IFC EAP

advertisement

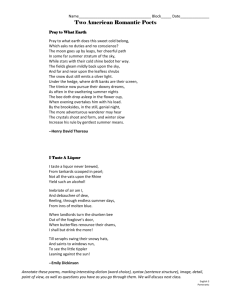

IFC EAP Pacific Sub-Regional Strategy December 2008 Pacific context •Challenges • 11 countries, 11 governments, 11 political-economies • The tyranny of distance: small, isolated, narrowly based economies – Extractive industries; agriculture; tourism • The ‘Arc of Instability’: several fragile post-conflict countries • Limited capacity • Intensive donor coordination •Opportunities • Historically good growth (though expected to slow through current crisis, financial sector is substantially shielded through presence of well capitalized Australian Banks; oil price fall a boon for all except PNG and Timor-Leste) • Discernable improvement in Government competence, and appreciation of private sector • High aid environment: number one development priority for Australia & New Zealand • Concrete examples exist of private sector solutions - telecommunications, aviation, power etc 2 One IFC Strategy •BEE •Financial markets •Infrastructure •High-potential sectors – Tourism – Extractive Industries – Agribusiness 3 Investment Portfolio •PNG Microfinance •Digicel PNG •Bank South Pacific (trade finance facility) •ECOM PNG •KULA II 4 Business Enabling Environment • Challenges – isolated, narrowly-based & small economies – Instabilty • Opportunities – Pacific getting more attention in IFC due to IDA country focus – scaling-up and programmatic approach – more effective program delivery mechanism under WBG banner • Initiatives – Broad BEE product coverage – regulatory simplification, investment policy and promotion, Doing Business rapid response, ADR, Industry Specific BEE • Regional approach through Pacific BEE Program • Vanuatu, Tonga, Papua New Guinea and Solomon Islands, suite of four replicable BEE interventions • A P/P Task Force in each Program country to sustain reforms • Linkages between BEE program and A2F and Tourism programs through P/P working groups – Using the Doing Business indicators to diagnose gender specific constraints and introduce reforms – Examples of other BEE interventions, eg; Timor Leste PPD, PNG Informal Economy project; Gender aspects of regulation 5 Access to Finance •Challenges – Low Capacity & small scale – Multiple donors •Opportunities – Regulatory environment little changed since independence - drive for reform – Finance sector dominated by large multinational institutions - niche for local institutions – Region-wide telecommunications revolution •Initiatives – Financial Markets Infrastructure • • • • – – – – Credit Bureaus Secured Transactions Company Registries Payments Systems Microfinance Mobile Phone Banking Sustainable energy financing Investment prospects 6 Tourism •Challenges – Critical sector for many client countries but development impeded by BEE, A2F and infrastructure constraints, as well as accessibility, instability and local capacity barriers. – Tourism investment leads exist but most ‘too small’ for IFC and/or need ‘packaging’ support. •Opportunities – Investment prospects identified – Tourism accounts for 20% of GDP and employment in Pacific (world average 10% & 8.3% respectively) – Travel demand for Pacific is increasing [1.1m 2004 1.4m 2010] – Investment prospects •Initiatives – Tourism impediments diagnostic program: seven countries (extension to two more under consideration). – Tourism reform program (forthcoming) – WHL ‘Access to Market’ projects in Timor-Leste & Solomon Islands (Samoa, Vanuatu, Fiji completed) 7 Infrastructure •Challenges – Limited private sector interest due to: – Small size of the deals/small economies – Geographic dispersion and isloation – Limited natrual resources •Opportunities – Newly formed Pacific Region Infrastructure Facility – Opportunity for IFC to provide inputs on PSP across region; identify potential infra projects – Investment prospects •Initiatives – Current active mandate ( Air Vanuatu). Process currently on hold. – Close collaboration with WB & PRIF to achieve intergration with upstream work 8 Timor-Leste •Challenges – – – – – – Fragile state Small economy – high population growth - high (youth) unemployment Poor doing business (168/178); limited access to finance Weak institutions; lack of capacities in public and private sector Budget execution; low administrative capacity Donor-heavy environment •Opportunities – – – – GoTL reform orientation (2008 = “year of reform”) Natural resources (petroleum fund at $3bn) Natural assets (tourism industry) Potential investments by GoTL and private sector (infrastructure/roads; energy; telecom; coffee) •Strategy – – – – – Field presence 2006, co-located with World Bank Focus on a few critical areas Public-Private Dialogue to bring government and PS together, and assist coordination Policy dialogue (e.g Doing Business): influence and align with National Priorities BEE (incl. tourism), A2F 9 Papua New Guinea • Challenges – – – – – GDP lags behind population growth; widespread poverty, growing law & order problems Weak government entities; declining services; failing infrastructure Economy narrowly based on resource extraction Resource revenues not effectively contributing to grass roots development High liquidity among financial insitutions, but A2F remains poor Opportunities – – – – Relative political stability, Kina stable Very rich resource(forestry, fisheries, minerals, oil and gas, tourism) Good progress on GoPNG/IFC engagement on BEE, infrastructure PPP; already working with Central Bank Private sector recognises IFC role in brokering public-private dialogue • Strategy – – – – – – Field presence established Jan 2006, co-located with WB Focus on A2F, BEE and Infrastructure Leverage investment in A2F and ICT to strenghthen A2F impact Partner with WB in designing and delivery of Country Assistance Stategy Collaborate with WB in design/delivery of agriculture dev. program, leveraging IFC agribusiness investment Scope and pursue investment opportunities in OGM, GMS, Infrastructure, Financial Markets and Agribusiness 10 Team priorities • Global/Local – continue to leverage Hong Kong/D.C expertise in support of Pacific programs and transactions • Continue roll-out of ‘new-generation’ AS programs – focus on results – BEE, A2F, Tourism , CAS • Finalise and implement ‘Pacific Initiative’ – Expand prospects pool – Enhance relationships with Australian corporates – IDA/IFC infrastructure Initiative • Plan & prepare 2nd stage AS scale-up 11