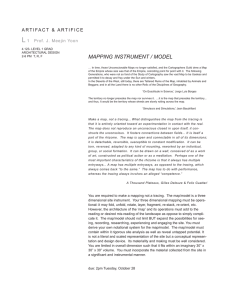

Cost Objects

advertisement

Basic Cost Management Concepts 2 2-1 A Systems Framework 1 Financial Accounting Information System • Inputs: well-specified economic events • Processes: rules and conventions established by the SEC and FASB • Outputs: financial statements for external users Cost Management Information System • Inputs and processes: set by management; not bound by externally imposed criteria • Outputs: reports for internal users 2-2 A Systems Framework 1 The cost management information system has three broad objectives that provide information for: 1) Costing services, products, and other objects of interest to management 2) Planning and control 3) Decision making The value chain is the set of activities required to design, develop, produce, market, deliver, and provide post-sales service for the products and services sold to customers. 2-3 Cost Assignment: Direct Tracing, Driver Tracing and Allocation 2 • Costs are sacrifices made to obtain goods or services. As long as they remain unexpired, they are on the balance sheet as an asset. • Expenses are expired costs which are deducted from revenues on the income statement. • Cost Objects are anything for which costs are measured and assigned. Some cost objects are tangible, such as the product we make; others are not such as activities we for which we wish to accumulate cost information. 2-4 Cost Assignment: Direct Tracing, Driver Tracing and Allocation 2 Traceability means that costs can be assigned easily and accurately, using a causal relationship. Methods of tracing: 1. Direct tracing: relies on physical observance of causal relationships to assign costs to cost objects. 2. Driver tracing: relies on drivers as causal factors to assign costs to cost objects. Costs that cannot be traced are considered indirect costs and are allocated products in some predetermined way. 2-5 Product and Service Costs 3 • Tangible products are goods produced by converting raw materials into finished products. • Services are activities performed for a customer or by a customer using the service provider’s products or facilities. Services have three characteristics that separate them from tangible products: • • • Intangibility Perishability Inseparability 2-6 Product and Service Costs 3 Manufacturing Costs (Production Costs) • Direct materials are those materials that are directly traceable to the goods or services being produced. • Example: The cost of wood in furniture. • Direct labor is the labor that is directly traceable to the goods or services being produced. • Example: Wages of assembly-line workers. • Overhead are all other manufacturing costs. • Example: Plant depreciation, utilities, property taxes, indirect materials, indirect labor, etc. 2-7 Product and Service Costs 3 Prime and Conversion costs • Prime Cost is the sum of direct materials and direct labor. • Conversion Cost is the sum of direct labor and overhead. •Hint: Never add prime cost and conversion cost or you will have double counted labor because it is included in each definition! 2-8 Product and Service Costs 3 Nonproduction Costs (Period Costs) • Marketing (selling) costs are the costs necessary to market, distribute, and service a product or service. • Example: Advertising, storage costs, and freight out. • Administrative costs are the costs associated with research, development, and general administration of the organization that cannot reasonably be assigned to either marketing or production. • Example: Legal fees, salary of the chief executive officer. 2-9 External Financial Statements 4 • Income Statement: Manufacturing Firm • • • • • • Prepared for external parties Follows standard format Is referred to as an absorption-costing or fullcosting income statement because all manufacturing costs are absorbed into the cost of goods. Cost of Goods Manufactured represents the total manufacturing cost of goods completed during the period. Work in Process consists of all partially completed unites found in production at a given point in time (usually the end of one period/beginning of the next). Cost of Goods Sold is the manufacturing cost of all goods that were sold during the period. 2-10 Traditional and Activity-Based Cost Management Systems • 5 Traditional Cost Management Systems • • Traditional Cost Accounting • Assumes all costs can be classified as fixed or variable with respect to changes in units or volume. • Allocates costs that are not unit-based. Traditional Cost Control • Assigns costs to organizational units and holds the unit manager responsible for controlling the assigned costs. • Performance is measured by comparing actual outcomes with standard or budgeted outcomes. • Emphasis is on financial measures of performance. 2-11 Traditional and Activity-Based Cost Management Systems • 5 Activity-Based Cost Management Systems • • Activity-Based Cost Accounting • Emphasizes tracing over allocation • Identifies non-unit-based activity drivers. • Flexible system capable of producing cost information for a variety of purposes. Activity-based Cost Control • Seeks to understand and control activities rather than costs. • • Activity-based management (ABM) focuses on improving customer value. Looks at the process view and focuses accountability on activities to maximize systemwide performance. 2-12