ability, through knowledge and computation, to discover adaptive behavior The Economic Actor • Textbook economics – Outer: supply and demand – Inner: cost curves • Used – As description of how firms behave (positive) – As advice on how to maximize profits • Does not consider how these values are estimated Procedural Rationality • Many of the values are rough estimates – How elastic is demand? • Real life involves many interacting decisions – Product quality? – How many products? – How to market? • Problem changes from one of choosing the right course of action to locating a good action Supporting Economic Decisions • Operations Research – Uses linear programming (and similar techniques) to find optimal solutions to limited representations of reality – Optimal solution rarely is optimal but is often satisfactory • Artificial Intelligence – Uses rule-based reasoning (and similar techniques) to make decisions based on more aspects of a complex and less well structured reality – Solutions are good enough rather than being optimal in any respect • Satisficing – finding a solution that is good enough Aspirational Levels • “Because real-world optimization, with or without computers, is impossible, the real economic actor is in fact a satisficer” • Aspirations affect what is satisfactory – Most people register slightly above/below satisfactory – Aspirations are based on historical levels – Aspirations change (up and down) over time • Many simultaneous aspirations – Satisficing meets aspirations along all dimensions Markets and Organizations • Many mechanisms for coordinating actions among actors – Markets – Central planning – Bargaining and negotiation – Hierarchic organizations – Balloting procedures • Roughly 80% of human activity in the US economy takes place within organizations Markets and Optimality • Assumptions of market optimization – Actors have perfect information – Actors act to maximize utility/profits • Not realistic – Markets are populated by satificers – Information is limited, time is limited, etc. • “The marvel is not that (the dancing dog) dances well but that it dances at all” Order without a Planner • Complex design is often assumed to be the result of planning – Example of medieval cities • Collapse of Eastern Europe Economies – Cannot function well without smoothly operating markets • Poor performance since – Cannot function well without effective organizations • “The most significant fact about this system is the economy of knowledge with which it operates, or how little the individual participants need to know in order to be able to take the right action.” Friederich von Hayak Uncertainty and Expectations • Feedforward (prediction) and feedback can help control for uncertainty – But actors are not independent • Actors start trying to outguess one another – “Economic chicken”, speculation – Prisoner’s Dilemma – treachery pays • Unstable solution unless satisficing rather than optimizing • Classical economics avoided such issues by focusing on situations where mutual expectations play no role Bounded Rationality • There is a limit to what actors know about the state of their environment • Actors have limited time in which to determine their next action • Economic actors gradually learn about their environments to select satisficing, not optimizing, actions Business Organization • Market-organization boundary – What decisions are made within vs. what is made outside of the organization – One view is to consider the transaction costs of using a market • Successful organizations structure themselves – To localize and minimize information demands of decision makers – Resulting in specialization of role – Ensuring no single person or group needs to be an expert on all aspects Organizations and Uncertainty • Each market decision is impacted by the decisions of others in the market – Markets result in the type of uncertainty that causes outguessing and similar behaviors • Markets absorb uncertainty by removing some decisions and by causing actors to be more aligned in their goals • Organizations also augment human reason by placing people in cooperative rather than competitive roles – (Docile) People can learn from one another Evolutionary Models • Local and global optimization – Hill climbing algorithms – Choice of metric vs. English measurements • Each step is better for current situation – No planning, no feedforward, no design • Business/economic evolution – Lamarkian – any new idea can be incorporated as soon as its success is observed – No predictable equilibrium but a complex process that continues indefinitely