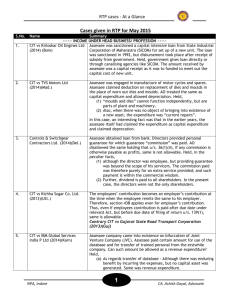

gist of important judgments relating to tds SECTION 191 – DIRECT

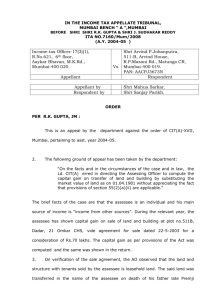

advertisement