Accrual Accounting and the Financial Statements

advertisement

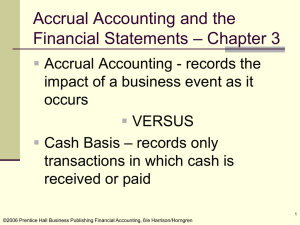

Accrual Accounting and the Financial Statements Chapter 3 1 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Learning Objective 1 Relate accrual accounting and cash flows. 2 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Accrual Accounting vs Cash Basis Accounting Accrual Accounting - records the impact of a business event as it occurs Cash Basis – records only transactions in which cash is received or paid 3 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren The Time-Period Concept Financial statements are prepared for specific periods and at regular intervals. 4 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Learning Objective 2 Apply the revenue and matching principles. 5 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Revenue Principle Revenue is recorded when it is earned. The amount of revenue to record is the cash value of goods transferred to customer. 6 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren The Matching Principle Record all expenses incurred during the accounting period Match expenses against revenues earned 7 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Learning Objective 3 Update the financial statements by adjusting the accounts. 8 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Air & Sea Unadjusted Trial Balance April 30, 20x3 Account Cash Accounts receivable Supplies Prepaid rent Furniture Accounts payable Unearned service revenue Common stock Retained earnings Dividends Service revenue Salary expense Utilities expense Total Debit $24,800 2,250 700 3,000 16,500 Credit 13,100 450 20,000 11,250 3200 $7,000 950 400 $51,800 $51,800 9 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Categories of Accounting Adjustments Deferrals Depreciation Accruals 10 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Prepaid Expenses: Rent On April 1, 20x3, Air & Sea Travel prepays three months office rent. Prepaid Rent 3,000 Cash 3,000 11 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Prepaid Expenses: Rent What is the adjusting entry on April 30? Date General Journal Accounts and Explanations PR April 30 Rent Expense Prepaid Rent To record rent expense ($3,000 x 1/3) Debit Credit 1,000 1,000 12 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Prepaid Expenses: Supplies On April 2, 20x3, Air & Sea Travel paid cash of $700 for office supplies. Supplies 700 Cash 700 13 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Prepaid Expenses: Supplies An inventory at month end indicated that $400 in office supplies remained. Supplies 4/2 700 4/30 300 Bal. 400 Supplies Expense 4/30 300 Bal. 300 14 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Depreciation Allocation of the cost of a plant asset to expense over the asset’s useful life 15 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Depreciation of Plant Assets On April 3, the business purchased furniture on account for $16,500. The furniture is expected to last 5 years. Furniture 16,500 Accounts Payable 16,500 16 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Depreciation of Plant Assets Straight-line method of depreciation allocates equal amounts each accounting period. $16,000 ÷ 5 years = $3,300 per year $3,300 ÷12 months = $275 per month 17 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Depreciation of Plant Assets What is the adjusting entry on April 30? Date General Journal Accounts and Explanations PR April 30 Depreciation Expense, Furniture Accumulated Depreciation, Furniture To record depreciation Debit Credit 275 275 18 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Book Value The net amount of a plant asset (cost minus accumulated depreciation) Plant Assets of Air & Sea at April 30, 20x5 Furniture $ 16,500 Less Accumulated Depreciation (275) $ Building $ 48,000 Less Accumulated Depreciation (200) Book value of plant assets $ 16,225 47,800 64,025 19 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Accrued Expense A liability that arises from an expense that has not yet been paid. Air & Sea Travel pays its employees a monthly salary of $1,900, half on the 15th and half on the last day of the month. If a payday falls on the weekend, Air & Sea pays the employee on the following Monday. 20 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Accrued Expenses Salary Expense 4/15 950 4/30 950 Bal. 1,900 Cash 4/15 950 Salary Payable 4/30 950 Bal. 950 21 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Accrued Revenue A revenue that has been earned but not received in cash. Bank One hires Air & Sea Travel on April 15 to arrange travel services on a monthly basis. Bank One will pay the travel agency $500 monthly, with the first payment on May 15. 22 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Accrued Revenues Adjusting entry: Date General Journal Accounts and Explanations PR April 30 Accounts Receivable Service Revenue To accrue service revenue Debit Credit 250 250 23 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Unearned Revenue An obligation arising from receiving cash before providing a service. Plantation Foods engages Air & Sea Travel agreeing to pay the agency $450 monthly, beginning immediately. Air & Sea Travel collects the first amount on April 20 and earns one-third the last 10 days. 24 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Unearned Revenues Date General Journal Accounts and Explanations PR April 20 Cash Unearned Revenue Received advanced payment Date General Journal Accounts and Explanations PR April 30 Unearned Revenue Revenue To record revenue earned ($450 x 1/3) Debit Credit 450 450 Debit Credit 150 150 25 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Air & Sea Travel Work Sheet For the Month Ended April 30, 20x5 Unadjusted Trial Account Balance Adjustments Title Debit Credit Debit Credit Cash 24,800 Accounts receivable 2,250 e. 250 Supplies 700 b. 300 Prepaid rent 3,000 a. 1000 Furniture 16,500 Accum depr, furn c. 275 Accounts payable 13,100 Salary payable d. 950 Income tax payable g. 540 Unearned svc rev. 450 f. 150 Common stock 20,000 Retained earnings 11,250 Dividends 3200 Service revenue $7,000 e. 250 f. 150 Salary expense 950 d. 950 Rent expense a. 1000 Supplies expense b. 300 Depr. Exp, furn. c. 275 Utilities expense 400 Income tax expense g. 540 Total $51,800 $51,800 3,465 3,465 Step 2 Plan Adjustments Step 2 Prepare Adjusted Trial Balance Adjusted Trial Balance Debit Credit 24,800 2,500 400 2,000 16,500 275 13,100 950 540 300 20,000 11,250 3,200 $7,400 Step 1 Prepare Unadjusted Trial Balance 1,900 1,000 300 275 400 540 53,815 53,815 Learning Objective 4 Prepare the financial statements. 27 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Air & Sea Travel, Inc. Income Statement Month Ended April 30, 20x5 Revenue: Service revenue Expenses: Salary expense $1,900 Rent expense 1,000 Utilities expense 400 Supplies expense 300 Depreciation expense 275 Income before tax Income tax expense Net income $7,400 3,875 $3,525 540 $2,985 28 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Air & Sea Travel, Inc. Statement of Retained Earnings Month Ended April 30, 20x5 Retained earnings, April 1, 20x5 Add: Net income Less: Dividends Retained earnings, April 30, 20x5 $11,250 2,958 $14,235 ( 3,200) $11,035 29 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Air & Sea Travel, Inc. Balance Sheet April 30, 20x5 Assets Cash $24,800 Accounts receivable 2,500 Supplies 400 Prepaid rent 2,000 Furniture $16,500 Less: Accumulated depreciation ( 275) 16,225 Total assets $45,925 Liabilities Accounts payable $13,100 Salary payable 950 Unearned revenue 300 Income tax payable 540 Total liabilities $14,890 Stockholders’ Equity Common stock $20,000 Retained earnings 11,035 Total $31,031 Total liabilities and stockholders’ equity $45,925 Learning Objective 5 Close the books. 31 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Closing Entries Prepare the accounts for the next period’s transactions. Transfer the revenue, expense, and dividends balances to Retained Earnings. 32 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Which Accounts Need To Be Closed? Temporary accounts are closed Revenue Expense Dividends Permanent accounts are not closed Assets Liabilities Stockholders’ equity 33 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Journalizing the Closing Entries General Journal Date April 30 April 30 April 30 Accounts and Explanations PR Debit Service Revenue Retained Earnings 7,400 Retained Earnings Rent Expense Salary Expense Supplies Expense Depreciation Expense Utilities Expense Income Tax Expense 4,415 Retained Earnings Dividends 3,200 Credit 7,400 1,000 1,900 300 275 400 540 3,200 Posting the Closing Entries Rent Expense 1,000 1,000 Salary Expense 950 950 1,900 1,900 Other Expenses 1,515 1,515 Retained Earnings 4,415 11,250 3,200 7,400 11,035 Service Revenue 7,000 250 150 7,400 7,400 Dividends 3,200 3,200 Classifying Assets and Liabilities List assets and liabilities in order of their relative liquidity. Liquidity - how quickly an item can be converted to cash. 36 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Classifying Assets and Liabilities Current assets Long-term assets Current liabilities Long-term liabilities 37 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Learning Objective 6 Use the current ratio and the debt ratio to evaluate a business. 38 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Current Ratio Measures company’s ability to pay current liabilities with current assets Total current assets Total current liabilities Rule of thumb: A strong current ratio is 2.00 39 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren Debt Ratio The proportion of assets that is financed with debt. Measures business’s ability to pay total liabilities Total liabilities Total assets A low debt ratio is safer than a high debt ratio. 40 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren End of Chapter 3 41 ©2006 Prentice Hall Business Publishing Financial Accounting, 6/e Harrison/Horngren