Further Reforms after the “BIG BANG”: The JGB Market

advertisement

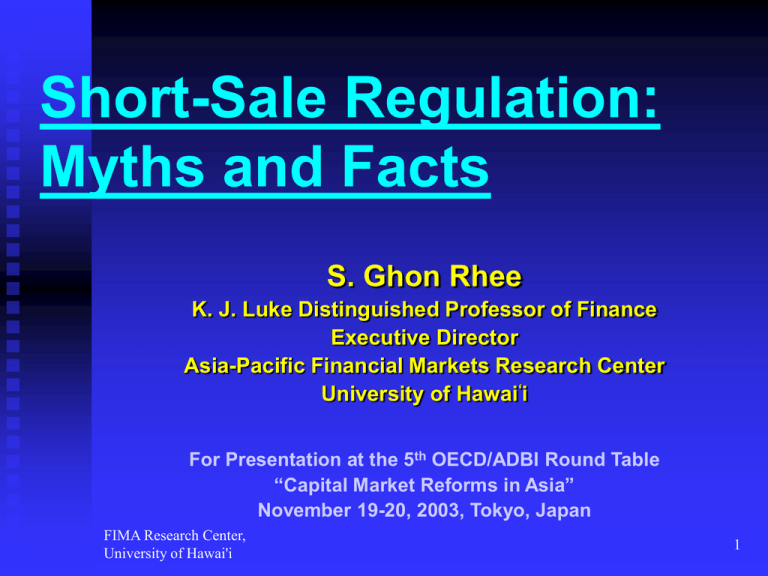

Short-Sale Regulation: Myths and Facts S. Ghon Rhee K. J. Luke Distinguished Professor of Finance Executive Director Asia-Pacific Financial Markets Research Center University of Hawai‘i For Presentation at the 5th OECD/ADBI Round Table “Capital Market Reforms in Asia” November 19-20, 2003, Tokyo, Japan FIMA Research Center, University of Hawai'i 1 Current Status of Short-Sale Regulation in Asia Country Short-Selling Permitted China Hong Kong, SAR No Yes Indonesia Yes Japan Yes Korea Malaysia Philippines No No No Singapore No Taipei,China Thailand No Yes Details Allowed for Designated Securities Reinstated Uptick Rule in 9/98 No Specific Regulations Prohibiting Short Selling as long as Sufficient Shares are Available Uptick Rule Last Price is a Downtick or a ZeroMinus Tick as of 3/6/02 SEC Approved the Rules on SBL and Short Selling, but they are not clearly defined No statutory prohibition, but the present CDP system actively works against it. Allowed for the SET 50 Component Stocks Source: Morgan Stanley FIMA Research Center, University of Hawai'i 2 Recent Developments in Short-Sale Regulation: US Market SEC Concept Release No. 34-42037: Short Sale (September 1999) Two Focuses: a. Potential Abuse of Short-Selling for Downward Price Manipulation on Illiquid Stocks b. Application of the Up-Tick Rule to all US Markets Currently Nasdaq Small Cap, OTC Bulletin Board, and OTC Pink Sheet are not subject to short sale restrictions FIMA Research Center, University of Hawai'i 3 Recent Developments in Short-Sale Regulation: UK Market FSA Discussion Paper 17 “Short Selling” (October 2002) FSA Position a. Short Selling is a legitimate investment activity b. Introduction of Specific Regulatory Constraints Not Warranted c. Greater Transparency FIMA Research Center, University of Hawai'i 4 Recent Developments in Short-Sale Regulation: Japanese Market FSA’s Anti-Deflationary Measures (February 2002) a. b. c. d. e. Up-Tick Rule (as of March 2002) Review of Margin Transactions and Institutional Borrowing Increase in lending rate of individual stocks identified for excessive borrowing Disclosure of Short-Selling Data on a regular Interval Revision of Stock Exchange Rules for Additional Collateral for Margin Transactions FIMA Research Center, University of Hawai'i 5 What Do We Know About the Impact of Short-Sales Constraints? 1. Do They Impede Market Efficiency? 2. Do They Prevent Price Declines? 3. Do They Cause Overpricing and Subsequent Negative Returns? 4. Do Speculative Short Sales Exist? FIMA Research Center, University of Hawai'i 6 Do Short-Sale Constraints Impede Market Efficiency? (I) The Answer is Positive US Market: Aggregate level of short sales for individual stocks is disseminated only once a month Australian Market: Short sale-related information is disseminated on real time basis FIMA Research Center, University of Hawai'i 7 Do Short-Sale Constraints Impede Market Efficiency? (II) Significant Negative Reaction to Short Sale Information is Found Negative returns are approximately -0.02% over 20 trades after short-sales information is released [Aitken, Frino, McCorry, and Swan (1998)] High degree of transparency is desired since short sales convey the information that results in reassessment of stock valuation FIMA Research Center, University of Hawai'i 8 Do Short-Sale Constraints Impede Market Efficiency? (III) Hong Kong Market Before January 3, 1994: No short selling was allowed in Hong Kong b. As of March 25, 1996: 113 stocks were allowed to be sold short and HKEx abolished the uptick rule FIMA Research Center, University of Hawai'i 9 Do Short-Sale Constraints Impede Market Efficiency? (IV) Relation between the Hang Seng Index futures market and the underlying HIS component stock market strengthens with the introduction of short sales a. Contemporaneous Correlation 0.077 Before January 1994 0.249 After March 25, 1996 b. Duration of the HIS Futures market lead over the HIS cash market 15 minutes Before January 1994 9 minutes After March 25, 1996 Jiang, Fung, and Cheng (2001) FIMA Research Center, University of Hawai'i 10 Can Short-Sales Constraints Prevent Price Declines? The Answer is Negative a. b. c. If some investors are constrained from selling short, their unrevealed negative information will not be manifest until the market begins to drop, which further aggravates market declines [Hong and Stein (2002)] Price reactions to quarterly earnings announcements are greater when short-sales are costly [Reed (2003)] Distribution of earnings announcement-day returns is more left-skewed and suffer from higher volatility when short-sales are costly [Reed (2003), Ho (1996)] FIMA Research Center, University of Hawai'i 11 Do They Cause Overpricing and Subsequent Negative Returns? The Answer is Positive a. With short-sales constraints, a stock price will reflect the optimists’ valuations because the pessimists simply sit out of the market as opposed to selling short. b. Stocks that are expensive to short tend to be overpriced and exhibit low subsequent returns FIMA Research Center, University of Hawai'i 12 Nikkei 225 Index Movement and Short-sale Regulation 15000 14000 3/6/02 11358.53 13000 12000 11000 9/5/02 9222.12 10000 2/8/02 9686.06 3/19/03 8051.04 11/4/02 9/4/02 7/4/02 5/4/02 3/4/02 1/4/02 11/4/01 FIMA Research Center, University of Hawai'i 9/4/01 7/4/01 5/4/01 3/4/01 1/4/01 7000 3/4/03 8000 1/4/03 9000 13 Do Speculative Short Sales Exist? (I) Perhaps Yes in the Past but No Longer Day-of-the-Week Anomaly in the US Market (1962-1999) a. Large Positive Returns on Fridays: 0.245% b. Large Negative Returns on Mondays: . -0.093% Total Week-end Effect 0.338% The inability of trading over the weekend forces short sellers close speculative short positions on Fridays and recreate the position on Mondays FIMA Research Center, University of Hawai'i 14 Do Speculative Short Sales Exist? (II) A. Week-End Returns Stocks with high short interest vs. Stocks with low short interest: 0.39% vs. 0.27% B. Subperiod Week-End Returns (Individual Stock Options introduced in 1977) High Put Volume Low Put Volume 1963-1977: 0.49% 0.25% 1978-1987: Insignificant 0.42% 1988-1999: Insignificant 0.37% FIMA Research Center, University of Hawai'i Chen and Singal (2003) 15 In Conclusion The Bottom Line Message: “Why Do We Want to Regulate Short Sales?” 1. Short-Sale Constraints Impede Market Efficiency 2. Short-Sale Constraints Can Not Stop Price Declines 3. Put Options Provide Far More Effective and Less Costly Way of Creating Short Positions 3. Short-Sales Represent Only a Small Portion of the Total Market Volume However, Short-Sales Constraints May be Justified for Illiquid Stocks or Small-Sized Firm Stocks FIMA Research Center, University of Hawai'i 16 Thank You!