Electricity Industry Center Carnegie Mellon University

advertisement

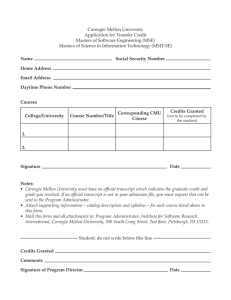

Carnegie Mellon University Beyond Blind Faith: Rethinking Electricity Restructuring Seth Blumsack Carnegie Mellon University blumsack@cmu.edu Electricity Industry Center Carnegie Mellon University Overview Carnegie Mellon Electricity Industry Center (CEIC) • One of 27 Sloan Centers of Excellence in different industries • 17 Faculty and 22 Ph.D. students at CMU, 9 Ph.D.s granted so far. • Probably the largest effort of its kind in the world focused on interdisciplinary problems of the electricity industry. • Close cooperation with all stakeholders: Industry, regulators, government agencies, consumers, labor, national laboratories. • Strategic focus on issues of middle and long-term importance • Focus scientific knowledge to clarify the big picture issues and work though individual projects on: –Market Structure and Performance –Distributed Energy Resources –Advanced Generation and Transmission Technologies –Environmental and Sustainability Issues –Reliability and Security Electricity Industry Center Carnegie Mellon University Overview 1. Deregulation or better regulation? 2. Why RTO markets may inherently raise costs 3. Retail competition has not lowered electricity prices 4. Investment: What can LMP tell us? 5. The good, the bad, and the ugly of LMP 6. Current RTO and market challenges Electricity Industry Center Carnegie Mellon University Why Did We Need Deregulation Restructuring To Do Something in the First Place? Electricity Industry Center Carnegie Mellon University U.S. Net Electric Generation 7000 6000 Billion kWh 5000 4000 3000 2000 70 B kWh / year (10,000 MW/yr) 7¾ % / year 1000 1960 1970 1980 1990 2000 Electricity Industry Center Carnegie Mellon University Electricity Industry Center Carnegie Mellon University Why Not Reform Regulation? • 1970s energy crises increased fuel costs, shifted demand growth from exponential to linear • Utility generation/transmission investments became “white elephants” • Regulators had no choice but to allow utilities to pass costs on to consumers, increasing prices • Consumer anger with utilities and regulators, accusations of “gold-plating” • Oil and gas deregulation followed by lower prices Electricity Industry Center Carnegie Mellon University Effective regulation requires expertise and information – even the best regulators have less of both than the companies they’re trying to regulate! Electricity Industry Center Carnegie Mellon University Creating Competitive Electricity Markets May Inherently Raise Costs Electricity Industry Center Carnegie Mellon University Marginal and Average Cost Pricing Electricity Industry Center Carnegie Mellon University Uniform Price Auctions Electricity Industry Center Carnegie Mellon University Are Electricity Markets Competitive? The usual market concentration metrics (HHI, etc.) do not translate well into electricity markets. A better notion is the pivotal supplier – a single supplier or group of suppliers is pivotal if their capacity exceeds the spare capacity of the system as a whole – buy from them or suffer blackouts! Example of a “pivotal” monopolist Suppose that: • Total generation capacity is 100 MW; • Firm M controls 18 MW; • The ISO announces that it seeks to buy 90 MW; Results: • Firm M knows that it has monopoly power! • If every other firm in the market had less than 1% of market share, the conventional HHI would be 324. Electricity Industry Center Carnegie Mellon University Should We Worry About Groups of Pivotal Suppliers? Yes! Sarosh Talukdar has simulated markets that have 10 suppliers or 10 demanders, each with 10% of capacity Red: Inelastic Demand Blue: Elastic Demand Electricity Industry Center Carnegie Mellon University Pivotal Firms in CA, PJM, NYISO, 2000/2001 100% CAISO 90% PJM 80% Duration (% of Hours) NYISO 70% 60% 50% 40% 30% 20% 10% 0% 1 2 3 4 Number of Pivotal Firms 5 6 Electricity Industry Center Carnegie Mellon University Mitigating Pivotal Suppliers • Have price caps & force generators to offer power at variable cost when demand is high • Build more generation • Build more transmission • Break up firms to keep them small • Change structure: Eliminate hourly auctions Each of these would work, but would involve substantial costs – many would be more costly than the ~10% efficiency improvements attributed to restructuring. Electricity Industry Center Carnegie Mellon University Price Caps Current FERC regulations: • Price caps to keep price in control • Require pivotal firms to offer electricity at variable cost when demand is high • Firms could never cover their fixed costs and so no future investment Electricity Industry Center Carnegie Mellon University Expand Generation Capacity This will do the job, but the costs can be substantial – would increase costs by at least 2 cts/kWh in any RTO. Mitigation Cost ($ billion) 8 CAISO PJM NYISO 6 4 2 0 1 2 3 4 5 6 Number of Pivotal Firms Assumptions: $600/kW capital cost, 10% discount rate (CAPM), all new generation is gas-fired with a 30-year economic life, capacity is on standby during hours with pivotal suppliers. Electricity Industry Center Carnegie Mellon University Expand Transmission Capacity This will only work if cheap imports are readily available – could be true in California, but probably not in the Eastern Interconnect AZ CA NM OR WA AZ 1 0.90 0.93 -0.10 -0.48 PJM NYISO ECAR SERC NEPOOL CA NM OR WA 1 0.80 -0.04 -0.41 1 0.10 -0.33 1 0.77 1 PJM 1 0.92 0.90 0.87 0.91 NYISO ECAR 1 0.78 0.83 0.86 1 0.88 0.84 Demand correlation matrix – Western States SERC NEPOOL 1 0.74 Demand correlation matrix – Eastern Interconnect 1 Electricity Industry Center Carnegie Mellon University Force Large Generators to Divest This would reduce market power but might also reduce operational efficiency – there is evidence of this from the nuclear sector 100% Mean Capacity Factor 80% 60% 40% 20% Firms owning one plant Firms owning two plants Firms owning three plants Firms owning > 3 plants 0% 1993 1997 2000 2002 Year Electricity Industry Center Carnegie Mellon University Increased Risk in a Capital-Intensive Industry • Merchant debt has dropped to junk; IOU debt below A grade • Public power debt still has A grade Source: The Brattle Group • For a new coal plant, capital is at least 2/3 of total cost. Investors demanding 15% or 20% instead of 10% can increase costs by 1 to 5 cts/kWh Electricity Industry Center Carnegie Mellon University RTOs Are Costly Institutions • Startup costs for California ISO estimated at $500 million to $1 billion, with operating costs of $200 million/year • PJM has operating costs of $250 million/year Source: Public Power Council Electricity Industry Center Carnegie Mellon University Retail Competition Has Not Lowered Industrial Electricity Prices Electricity Industry Center Carnegie Mellon University Why Retail Competition? Restructuring in the electric power industry was supposed to lower costs, increase efficiency, and make markets more competitive. How have we done? “…more than $3 billion in savings in 2002 in the Mid-Atlantic (PJM) region…approximately $28.5 billion in future savings…additional macroeconomic benefits should double the direct customer benefits…” (Excerpts from Benefits of Competition in the Mid-Atlantic Region, Center for the Advancement of Energy Markets) Sounds Great! Electricity Industry Center Carnegie Mellon University What is Really Going On? To the extent that retail prices have fallen, it is because regulators have mandated rate-cuts and freezes. Many of these expire soon… Some Proposed Retail Rate Increases Connecticut Light & Power: 22% Delmarva Power: 56% to 117% TXU Corp. (Texas): 80% (actual, not proposed) NStar (Massachusetts): 60% to 80% Baltimore Gas & Electric: 72% proposed, at least 15% actual Electricity Industry Center Carnegie Mellon University We examine industrial sales and revenue data from EIA forms 826 and 861 Electricity Industry Center Carnegie Mellon University Electricity Industry Center Carnegie Mellon University Frequencies Present in Maryland Industrial Price Data 12 months 5 6 months 4 months 3 months 2.4 months Power 4 3 2 1 0 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 Frequency (cycles per month) Electricity Industry Center 0.5 Carnegie Mellon University Maryland Industrial 6.5 Cents per kWh 6 5.5 5 4.5 4 3.5 1990 91 92 93 94 95 96 97 98 99 2000 01 02 03 Electricity Industry Center 04 Carnegie Mellon University Western Industrial 12 CA AZ NV 10 CA OR Cents per kWh WA 8 NV 6 AZ 4 OR WA 1990 91 92 93 94 95 96 97 98 99 2000 01 02 03 Electricity Industry Center 04 Carnegie Mellon University Southern Industrial 12 FL GA Cents per kWh 10 MS AL SC 8 6 4 1990 91 92 93 94 95 96 97 98 99 2000 01 02 03 Electricity Industry Center 04 Carnegie Mellon University New England Industrial 12 RI Cents per kWh 10 NH MA 8 CT VT 6 RI MA CT 4 NH VT 1990 91 92 93 94 95 96 97 98 99 2000 01 02 03 Electricity Industry Center 04 Carnegie Mellon University 10% Annual Industrial Price Change 5% 0% -5% -10% -15% -20% Before After -25% Electricity Industry Center Carnegie Mellon University 5% Annual Industrial Price Change 2.5% 1.3% 1.0% 0.8% 0.3% 0% 0.0% -0.6% -0.7% -1.3% -0.8% -0.8% -0.7% -1.3% -1.8% Before After -5% Electricity Industry Center Carnegie Mellon University 5% Annual Industrial Price Change 2.1% 2.0% 1.8% 1.7% 0.9% 0.8% 0.4% 0.4% 0.5% 0.3% 0% 0.0% -1.7% Before After -5% Electricity Industry Center Carnegie Mellon University Correlation of Restructuring with Industrial Price Changes Regulated Restructured Annual Rate of Change After - Before 10% 5% 0% -5% -10% -15% -20% -25% Electricity Industry Center Carnegie Mellon University Large Customers Should Have Been the Beneficiaries of Retail Competition • They have the option to purchase power in bilateral contracts through RFP / direct negotiation for block purchases; they can become their own load-serving entity and buy in the wholesale market. They are getting killed. Hourly Wholesale Electricity Prices in Beaver 12 10 Spot vs. long term cents per kWh 8 6 4 2 5/18/2005 5/19/2005 0 0 6 12 Hour of the Day 18 Electricity Industry Center 24 Carnegie Mellon University What Can LMP Tell Us About Investment? Electricity Industry Center Carnegie Mellon University Investment Issues Under Restructuring Restructured markets have not had a stellar record encouraging investment. What is going on here? 1. Merchant generation investment and the gas bubble 2. Capacity markets, price caps, and resource adequacy 3. Transmission What is the role of LMP in all of this? Electricity Industry Center Carnegie Mellon University Restructuring and Natural Gas Monthly Natural Gas Citygate Price and consumption of natural gas for electric power generation 16 7 14 6 Consumption for Electricity 12 $ per mcf 10 4 8 3 6 2 4 Natural Gas Price 1 2 1990 - 1992 1994 1996 1998 2000 2002 2004 2006 Electricity Industry Center TCF used for electricity 5 Carnegie Mellon University Capacity Markets Out-of-market purchases, Reliability pricing model, etc… Electricity Industry Center Carnegie Mellon University Capacity Markets and LMP • Uniform price auction used in RTO markets starves the peakers and transfers these “rents” to baseload plants. • LMPs are incredibly volatile, as are spot prices for every energy commodity – short-run demand curve is highly inelastic, and short-run supply curve is very steep near the capacity constraint. • Capacity payments are a political “second-best” solution to get peakers and newer generators into the market when the RTO uses caps and other mechanisms to keep LMPs low. • Does a depreciated 50-year old nuke with MC = 1.5 cts/kWh actually need a capacity payment? Electricity Industry Center Carnegie Mellon University The Transmission Grid is Under Stress • TLRs increasing • Average and total congestion costs increasing in restructured systems • Investment in high-voltage lines declining PJM Congestion Costs 3.50 Total Congestion Costs ($M) 3.00 Total 2,000 Average 2.50 1,500 2.00 1.50 1,000 1.00 500 Average Congestion Costs ($/MWh) 2,500 0.50 0 0.00 1999 2000 2001 2002 2003 2004 2005 Electricity Industry Center Carnegie Mellon University Whatever Happened to Merchant Transmission? “The real difference between the U.S. and France is that American economists believe that markets work in theory but not in practice, whereas French economists believe that markets work in practice but not in theory.” -- Ezra Beeman of CERA (Paris) North American RTOs have been demonstrating a distinctly Gallic flair. They are still trying to attract merchant AC transmission investment, dangling FTRs as carrots. Electricity Industry Center Carnegie Mellon University Merchant Transmission in Theory • Locational marginal prices (LMP) are investment signals; differences in LMPs tell investors where to upgrade existing lines or where to build new lines • Investors are given financial rights to the congestion revenue, in the form of point-to-point rights (Financial Transmission Rights or FTR) • The holder of an M megawatt FTR, defined between nodes a and b in the grid, at time t receives FTR Revenue: M (LMPa,t – LMPb,t) Electricity Industry Center Carnegie Mellon University Merchant Transmission Critique #1 Bus 2 π2 = $46.96 FS12 = 55 MW μS12 = $45.87 FS24 = 36.7 MW μS24 = $0 FS23 = 18.3 MW μS23 = $0 Bus 1 PG1 = 91.67 MW π1 = $11.96 FS13 = 36.7 MW μS13 = $0 FS34 = 55 MW μS34 = $20.30 Bus 4 PL4 = 100 MW PG4 = 8.33 MW π4 = $51.67 Bus 3 π3 = $33.72 "From" Bus 2 4 3 "To" Bus 1 3 2 "From" Price ($/MWh) 46.96 51.67 33.72 "To" Price ($/MWh) 11.96 33.72 46.96 Difference ($/MWh) 35 17.95 -13.24 Size (MW) 5 5 18.3 Total Value ($/h) 175 89.75 -242.292 $22.46 I can profit from building a line that causes congestion! Electricity Industry Center Carnegie Mellon University Merchant Transmission Critique #2 • LMP differences do not capture the system cost of congestion • If the line is expanded, the LMP difference disappears. Why would anyone invest in a system like this? Electricity Industry Center Carnegie Mellon University Merchant Transmission Critique #3 Bus 2 π2 = $46.96 FS12 = 55 MW μS12 = $45.87 FS24 = 36.7 MW μS24 = $0 FS23 = 18.3 MW μS23 = $0 Bus 1 PG1 = 91.67 MW π1 = $11.96 FS13 = 36.7 MW μS13 = $0 FS34 = 55 MW μS34 = $20.30 Bus 4 PL4 = 100 MW PG4 = 8.33 MW π4 = $51.67 Bus 3 π3 = $33.72 • Building line (2,3) causes congestion, but may provide a reliability benefit. • Merchant transmission assumes that congestion and reliability are independent. Electricity Industry Center Carnegie Mellon University Policy Assumes Congestion and Reliability are Separable and Independent Congressional, FERC, and RTO policy divides transmission investments into those which enhance reliability and those which reduce congestion: • Federal Power Act, Sec. 215(e): FERC has regulatory jurisdiction over economic transmission matters (i.e., congestion), and the ERO has jurisdiction over technical matters (i.e., reliability). • Merchant AC transmission via transmission congestion contracts, participant funding, congestion reduction, etc. • Cost allocation for new lines based on a reliability or congestion designation. Lines for reliability have their costs socialized, while lines for congestion are paid for by designated “beneficiaries.” Electricity Industry Center Carnegie Mellon University Congestion and Reliability are Almost Never Independent • Simple simulations on a 118-bus network to isolate the contributions of individual lines to congestion and reliability. • Those that cause congestion also tend to increase reliability. Electricity Industry Center Carnegie Mellon University Is Merchant Transmission the Problem? • Actually, no. The real problem is with using LMP to compensate transmission investment. • Merchant transmission has been the policy of FERC and RTOs for several years – FTRs have not gotten a single merchant line built! • Long-term contracts have gotten lines built (e.g., Neptune line) Electricity Industry Center Carnegie Mellon University Where to From Here? Electricity Industry Center Carnegie Mellon University Summary: Which do you Want First, the Bad News or the Bad News? • Blind faith in restructuring and organized markets have not brought down electricity costs. Prices have declined, but only by edict from regulators. • LMPs are naturally volatile and can/should spike to very high levels during peak periods. RTOs have not permitted this. • Price caps and other actions have required the development of intricate and unnecessary capacity markets. • Congestion and reliability are system attributes. AC transmission investment is a systems problem that LMPs cannot solve. Electricity Industry Center Carnegie Mellon University What is Wrong with LMP? • LMP is a by-product of constrained economic dispatch. It tells you some things about the system right now. • In a competitive market, prices must send signals and convey information. • LMP does convey some information – such as whether there is congestion – but it does not necessarily tell you the best corrective action. • LMPs as currently used represent incomplete information. LMPs do not say anything about reactive power, reliability, admittance, inertia, contingencies, marginal/aggregate losses (in some RTOs), all of which are part of the electric “good” that customers purchase. Electricity Industry Center Carnegie Mellon University Some Current Market Challenges • Forward markets for energy: oil and natural gas prices are just as volatile as electricity LMPs. But oil and gas have liquid forward markets which allow for risk management. NYMEX has not been effective for electricity. • Compensating FACTS and other new technologies – what would it mean to have an “LMP” for a phase-shifting transformer? • Ancillary services markets have been uncompetitive. Should ancillary services be procured jointly with energy in the spot market? Would this capture enough value of ancillary services to attract investment? • Demand response – engaging consumers to be active market participants. Is this an engineering or economic problem? Electricity Industry Center Carnegie Mellon University Thank You! Seth Blumsack blumsack@cmu.edu www.andrew.cmu.edu/~sblumsac www.cmu.edu/electricity Electricity Industry Center