Document

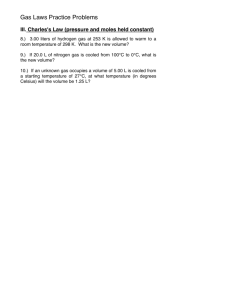

advertisement

Basic Cost Management Concepts Prepared by Douglas Cloud Pepperdine University 2-1 Objectives 1. Describe a cost management information After studying this system, its objectives, and its major chapter, you should subsystems, andbe indicate how it relates to able to: other operating and information systems. 2. Explain the cost assignment process. 3. Define tangible and intangible products, and explain why there are different product cost definitions. 2-2 Objectives 4. Prepare income statements for manufacturing and service organizations. 5. Explain the differences between traditional and contemporary cost management systems. 2-3 A Systems Framework A system is a set of interrelated parts that performs one or more processes to accomplish specific objectives. Example: An air conditioning system for a home 2-4 Operational Model of an Air Conditioning System Cooling Process Inputs: Freon Warm Air Electricity Output: Cooled Air Delivery Process Inputs: Cooled Air Electricity Ducts Output: Delivered Cooled Air 2-5 Accounting Information System An accounting information system is a system consisting of interrelated manual and computer parts, using processes such as collecting, recording, summarizing, analyzing, and managing data to provide information to users. Like any system, an accounting information system consists of: (1) objectives, (2) interrelated parts, (3) processes, and (4) outputs. 2-6 Operational Model for an Accounting Information System Economic Events Collecting Classifying Summarizing Analyzing Managing Special Reports Financial Statements Budgets Performance Reports Personal Communication Inputs Processes Outputs Users 2-7 Accounting Information Systems The financial accounting information system is an accounting information subsystem that is primarily concerned with producing outputs for external users. The cost management information system is an accounting information subsystem that is primarily concerned with producing outputs for internal users using inputs and processes needed to satisfy management objectives. 2-8 Accounting Information Systems The cost management information system has three broad objectives that provide information for-1) Costing out services, products, and other objects of interest to management 2) Planning and control 3) Decision making 2-9 An Integrated Cost Management System Design and Development System Production System Cost Management System Marketing and Distribution System Customer Servicing System 2-10 The Subsystems of the Accounting Information System Accounting Information System Financial Accounting Information System Cost Management Information System Cost Accounting Information System Operational Control System 2-11 Basic Cost Concepts Cost is the cash or cash equivalent value sacrificed for goods and services that are expected to bring a current or future benefit to the organization. Costs are incurred to produce future benefits. Expired costs are called expenses. Unexpired costs are classified as assets and appear on the balance sheet. Assigning cost accurately to cost objects is crucial. 2-12 Basic Cost Concepts A cost object is any item, such as products, customers, departments, projects, activities, and so on, for which costs are measured and assigned. Example: A bicycle is a cost object when you are determining the cost to produce a bicycle. An activity is a basic unit of work performed within an organization. Example: Setting up equipment, moving materials, maintaining equipment, designing products, etc. 2-13 Basic Cost Concepts Traceability is the ability to assign a cost to a cost object in an economically feasible way by means of a causal relationship. Direct costs are those costs that can be easily and accurately traced to a cost object. Example: The salary of a supervisor of a department, where the department is defined as the cost object. 2-14 Basic Cost Concepts Indirect costs are those costs that cannot be traced easily and accurately to a cost object. Example: The cost of heating and cooling a plant that manufactures five products. 2-15 Cost Assignment Methods Cost of Resources Resource Drivers Direct Tracing Physical Observation Driver Tracing Allocation Activity Drivers Convenience Assumed Linkage Cost Objects 2-16 Product Cost Definitions Value-Chain Product Costs Operating Product Costs Traditional Product Costs Production Production Production Marketing Marketing Customer Service Customer Service Pricing Decisions Product Mix Decisions Strategic Profitability Analysis Strategic Design Decisions Tactical Profitability Analysis Research and Development External Financial Reporting 2-17 Manufacturing Costs Direct materials are those materials that are directly traceable to the goods or services being produced. Example: The cost of wood in furniture. Direct labor is the labor that is directly traceable to the goods or services being produced. Example: Wages of assembly-line workers. Overhead are all other manufacturing costs. Example: Plant depreciation, utilities, property taxes, indirect materials, indirect labor, etc. 2-18 Nonproduction Costs Marketing (selling) costs are the costs necessary to market, distribute, and service a product or service. Example: Advertising, storage costs, and freight out. Administrative costs are the costs associated with research, development, and general administration of the organization that cannot reasonably be assigned to either marketing or production. Example: Legal fees, salary of the chief executive officer. 2-19 Nonproduction Costs For external financial reporting, marketing and administrative costs are not inventoried. They are referred to as period costs. 2-20 Production or Manufacturing Costs Direct Materials Direct Labor Overhead Nonproduction or Operating Costs Marketing Expense Prime Cost Order-Getting Costs Order-Filling Costs Conversion Cost Administrative Expense 2-21 Manufacturing Organization Income Statement For the Year Ended December 31, 2004 Sales Less: Cost of goods sold $2,800,000 1,300,000 Gross margin Less operating expenses: $ 700,000 Selling expenses Administrative expenses Operating income $300,000 From the Cost 150,000of Goods 450,000 Sold $Schedule 250,000 2-22 Statement of Cost of Goods Manufactured For the Year Ended December 31, 2004 Direct materials: Beginning inventory $200,000 Add: Purchases 450,000 Materials available $650,000 Less: Ending inventory 50,000 Direct materials used in production $ 600,000 Direct labor 350,000 Manufacturing overhead: Indirect labor $122,500 Depreciation 177,500 Rent 50,000 Utilities 37,500 Property taxes 12,500 Maintenance 50,000 450,000 Total manufacturing costs continued added $1,400,000 2-23 Total manufacturing costs added Add: Beginning work in process Less: Ending work in process Cost of goods manufactured $1,400,000 200,000 400,000 $1,200,000 Work in process consists of all partially completed units found in production at a given point in time. 2-24 Cost of Goods Sold Schedule For the Year Ended December 31, 2004 Cost of goods manufactured Add: Beginning inventory finished goods Cost of goods available for sale Less: Ending inventory finished goods Cost of goods sold $1,200,000 250,000 $1,450,000 150,000 $1,300,000 From the Statement of Cost of Goods Manufactured 2-25 Activity-Based Management Model Cost View Resources Process View Driver Analysis Activities Performance Analysis Why? What? How well? Products and Customers 2-26 Functional-Based and ActivityBased Cost Management Systems Functional-Based 1. Unit-based drivers 2. Allocation-intensive 3. Narrow and rigid product costing 4. Focus on managing costs 5. Sparse activity information 6. Maximization of individual unit performance 7. Uses financial measures of performance 2-27 Functional-Based and ActivityBased Cost Management Systems Activity-Based 1. Unit- and nonunit-based drivers 2. Tracing intensive 3. Broad, flexible product costing 4. Focus on managing activities 5. Detailed activity information 6. Systemwide performance maximization 7. Uses both financial and nonfinancial measures of performance 2-28 Trade-Off Between Measurement and Error Costs Cost Total Cost Measurement Cost Error Cost Low Accuracy Optimal Level High Accuracy 2-29 Shifting Costs Cost Old Measurement Cost New Measurement Cost New Error Cost Old Error Cost Low Old Optimum New Optimum Accuracy High 2-30 End of Chapter 2-31 2-32