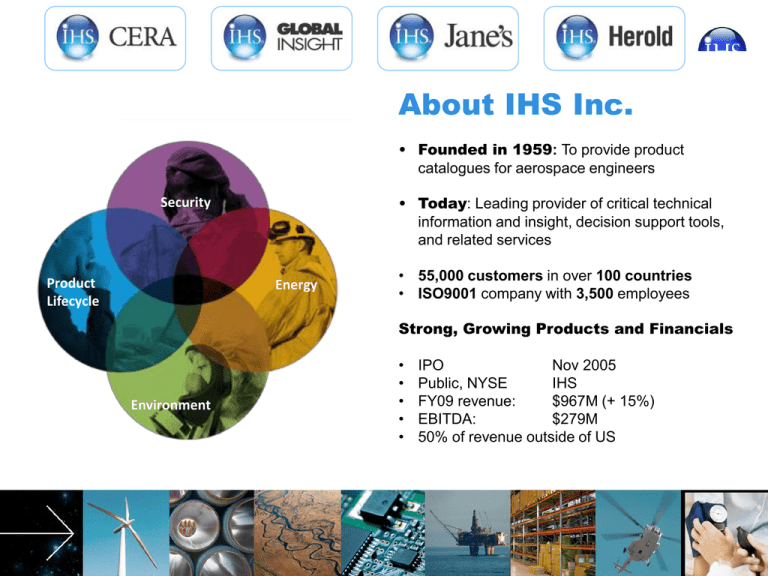

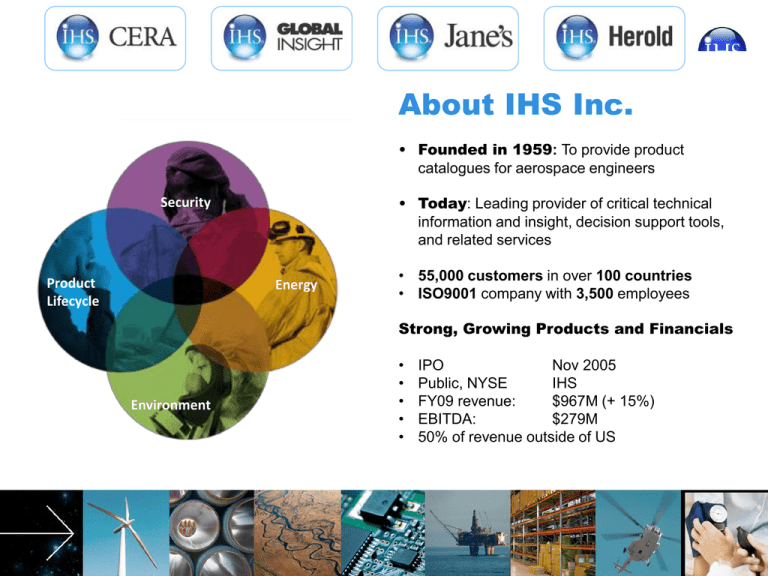

About IHS Inc.

• Founded in 1959: To provide product

catalogues for aerospace engineers

• Today: Leading provider of critical technical

information and insight, decision support tools,

and related services

Security

Product

Lifecycle

Energy

• 55,000 customers in over 100 countries

• ISO9001 company with 3,500 employees

Strong, Growing Products and Financials

Environment

Copyright © 2009 IHS Inc. All Rights Reserved.

•

•

•

•

•

January 2009

IPO

Nov 2005

Public, NYSE

IHS

FY09 revenue:

$967M (+ 15%)

EBITDA:

$279M

50% of revenue outside of US

Proliferation of Environmental regulations

Geographic and medical device compliance lists

RoHS v2 Recast

UN Stockholm Convention on Persistent Organic Pollutants

Norway PoHS

China RoHS

Japan

REACH SVHC

Customer RFP Driven (Chemicals and Materials)

IBM, Dell, HP, Cisco…

Kaiser, Premier, Novation, Amerinet …

Thales, Airbus …

Health Canada

Canadian Chemical Management

EU Medical Device Directive

US Code of Federal Regulations; Food and Drug Administration

US California Proposition 65

…

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Here are at least five good reasons to act …

Fears surrounding ‘toxic’ substances used in our products

Deca-BDE?

DEHP?

Cadmium?

Phthalates?

Lead?

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Chemical Management – not optional for the supply

chain.

What are your priorities?

Place enabler in appropriate quadrant for your company

A2

B

A1

Regulations

A1

Tracking and interpretation; alerts

A2

A2

Standards & Lists

A2

A2

Standards for matl. composition

declaration and chemical lists

D1

I

M

P

O

R

T

A

N

C

E

High

B

Content:

Material composition, SVHC,

Compliance, Registration,

Obsolescence, Alternatives

C

System of Record & Analysis C

MDS, part and material

composition mgmt; List reporting;

BOM and risk analysis

D2

E

C

D1

Low

D2

D2

A1

Low

High

URGENCY

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

B

Notification: Inbound

Aggregate and manage from

upstream suppliers

D1

Notification: Outbound

Publish to downstream users

D2

E

Green Inventory Optimization E

Duplication across enterprise,

safer and less costly alternatives

F

Verification & Auditing

Physical substance testing,

process and content auditing

F

Who is Impacted?

Impact is cross-functional and global

Global Supply Chain: Impact to continuity of supply; Disruption due to material

obsolescence and availability.

Global Manufacturing: Supply chain disruptions have already impacted material availability,

costs and lead-times for production.

Global EHS: Product stewardship regulations and customer demands continue to proliferate

globally. Lack of systems and information to respond is inefficient and resource intensive.

Global and Local Regulatory: Additional label reviews, change package reviews and

approvals, tech file/design dossier updates and submissions, reviews for PMA and 510(k)

impact. Assessments needed for global impact to registrations.

R&D: Identification of alternate materials and costly, unscheduled product redesign.

Global PSM: Collection of material content data from suppliers. Identifying alternate

suppliers in compliance with global requirements. Increased supplier management.

Global Sales & Marketing: Inability to quickly and accurately respond to customer material

content requests and RFP’s such as Kaiser and Premier.

Global Ethics & Compliance: Adherence to Code of Conduct.,

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

2

Priority Declarable Substance List (PDSL)

Aerospace and Defense Standard Substance List

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Make vs. Buy: Calculation Model

Economies of Scale with Industry Standardization

Make: In House

Do it Yourself (Independent)

$

Buy:

Outsource (Third Party Specialist)

Buy: Economies of Scale

Outsource + Industry

Standardization

Copyright © 2009 IHS Inc. All Rights Reserved.

Time

January 2009

e

Impact to Supply Chain

Disruption of Supply Chain: Lessons Learned from RoHS

Chemical Restrictions Impacting Margin:

RoHS Lead Restrictions = 35% to 300%

Increase in Costs for Leaded Parts

Individual Manufacturer Price Book Examples 5/30/2008

3x

3

2.5

2

1.5x

1.35x

1.5

1

0.5

Chemical

Registration

Deadline

0

Mosfet

Tantalum Capacitor

RoHS Compliant Alternative

Op Amp

Traditional Pb Part

Chemical Restrictions Impacting Obsolescence:

SVHC Publication was a significant factor in the

300% increase of End of Life (EOL) documents

for electrical components in 2008

SVHC

Publication

4

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Just how big of a deal is this to medical industry?

It’s a very, VERY big deal!

2009 Fortune 1000:

Top Medical Products & Equipment

Rank Company

1

Medtronic

2

Baxter International

Fortune 1000 rank

196

$ millions

$13,515.00

219

$12,348.00

3

Boston Scientific

320

$8,050.00

4

Becton Dickinson

347

$7,158.50

5

Stryker

375

$6,718.20

6

St. Jude Medical

520

$4,363.30

7

Zimmer Holdings

543

$4,121.10

8

Beckman Coulter

675

$3,098.90

9

C.R. Bard

791

$2,452.10

10

Teleflex

797

$2,420.90

11

Biomet

808

$2,383.30

12

Applied Biosystems

811

$2,361.50

13

Dentsply International

847

$2,193.70

14

Varian Medical Systems

876

$2,104.90

15

Kinetic Concepts

938

$1,877.90

16

Hill-Rom Holdings

942

$1,862.00

17

Bio-Rad Laboratories

977

$1,764.40

18

Invacare

983

$1,755.70

$80,549.40

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Only one of these

companies did not

participating in

today’s webcast.

Redesign Timelines from IHS Medical Webinar

Understand/Scope Timeline and Costs

Redesign or certifying your primary product/line would take?

Less than 1 month

4.5%

1 - 3 months

4.5%

3 - 6 months

8.0%

6 - 12 months

30.7%

12 - 18 months

82%

20.5%

More than 18 months

31.8%

0%

Copyright © 2009 IHS Inc. All Rights Reserved.

5%

10%

15%

January 2009

20%

25%

30%

35%

Impact to Product Design

Unscheduled Product Redesigns – Long Pole in Tent

Example Scenario from a current IHS Project

33%

of OEM’s Parts found to be out of compliance to various regulations

79%

of those parts had a supplier recommended replacement.

21%

of those parts had no supplier recommended replacement

What is your average

timeline for product

redesign and

certification - 6, 12 or

18 months.

What would be the impact if forced to engage in an

unscheduled redesign and certification of 21% of our

non-compliant parts?

5

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Webinar Live Polling:

Solution needs to support Compliance, LC ….

LIVE Audience Poll Question: To introduce a new part or establish material

compliance, which factors play a role in part evaluation? (check all that apply)

Lifecycle Analysis &

68.7%

Supply Continuity

72.9%

Reliability

77.0%

Compliance Status

Material Disclosure &

79.1%

Composition

Technical Fit (e.g. Form,

87.5%

Fit, Function)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

TECHNICAL FIT:

More important than

compliance itself.

100%

Live Audience Poll: Supply & Demand Chain Executive Webcast "Redesigning Medical Supply Chains" featuring IHS October 15, 2009

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

IHS Electronics Database: Provides Lifecycle Visibility

Ignore lifecycle at a great cost and a great risk

Two primary lifecycle methods:

Predictive planning algorithms - commodity analytics

1.

•

Fill data gap

•

Validates supplier responses

Supplier response

2.

•

Typically less than < 50% response

Predictive Characteristics

Sales A

Trends

Memory

Organization

Memory

Density

5

1

Semiconductors and Components:

A Product Lifecycle Point of View

6

New Product

Product Change

End of Life (EOL) or

Introduction (NPI)

Notification (PCN)

Discontinuance (PDN)

LTB Notice

3 Package

2

Supply

Voltage

Maturity

4 Spee

d

Illustrative example of key Technology

Group attribute drivers (SRAM) and Sales

Data

Decline

Growth

LTB

YTEOL

Introduction

Today

Phase-out

Obsolete

Case Study: Medical OEM undertook compliance program investment without full visibility in

part status Missed 11% of parts obsolete or on LTB after re-design was complete.

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Best Practice: You Need Access to Alternatives

Alternative parts, materials, and supplier evaluation

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

IHS is uniquely positioned to address REACH

Information critical to comply, manage risk, optimize performance

• Which regulations apply to me and what they impact?

• Which localized versions, requirements, and legal

obligations?

• How do I identify, compare and select

compliant, lower-risk alternatives?

• Which of my business plans and products are exposed

to risk?

• How do I evaluate, compare and drive

greater business performance?

• How do I establish my supplier,

material, and compliance

requirements?

• How do I optimise a product portfolio to

improve market position?

• How do I aggregate and process

high volumes of complex/disparate

data?

• How do I monitor supply chain

performance and escalate critical

issues?

• How do I declare compliance and material

composition to stakeholders?

• How do I manage changes upstream and

downstream within supply chains?

• How do I maintain supplier, material and

product compliance information?

• How do I verify the receipt or

acknowledgement of documents &

information?

• How do I measure and report the current

state of compliance and risk?

Copyright © 2009 IHS Inc. All Rights Reserved.

• How do I monitor constant regulatory

changes and supply chain realignment?

January 2009

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

16

Consistent and Clear Format

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Compliance Data Collection

All Parts (AVL): Electronic, Mechanical, Sub-Assemblies…

Custom

Mechanical

Raw Materials

Assemblies

Adhesives

Fasteners

Plastics

Chemicals

Copyright © 2009 IHS Inc. All Rights Reserved.

Cables

January 2009

Components

IHS’ ISO9001 Process

Over 50M parts,1B attributes employing over 45 logic checks per part

Component Management Tool

ISO 9001

Process

SE Suppliers’ Part

Composition

Data

Existing

Material

and

SDS

Content

Expertise

Aggregate

Classify

Logic Checks

• CAS Numbers

• Substance Names

• Computational

Consistency, etc.

√

Enrich

Standardize

QA

PLM

Material Composition

Database

? # of Article & Preparation

? # suppliers

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Not

optional

Comply Plus

AVX Component

Full Material Disclosure Example (Before IHS Processing)

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

After

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Availability FMD in IPC1752 Format

Sample - 1.4M Full Material Disclosure (FMD) Documents

Availability of FMD Data in IPC1752 Format

100%

80%

60%

40%

20%

0%

FMD's provided in IPC1752 format

FMD provided in other formats

Manually normalize data from all formats - XLS, XML, Word, HTML, PDF –

for bulk loading into EMARS

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Optional – IHS Composition Database

ComplyPlus can house CAS level composition data for analysis

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

IHS Comply Plus

Compliance Data System of Record and Analysis

Store/manage/access (Parametric Data)

•

•

•

•

SVHC/Hazardous materials

Full material composition

REACH declaration of compliance

Store/manage/access (Documents)

•

•

•

•

•

REACH CoC document

Safety Datasheet (SDS)

Product Datasheet

Full Material Declaration document

Other documents

•

•

Where Used: Find all articles and

preparations containing a specific

substance (such as proposed SVHC)

• What-if scenarios: If the entire SIN

list became SVHC, how would that

affect my supply chain?

Traditional licensed and installed application vs. SaaS

Connection between systems for key data points

Copyright © 2009 IHS Inc. All Rights Reserved.

On part contents against Hazardous

Substances Lists of interest (SVHC15, SIN List, 67/54/EEC, PDSL, etc.)

• By collections of items (electronic

components, specific manufacturer’s

parts, preparations, plastics, paints,

etc.)

Simulate

Access

•

Report

January 2009

IHS Comply Plus

Product and Material Compliance Analysis

Part and Manufacturer

Information

REACH, PDSL and

Other Compliance

Information.

Part Substances,

Weight, Pct.

Contribution (If

Sourced)

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

IHS Comply Plus

Product and Material Compliance Analysis and Expanded Part Data

View Composition

Information by % or

Weight

And

Identify % of

Composition with CAS

Material Composition Information Can be Stored,

Aggregated from all Sub-Components,

Compared Against Various Lists and Thresholds,

and Summarized at the Part Level

Indicators and Reports Update Dynamically

Based on Updates Made to Substance Lists

Supports REACH, PDSL, SIN 1.0, Custom Lists,

Many Others

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

26

Analysis and Reporting

Copyright © 2009 IHS Inc. All Rights Reserved.

January 2009

Leveraging Core Competencies

Enables OEM to drive differentiation and value

OEM Competency:

• Collecting publicly available data not core competency

• Focus on OEM market and market IP

• Core work starts once data returned - EOL. redesign, supplier selection

Suppliers

• Focus on engineering/supply chain decisions

• Leverage supplier relationship for escalation

Competency:

Part and Material

Compliance and

Composition Info.

• BOM load

and analysis

• Parts

Attributes

• Parts

Reused

• Aggregating technical/composition data core competency

• ISO 9001 certified data collection process

• Data validation with cooperative supplier escalation

• over 50M components, 1B attributes and 10,000 MFR processed

• Third party expertise recognized

by regulatory agencies – UK BERR

January 2009

Copyright © 2009 IHS Inc. All Rights Reserved.